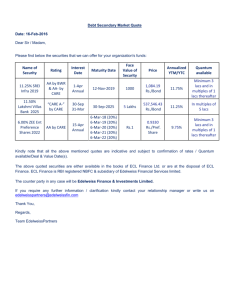

Shriram Transport Finance Company Limited

advertisement