Northrop Grumman Northrop Grumman Electronic Systems

advertisement

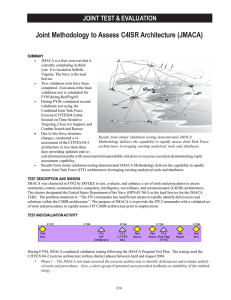

Northrop Grumman Electronic Systems April 2015 Forward-Looking Statements This presentation contains statements, other than statements of historical fact, that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expect,” “intend,” “may,” “could,” “plan,” “project,” “forecast,” “believe,” “estimate,” “guidance,” “outlook,” “anticipate,” “trends,” "goals," and similar expressions generally identify these forward-looking statements. Forward-looking statements include, among other things, statements relating to our future financial condition, results of operations and cash flows. Forward-looking statements are based upon assumptions, expectations, plans and projections that we believe to be reasonable when made, but which may change over time. These statements are not guarantees of future p g performance and inherently y involve a wide range g of risks and uncertainties that are difficult to p predict. Specific p risks that could cause actual results to differ materially from those expressed or implied in these forward-looking statements include, but are not limited to, those identified and discussed more fully in the section entitled "Risk Factors" in our Form 10-K for the year ended December 31, 2014. They include: • our dependence on a single customer, the U.S. Government • delays or reductions in appropriations for our programs and U.S. Government funding • investigations, claims and/or litigation • our international business • the th iimproper conduct d t off employees, l agents, t business b i partners t or jjoint i t ventures t i which in hi h we participate ti i t • the use of accounting estimates for our contracts • cyber and other security threats or disruptions • changes in actuarial assumptions associated with our pension and other post-retirement benefit plans • the performance and financial viability of our suppliers and the availability and pricing of raw materials and components • competition within our markets • changes in procurement and other laws and regulations applicable to our industry • natural and/or environmental disasters • the adequacy of our insurance coverage, customer indemnifications or other liability protections • the products and services we provide related to nuclear operations • changes in business conditions that could impact recorded goodwill or the value of other long-lived assets • our ability to develop new products and technologies and maintain technologies, facilities, equipment and a qualified workforce • our ability to meet performance obligations under our contracts • unforeseen environmental costs • our ability to protect our intellectual property rights • changes in our tax provisions or exposure to additional tax liabilities • the spin-off of our former Shipbuilding business Additional information regarding these risks and other important factors can be found in the section entitled "Risk Factors" in our Form 10-K for the year ended December 31, 2014 and as disclosed in this report and from time to time in our other filings with the SEC. You are urged to consider the limitations on, on and risks associated with with, forward-looking statements and not unduly rely on the accuracy of forward-looking statements. These forward-looking statements speak only as of the date of this presentation or, in the case of any document incorporated by reference, the date of that document. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. This presentation also contains non-GAAP financial measures. A reconciliation to the nearest GAAP measure and a discussion of the company's use of these measures are included in the appendix of this presentation. Northrop Grumman Today • Leading global security company • 2014 sales of $24.0 billion • Leading capabilities – Unmanned Systems – Cyber – C4ISR – Logistics – Strike aircraft • Electronic Systems – 2014 sales of $7.0 billion – 2014 operating p g margin g rate of 16.5% – $10.0 billion backlog (3/31/15) – 16,800 employees – Top tier global defense electronics supplier Strong sustainable performance for shareholders and customers 3 Electronic Systems – Value Proposition Performance • Margin performance and cash generation • Invest and innovate for affordability • Diverse, engaged workforce Strategy - sustainable competitive differentiation • Protect the core and adapt existing solutions • Capitalize on extensive installed base • International I t ti l expansion i on global l b l core • Invest in select breakthroughs and near adjacencies • Elevate partnerships, supply chain Risk Management • Focus on execution • Smart capture p management g • Scalable enterprise 4 Financial Performance Sales and Margin • Stable revenue p performance in challenging budget environment 10 17.1% 9 • Outstanding margin rate performance 8 – ~300 300 bps margin rate e expansion pansion – Disciplined focus on cost and affordability 6 – Consistently strong cash conversion $ Billions 7 • Cash C h 16.5% 16% 14.5% 13.4% 14% % – Solid program performance – Portfolio shaping to focus on core competencies 18% 17.1% 12% 5 4 10% 7.6 7.4 7.0 7.1 7.0 8% 3 6% 2 4% 1 – Low capital requirements 0 2% 2010 5 2011 2012 2013 2014 Strategy Core Near Adjacencies Fixed-Wing Rotary Marines Air Force Protecting and Adapting Transitioning International Long--Term Differentiation Long • Common building blocks across p product areas Expanding 6 • Capital investment • Factory of the Future • Sustained high IR&D • Technology breakthroughs • Outstanding CRAD performance Investing for the Future Portfolio … Where We Work International Employees: 1,800 Revenue: 24% Baltimore, MD C4ISR: Radar, Exploitation United States Employees: 15,000 Revenue: 76% Rolling Meadows, IL C4ISR & Cyber/NK: EO/IR, Electronic Warfare Sunnyvale, CA Precision Gear, Heavy Machinery Woodland Hills, CA C4ISR: Navigation, Situational Awareness Azusa, CA C4ISR: Space Sensors Serving an installed base in ~70 nations across six continents 7 Portfolio … Who We Serve Our Customers 50% 50% 6% U.S. Army Prime 18% U.S. Navy 20% U.S. Air Force 25% 75% 24% International 32% Other U.S. US Gov’t Sub Competitive Sole Source 37% 75% 63% Sales $7.0B All data are based on 2014 Sales 8 Cost Type Fixed Price/T&M Portfolio … What We Do Business Focus Areas Logistics 2% Other 4% C4ISR Business Focus Area PED Other 2% 4% Comms 1% Nav 9% Strike 9% C2 11% Cyber/NK 13% C4ISR 72% EO/IR 14% Radar 59% 60% All data are based on 2014 Sales PED = Processing, Exploitation and Dissemination 9 C4ISR • Radar / RF – Key capabilities control airborne early warning & • Fire control, control, tactical surveillance, maritime surveillance, air and missile defense – Key products / programs y • F-35,, F-22,, F-16 radar family • 737 MESA, AWACS • Global Hawk, Triton, Joint STARS • TPS-78, G/ATOR • SPQ 9B SPQ-9B – Key opportunities • Global F-16, airborne surveillance, global ground-based air defense upgrade market 10 • Space Sensors – Key capabilities • Missile warning sensors • Weather sensors • Active and passive RF and EO – Key products / programs • DSP, SBIRS – Key opportunities • Restricted C4ISR (continued) • EO/IR • Navigation – Key capabilities • Targeting and surveillance; ranging, designation and illumination – Key products / programs • LITENING, F-35 Distributed Aperture System (DAS), LLDR – Keyy opportunities pp • LITENING expansion • Infrared Search and Track 11 – Key capabilities • Inertial navigation and positioning systems – Key products / programs • Wide array of nav products for ships, aircraft, spacecraft, and weapons systems – Keyy opportunities pp • GPS-challenged environments C4ISR (continued) • Processing, Exploitation and Dissemination (PED) – Key capabilities • Enterprise integration of multiintelligence mission data across all domains – Key products / programs • SBIRS Ground Processing – Keyy opportunities pp • International 12 • Situational Awareness / C2 – Key capabilities • Modular integrated avionics suites and components – Key products / programs • Blackhawk cockpit – Key opportunities • International upgrades Cyber (including Non-Kinetic / Electronic Warfare) • RF Electronic Warfare – Key capabilities • Electronic attack, electronic support, information operations, special communications, EW simulation – Keyy p products / p programs g • ALQ-218, APR-39, P-8 EWSP and ESM, DoD and Intel Community programs – K Key opportunities ii • Unmanned EW • Restricted 13 • EO/IR Countermeasures – Key capabilities • IR warning and jamming • Threat warning sensors – Key products / programs • IRCM product family – Key opportunities • Integrated aircraft selfprotection equipment Strike: Marine & Undersea • Key capabilities – Naval power and propulsion, control systems, launchers, integrated bridge systems, undersea sensors/controls • Key products / programs – Machinery controls, nuclear instrumentation and control, mine countermeasures, support to current U.S. submarine force • Key opportunities – International mine hunting, surface and subsurface sensors/controls 14 Diverse Portfolio for Value Growth 15 Electronic Systems – Value Proposition Performance • Margin performance and cash generation • Invest and innovate for affordability • Diverse, engaged workforce Strategy - sustainable competitive differentiation • Protect the core and adapt existing solutions • Capitalize on extensive installed base • International I t ti l expansion i on global l b l core • Invest in select breakthroughs and near adjacencies • Elevate partnerships, supply chain Risk Management • Focus on execution • Smart capture management • Scalable enterprise 16