Annual Financial Report 2014 - Air France KLM

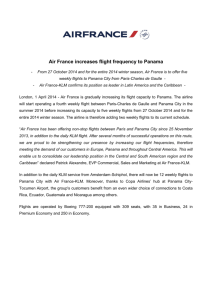

advertisement