effective dates of principal dodd

advertisement

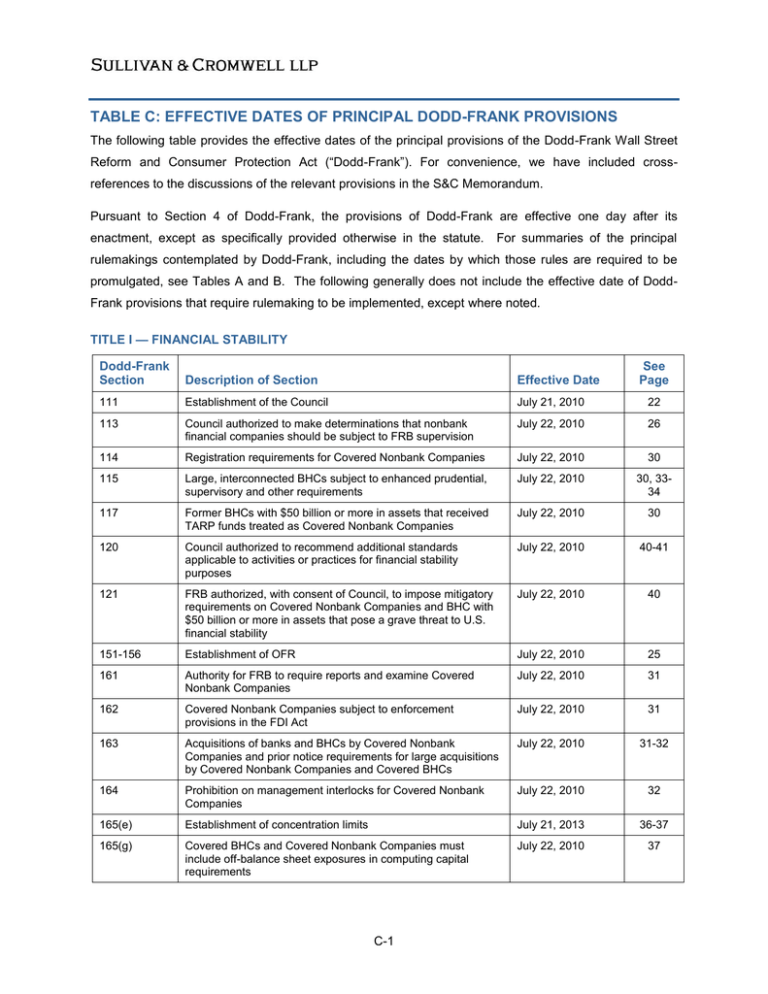

TABLE C: EFFECTIVE DATES OF PRINCIPAL DODD-FRANK PROVISIONS The following table provides the effective dates of the principal provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”). For convenience, we have included crossreferences to the discussions of the relevant provisions in the S&C Memorandum. Pursuant to Section 4 of Dodd-Frank, the provisions of Dodd-Frank are effective one day after its enactment, except as specifically provided otherwise in the statute. For summaries of the principal rulemakings contemplated by Dodd-Frank, including the dates by which those rules are required to be promulgated, see Tables A and B. The following generally does not include the effective date of DoddFrank provisions that require rulemaking to be implemented, except where noted. TITLE I — FINANCIAL STABILITY Dodd-Frank Section Description of Section Effective Date 111 Establishment of the Council July 21, 2010 22 113 Council authorized to make determinations that nonbank financial companies should be subject to FRB supervision July 22, 2010 26 114 Registration requirements for Covered Nonbank Companies July 22, 2010 30 115 Large, interconnected BHCs subject to enhanced prudential, supervisory and other requirements July 22, 2010 30, 3334 117 Former BHCs with $50 billion or more in assets that received TARP funds treated as Covered Nonbank Companies July 22, 2010 30 120 Council authorized to recommend additional standards applicable to activities or practices for financial stability purposes July 22, 2010 40-41 121 FRB authorized, with consent of Council, to impose mitigatory requirements on Covered Nonbank Companies and BHC with $50 billion or more in assets that pose a grave threat to U.S. financial stability July 22, 2010 40 151-156 Establishment of OFR July 22, 2010 25 161 Authority for FRB to require reports and examine Covered Nonbank Companies July 22, 2010 31 162 Covered Nonbank Companies subject to enforcement provisions in the FDI Act July 22, 2010 31 163 Acquisitions of banks and BHCs by Covered Nonbank Companies and prior notice requirements for large acquisitions by Covered Nonbank Companies and Covered BHCs July 22, 2010 31-32 164 Prohibition on management interlocks for Covered Nonbank Companies July 22, 2010 32 165(e) Establishment of concentration limits July 21, 2013 36-37 165(g) Covered BHCs and Covered Nonbank Companies must include off-balance sheet exposures in computing capital requirements July 22, 2010 37 C-1 See Page Dodd-Frank Section See Page Description of Section Effective Date 171(b) New debt and equity instruments issued by certain DIHCs and Covered Nonbank Companies subject to new capital requirements May 19, 2010 42 171(b) Phase-in period for debt and equity instruments issued by certain DIHCs and Covered Nonbank Companies before May 19, 2010 January 1, 2013 43 171(b) DIHCs not previously supervised by FRB subject to new capital requirements, except with respect to newly issued debt and equity instruments July 21, 2015 43 171(b) Subsidiaries of non-U.S. banking organizations that currently meet capital requirements based on home country standards subject to new capital requirements July 21, 2015 43 172 FDIC back-up examination and enforcement authority for Covered BHCs and Covered Nonbank Companies that are not in sound condition July 22, 2010 45 TITLE II — ORDERLY LIQUIDATION AUTHORITY Dodd-Frank Section Description of Section Effective Date See Page 201-212 Establishment of OLA July 22, 2010 49-56 See Page TITLE III — TRANSFER OF POWERS TO OCC, FDIC AND FRB Dodd-Frank Section Description of Section Effective Date 312 Transfer of OTS responsibilities to OCC, FDIC and FRB Transfer Date 57 313 OTS to be abolished 90 days after Transfer Date 57-58 316(c) FRB, FDIC and OCC must each publish list of regulations transferred to it from OTS that the agency will enforce Transfer Date 58 318 FRB must assess fees to cover expenses in supervising BHCs and SLHCs with assets of $50 billion or more and Covered Nonbank Companies Transfer Date 59 331 FDIC must amend assessment base for federal deposit insurance to use average total assets less tangible equity July 22, 2010 59 332 Repeal of provisions regarding Required Dividends from the Deposit Insurance Fund July 22, 2010 59 333 Repeal of requirement that FDIC obtain consent of the appropriate federal banking agency before requiring a report from a depository institution July 22, 2010 60 334(a) Increase in the ceiling for the Deposit Insurance Fund from 1.15% to 1.35% and requirement that it be met by September 30, 2020, with offset for depository institutions with assets of less than $10 billion; and elimination of the ceiling on the Fund July 22, 2010 60 334(b) Requirement for FDIC to make public the Deposit Insurance Fund’s reserve ratio and designated reserve ratio July 22, 2010 60 335 Permanently increase maximum for federal deposit insurance to $250,000 retroactive to January 2008 July 22, 2010 60 C-2 Dodd-Frank Section Description of Section Effective Date See Page 336 Management of the FDIC Transfer Date 61 341 Savings associations converting to national banks may retain branches and establish additional branches in any State in which it was located before conversion as permitted for a state bank in that State July 22, 2010 61 342 Establishment of Office of Minority and Women Inclusion 6 months after Transfer Date 61-62 343 Provision of full federal deposit insurance for non-interest bearing demand accounts at insured depository institutions until January 1, 2013 December 31, 2010 60 343 Provision of full federal deposit insurance for non-interest bearing demand accounts at insured credit unions until January 1, 2013 July 21, 2010 60 TITLE IV — PRIVATE FUND INVESTMENT ADVISERS REGISTRATION ACT OF 2010 Dodd-Frank Section Description of Section Effective Date 401-419 All Sections July 21, 2011; but (1) voluntary registration prior to effectiveness permitted and (2) certain rulemaking and reporting requirements appear to be effective upon enactment See Page 117-127 TITLE V — INSURANCE Dodd-Frank Section Description of Section Effective Date See Page 501-502 Establishment of Federal Insurance Office July 22, 2010 157-162 511-522; 524542 Reform of regulation of the nonadmitted property/casualty insurance market and the reinsurance markets July 21, 2011 162-164 523 Prohibition on states collecting any fees relating to the licensing of a surplus lines broker in the state, unless the state has laws or regulations providing for the participation by the state in the national insurance database of the NAIC July 21, 2012 163 TITLE VI — REGULATION OF BHCS, SLHCS AND DEPOSITORY INSTITUTIONS Dodd-Frank Section See Page Description of Section Effective Date 603 3-year moratorium on grant of federal deposit insurance for certain depository institutions excluded from definition of “bank” under BHC Act and approval of Change In Bank Control notices for such institutions July 22, 2010 62 603 GAO study of exemptions from “bank” definition in BHC Act Not later than January 21, 2012 63 C-3 Dodd-Frank Section See Page Description of Section Effective Date 604 Removal of restrictions in BHC Act on FRB examination, enforcement and rulemaking authority over functionally regulated subsidiaries of BHCs and grant to FRB of similar authority for SLHCs Transfer Date 63 604(d), (f) A financial stability standard added to Bank Merger Act and BHC Act Transfer Date 68 604(e) Prior FRB approval under BHC Act required for acquisitions of nonbank companies by financial holding companies with consolidated assets over $10 billion Transfer Date 67 604(i) Exclusion from SLHC status of companies that own a limited purpose trust company and grandfathered SLHCs ordered by FRB to establish an intermediate holding company Transfer Date 83 605 FRB required to examine nonbank subsidiaries of BHCs and SLHCs engaged in activities permissible for depository institution subsidiaries and grant of back-up examination and enforcement authority to OCC and FDIC Transfer Date 65-66 606(a) Financial holding companies must be well-capitalized and wellmanaged to maintain status Transfer Date 67 606(b) SLHCs (except grandfathered SLHCs) must meet wellcapitalized, well-managed and other standards to engage in financial activities only permitted for financial holding companies Transfer Date 67-68 607 Well-capitalized and well-managed standard required for interstate acquisitions of and mergers with banks under BHC Act and Bank Merger Act Transfer Date 67 608 - 609 Amendments to Section 23A of the Federal Reserve Act, including coverage of credit exposure on derivative transactions and securities lending and borrowing transactions 1 year after Transfer Date 70-72 610 Credit exposure on derivatives and other transactions covered under national bank lending limit 1 year after Transfer Date 73 611 Requires credit exposure on derivatives to be regulated in state banks lending limits 18 months after Transfer Date 73 612 Charter conversions of insured depository institutions prohibited if subject to an enforcement order or memorandum of understanding with respect to a significant supervisory matter unless certain requirements are met July 22, 2010 69-70 613 De novo branching for national and state banks into other states permitted if a state bank chartered in that state could establish a branch at proposed location July 22, 2010 84 614 Amendments to insider lending restriction of Section 22(h) of the Federal Reserve Act, covering credit exposure on derivative transactions, repurchase and reverse repurchase agreements, and securities lending and borrowing transactions 1 year after Transfer Date 72 615 FDI Act amended to require that purchases of assets by a bank from, and sales by a bank to, an insider must be on market terms Transfer Date 72 616 FRB authorized to issue rules to establish capital requirements for BHCs and SLHCs Transfer Date 65 C-4 Dodd-Frank Section See Page Description of Section Effective Date 616 FRB authorized to require BHCs or SLHCs to serve as a source of strength to subsidiary insured depository institutions and OCC and FDIC authorized to require other holding companies of insured depository institutions to do so Transfer Date 65 616(c) FRB, OCC and FDIC must seek to make capital requirements for depository institutions countercyclical Transfer Date 65 617 Investment bank holding company framework under Exchange Act repealed Transfer Date 73 618 Securities holding companies that are required by a non-U.S. regulator or statute to be subject to comprehensive consolidated supervision may register with the FRB July 22, 2010 73-74 619 Volcker Rule prohibitions on proprietary trading and sponsorship and investment in hedge and private equity funds Earlier of 12 months after adoption of final agency rules and July 21, 2012 74-75 619(b) Council study of Volcker Rule and recommendations on modifications to Rule and its implementation January 21, 2011 78-79 619(b) FRB, OCC, FDIC, SEC and CFTC rules required to implement Volcker Rule 9 months after completion of Council study of Volcker Rule 619(c) Divestiture required for investments and activities prohibited by the Volcker Rule 2 years after effectiveness of Rule with possibility of 3 one-year 1 extensions 79-80 620 Study of bank activities, the risk of such activities, and riskmitigation activities January 21, 2012 81 621 Amendment to Securities Act of 1933 relating to conflicts of interest in certain securitizations Issuance by SEC of final rules which are required by April 17, 2011 139 622 Limit on expansion by large financial firms, including Covered Nonbank Companies designated under Title I July 22, 2010, subject to Council study (by January 21, 2011) and FRB rulemaking (April 2 21, 2011) 68-69 623 Limits on interstate bank mergers and interstate acquisitions of savings associations and certain other insured depository institutions by BHCs and SLHCs July 22, 2010 69 624 Amendments to SLHC Act with respect to qualified thrift lender requirements July 22, 2010 83 79 1 There are special rules for investments in illiquid funds beyond this two-year period. 2 It is unclear whether Section 620 would be effective prior to the adoption of the FRB’s rule pursuant to this provision. C-5 Dodd-Frank Section Description of Section Effective Date See Page 625 Amendment to SLHC Act regarding dividends by certain mutual holding companies Transfer Date 83-84 626 FRB authorized to require SLHCs to establish intermediate holding companies Unclear- Likely Transfer Date 82 627 Repeal of federal prohibitions on payment of interest on demand deposits July 21, 2011 84 628 Amendment to BHC Act to permit exempt credit card banks to extend credit card loans to small businesses July 22, 2010 84 TITLE VII — DERIVATIVES Dodd-Frank Section See Page Description of Section Effective Date 712 Review of regulatory authority of CFTC and SEC under Subtitle A of Title VII July 16, 2011 ___ 714 CFTC and SEC authorized to collect information and issue reports regarding swaps July 16, 2011 109 715 CFTC and SEC authorized to prohibit non-U.S. entities from participating in U.S. swap market July 16, 2011 108 716 Prohibition against federal assistance to any swaps entity July 21, 2012 98-99 717 Amends Commodity Exchange Act and Securities Exchange Act to create joint process to approve new products July 16, 2011 ___ 718 CFTC and SEC authorized to determine status of novel derivative products July 16, 2011 ___ 718(b) Judicial resolution of CFTC and SEC conflict over status of novel derivative products July 16, 2011 ___ 721 Treasury Secretary granted authority to exempt foreign exchange swaps and forwards July 16, 2011 94 721 Amends Commodity Exchange Act to include certain new definitions July 16, 2011 ___ 721 Motion picture box office receipts are not considered futures June 1, 2010 ___ 722 Clarification of regulatory authority of the SEC, CFTC and FERC under Dodd-Frank July 16, 2011 112 723 Prohibition against entering into or execution of agricultural swaps unless CFTC permits such swaps pursuant to Section 4(c) of the Commodity Exchange Act July 16, 2011 ___ 724 Segregation requirements for cleared and uncleared swaps July 16, 2011 108 725 Registration requirements for derivatives clearing organizations, including core principles and reporting requirements July 16, 2011 99 728 Registration requirement for swap data repositories, including reporting requirements July 16, 2011 ___ 729 Existing swaps reported to swap data repository, not later than 30 days after issuance of an interim final rule or within 90 days of final rule July 16, 2011 102 730 Large swap trader reporting requirements July 16, 2011 101 C-6 Dodd-Frank Section See Page Description of Section Effective Date 733 Registration requirements for swap execution facilities, including core principles, imposition of position limits and reporting requirements July 16, 2011 ___ 735 Core principles for designated contract markets, including imposition of position limits July 16, 2011 106-107 738(a) CFTC granted authority over non-U.S. boards of trade July 16, 2011 108 739 Legal certainty for swap transactions July 16, 2011 ___ 742 CFTC authority over retail commodity transactions, including retail foreign exchange transactions July 16, 2011 ___ 745 Enhanced compliance for registered entities July 16, 2011 ___ 746 Commodity Exchange Act prohibition against governmental insider trading July 16, 2011 ___ 752 CFTC, SEC and prudential regulators shall consult and share information, as appropriate, with international regulators July 16, 2011 ___ 753 Amends Commodity Exchange Act manipulation standard and prohibits market manipulation of swap transactions Date of effectiveness of the CFTC’s final rule pursuant to Title VII of Dodd-Frank 109 761 Amends Exchange Act to include new definitions July 16, 2011 ___ 762 Amends Section 2A of the Securities Act and Section 3A of the Exchange Act to remove references to repealed Sections 206B and 206C of the Gramm-Leach-Bliley Act (prohibition of regulation of security-based swap agreements) July 16, 2011 ___ 763(b) Registration requirement for clearing agencies July 16, 2011 99-100 763(c) Registration requirement for security-based swap execution facilities July 16, 2011 100 763(d) Segregation of assets held as collateral in security-based swap transactions July 16, 2011 107-108 763(h) Position limits for security-based swaps and large trader reporting July 16, 2011 ___ 763(i) Registration requirements for swap data repositories July 16, 2011 ___ 764(a) Registration of security-based swap dealers and major security based swap participants July 16, 2011 96-97 765 SEC rulemaking on conflicts of interest in the security-based swap market January 17, 2011 ___ 766(a) Recordkeeping for certain security-based swaps July 16, 2011 102 766(a) Reporting for certain security-based swaps October 19, 2010 767 Preemption of state gaming authority and bucket shop laws July 16, 2011 111 768 Amends Securities Act to include security-based swaps and require registration of security-based swaps July 16, 2011 94-95 773 Amendment to the civil penalty provisions of the Exchange Act July 16, 2011 ___ C-7 101-102 TITLE VIII — PAYMENT, CLEARING AND SETTLEMENT SUPERVISION Dodd-Frank Section 801-814 Description of Section Effective Date Provides for the designation and supervision of payment, clearing and settlement activities July 21, 2010 See Page 46 TITLE IX — INVESTOR PROTECTIONS AND IMPROVEMENTS TO REGULATION OF SECURITIES Dodd-Frank Section Description of Section Effective Date 911 Establishment of IAC within the SEC July 22, 2010 173 915 Establishment of the Office of the Investor Advocate within the SEC July 22, 2010 174 916 Accelerating time allowed for SEC evaluation of proposed SRO rule changes July 22, 2010 114 922-923 Incentives and protection to whistleblowers July 22, 2010 174-175 925 SEC’s collateral bar authority with regard to individuals who violate the Exchange Act or the Advisers Act extended to the full range of registered securities entities July 22, 2010 177 927 Voiding any contractual provisions requiring a person to waive compliance with SRO rules (rather than rules of an exchange) July 22, 2010 114 928 Clarifying that the restrictions of Section 205 of the Advisers Act do not apply to state-registered investment advisers July 22, 2010 126 929 Amendment of Section 7(c)(1)(A) of the Exchange Act regarding margin lending prohibitions July 22, 2010 ___ 929A Employees of subsidiaries and affiliates of public companies included in existing whistleblower protections of the SarbanesOxley Act July 22, 2010 175 929B Civil money penalties for securities laws violations may be used to benefit victims even without obtaining disgorgement from the defendant July 22, 2010 ___ 929C Increasing SIPC borrowing limits from the Treasury Department July 22, 2010 179 932-935 Establishment of the Office of Credit Ratings to oversee NRSROs; reforms of NRSRO corporate governance, liability and disclosure July 22, 2010 140-145 939 The FDI Act, the Investment Company Act of 1940, the Exchange Act and other U.S. statutes revised to remove references to credit ratings July 21, 2012 146-147 942 Certain new ABS disclosure and reporting obligations July 22, 2010 138 944 Elimination of existing exemption from registration for some mortgage-backed securities July 22, 2010 139 951 Any proxy, consent or authorization for meetings occurring after January 21, 2011, must provide for non-binding shareholder votes to approve executive compensation, establish frequency of “say-on-pay” votes and approve golden parachutes For meetings occurring after January 21, 2011 128-129 952 Disclosure requirements regarding compensation committee use of compensation consultants For meetings occurring on or after July 21, 2011 129-131 C-8 See Page Dodd-Frank Section See Page Description of Section Effective Date 957 Provisions regarding new broker voting rules of any exchange to be registered as a “national securities exchange” with the SEC July 22, 2010 134 965 SEC’s Division of Trading and Markets and Division of Investment Management to maintain a separate staff of examiners July 22, 2010 153 966 SEC inspector general required to establish a system for confidential submission of suggestions to improve the efficiency of, or allegations of inefficiency in, the SEC; inspector general required to submit annual report to Congress regarding the suggestions and allegations received July 22, 2010 153 971 Expansion of SEC rulemaking authority with respect to proxy access July 22, 2010 133-134 975 “Municipal advisors” required to register under Section 15B of the Exchange Act and subject to liability for fraudulent, deceptive or manipulative acts or practices; changes to the composition, authority and obligations of the MSRB October 1, 2010 148-149 979 Establishment of the Office of Municipal Securities within the SEC July 22, 2010 150 981 PCAOB authorized to share information relating to a public accounting firm with any non-U.S. auditor oversight authority under certain circumstances July 22, 2010 151 982 PCAOB authorized to establish rules, subject to SEC approval, for inspection and examination of auditors of brokers and dealers; auditors of brokers and dealers subject to PCAOB inspection required to register with the PCAOB; brokers or dealers required to pay annual accounting support fees to the PCAOB; PCAOB authorized to refer investigations to an SRO with jurisdiction over the relevant broker or dealer July 22, 2010 151 983 Securities Investor Protection Act protections extended to cover both securities and futures contracts in a single “portfolio margining account” July 22, 2010 ___ 984 Prohibition on participating in transactions involving the lending or borrowing of securities in contravention of SEC rules July 22, 2010 114 987 Threshold for “material loss” under the FDI Act increased; process established for review of losses below the “material loss” threshold July 22, 2010 60-61 988 New procedures established for reporting material and nonmaterial losses by the Share Insurance Fund of the NCUA July 22, 2010 91 989A Bureau’s Office of Financial Literacy required to establish a grant program for states related to protection of senior investors July 22, 2010; appropriations for fiscal years 20112015 authorized 188 989B, C, D, E Reforms of the Inspector General Act of 1978; creation of the Council of Inspectors General on Financial Oversight July 22, 2010 155 989G Amends Sarbanes-Oxley Section 404 to exempt nonaccelerated filers and smaller reporting companies from Section 404(b) July 22, 2010 156 C-9 Dodd-Frank Section Description of Section Effective Date See Page 991 SEC Reserve Fund and related provisions October 1, 2011 155 991 SEC “match funding” authority Later of October 1, 2011 or the date of enactment of an Act making a regular appropriation to the SEC for fiscal year 2012 ___ 991 Amendments to SEC registration fee provisions October 1, 2011, except that for fiscal year 2012, the SEC must publish a rate established under Exchange Act Section 6(b), on August 31, 2011 155 991 Authorization of appropriations for fiscal years 2011 to 2015 July 22, 2010 155 991 Budget transmittal amendments July 22, 2010 (but by its terms, the provision first applies to the fiscal year 2012 budget) 155 TITLE X — BUREAU OF CONSUMER FINANCIAL PROTECTION Dodd-Frank Section Description of Section Effective Date 1011-1018 Establishment of Bureau of Consumer Financial Protection July 21, 2010 166 1021-1029 Enumeration of the powers of the Bureau of Consumer Financial Protection Designated Transfer Date 166-171 1031-1037 Sets forth certain specific authorities of the Bureau of Consumer Financial Protection Designated Transfer Date 166-170 1041-1048 Concerning the effect of Title X on state law, the enforcement powers of states, and preemption of state consumer financial protection laws by federal law Designated Transfer Date 170-171 1051-1058 Establishment of the enforcement powers of the Bureau of Consumer Financial Protection Designated Transfer Date 167-168 1061 Transfer of functions from other agencies to the Bureau of Consumer Financial Protection Designated Transfer Date 166 1064 Transfer of personnel from other agencies to the Bureau of Consumer Financial Protection Transfers to occur not later than 90 days after Designated Transfer Date ___ 1073 Amendment to the Equal Credit Opportunity Act requiring collection of certain small business loan data under that Act Designated Transfer Date ___ 1075(a) Restrictions on electronic debit transaction interchange fees July 21, 2011 171 1081 Conforming amendments to the Inspector General Act of 1978 July 22, 2010 ___ C-10 See Page Dodd-Frank Section Description of Section Effective Date See Page 1082 Conforming amendments to the Privacy Act of 1974 July 22, 2010 ___ 1083-1100G Conforming amendments to other statutes affected by creation of the Bureau including the Equal Credit Opportunity Act, Fair Credit Reporting Act, Fair and Accurate Credit Transactions Act, Home Mortgage Disclosure Act, TILA and others Designated Transfer Date 166 TITLE XI — FEDERAL RESERVE SYSTEM PROVISIONS Dodd-Frank Section See Page Description of Section Effective Date 1101 FRB’s emergency lending authority under Section 13(3) of the Federal Reserve Act limited to credit programs and facilities with broad-based eligibility and subject to certain other requirements July 22, 2010 84 1102 GAO authorized to audit emergency credit facilities authorized by FRB under Section 13(3) and discount window advances and open market transactions effected after July 21, 2010 July 22, 2010 85-86 1103(a) FRB required to place on its website, within 6 months of public release, specified information, including public information regarding GAO audits and audited financial statements of FRB and Federal Reserve banks July 22, 2010 87 1103(b) FRB must make public within certain timeframes detailed information, including identifying details, concerning discount window advances and open-market transactions engaged in after July 21, 2010, and emergency credit facilities established under Section 13(3) after July 21, 2010 July 22, 2010 87-88 1104, 1105 FDIC granted emergency financial stabilization authority, with FRB, Treasury approval and Congressional authorization, to provide a widely-available program to guarantee obligations of solvent depository institutions and their holding companies and subsidiaries of such entities July 22, 2010 88-89 1106 Elimination of FDIC’s current authority to provide systemic risk assistance to solvent insured depository institutions and their solvent holding companies under a widely available program and to provide open bank assistance July 22, 2010 89-90 1107 Class A directors of Federal Reserve banks may not vote for Reserve Bank Presidents July 22, 2010 90 1108 Creation of a second vice chairman of the FRB for supervision July 21, 2010 90 1108 FRB governance matters July 22, 2010 90 1109 GAO audit of all credit facilities and programs established during the financial crisis under Section 13(3) of the FR Act and the Term Auction Facility and GAO Audit of Federal Reserve System governance July 22, 2010 86-87 1109(e) Publication of detailed information, including the identity of the persons provided assistance, concerning audit extended under the above facilities and programs December 1, 2010 87 1100G Small business fairness and regulatory transparency Designated Transfer Date ___ C-11 TITLE XII — IMPROVING ACCESS TO MAINSTREAM FINANCIAL INSTITUTIONS ACT OF 2010 Dodd-Frank Section See Page Description of Section Effective Date 1204 Treasury Secretary authorized to establish a program designed to expand access to financial institutions for low- and moderate-income individuals July 22, 2010 187 1205 Treasury Secretary authorized to establish programs to provide low-cost alternatives to payday loans July 22, 2010 188 1206 Community Development Financial Institutions Fund permitted to make grants to community development financial institutions July 22, 2010 188 1201-1203 All other provisions of Improving Access to Mainstream Financial Institutions Act of 2010 July 22, 2010 ___ 1207-1210 TITLE XIII — PAY IT BACK ACT Dodd-Frank Section 1301-1306 Description of Section Effective Date “Pay It Back Act,” including amendment reducing TARP authorization, amendments to Housing and Economic Recovery Act of 2008 and amendments to the American Recovery and Reinvestment Act of 2009 July 22, 2010 See Page 157 TITLE XIV — MORTGAGE REFORM AND ANTI-PREDATORY LENDING ACT Dodd-Frank Section Description of Section Effective Date See Page 1401-1497 Various provisions of Title XIV Earlier of date final regulations implementing section take effect or 18 months after Designated Transfer Date 183-187 1473(f) Appraisal management services July 21, 2013, subject to Council extension of up to 12 months ___ 1496(a) Funding for Homeowners’ Relief Fund October 1, 2010 187 1497(a) Additional assistance for Neighborhood Stabilization Program October 1, 2010 187 1498 Legal assistance for foreclosure-related issues July 21, 2010 187 TITLE XV — MISCELLANEOUS PROVISIONS Dodd-Frank Section See Page Description of Section Effective Date 1501 Requirement to oppose IMF loans to certain countries if not likely to be repaid in full July 22, 2010 156 1503 Mine safety disclosure requirements August 20, 2010 117 C-12 TITLE XVI — FINANCIAL CRISIS ASSESSMENT AND FUND Dodd-Frank Section 1601 Description of Section Effective Date Amendment of Section 1256 of the Internal Revenue Code to explicitly exclude any interest rate swap, currency swap, basis swap, interest rate cap, interest rate floor, commodity swap, equity swap, equity index swap, credit default swap or similar agreement from the scope of Section 1256 Applies to taxable years beginning after July 21, 2010 C-13 See Page 104