Agenda Friday, October 14, 2011 Whistle While You Work: Ethical Issues Associated

advertisement

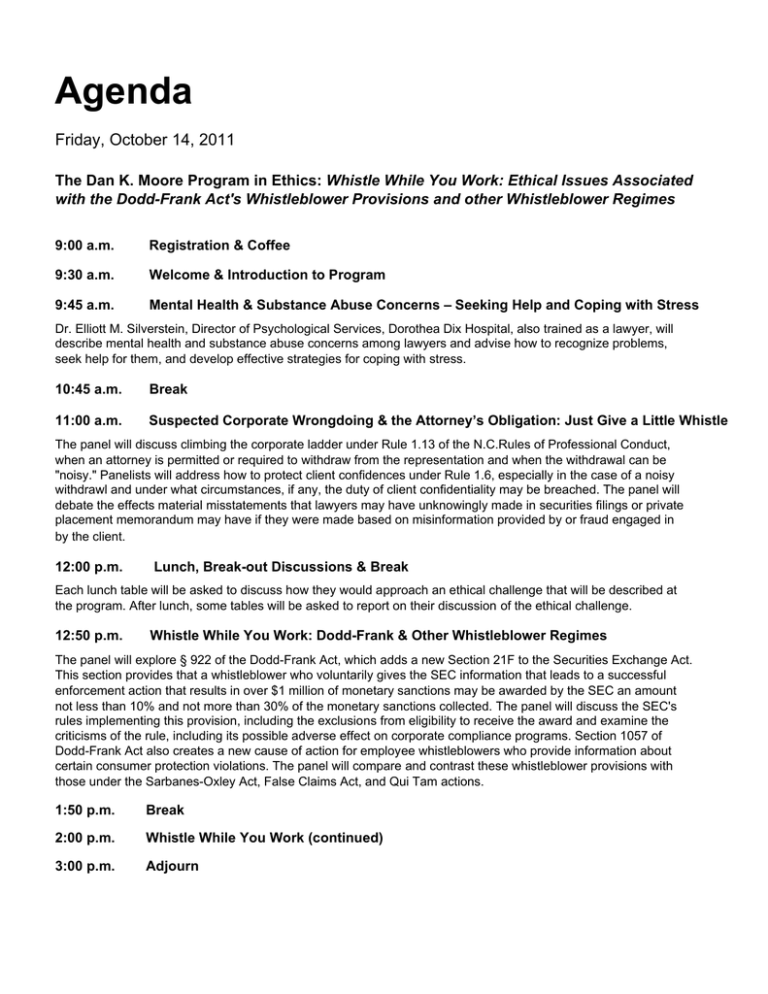

Agenda Friday, October 14, 2011 The Dan K. Moore Program in Ethics: Whistle While You Work: Ethical Issues Associated with the Dodd-Frank Act's Whistleblower Provisions and other Whistleblower Regimes 9:00 a.m. Registration & Coffee 9:30 a.m. Welcome & Introduction to Program 9:45 a.m. Mental Health & Substance Abuse Concerns – Seeking Help and Coping with Stress Dr. Elliott M. Silverstein, Director of Psychological Services, Dorothea Dix Hospital, also trained as a lawyer, will describe mental health and substance abuse concerns among lawyers and advise how to recognize problems, seek help for them, and develop effective strategies for coping with stress. 10:45 a.m. Break 11:00 a.m. Suspected Corporate Wrongdoing & the Attorney’s Obligation: Just Give a Little Whistle The panel will discuss climbing the corporate ladder under Rule 1.13 of the N.C.Rules of Professional Conduct, when an attorney is permitted or required to withdraw from the representation and when the withdrawal can be "noisy." Panelists will address how to protect client confidences under Rule 1.6, especially in the case of a noisy withdrawl and under what circumstances, if any, the duty of client confidentiality may be breached. The panel will debate the effects material misstatements that lawyers may have unknowingly made in securities filings or private placement memorandum may have if they were made based on misinformation provided by or fraud engaged in by the client. 12:00 p.m. Lunch, Break-out Discussions & Break Each lunch table will be asked to discuss how they would approach an ethical challenge that will be described at the program. After lunch, some tables will be asked to report on their discussion of the ethical challenge. 12:50 p.m. Whistle While You Work: Dodd-Frank & Other Whistleblower Regimes The panel will explore § 922 of the Dodd-Frank Act, which adds a new Section 21F to the Securities Exchange Act. This section provides that a whistleblower who voluntarily gives the SEC information that leads to a successful enforcement action that results in over $1 million of monetary sanctions may be awarded by the SEC an amount not less than 10% and not more than 30% of the monetary sanctions collected. The panel will discuss the SEC's rules implementing this provision, including the exclusions from eligibility to receive the award and examine the criticisms of the rule, including its possible adverse effect on corporate compliance programs. Section 1057 of Dodd-Frank Act also creates a new cause of action for employee whistleblowers who provide information about certain consumer protection violations. The panel will compare and contrast these whistleblower provisions with those under the Sarbanes-Oxley Act, False Claims Act, and Qui Tam actions. 1:50 p.m. Break 2:00 p.m. Whistle While You Work (continued) 3:00 p.m. Adjourn