2014 annual report - Investor Relations Solutions

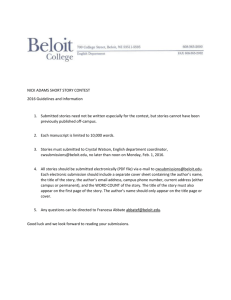

advertisement