Imbalance Pricing - Single Electricity Market Operator

advertisement

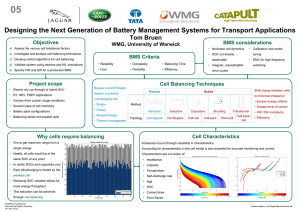

19/02/2016 Imbalance Pricing CONTENTS 1 2 Requirements .................................................................................................................................. 2 1.1 SEM Committee Decision........................................................................................................ 2 1.2 Requirements of I-SEM Flagging and Tagging Solution .......................................................... 3 Development and Discussion; ......................................................................................................... 4 2.1 3 Background on Flagging & Tagging ......................................................................................... 4 Implementation Proposal ............................................................................................................... 8 3.1 Flagging and Tagging Process.................................................................................................. 8 APPENDIX A: Draft Rules ....................................................................................................................... 25 APPENDIX B: Detailed Flagging Rules.................................................................................................... 28 1 1 REQUIREMENTS 1.1 SEM COMMITTEE DECISION The SEM Committee decision on imbalance pricing is that the imbalance pricing approach should be based on Flagging and Tagging. From the SEM Committee decision: “The SEM Committee sees merit in both dispatch based approaches, but on balance believes that Flagging and Tagging is the most appropriate approach to delivering an imbalance price that reflects the costs incurred by the TSO in energy balancing the system. The SEM Committee anticipates that the I-SEM arrangements can draw on the GB experience. However, it notes that there will be differences between the GB approach, and that developed in I-SEM, that will reflect the characteristics of the I-SEM, which is a more constrained system than GB, and that there will therefore be a number of implementation challenges. A working group will be established, to consider the detailed implementation of Flagging and Tagging including the setting of key parameters and the classification of energy and non-energy actions. The SEM Committee considers that the arrangements should, insofar as possible be automated and minimise the scope for any TSO subjectivity. Any possible back up arrangements should also fall within the scope of this working group’s work.” The Imbalance Pricing Process set out in this paper is based on the requirements set out in the paper in particular that the flagging and tagging process should be used to identify the marginal energy action taken and set the price accordingly. This aligns with the ACER Recommendation 03-2015 on the Network Code on Electricity Balancing where the text was explicitly changed to include the requirement that, “imbalances are settled at a price that reflects the real-time value of energy”. The SEM Committee decision included a summary of participants responses including that: • • • • … imbalance prices should be based on the actions taken by the TSO to balance the system. … the approach should be capable of delivering prices shortly after the trading period. … any arrangements should not be overly influenced by any TSO subjectivity in determining which actions, or parts of actions, are classified as non-energy and thus excluded from the calculation of imbalance prices. … the basis of the price calculation should be transparent. Therefore, in response to participants views, the SEM Committee also decided that the implementation of Flagging and Tagging in the I-SEM should include the greatest level of objectivity that can be achieved. There are three key elements to this: • First, the process for the classification of actions taken by the TSOs needs to be clearly documented, thus avoiding ambiguity. 2 • • Second, the processes put in place by the TSOs to tag out non-energy actions from the calculation of imbalance prices must be published, and the TSO performance audited and reported on annually. Third, the SEMC considers that the implementation of Flagging and Tagging in TSO systems should focus on solutions that are automated to the greatest extent practical. The SEMC recognised that the detailed arrangements in I-SEM will be complex and will require significant implementation effort because of the likely level of non-energy actions. Taking the SEMC Decision that I-SEM Imbalance Pricing should be based on Flagging and Tagging, the following section Requirements of I-SEM Flagging and Tagging Solution1.2 outlines the key requirements arising from the decision. 1.2 REQUIREMENTS OF I-SEM FLAGGING AND TAGGING SOLUTION Based on the SEM Committee Decision the Imbalance Pricing solution needs to have the following characteristics. 1.2.1 EFFICIENT: 1. Marginal energy action taken to meet the NIV. 2. Based on actual dispatch / actions taken. 3. Mitigates imbalance price pollution by non-energy actions. 4. Mitigates spurious outcomes and/or excessive volatility. 5. Can produce prices within one hour of real time. 1.2.2 ROBUST & ADAPTABLE: 6. Builds on GB experience. 7. Adapted for non-energy requirements of I-SEM. 8. Not susceptible to over-tagging. 9. Capable of operating under changing market dynamics. 1.2.3 OBJECTIVE & TRANSPARENT: 10. Clearly documented process published. 11. Automated to the greatest extent practical. 12. Not be overly influenced by any TSO subjectivity. 3 2 DEVELOPMENT AND DISCUSSION; 2.1 BACKGROUND ON FLAGGING & TAGGING The SEM Committee decision noted that the approach for I-SEM could build on the experience in the GB market. Hence, this paper provides comparisons between the Flagging and Tagging approach in GB and how that might applied or varied to suit I-SEM. As is shown in Figure 1, GB Flagging & Tagging has evolved considerably since its initial development in 2001. This evolution has taken into account the many changes that have occurred in the underlying market architecture since then and many of the components of the mechanism today are there due to legacy issues. An important part of this implementation process is to determine which of the components of the current mechanism are needed for the I-SEM and which ones aren’t. In addition, we need to take into account the direction of travel of the GB mechanism in relation to the changes under the Electricity Balancing Significant Code Review process, which is coming to a conclusion. These reforms include the move to a single imbalance price, a PAR of 1 by Nov 2018 and the inclusion of Reserve Scarcity Pricing. Figure 1 - History of Imbalance Pricing Arrangements in GB 2.1.1 COMPARISON BETWEEN THE I-SEM AND GB MARKETS When considering GB as a starting point for the I-SEM imbalance pricing, it is important to recognise the differences between the I-SEM and GB market designs. This will inform our thinking around which components are required for I-SEM and which are not necessary. In addition, some of the 4 steps in the GB process need to be adapted to cater for differences in the market arrangements and underlying physical system (e.g. the SO flagging and tagging process proposed for I-SEM is quite different from GB). The core components of the market arrangements are set out in the Table 1 below. Table 1 - Comparison between I-SEM and GB market arrangements Market Component I-SEM GB Fowards Financial Physical DAM Market Coupling Market Coupling IDM Market Coupling Market Coupling Imbalance Price Single marginal price Single PAR50 price Imbalances Pay-as-cleared Pay-as -cleared Scarcity Pricing Reserve based* Reserve based BOAs Pay-as-cleared Pay-as-bid Side Payments Yes, for cost recovery No TSO Actions BM BM & Balancing Services Non-energy actions flagged To be determined. Need to consider all initially. Transmission, intra-period, emergency, SO-SO Of particular note in the above table is the fact that GB bid offer acceptances are pay-as-bid whereas in I-SEM they are pay-as-cleared with side payments (i.e. the greater of the offer and the imbalance price for incs and the lesser of the offer and imbalance price for decs). This is important for two reasons: a. there is an incentive to reflect costs in offers as it maximises the chance of being scheduled and earning inframarginal rent. This is in contrast to the pay-as-bid regime in GB where as they will only be paid their offer, the incentive on market participants is to submit offers that chase the marginal price. For this reason, there is likely to be greater downward pressure on offers in the ISEM than in GB, all other things being equal. b. it means that the TSOs in I-SEM face similar incentives as market participants in the balancing market i.e. to reduce insofar as possible the volume of trade that would be subject to higher prices. Also of importance is that in the I-SEM arrangements the balancing market is the only means by which the TSO can manage operational constraints system. In GB on the other hand, the TSOs can avail of the Balancing Market but also longer term Balancing Service Agreements. 2.1.2 ACTIONS FLAGGED AS NON-ENERGY ACTIONS IN GB 5 Figure 2 below sets out which of a typical set of non-energy actions would be flagged in GB. On the right hand side of the figure, the process employed by National Grid for SO Flagging is shown. As can be seen, many non-energy actions types are not covered by the SO flagging approach. Figure 2- Typical Non-Energy Actions and GB Process 2.1.3 I-SEM NON-ENERGY REQUIREMENTS: The below table sets out the types of security constraints typically present on the Ireland and Northern Ireland systems. Non-energy actions could be taken for any of the below reasons among others and, therefore, it is important that they are captured by the imbalance pricing process. Table 2- Ireland and Northern Ireland Non-Energy Requirments 2.1.4 DEFINITIONS OF FLAGGING AND TAGGING IN GB 6 It is important from the outset to understand the distinction between flagging and tagging. A key difference is that flagging identifies actions that should potentially be removed from the imbalance price calculation, tagging removes the price and the volume of the action from the calculation. These are set out in more detail in Figure 3. Figure 3 - Flagging, Classification and Tagging 7 3 IMPLEMENTATION PROPOSAL 3.1 FLAGGING AND TAGGING PROCESS 3.1.1 OVERVIEW The Imbalance Pricing process takes place immediately after the real time operation of the system between the calculation of instruction profiles and quantities of bid/offer acceptances and before the imbalance settlement process as shown in Real Time Dispatch Application Dispatch Instructions Instruction Profiling Quantities of Bid / Offer Acceptances Imbalance Pricing Imbalance Settlement Figure 4 - Upstream and downstream processes from Imbalance Pricing The Imbalance Pricing Process itself is made up of four distinct parts as set out in Figure 5. These are developed in the next section. Inputs Ranked Set of Actions Taken, Real Time Dispatch System Outputs, Parameters Flagging SO flag, Non-marginal flag, Emergency Instruction flag, CADL flag Classification Price of Marginal Energy Action Taken, Replacement Prices Tagging De Minimis tag, NIV tag, PAR tag Pricing Administered Scarcity Price, Imbalance Price Figure 5 - Imbalance Pricing Process 8 3.1.2 INPUTS Table 3 sets out the main input variables, parameters and outputs from the Imbalance Pricing Calculation. Table 3 - Inputs, Parameters, Outputs Type Index Index Parameter Parameter Parameter Parameter Element Long Name Definition Source Units Imbalance Price Period Index of Imbalance Price Periods in Imbalance Settlement Period QBOA calculator none k Rank Index of accepted bids and offers in ascending order from lowest priced bid to highest priced offer Imbalance Pricing Process IPPD Imbalance Price Period Duration Period over which the price applies. Proposed IPPD is 5 minutes. Parameter Decision min CADL Continuous Acceptance Duration Limit Limit to flag very short actions to prevent them setting the price. Parameter decision min DMAT De Minimis Acceptance Threshold Threshold to remove low volume actions from pricing process. Parameter decision MWh PAR Price Average Reference Volume over which the imbalance price is calculated. Parameter decision MWh φ 9 Type Element AO Long Name Definition Source Units Accepted Offer Quantity See Imbalance Settlement QBOA Calculator MWh Input value Q Input value QABuoiφ Accepted Bid Quantity See Imbalance Settlement QBOA Calculator MWh Input value PBOuβoiφ Bid Offer Price See Imbalance Settlement QBOA Calculator €/MWh Administered Administered Scarcity Price Scarcity Price Decision CRM Decision 2 €/MWh Administered Administered Scarcity Scarcity Price Quantity Decision CRM Decision 2 MW RTD System MWh Parameter Parameter P AS Q uoiφ iφ AS iφ Input Value 𝑄𝑅𝑇𝐷𝑢𝜑 Real Time Dispatch Energy Quantity Quantity from the TSO real time dispatch system to determine nonenergy actions. Input Value Real Time Dispatch 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 System Service Quantity Quantity from the TSO real time dispatch system to determine nonenergy actions. RTD System Varies by System Service Real Time Dispatch Energy Requirement Quantity from the TSO real time dispatch system to determine nonenergy actions. RTD System MWh Real Time Dispatch Quantity from the TSO real time RTD System Varies by Input Value 𝑅𝑅𝑇𝐷𝑢𝜑 Input Value 𝑅𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 10 Type Input Value Input Value Input Value Input Value Output Output Output Element 𝑄𝑢𝑖𝜑 𝐻𝑂𝐿𝑢𝜑 𝐿𝑂𝐿𝑢𝜑 P M F SO F NM F CADL φ ukφ ukφ ukφ Long Name Definition Source Units System Service Requirement dispatch system to determine nonenergy actions. Unit Bid Offer Breakpoints Quantity from the TSO real time dispatch system to determine nonmarginal actions. RTD System MW Higher Operating Limit Limit from the TSO real time dispatch system to determine nonenergy / nonmarginal actions. RTD System MW Lower Operating Limit Limit from the TSO real time dispatch system to determine nonenergy /nonmarginal actions. RTD System MW Market Price Price to be used when no IMBP exists. Ex-ante price from DAM and IDM. SO flag Flag used to identify nonenergy actions. Imbalance Pricing Process None Nonmarginal flag Flag used to identify nonenergy actions. Imbalance Pricing Process None CADL flag Flag used to identify CADL actions. Imbalance Pricing Process None System Service 11 Type Element Long Name Definition Source Units Output FFSukφ First Stage Flag Product of other flags Imbalance Pricing Process None FSOuξφ Constraint Flag Flag used to identify nonenergy actions due to constraint ξ Imbalance Pricing Process None TDMukφ De Minimis Tag Tag used to remove actions below De Minimis Acceptance Threshold Imbalance Pricing Process None TNIVuoiφ Net Imbalance Volume Tag Tag used to remove nonenergy and nonmarginal actions Imbalance Pricing Process None TPARukφ Price Average Reference Tag Tag used to remove actions that are outside the Price Average Reference Imbalance Pricing Process None RTAG Residual Tagged Volume Quantity used to ensure equal volumes of tagged offers and bids. Imbalance Pricing Process MWh PMEATφ Price of the Marginal Energy Action Taken Marginal Imbalance Price prior to the application of PAR Imbalance Pricing Process €/MWh Imbalance Price for period 𝜑 Marginal Imbalance Price prior to the Imbalance Pricing Process €/MWh Output Output Output Output Output Output Outputs P IMB φ 12 Type Element Long Name Definition Source Units Imbalance Pricing Process €/MWh application of PAR Outputs PIMBγ Imbalance Price for period 𝛾 Marginal Imbalance Price for Imbalance Settlement Period 3.1.3 RANKING OF DISPATCH ACTIONS The step involves sorting the actions taken based on their associated prices. Once we have completed the flagging and tagging process, the most expensive unflagged action taken is the marginal energy action taken. Purpose in GB: Separate stacks of buy actions and sell actions, ordered in economic merit, are the start point for the other aspects of the Flagging and Tagging process (some of which depend on the order of actions in the stack). Discussion: Ranked sets provide the fundamental functionality for marginal pricing, ensuring there is a stack of actions from one extreme in price to the other. Required for I-SEM? Yes; however, one ranked set may be preferable as there is a single imbalance price. All decremental actions taken (decs) shall be ranked in order from lowest price first to highest and numbered from 1 to M (number of decs). All incremental actions taken (incs) shall be ranked in order of price from lowest first to highest and numbered from M+1 to N (number of incs). Following each flagging or tagging step, this functionality is repeated. Draft Rules 1.1 The Balancing Market Operator shall assign a rank (k) to all Accepted Bids (QABuoiφ, PBOuoiφ) in order of Bid Offer Price (PBOuoiφ), lowest priced first, from k = 1 to M, where M is the total number of Accepted Bids; 1.2 The Balancing Market Operator shall assign a rank (k) to all Accepted Offers (QAOuoiφ, PBOuoiφ) in order of Bid Offer Price (PBOuoiφ), lowest priced first, from k = M+1 to N, where M is the total number of Accepted Bids and N is the total number of Accepted Bids and Accepted Offers; 3.1.4 FLAGGING The following section concerns the application of flags to accepted orders in order to identify the marginal energy action taken. 13 Flags are set equal to one initially and then set to zero where the flag is applied to an accepted order. This convention is adopted for also tags so that multiplication by a tag in the price calculation expressions will result in the retention of untagged actions (tag =1) and removal of tagged actions (tag=0). Draft Rules 2 Flagging The Balancing Market Operator shall set initial values of SO Flag (FSOukφ), Nonmarginal Flag (FNMukφ), CADL Flag (FCADLukφ) and De Minimis Tag (TDMukφ) for each Generator Unit u, all rank k and Imbalance Price Period φ to a value equal to one; 2.1 3.1.4.1 SYSTEM OPERATOR FLAGGING Purpose in GB: System Operator Flagging (SO-Flagging) is the process that identifies BOAs and Balancing Services Adjustment Actions that are potentially taken for system balancing reasons. The SO-Flagging process is documented in the System Management Action Flagging Methodology Statement which is required under National Grid’s Transmission Licence. For BOAs, the SO flags when it believes the BOA may be impacted by a transmission constraint. For Balancing Services Adjustment Actions, the SO also flags when it believes the balancing action was impacted by a transmission constraint. It also has two additional reasons for flagging a Balancing Services Adjustment Action: Any system-to-system balancing service over an Interconnector which is used to avoid adverse effects arising on the GB Transmission System from significant load profile changes; and Any system-to-system balancing service over an Interconnector which is used by another country’s Transmission System Operator (TSO) for the purposes of resolving a system operation issue. Discussion: As the main objective of Flagging and Tagging is to minimise the extent of price pollution arising from non-energy actions on the energy imbalance price, SO Flagging is an important component of the Imbalance Price calculation in I-SEM. In GB, whole units are flagged whenever binding transmission constraints give rise to units being run out of merit. Transmission constraints represent a subset of all non-energy actions as outlined in the previous section and consideration needs to be given to how best to capture all of the non-energy requirements in I-SEM. In addition, in order to automate the process and reduce TSO subjectivity in the flagging and tagging process, it is necessary to adopt a different approach to that used in GB. This approach is set out in detail in APPENDIX B: Detailed Flagging Rules. Needed for I-SEM: Yes. SO Flagging will form an important part of the flagging and tagging process. 14 Draft Rules 2.2 The Balancing Market Operator shall flag actions taken for non-energy reasons by setting SO Flag (FSOukφ) to a value of zero in line with the detailed methodology for the application of SO Flags set out in Appendix B as follows: For all k, FSOukφ = Π FSOuξφ, where Π is the product across all constraints ξ; 3.1.5 NON-MARGINAL FLAGGING Purpose in GB: Non-marginal Flagging (NM-Flagging) is not a feature of the GB balancing mechanism. Due to its origins as an average pricing mechanism which has progressively moved to a more marginal pricing, the GB pricing mechanism does not feature specific functionality necessary to identify the marginal energy action taken. Discussion: When we talk about a marginal action, we mean an action whose cost is invariant for a small increase and decrease in the size of the action. As the main objective of Flagging and Tagging is to identify the marginal energy action taken, the process first considers the actions taken, then removes non-energy actions to arrive at a set of energy actions taken and finally removes nonmarginal actions taken from the energy actions taken to arrive at the marginal energy action(s) taken. Without this step, a high priced energy action that is constrained could set the price. If we consider a high priced incremental offer up to a unit’s min stable generation, the unit may submit a high priced inc (e.g. €1000/MWh) over its min stable generation and min on time to ensure that it recovers its fixed and no load costs. If the unit subsequently reduces its incremental offer for quantities above its min stable generation to a level that reflects its variable cost only (e.g. €50/MWh), the TSO may accept this offer partially to balance the remaining energy imbalance as it represents the least cost action available. With the method proposed, both the higher priced offer and the lower priced offer would both be considered energy actions taken. This step ensures that the energy action taken that is bound by the units Min Stable Generation is prevented from setting the price as it does not reflect the marginal cost of balancing the system, leaving the action at €50/MWh as the marginal energy action taken. Needed for I-SEM: Yes. Non-marginal flagging will form an important part of the flagging and tagging process. Draft Rules 2.3 The Balancing Market Operator shall flag actions taken that are non-marginal by setting the Non-marginal Flag (FNMukφ) to a value of zero in line with the detailed methodology for the application of Non-marginal Flags set out in Appendix B 15 3.1.5.1 EMERGENCY FLAGGING Purpose in GB: To prevent the price from being set by actions taken due to events which were for system reasons but outside of normal system actions captured under SO Flagging etc. The emergency actions can be identified as flagged or unflagged actions. Discussion: This is an area that will need to be defined over the course of the rules development process in manner consistent with the emergency provisions of the Grid Code and associated arrangements. Required for I-SEM? Yes. To be defined in the SO Flagging process in Appendix B in line with emergency procedures under the Grid Codes. It is proposed that these instructions are captured under the SO Flagging process if they are for non-energy reasons or not flagged if they are for energy reasons. 3.1.5.2 CADL FLAGGING Purpose in GB: Remove sub half-hourly balancing actions from setting the price. Rationale is that the costs of such actions (e.g. to resolve a 5 minute demand spike) cannot be accurately targeted given that energy imbalances are only measured at the granularity of the imbalance settlement period (30 minutes in GB). Discussion: Need to consider imbalance settlement period duration, and the granularity of other flagging. Firstly, if the imbalance settlement period duration is to move to 15 minutes in the future, CADL (should there be one) should move with it. It must be asked whether a CADL of 15 minutes would be suitable given the intention to move towards that granularity. Also, if the imbalance price period is on a lower level of granularity than the imbalance settlement period (e.g. 5 minutes - 15 minutes), then it may be appropriate to allow acceptances of this granularity to set the price. Similar to this, if the price was to come from an average over the imbalance settlement period of smaller granularity time periods (e.g. every 5 minutes within the settlement period, as is being proposed), then there is potentially no need to CADL Flagging, as the impact of that one price on the whole imbalance settlement period has been reduced in the calculation of an average. Needed for I-SEM: Yes. Value of CADL to be determined as part of the consideration of all imbalance price setting parameters. As proposed, if there are multiple Imbalance Price Periods within an Imbalance Settlement Period – with the Imbalance Price equal to the average across the Imbalance Price Periods in the Imbalance Settlement Period - then CADL arguably should be less than the Imbalance Price Period. Draft Rules 2.4 The Balancing Market Operator shall flag actions taken whose Continuous Acceptance Duration is less than the Continuous Duration Acceptance Limit by setting the CADL Flag (FCADLukφ) to a value of zero in line with the detailed methodology for the application of CADL Flags set out in Appendix B 16 3.1.5.3 FIRST STAGE FLAG This section simply sets a flag as the product of all the flags applied in the previous steps. If the first stage flag for an action taken is zero, it means that the action taken is not the marginal energy action taken. The flagged actions taken still may be included in the price calculation if it is not tagged in the following section. Draft Rules 2.5 The Balancing Market Operator shall calculate the First Stage Flag (FFSukφ) for Generator Unit u, rank k and Imbalance Price Period φ as follows: FFSukφ = FSOukφ FNMukφ FCADLukφ; 3.1.6 CLASSIFICATION Purpose in GB: Allows all those flagged actions which are in merit in the ranked set (i.e. have more economic prices than the marginal unflagged action) to be included in the volume-weighted imbalance price. Discussion: The price of the most expensive unflagged action is the marginal imbalance price. In order to calculate the price over a Price Average Reference volume, it is necessary to unflag actions that are in merit (i.e. are less expensive than the most expensive unflagged action). Each flagged incremental action with a price greater than the price of the highest-priced unflagged incremental action remains flagged and it becomes unpriced. Otherwise, it becomes unflagged and its price is retained for the imbalance price calculation over the PAR volume. Similarly, each flagged decremental action with a price less than the price of the lowest-priced unflagged decremental action remains flagged and becomes unpriced. Otherwise, it becomes unflagged and its price is retained for the imbalance price calculation over the PAR volume. Needed in I-SEM? Yes; however, it is given effect by only including tagged volumes in the imbalance price calculation with volumes that were flagged but not tagged being included. For actions where the price is higher than the most expensive unflagged action, these units will be subject replacement pricing whereas if the price of the action is lower than the most expensive unflagged action, the actions price will be included in the pricing calculation (subject to tagging stage). 3.1.6.1 REPLACEMENT PRICE Purpose in GB: Any remaining unpriced actions are repriced at the weighted average of the most expensive 1MWh of unflagged actions (where there are no unflagged actions, a backup Market Price1 is used). This is to ensure that all actions contributing to the NIV have a price but that this price reflects the most expensive unflagged action rather than the original price of the flagged action. 1 The backup Market Price is an index price from the ex-ante markets or equivalent. 17 Discussion: The use of a replacement price is intimately linked to the use of PAR. It ensures that the imbalance is not unduely dampened by ensuring that the unpriced actions that contribute to meeting the imbalance volume are priced equal to the most expensive unflagged action. Needed for I-SEM: Yes. To be considered with PAR. Replacement Buy Price is set by the most expensive unflagged action in the direction of the NIV. This is the Price of the Marginal Energy Action Taken. If there are no unflagged system actions, it is set by the backup Market Price. Draft Rules 3 3.1 Classification The Balancing Market Operator shall calculate the Net Imbalance Volume (NIVφ) as follows: NIVφ= ∑QAOukφ +∑QABukφ; 3.2 The Balancing Market Operator shall calculate the Price of the Marginal Energy Action Taken (PMEATukφ) as follows: If NIVφ>0, PMEATukφ=Max(PBOukφFFSukφ) If NIVφ<0, PMEATukφ=Min(PBOukφFFSukφ) 3.3 The Balancing Market Operator shall calculate Replaced Bid Offer Prices (PRBOukφ) as follows: If NIVφ>0, PRBOukφ=Min(PBOukφ, PMEATukφ); If NIVφ<0, PRBOukφ=Max(PBOukφ, PMEATukφ); 3.1.7 TAGGING The following section concerns the application of tags to accepted bids and offers in order to identify the energy actions taken including the marginal energy action taken are to be included in the Imbalance Price calculation. Note: in the absence of PAR, the Imbalance Price would be based on the Marginal Energy Action Taken. If PAR > 0, the Imbalance Price is calculated across the Price Average Reference of Energy Actions Taken including the Marginal Energy Actions Taken. 3.1.7.1 DE MINIMIS TAGGING Purpose in GB: Prevents very small volumes arising in the half-hourly integration of dispatch instructions from influencing the price. Each accepted offer, or bid, or buy action or sell action, the absolute value of the volume (QAOuoih or QABuoih) which is less than the De Minimis Acceptance Threshold (DMAT) is De Minimis Tagged. 18 Discussion: Could be useful in many cases, e.g. if a dispatch profile strays briefly into a certain expensive band region as the profile is intended to bring the unit to its FPN to end the acceptance, and the only reason why the profile strayed into that band region is because of the technical limitations of the unit rather than consciously wishing to incur an order at that price, it could be unfair to allow that order to set the price for the whole imbalance settlement period. De Minimis actions may already be captured by CADL flagging, should that be implemented. The case where units would, as a whole, only be instructed by amounts this small is unlikely to arise, but what could arise is that a unit could be instructed, as a whole, by a relatively large amount, but one part of the instruction is only barely within a band, leading to the volume of the total instruction applicable to this band being very small. It may be appropriate to allow this to set the price if it was not spurious, e.g. if the unit was instructed to output at that level and kept there over the imbalance settlement period, this could be the marginal unit of energy. There could be an incentive to use resubmitting of inc/dec curves to influence price setting - using it in a way which changes the quantity bands only slightly so that a continuous acceptance following the initial closed acceptance would result in an order of a slightly higher price being accepted. This change could be made only small enough that the outcomes from the scheduling systems may not result in the TSO giving an instruction to slightly reduce the output of the unit to prevent this acceptance. If De Minimis tagging were implemented, it would remove this potential incentive. Required for I-SEM: Yes. De Minimis Tagging to be included in I-SEM. Value of DMAT to be determined as part of the consideration of all imbalance price setting parameters. Draft Rules 4 4.1 Tagging The Balancing Market Operator shall tag actions taken whose absolute quantity is less than the De Minimis Acceptance Threshold (DMAT) by setting the De Minimis Tag (TDMukφ) to a value of zero; 3.1.7.2 NIV TAGGING Purpose in GB: NIV is defined in GB as the difference between the sum of the volumes of the system buy actions, and the negative of the sum of the system sell actions. The NIV in I-SEM is consistent with this definition. NIV Tagging is used to identify the energy actions taken to meet the Net Imbalance Volume by netting the most expensive incremental and decremental actions until there are only actions in one direction and that the remaining volume is equal to the NIV. If the absolute value of the sum of the volumes of the system sell actions is less than or equal to the sum of the volumes of the system buy actions, then all system sell actions are NIV tagged. All system buy actions up until the last one (going from from most to least expensive) where the system sell action volume interacts, and the fraction of the last system buy action which brings the total volume 19 of system buy actions considered equal to the volume of the NIV tagged system sell actions, are also NIV tagged. Vice versa applies if the absolute value of the sum of the volumes of system sell actions is greater than the sum of the volumes of system buy actions: All system buy actions are NIV tagged, and system sell actions (in whole or the fraction required of the last one, going from least to most expensive) up to the volume of NIV tagged system buy actions are also NIV tagged. Discussion: It is important to recognise the history of the GB arrangements and that NIV tagging was introduced shortly after the NETA reforms and many years prior to the introduction of SO flagging. NIV tagging was in many respects a proxy for SO Flagging but makes the assumption that the energy balancing actions were the cheapest actions; however, this is often not the case (e.g. if a peaking unit is brought on at very short notice at a high price). In line with the SEMC decision, in order to arrive at, “an imbalance price that reflects the costs incurred by the TSO in energy balancing the system”, it is necessary to preserve these higher cost energy actions where they represent the marginal energy action taken. With the more comprehensive SO flagging process being proposed for I-SEM, we propose a variation of NIV tagging (previously referred to as SO Tagging but now combined with combined with GB NIV Tagging) that nets flagged actions taken in the opposite direction to the NIV firstly from flagged actions in the direction of the NIV and then from the highest priced unflagged actions to arrive at a set of NIV Tagged actions that sum to zero and a residual set of untagged actions that sum to the NIV. In addition, the proposed approach also accounts for situations where actions in opposite direction to the NIV are the marginal energy action. For example, where there are no non-energy actions and a unit is brought on to its min stable generation, necessitating backing off a cheaper unit to make room for the more expensive unit’s min stable generation. In this case, the decremental action is the marginal energy action taken and the proposed methodology accounts for this situation. This is a more general form of NIV tagging that takes into account the more comprehensive information available to the SO in relation non-energy actions and the marginal pricing design of the I-SEM where the imbalance price is based on the marginal energy action taken. Needed for I-SEM? Yes; however, the approach proposed for I-SEM is more general to the GB NIV tagging approach in that it protects the marginal energy action taken for situations where higher priced energy actions and energy actions in the opposite direction to the NIV are the marginal energy action taken. For situations where the marginal energy action taken is a lower priced action in the direction of the NIV, the outcome would be the same as NIV tagging. Draft Rules 4.2 4.2.1 The Balancing Market Operator shall calculate NIV Tag (TNIVukφ) for Generator Unit u, rank k and Imbalance Price Period φ as follows: Set initial values of TNIVukφ = FFSukφTDMukφ; 20 4.2.2 Let RTAGφ=-(∑QABukφ(1- TNIVukφ) + ∑QAOukφ(1- TNIVukφ)); 4.2.3 If ∑QABukφ TNIVukφ ≤ RTAGφ < 0: 4.2.3.1 Find b and β, RTAGφ = ∑k<bQABukφ TNIVukφ +βk=bQABukφ TNIVukφ; 4.2.3.2 Set TNIVukφ =0 for all k = 1 to b-1, TNIVukφ = 1 – β for k = b; 4.2.4 If RTAGφ < ∑QABukφ TNIVukφ: 4.2.4.1 Set TNIVukφ =0 for all k = 1 to M; 4.2.4.2 Find b and β, -RTAGφ = ∑k<bQAOukφ(1- TNIVukφ)+βk=bQAOukφ(1- TNIVukφ); 4.2.4.3 Set TNIVukφ =1 for all k = M+1 to b-1, TNIVukφ = 1 – β for k = b; 4.2.5 If 0< RTAGφ ≤∑QAOukφ TNIVukφ: 4.2.5.1 Find b and β, RTAGφ = ∑k>bQAOukφ TNIVukφ +βk=bQAOukφ TNIVukφ; 4.2.5.2 Set TNIVukφ =0 for all k = b+1 to N, TNIVukφ = 1 – β for k = b; 4.2.6 If RTAGφ > ∑QAOukφ TNIVukφ: 4.2.6.1 Set TNIVukφ =0 for all k = M+1 to N; 4.2.6.2 Find b and β, -RTAGφ = ∑k>bQABukφ(1- TNIVukφ)+βk=bQABukφ(1- TNIVukφ); 4.2.6.3 Set TNIVukφ =1 for all k = b+1 to M, TNIVukφ = 1 – β for k = b; 3.1.7.3 PAR TAGGING Purpose in GB: The last tagging process is Price Average Reference (PAR) Tagging. In GB, the original purpose of the PAR Tagging mechanism was to more closely align the main energy imbalance price with the price of the marginal energy balancing action (i.e. the most expensive action taken by the SO to balance total energy supply and demand). It is important to note that GB has moved progressively from average pricing, to chunky marginal pricing (PAR 500, PAR50) and intends to move to marginal pricing in 2018. The imbalance price is calculated based on the volume-weighted average of a defined volume of the most expensive remaining unflagged actions. In GB, as of 5th Nov 2015, this defined volume is 50MWh moving to 1MWh from 1st Nov 2018. Discussion: The SEM Committee decision sets out that the following in relation to PAR: Preference for marginal imbalance price. Suite of pricing parameters to be considered by Working Group (e.g. CADL, DMAT, PAR) Some averaging may be permitted if evidence based and time limited. Should not unduely dampen imbalance price. 21 From the comments submitted by participants, it is clear that there is an appetite for a PAR at least on a transitional basis. In order to facilitate further consideration of the need for PAR, we propose to include the functionality in the imbalance price calculation. Needed in I-SEM? Functionality for PAR will be included in the pricing calculation and whether it is used can be determined during the process for setting the imbalance price setting parameters. Draft Rules 4.3 The Balancing Market Operator shall calculate the value PAR Tag (TPARukφ) for Generator Unit u, rank k and Imbalance Price Period φ as follows: 4.3.1 Set TPARukφ=TNIVukφ; 4.3.2 Let GIVφ=∑QAOukφTNIVukφ -∑QABukφTNIVukφ;. 4.3.3 If GIVφ>PAR and NIVφ>0: 4.3.3.1 Find b and β, PAR = ∑k>bQAOukφ TPARukφ + β k=bQAOukφ TPARukφ∑k>bQABukφTPARukφ-βk=bQABukφ TPARukφ; 4.3.3.2 Set TPARukφ =0 for all k = 1 to b-1, TPARukφ = β for k = b; 4.3.4 If GIVφ>PAR and NIVφ<0, 4.3.4.1 Find b and β, PAR = ∑k<bQAOukφTPARukφ + β k=bQAOukφTPARukφ∑k<bQABukφTPARukφ-βk=bQABukφ TPARukφ; 4.3.4.2 Set TPARukφ =0 for all k = b+1 to N, TPARukφ = β for k = b; 4.4 The Balancing Market Operator shall calculate the Second Stage Tag (TSSukφ) for Generator Unit u, rank k and Imbalance Price Period φ as follows: TSSukφ = TDMukφ TNIVukφ TPARukφ; 3.1.8 PRICING 3.1.8.1 BUY PRICE ADJUSTMENT /SELL PRICE ADJUSTMENT 3.1.8.1.1 START COSTS Purpose in GB: Used to reflect balancing services agreement prices in the imbalance price. STOR contract components being replaced by Reserve Scarcity Pricing of activated reserves at the beginning of Flagging and Tagging Process. Discussion: One of the areas where the GB arrangements differ from the I-SEM arrangement concerns the ability of the TSO in GB to access balancing services outside of the balancing mechanism. The balancing mechanism in GB does not commence until one hour ahead of each 22 balancing period. The I-SEM on the other hand features an extended balancing market that runs in parallel to the intraday market and this period prior to hour ahead is the timeframe where the TSOs have to ensure that the system is secure and within operational security limits. Based on the SEM Committee decision, for actions taken prior to gate closure, generator units’ offers should be able to reflect their start and no load costs; for actions after gate closure, all costs should be reflected in one simple set of inc and decs. Actions taken prior to gate closure will therefore have start and no-load cost components and if these need to be reflected in the imbalance price, they could be introduced at this stage. It is likely that most actions taken prior to gate closure will be for non-energy reasons and thus these costs are unlikely to impact on the imbalance price; however, this is an area that can be kept under review to ensure that the imbalance price is cost reflective. Needed in I-SEM? No provision is required for recovery of explicit Start Costs and No Load Costs through the price. In line with the detailed design decision, any early actions by the TSOs shall only be taken for reasons of system security, priority dispatch or other statutory reasons. As these actions are flagged and tagged, they cannot set the price. 3.1.8.1.2 SCARCITY PRICE To be developed when decisions related to administered scarcity pricing as part of the second CRM consultation are published. 3.1.8.2 LOSS ADJUSTMENT FACTORS Purpose in GB: The BOAs used to calculate the main energy imbalance price are adjusted for transmission losses. This is done in the final calculation (see below). Balancing Services Adjustment Actions are adjusted by the SO before they are sent to the BSC Systems. Discussion: The loss adjustment of volumes in the imbalance pricing process is only relevant where PAR is used. The weighted average across a PAR volume is further weighted by the relevant transmission loss adjustment factors. Needed in I-SEM? Yes. The application of loss adjustment factors in the imbalance pricing process is to be developed further with their overall application in the Imbalance Settlement Process. 23 3.1.8.3 IMBALANCE PRICE The imbalance price is calculated as the weighted average across the actions that are not PAR tagged. Draft Rules 5 5.1 Imbalance Price Calculation The Balancing Market Operator shall calculate Imbalance Price (PIMBφ) as follows: PIMBφ=(ΣPRBOukφQAOukφTSSukφ-ΣPRBOukφQABukφTSSukφ)/(ΣQAOukφTSSukφΣQABukφTSSukφ); 24 APPENDIX A: DRAFT RULES 1 Inputs and Pre-Processing 1.1 The Balancing Market Operator shall assign a rank (k) to all Accepted Bids (QABuoiφ, PBOuoiφ) in order of Bid Offer Price (PBOuoiφ), lowest priced first, from k = 1 to M, where M is the total number of Accepted Bids; 1.2 The Balancing Market Operator shall assign a rank (k) to all Accepted Offers (QAOuoiφ, PBOuoiφ) in order of Bid Offer Price (PBOuoiφ), lowest priced first, from k = M+1 to N, where M is the total number of Accepted Bids and N is the total number of Accepted Bids and Accepted Offers; 2 Flagging 2.1 The Balancing Market Operator shall set initial values of SO Flag (FSOukφ), Nonmarginal Flag (FNMukφ), CADL Flag (FCADLukφ) and De Minimis Tag (TDMukφ) for each Generator Unit u, rank k and Imbalance Price Period φ to a value equal to one; 2.2 The Balancing Market Operator shall flag actions taken for non-energy reasons by setting SO Flag (FSOukφ) to a value of zero in line with the detailed methodology for the application of SO Flags set out in Appendix B as follows: For all k, FSOukφ = Π FSOuξφ, where Π is the product across all constraints ξ; 2.3 The Balancing Market Operator shall flag actions taken that are non-marginal by setting the Non-marginal Flag (FNMukφ) to a value of zero in line with the detailed methodology for the application of Non-marginal Flags set out in Appendix B 2.4 The Balancing Market Operator shall flag actions taken whose Continuous Acceptance Duration is less than the Continuous Duration Acceptance Limit by setting the CADL Flag (FCADLukφ) to a value of zero in line with the detailed methodology for the application of CADL Flags set out in Appendix B; 2.5 The Balancing Market Operator shall calculate the First Stage Flag (FFSukφ) for Generator Unit u, rank k and Imbalance Price Period φ as follows: FFSukφ = FSOukφ FNMukφ FCADLukφ; 3 3.1 Classification The Balancing Market Operator shall calculate the Net Imbalance Volume (NIVφ) as follows: NIVφ= ∑QAOukφ +∑QABukφ; 3.2 The Balancing Market Operator shall calculate the Price of the Marginal Energy Action Taken (PMEATukφ) as follows: 25 If NIVφ>0, PMEATukφ=Max(PBOukφFFSukφ) If NIVφ<0, PMEATukφ=Min(PBOukφFFSukφ) The Balancing Market Operator shall calculate Replaced Bid Offer Prices (PRBOukφ) as follows: 3.3 If NIVφ>0, PRBOukφ=Min(PBOukφ, PMEATukφ); If NIVφ<0, PRBOukφ=Max(PBOukφ, PMEATukφ); 4 Tagging 4.1 The Balancing Market Operator shall tag actions taken whose absolute quantity is less than the De Minimis Acceptance Threshold (DMAT) by setting the De Minimis Tag (TDMukφ) to a value of zero; 4.2 The Balancing Market Operator shall calculate NIV Tag (TNIVukφ) for Generator Unit u, rank k and Imbalance Price Period φ as follows: 4.2.1 Set initial values of TNIVukφ = FFSukφTDMukφ; 4.2.2 Let RTAGφ=-(∑QABukφ(1- TNIVukφ) + ∑QAOukφ(1- TNIVukφ)); 4.2.3 If ∑QABukφ TNIVukφ ≤ RTAGφ < 0: 4.2.3.1 Find b and β, RTAGφ = ∑k<bQABukφ TNIVukφ +βk=bQABukφ TNIVukφ; 4.2.3.2 Set TNIVukφ =0 for all k = 1 to b-1, TNIVukφ = 1 – β for k = b; 4.2.4 If RTAGφ < ∑QABukφ TNIVukφ: 4.2.4.1 Set TNIVukφ =0 for all k = 1 to M; 4.2.4.2 Find b and β, -RTAGφ = ∑k<bQAOukφ(1- TNIVukφ)+βk=bQAOukφ(1- TNIVukφ); 4.2.4.3 Set TNIVukφ =1 for all k = M+1 to b-1, TNIVukφ = 1 – β for k = b; 4.2.5 If 0< RTAGφ ≤∑QAOukφ TNIVukφ: 4.2.5.1 Find b and β, RTAGφ = ∑k>bQAOukφ TNIVukφ +βk=bQAOukφ TNIVukφ; 4.2.5.2 Set TNIVukφ =0 for all k = b+1 to N, TNIVukφ = 1 – β for k = b; 4.2.6 If RTAGφ > ∑QAOukφ TNIVukφ: 4.2.6.1 Set TNIVukφ =0 for all k = M+1 to N; 4.2.6.2 Find b and β, -RTAGφ = ∑k>bQABukφ(1- TNIVukφ)+βk=bQABukφ(1- TNIVukφ); 4.2.6.3 Set TNIVukφ =1 for all k = b+1 to M, TNIVukφ = 1 – β for k = b; 26 4.2.7 The Balancing Market Operator shall calculate the value PAR Tag (TPARukφ) for Generator Unit u, rank k and Imbalance Price Period φ as follows: 4.2.8 Set TPARukφ=TNIVukφ; 4.2.9 Let GIVφ=∑QAOukφTNIVukφ -∑QABukφTNIVukφ;. 4.2.10 If GIVφ>PAR and NIVφ>0: 4.2.10.1 Find b and β, PAR = ∑k>bQAOukφ TPARukφ + β k=bQAOukφ TPARukφ∑k>bQABukφTPARukφ-βk=bQABukφ TPARukφ; 4.2.10.2 Set TPARukφ =0 for all k = 1 to b-1, TPARukφ = β for k = b; 4.2.11 If GIVφ>PAR and NIVφ<0, 4.2.11.1 Find b and β, PAR = ∑k<bQAOukφTPARukφ + β k=bQAOukφTPARukφ∑k<bQABukφTPARukφ-βk=bQABukφ TPARukφ; 4.2.11.2 Set TPARukφ =0 for all k = b+1 to N, TPARukφ = β for k = b; 4.3 The Balancing Market Operator shall calculate the Second Stage Tag (TSSukφ) for Generator Unit u, rank k and Imbalance Price Period φ as follows: 5 TSSukφ = TDMukφ TNIVukφ TPARukφ; 6 Imbalance Price Calculation 6.1 The Balancing Market Operator shall calculate Imbalance Price (PIMBφ) as follows: PIMBφ=(ΣPRBOukφQAOukφTSSukφ-ΣPRBOukφQABukφTSSukφ)/(ΣQAOukφTSSukφΣQABukφTSSukφ) 27 APPENDIX B: DETAILED FLAGGING RULES This Appendix sets out the flagging rules that would be required today based on the Operational Constraints Update published by the TSOs in Oct 2015. The rules to be applied on any particular day will need to reflect the constraints used in the Real Time Dispatch system that is used to inform dispatch decisions. 6.2 The Balancing Market Operator will set the Constraint Flag (FSOuξφ) for Generator Unit u, Operational Constraint ξ and Imbalance Price Period φ equal to zero for all units where the following conditions are true. TOTAL OPERATING AND REPLACEMENT RESERVES For Primary Operating Reserve (𝜉 = 1), Secondary Operating Reserve (𝜉 = 2), Tertiary Operating Reserve I (𝜉 = 3), Tertiary Operating Reserve II (𝜉 = 4) and Replacement Reserve (𝜉 = 5): 1(a): ∑𝑢∗ 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = κξ max𝑢 𝑄𝑅𝑇𝐷𝑢𝜑 … (1𝐴) 𝑎𝑛𝑑 1(b): For units u*: 𝑄𝑅𝑇𝐷𝑢𝜑 + 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝐻𝑂𝐿𝑢𝜑 𝑜𝑟 𝑄𝑅𝑇𝐷𝑢𝜑 = 𝐿𝑂𝐿𝑢𝜑 Where Σ𝑢∗ is the sum over all generator units u excluding the largest infeed (max𝑢 𝑄𝑅𝑇𝐷𝑢𝜑 ) and κξ is the percentage of the largest infeed to be covered by the reserve requirement. The algebra in this rule set defines a set of tests to determine whether a particular action was taken for reserve reasons. The first test checks if the total requirement for the operating reserve in question is binding (i.e. the amount being provided exactly equals the amount required). This indicates whether the reserve requirement is resulting in non-energy actions. The second test checks if the action taken is bound by the reserve constraint. The is more clearly illustrated in the next slide. Figure 0-1 - If ORi is binding, unit is only bound if change in output reduces ORi provision 28 Figure 0-1 shows a typical reserve characteristic for a generator unit. The unit has to be on at min stable level to provide the operating reserve. The unit can provide its max operating reserve up to the level where the headroom starts to decrease for every increase in unit output. If the first NER1 test is true (i.e. the operating reserve is binding) then the second test is only true if the actions places the unit in the area indicated by the red line. In this area (or at LOL), the unit cannot change its output in both directions without resulting in a reserve shortfall. The concept that the unit has to be able to move in both directions is important. A binding requirement arises from two forces pushing up against each other – on one side we have the economic force and on the other we have the force of the requirement. In the above diagram, if the unit was in merit to be at its HOL but it was needed for its max operating reserve, the unit would be dispatched to point where the green line becomes red slopes downwards. At this point, the economic force is pushing the units output upwards to its HOL and the reserve requirement force is pushing its output downwards to get max operational reserve (but it stops at this point because it gets no additional reserve). The economic force acts on the unit until its output is at the most economic level and in the absence of any requirements in the opposite direction, the unit will move to this level and the economic force will cease to apply. A limit or requirement that prevents the unit from achieving its most economic level causes the units to be at a level that is not the most economically efficient. As it is extremely unlikely that a limit or requirement would be at the exact same point as the economically efficient point, it follows that units that are bound by limits or requirements are not marginal i.e. they are not the last action taken. 3.1.8.4 MINIMUM OPERATING AND REPLACEMENT RESERVES For minimum Primary Operating Reserve (𝜉 = 6), Secondary Operating Reserve (𝜉 = 7), Tertiary Operating Reserve I (𝜉 = 8), Tertiary Operating Reserve II (𝜉 = 9) and Replacement Reserve (𝜉 = 10) in Ireland and minimum Primary Operating Reserve (𝜉 = 11), Secondary Operating Reserve (𝜉 = 12), Tertiary Operating Reserve I (𝜉 = 13), Tertiary Operating Reserve II (𝜉 = 14) and Replacement Reserve (𝜉 = 15) in Northern Ireland: 2(a): ∑𝑢+ 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝑅𝑆𝑆𝑅𝑇𝐷𝜉𝜑 and 2(b): For units u+: 𝑄𝑅𝑇𝐷𝑢𝜑 + 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝐻𝑂𝐿𝑢𝜑 𝑜𝑟 𝑄𝑅𝑇𝐷𝑢𝜑 = 𝐿𝑂𝐿𝑢𝜑 Where Σ𝑢+ is the sum over all generator units u in Ireland (ξ=6-10) and Northern Ireland (ξ=11-15). 3.1.8.5 NEGATIVE RESERVES IRELAND AND NORTHERN IRELAND For Negative Reserve in Ireland (𝜉 = 16) and Negative Reserve in Northern Ireland (𝜉 = 17): 3(a): ∑𝑢+ 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝑅𝑆𝑆𝑅𝑇𝐷𝜉𝜑 and 3(b): For units u+: 𝑄𝑅𝑇𝐷𝑢𝜑 + 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝐿𝑂𝐿𝑢𝜑 Where Σ𝑢+ is the sum over all generator units u in Ireland (𝜉 = 16) and Northern Ireland (𝜉 = 17). 3.1.8.6 SYSTEM NON SYNCHRONOUS PENETRATION For System Non-Synchronous Penetration limits (ξ=18): 4(a): ∑𝑊𝑖𝑛𝑑 𝑄𝑅𝑇𝐷𝑢𝜑 +∑𝐼𝑚𝑝𝑜𝑟𝑡𝑠 𝑄𝑅𝑇𝐷𝑢𝜑 𝑅𝑅𝑇𝐷𝑢𝜑 +∑𝐸𝑥𝑝𝑜𝑟𝑡𝑠 𝑄𝑅𝑇𝐷𝑢𝜑 = 𝑆𝑁𝑆𝑃 𝐿𝑖𝑚𝑖𝑡 29 Where Σ𝑊𝑖𝑛𝑑 is the sum over all wind generator units, Σ𝐼𝑚𝑝𝑜𝑟𝑡 is the sum over interconnector imports and Σ𝐸𝑥𝑝𝑜𝑟𝑡 is the sum over interconnector exports. 3.1.8.7 INERTIA For the System Inertia requirement (ξ=19): 5(a): ∑𝑢 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝑅𝑆𝑆𝑅𝑇𝐷𝜉𝜑 and 5(b): For units u: 𝑄𝑅𝑇𝐷𝑢𝜑 + 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝐿𝑂𝐿𝑢𝜑 3.1.8.8 IRELAND AND NORTHERN IRELAND DYNAMIC AND VOLTAGE STABILITY For Northern Ireland System Stability (ξ=20), Ireland System Stability (ξ=21), North West Generation (ξ=22), Kilroot Generation (ξ=23), Dublin Generation 1 (ξ=24), Dublin Generation 2 (ξ=25), Dublin Generation 3 (ξ=26), Dublin North Generation (ξ=27), Dublin South Generation (ξ=28), South Generation (ξ=29), Moneypoint (ξ=30) constraints: 6(a): ∑𝑢∗ 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝑅𝑆𝑆𝑅𝑇𝐷𝜉𝜑 and 6(b): For units u*: 𝑄𝑅𝑇𝐷𝑢𝜑 = 𝐿𝑂𝐿𝑢𝜑 Where Σ𝑢∗ is the sum across all the units u* in the constraint. 3.1.8.9 IRELAND AND NORTHERN IRELAND UNIT LIMITS For limits on units needed for Replacement Reserves in Ireland (ξ=31), Replacement Reserve in Northern Ireland (ξ=32), Ballylumford Generation (ξ=33), Moyle Export (ξ=34), Moyle Import (ξ=35), Cork Generation (ξ=36) and South Generation (ξ=37), EWIC Import (ξ=38), EWIC Export (ξ=39), Turlough Hill Import (ξ=40), Turlough Hill Export (ξ=41) and Hydro Smolt Protocol (ξ=42). 7(a): ∑𝑢∗ 𝑄𝑆𝑆𝑅𝑇𝐷𝑢𝜉𝜑 = 𝑅𝑆𝑆𝑅𝑇𝐷𝜉𝜑 Where Σ𝑢∗ is the sum across all the relevant units u* in Replacement Reserves in Ireland (ξ=31), Replacement Reserve in Northern Ireland (ξ=32), Ballylumford Generation (ξ=33), Moyle Export (ξ=34), Moyle Import (ξ=35), Cork Generation (ξ=36) and South Generation (ξ=37), EWIC Import (ξ=38), EWIC Export (ξ=39), Turlough Hill Import (ξ=40), Turlough Hill Export (ξ=41) and Hydro Smolt Protocol (ξ=42). 3.1.9 NON-MARGINAL FLAGGING Each Accepted Bid or Accepted Offer shall have their Non-Marginal Flag (𝐹𝑁𝑀𝑢𝜑) set equal to one if any of the following sets of criteria are satisfied: 𝑄𝑅𝑇𝐷𝑢 = 𝐿𝑂𝐿𝑢𝜑 or 𝑄𝑅𝑇𝐷𝑢 = 𝐻𝑂𝐿𝑢𝜑 or 𝑄𝑅𝑇𝐷𝑢 = 𝑄𝑢𝑖𝑜𝜑 3.1.10 CADL FLAGGING Detailed CADL Flagging Method will be developed further based on the detailed methodology for Instruction Profiling. 30