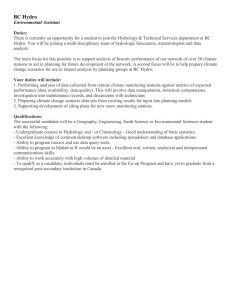

Hydro One

advertisement