Financial Aid Boulder High 11-5

advertisement

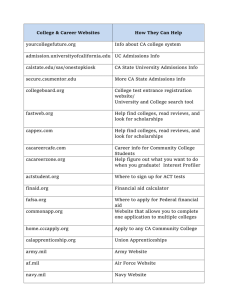

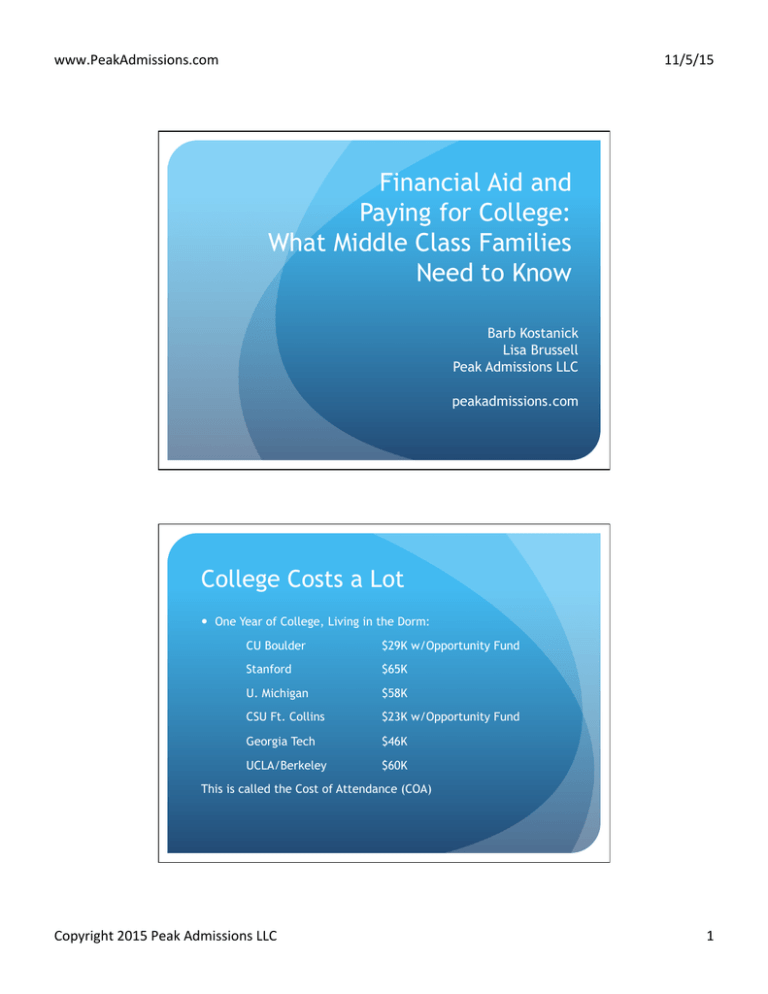

www.PeakAdmissions.com/ 11/5/15/ Financial Aid and Paying for College: What Middle Class Families Need to Know Barb Kostanick Lisa Brussell Peak Admissions LLC peakadmissions.com College Costs a Lot ! One Year of College, Living in the Dorm: CU Boulder $29K w/Opportunity Fund Stanford $65K U. Michigan $58K CSU Ft. Collins $23K w/Opportunity Fund Georgia Tech $46K UCLA/Berkeley $60K This is called the Cost of Attendance (COA) Copyright/2015/Peak/Admissions/LLC/ 1/ www.PeakAdmissions.com/ 11/5/15/ College Costs are a challenge for most families Five strategies: 1. Understanding Your Resources, 529 College Savings Plans & the Colorado Opportunity Fund 2. Financial Aid (also called need-based aid) 3. Scholarships (also called merit aid) that are not needbased 4. Finding Less Expensive Colleges 5. Helping Your Student Build an Appropriate College List Resources You Control ! Savings (529 Plans + Other Savings/Investments) ! Colorado College Opportunity Fund ! Tax Credits ! Dorm Savings ! Student Work Earnings ! Cash Flow from Your Income that can help with College Copyright/2015/Peak/Admissions/LLC/ 2/ www.PeakAdmissions.com/ 11/5/15/ Colorado-endorsed 529 plans ! College savings plans sponsored by the State of Colorado come with a special tax benefit: Every dollar you contribute gets you a dollar for dollar reduction in your Colorado Taxable Income. Contribute $10,000, save $463 in income tax. ! Usable at almost every college in the US & many overseas ! Can be used to pay for tuition, mandatory fees, room & board, books & supplies. ! 529 plans assets are treated more favorably in the federal formula than are student savings accounts ! CollegeInvest.org !Colorado’s state program Colorado Opportunity Fund ! Grant (Money that does not need to be repaid!) ! Approximately $2,250/year for students attending a four-year public college or university in Colorado -most public colleges build this into their costs ! Approximately $1,125/year for students attending certain private colleges (DU, Regis, Colorado Christian) ! No income limit, but must sign up to get it Copyright/2015/Peak/Admissions/LLC/ 3/ www.PeakAdmissions.com/ 11/5/15/ American Opportunity Tax Credit ! $2,500/year for the first four years of college ! Married? Income (MAGI) must be under $160K for full credit, no credit if income >180K ! Single? Income (MAGI) must be under $80K for full credit, no credit if income >$90K ! Very low income? May only be eligible for $1,000 Mariah lives at home with mom & dad– Family spends ! Food & HH consumables $400/week ! Restaurants $300/month ! Starbucks/Fast Food $80/month " For 30 weeks a year (the time away at college) Mariah’s share of this is $5K. (Many families spend more) But really, it is more: Less utilities, not as much driving around as parents, and not as much need to grab fast food because of tight schedules trying to get from here to there Copyright/2015/Peak/Admissions/LLC/ 4/ www.PeakAdmissions.com/ 11/5/15/ She plays soccer, sings in choir & takes AP classes at HS: ! Club Soccer Fees $1,500 – 3,500/year w/travel ! School sport & clothing $400 ! Choir fees & tickets $150 ! AP & School fees $300 ! Snacks & lunches $500 ! Parking/Bus/Gas $400 ! Award Banq./Gifts $100 " $3,350 – 5,350 in direct student expenses…at least But there is even more… ! Religious groups & retreats ! Summer camps & programs ! Tutoring ! Lift tickets (and gas to get there) ! Music instruction ! Team snacks ! Participation fees for clubs, scouts Copyright/2015/Peak/Admissions/LLC/ 5/ www.PeakAdmissions.com/ 11/5/15/ If you don’t let your lifestyle expand, this can be used for college ! Typical middle class families with incomes under $100K spend approximately $6-8K/per child ! Typical middle class families with incomes over $100K spend approximately $9-13K/year ! Typical students on traveling sports teams spend significantly more, especially if the family also travels to some competitions The College COA includes: ! Food (dorm food, but still…) ! Modest eating out budget ! Tutoring centers on campus ! No extra charge for tests ! Rec center, activities and clubs with expense almost all bundled into the fees you’re paying the college ! Budget for books and supplies " And many significant discounts for activities like skiing Copyright/2015/Peak/Admissions/LLC/ 6/ www.PeakAdmissions.com/ 11/5/15/ Work is Good…Skin in the Game is Even Better ! College students who work up to 15 hours/week have better grades than do students who do not work ! College jobs are plentiful ! Summer jobs are usually easy to get for college students, and if they’re living at home, they should be able to save that for college expenses " When students spend their own money for books, supplies, personal expenses and transportation, they become much more careful consumers So What Do We Have as Family Resources? ! College savings/4 (Assume $32,000 balance) $8000 ! Savings from the student living in the dorm $9000 ! Student summer job & school job $4500 ! American Opportunity Tax Credit $2500 Total $24,000 ==> Even with NO savings, this comes to $16,000/year Use the Worksheet to figure YOUR hidden resources Copyright/2015/Peak/Admissions/LLC/ 7/ www.PeakAdmissions.com/ 11/5/15/ What You Need to Know About Financial Aid Financial Aid ! Determined by each college individually using data you submit on your financial aid forms ! Colleges often expect that a family can spend 20% or more of the family’s gross income on college ! Most colleges do not have enough financial aid to meet all the needs that families have ! Formulas are based on your income, assets, and family size Copyright/2015/Peak/Admissions/LLC/ 8/ www.PeakAdmissions.com/ 11/5/15/ But it can look a lot different with financial aid: Harvard CU Boulder Cost of Attend. $65K $28K Average price paid by a family earning $90K/yr Up to $9,000 $28K Average price paid by a family earning $120K/yr Up to $12K $28K Merit Awards None For students in the top 20% of CU students, $2.5-5K/yr. NET PRICE FOR FAMILY EARNING $120K $12K $23K How Much Might My Family’s EFC be for One Year? Rough (Very Rough) estimates: Adjusted Gross Income $50,000 – $4,000 EFC Adjusted Gross Income $90,000 -- $16,000 EFC Adjusted Gross Income $120,000 -- $25,000 EFC Adjusted Gross Income $160,000 -- $39,000 EFC Adjusted Gross Income $175,000 -- $44,000 EFC DOES NOT APPLY IF You Are Divorced, or Own Rental Property or Own a Business or Have Other Large Assets Copyright/2015/Peak/Admissions/LLC/ 9/ www.PeakAdmissions.com/ 11/5/15/ Two financial aid systems: ! FAFSA – the Federal method, used by almost all public colleges and universities – standard formula established by the federal government ! Profile – the supplement used by many private universities – each college can set their own formula " Key – Even though the formula may suggest that you are eligible for financial aid, it is the college’s own policies and resources that determine what aid you get " You apply for financial aid every single year for each student Home Equity & Financial Aid ! Not used by colleges that ONLY use the FAFSA (most public colleges and some private colleges) ! Used to some degree by most selective colleges that use the Profile (private colleges and a few public colleges) ! Some cap home equity at 1.0, 1.2, 2.0, or 2.4 times the family’s gross income ! Some consider all home equity to be available ! A few do not use it at all Copyright/2015/Peak/Admissions/LLC/ 10/ www.PeakAdmissions.com/ 11/5/15/ Of Course We Have Need, Don’t We? 70 60 50 Cost/Year 40 30 20 10 0 CU Boulder CSU Ft. Collins Georgetown U. Wisconsin Who Has Need? -- Depends on Cost & EFC Key Concepts ! Grant: Money you do not need to pay back. Usually given based on financial need. Re-evaluated each year based on your new financial data. ! Merit Scholarship: Scholarships based on academic or other merit. Often awarded to freshmen for 4 years ! Need-Based Merit Scholarships: Scholarships offered to students based on merit AND financial need ! Loans: Money you or your student will need to pay back! Copyright/2015/Peak/Admissions/LLC/ 11/ www.PeakAdmissions.com/ 11/5/15/ Each College Has a “Net Price Calculator” ! Estimates your family’s actual out-of-pocket costs at that college ! May be inaccurate – the more questions it asks, the more likely it is to be accurate ! Uses last year’s tuition & fees ! Inaccurate if you own rental property or own a business ! On each college’s website Divorce ! FAFSA ! Custodial parent & custodial parent’s new spouse (!) ! Private colleges Often Require Data from All ! Colleges will not offer financial aid if both parents do not submit information ! Rare exceptions (abuse, prison, long-absent) ! Neither FAFSA nor Profile consider divorce agreements or prenup agreements Gain the cooperation of the non-custodial parent, or focus college list on colleges that do not need your ex’s data Copyright/2015/Peak/Admissions/LLC/ 12/ www.PeakAdmissions.com/ 11/5/15/ Scholarships & Merit Aid Who Gets Merit Aid? Outstanding Students in the context of THAT college’s freshman class ! Ivy League/Stanford – nobody (everyone’s fabulous!) ! Elite privates – from top 1% to top 15% of the college’s entering class -- or none at all ! Less selective private colleges – perhaps up to top 40% of the college’s entering class get some merit aid ! Public universities – often top 20% of students, but the amount varies a lot – some guaranteed " Key to understanding affordability for your student Copyright/2015/Peak/Admissions/LLC/ 13/ www.PeakAdmissions.com/ 11/5/15/ Merit Aid (Scholarships) ! Biggest pool is the merit aid offered by the colleges to the students they most strongly want to attract ! Some Public Out-of-State colleges have generous merit aid ! Some colleges require a separate (or earlier) application for certain merit awards ! Some merit-aid is actually influenced by need ! Both financial aid and merit aid are usually wrapped into a “package” by the college Are You Fishing in the Right Pool? ! Some colleges give Merit scholarships, some don’t (or give only a very few) ! Colleges that do give significant merit scholarships: Cooper Union, U. of Richmond, Trinity (CT), Babson, Boston U., Vanderbilt, USC, U. Miami, Tulane, Boston College, Chapman, St. Lawrence, Emory, Wake Forrest, George Washington, Rhodes, Bentley, Smith, Willamette Puget Sound, Grinnell, Clark, DU, Redlands, Creighton, Scripps, U. Chicago ! Colleges that do NOT give merit aid: Ivy League, Stanford, Amherst, Barnard, Bates, Cal Tech, Colgate, Georgetown, Haverford, MIT, Pomona, Reed, Williams Copyright/2015/Peak/Admissions/LLC/ 14/ www.PeakAdmissions.com/ 11/5/15/ Test Scores and Grades Matter ! Colleges generally award more merit aid to students with better test scores compared to other students admitted to THAT college ! Colleges may also consider GPA (weighted or unweighted or recalculated by the college) ! Earning better test scores can have a MAJOR impact on both merit aid and college admissions With strong test scores & grades, COA could be very low: U New Mexico Texas State U Ohio Purdue Ft. Wayne U. Ala. Huntsville Louisiana Tech U. Alabama Western Kentucky Florida A&M Western Illinois U LSU Automatic, but subject to change each year! Copyright/2015/Peak/Admissions/LLC/ 15/ www.PeakAdmissions.com/ 11/5/15/ Some Public Colleges Give InState Rates to students with high test scores/GPA combinations ! U of Alabama, U of Mississippi, U. Arkansas ! Texas A&M and many public Texas universities for students awarded academic scholarships (so you get a scholarship + in-state tuition) ! Oklahoma State , U. Michigan Dearborn, Louisiana Tech, Boise State ! Some have early deadlines! National Merit SF/Finalist Big Automatic Scholarships Full/Nearly Full Tuition + more Big Scholarships ! Baylor ! Boston U: $20K ! U Alabama ! U. Rochester: $17K ! Fordham ! Arizona State: Up to full tuition ! Texas A&M ! Auburn $15K + room + computer ! U Nebraska ! Rochester Institute of Tech: $17K ! Loyola Chicago ! U. Florida: $4k + pay in-state tuition List is subject to change every year! Copyright/2015/Peak/Admissions/LLC/ 16/ www.PeakAdmissions.com/ 11/5/15/ Finding Colleges with Great Merit Opportunities: College Average Merit Award % of Freshmen Getting Any Merit Award Johns Hopkins $29,310 1% Vanderbilt $24,505 9% University of Southern Cal. $18,874 24% Some colleges give a few very large awards, others give merit awards to a larger percentage of students – useful when you are considering where to apply Finding Less Expensive Colleges Copyright/2015/Peak/Admissions/LLC/ 17/ www.PeakAdmissions.com/ 11/5/15/ Finding Less Expensive Colleges ! Regional Consortiums that offer tuition discounts (WUE, for those of us in the western US) ! Tuition discounts offered by some neighboring states to Colorado residents ! Tuition discounts/guaranteed scholarships offered to children or grandchildren of alumni (ask your college) ! Lower cost colleges and universities (Midwest and South are generally less expensive than the West Coast and the Northeast) Western Undergraduate Exchange WUE – say “Woo-ee” ! 70 4-year public colleges in the western U.S. that offer Colorado students a special deal: Tuition that is no more than 50% higher than in-state students pay College OOS Cost (COA) WUE Rate (COA) Savings U. of Montana $35K $21.5K $13.5K/year U. of Hawaii $43K $30K $13K/year Western Washington U. $36K $27.5K $8.5K/year U. of Alaska $34K $24K $10K/year Cal State Monterey Bay $30K $23K $7K/year $27K $11.5K/year Portland State U. $38.5K Based on 2014-15 COA Copyright/2015/Peak/Admissions/LLC/ 18/ www.PeakAdmissions.com/ 11/5/15/ And others offer special deals ! Some neighboring states give special deals to Colorado students – Wyoming and New Mexico are particularly good ! Some colleges (public & private) give special scholarships or discounts to children (and sometimes grandchildren) of alumni – always worth checking So Why Does It Matter? ! It is a starting point for seeing how you “look” for financial aid purposes ! It SHOULD change your strategy for choosing schools for your list to make sure that there are several financial safety schools on the list: ! Schools that you can get into (very likely) ! That your family can afford with the college’s typical financial aid OR that have scholarships/merit awards that are very likely for students with your grades/scores ! That you like AND WANT TO ATTEND Remember…Harvard is a lottery ticket. Don’t rely on it! Copyright/2015/Peak/Admissions/LLC/ 19/ www.PeakAdmissions.com/ 11/5/15/ Strategies for maximizing aid Apply on Time! ! For each college on your student’s list: ! When is the Profile or school-specific form due? (if applicable) ! When is the FAFSA due? (Dates are changing…for current seniors, can’t submit until after January 1 – but starting next year you will be able to submit starting in October) ! When are copies of tax forms due? (if required) ! Don’t Wait - Estimate! ! You may need to complete the forms before you’ve filed taxes Copyright/2015/Peak/Admissions/LLC/ 20/ www.PeakAdmissions.com/ 11/5/15/ Conservatively Value Investments ! Checking, savings and stocks are easy to value ! Other assets require an estimate: be fair, but be conservative – what could it be sold for as-is, quick sale, cash buyer LESS whatever you owe on it ! Do NOT include retirement accounts as assets EXCEPT when you are specifically asked about retirement assets* *Most common mistake! Most of All… Do not finalize a college list unless you have at least two “likely” schools on it – ! academically a fit ! Socially/environmentally a fit ! Financially a fit for your family with the resources you expect to have and likely financial aid www.bigfuture.collegeboard.org Copyright/2015/Peak/Admissions/LLC/ 21/ www.PeakAdmissions.com/ 11/5/15/ Bigfuture.org ! Website with information on almost all colleges ! Under the tab “Paying” you can see the college’s costs ! Under the tab “Financial Aid by the Numbers” you can see: ! Average non-need based aid (aka merit scholarships) ! Average need-based aid ! Average loans offered to students ! Percentage of financial aid offered as grants/scholarships and loans ! Average % of need met Summary ! Do your homework: explore net costs ! Decide on steps you might take to improve the picture ! Consider carefully what your family could afford, and how that will work if you have multiple kids ! Make sure the college lists include some financial safeties that also meet your academic needs ! Get help if you need it Copyright/2015/Peak/Admissions/LLC/ 22/ www.PeakAdmissions.com/ 11/5/15/ Peak Admissions ! www.peakadmissions.com ! Barb Kostanick barb@peakadmissions.com 720-300-5098 ! Lisa Brussell lisa@peakadmissions.com 303-947-5958 Copyright/2015/Peak/Admissions/LLC/ 23/