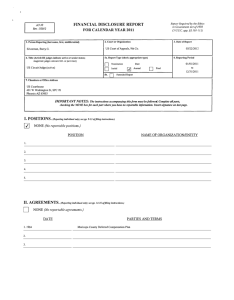

Page 1: Richard F. Cebull – 2006

advertisement

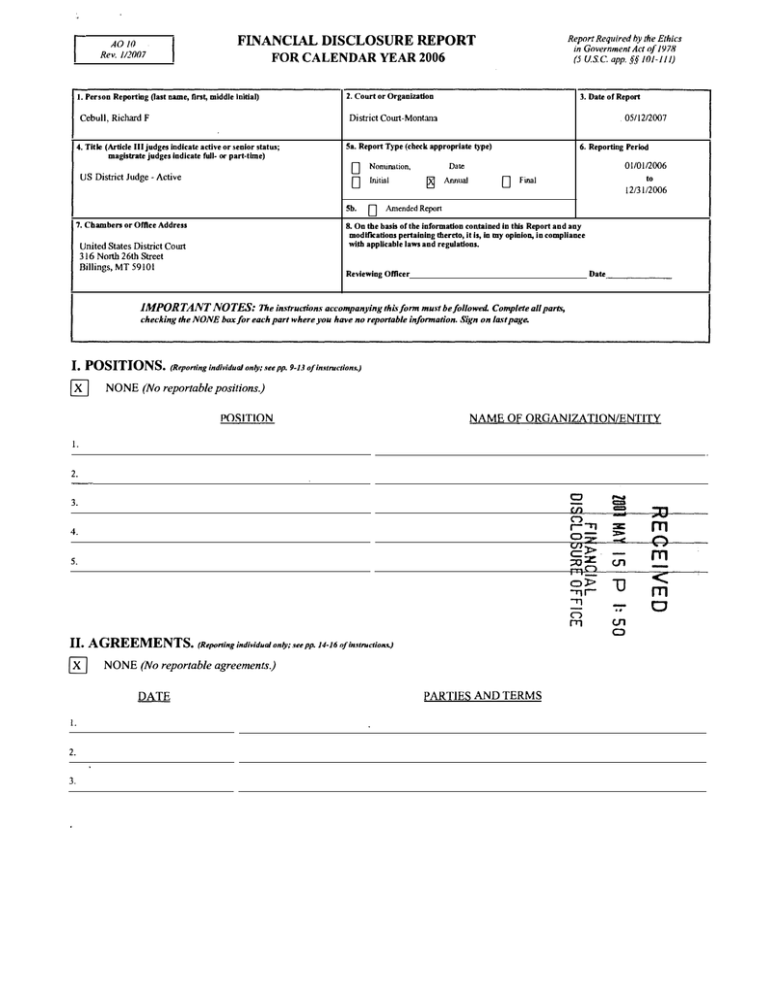

FOR CALENDAR YEAR 2006

l. Person Reporting (last ruune, first, middle Initial)

Cebull, Richard

Report Required by the Ethics

in Government Act of 1978

(5 U.S.C. app. §§ 101-111)

FINANCIAL DISCLOSURE REPORT

AO!O

Rev. 112007

F

2. Court or Organization

3. Date of Report

05/12/2007

District Court-Montana

4. Title (Article III judges indicate active or senior statU5;

6. Reporting

Sa. Report Type (check appropriate type)

Period

magistrate judges indicate full- or part-tbne)

D

D

US District Judge - Active

Initial

D

Sh.

7. Chambers or Office Address

Date

Nonunation,

Annual

01/01/2006

D

United States District Court

Amended Report

Reviewing Officer

Date

IMPORTANT NOTES: The imtructions accompanying thi form mu t be followed. Complete all

checking the NONE box for each part where you have no reportable information. Sign on last page.

0

1213112006

8. On the basis orthe information contained in this Report and any

modif"ications pertaining thereto, it is, in my opinion, in compliance

with applicable laws and regulations.

316 North 26th Street

Billings, MT 59101

I. POSITIONS.

to

Final

parts,

)

(Reporting individual only; .... pp. 9-13 ofin.•ll'Uclion...

NONE (No reportable positions.)

POSITION

NAME OF ORGANIZATION/ENTITY

I.

2.

0

3.

en

('")

, .,,

oU>z

c:t>.

:::0 ::z

FTlC)

ol>

"'Tll

"'Tl

0

fT1

4.

5.

JJ. AGREEMENTS.

0

(Rq>orting individual only; .•ee pp. 14-16 ofitutruction.'-)

NONE (No reportable agreements.)

PARTIES AND TERMS

I.

2.

3.

Si:

-

3:

>-<

c.n

'U

..•

c.n

0

;:o

m

(')

m

-

<

m

CJ

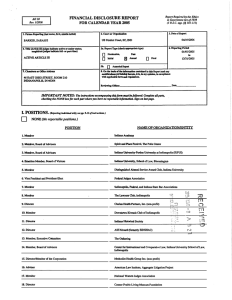

FINANCIAL DISCLOSURE REPORT

Page 2of11

Name of Person Reporting

Date of Report

Cebull, Richard F

III. N0N-INVESTMENT INcoME.

0511212007

(RqHJrting individ11al UJtd .<pou.<e; .•u pp. 17-24 of in.<tructioH.<.)

A. Filer's Non-Investment Income

[RJ

NONE (No reportable non-investment income.)

SOURCE AND TYPE

INCOME

(yours, not spouse's)

I.

2.

3.

4.

5.

B. Spouse's Non-Investment Income

-

Ifyo11 ._..married during any portioH of the reporting year,<'OMp/ete thl• .<e<tion.

(Dollar amount not required except for honoraria.)

[RJ

NONE (No reportable non-investment income.)

SOURCE AND TYPE

].

2.

3.

4.

5.

IV. REIMBURSEMENTS

-

tl'an.<portation, lodging,food, enrertainmen£

(Includes those to spo«l'e and dependent children. See pp. 15-17 of instructions.)

NONE (No reportable reimbursements.)

SOURCE

I.

2.

3.

4.

5.

DESCRIPTION

FINANCIAL DISCLOSURE REPORT

Page 3of11

V. GIFTS.

(KJ

Name of Person Reporting

Cebull, Richard F

Date

of Report

05/12/2007

(lndude.1 those to spou.<e and dependent children.. See pp. 18-31 ofin.•tru<1ion.<.)

NONE (No reportable gifts.)

SOURCE

DESCRIPTION

VALUE

I.

2.

3.

4.

5.

VJ. LIABILITIES.

(KJ

(Include.• tho.•e of spou.1e and depen.dent children. &e pp. 31-33 ofin.<truction...)

NONE (No reportable liabilities.)

CREDITOR

1.

2.

3.

4.

5.

DESCRIPTION

VALUE CODE

Page 4 of I I

CebuU,

VII. INVESTMENTS and TRUSTS

D

Date of Report

Name of Person Reporting

FINANCIAL DISCLOSURE REPORT

Richard

05/12/2007

F

- income, mlue, tran.<at1ion.• (Include.• those ofthe .•polL.. and dependent t•hi/dmt. See pp. 34-60 offiling in.'1nu1ion....)

NONE (No reportable income, assets, or transactions.)

A.

B.

c.

D.

Description of Assets

Income dilling

Gross value at end of

Transactions during reporting period

(including

trust assets)

reporting period

Place "(X)" after each asset

(I)

Type(e.g.

Date

Value

Gain

[dentityof

Method

buy, sell,

Month-

redemption)

Day

Code2

(J-P)

CodeI

(A-H)

buyer/seller

Code3

(2)

(1)

(2)

Amount

Type (e.g.

Value

Value

div., rent,

Code 2

(J-P)

CodeI

(A-H)

exempt from prior disclosure

reporting period

(I)

or int.)

(3)

(2)

(Q-W)

l.

BROKERAGE ACCOUNT# I

2.

MT UNIV REVS HIGHER ED FACS

IMPT-D

A

Interest

J

FORSYTH MT PCR

A

Interest

transaction)

4.

MT ST HEALTH FAC RV AUTH RV B/D

A

Interest

J

T

5.

ALLIANZ NFJ DIV VAL CL C

A

Dividend

J

6.

COLUMBIA SMALL CAP VALUE

11 CLC

A

Distribution

7.

MT ST BRO HSG RV AMT SINGLE FAM

A

8.

INTEL CORP CS

9.

QUALCOMM INC.

10.

ST MARY LAND

11.

Redemption

05/31

T

Buy

08/11

J

T

Buy

8/11

Interest

J

T

A

Dividend

J

T

Part Sell

2123

A

Dividend

J

T

Buy

02124

A

Dividend

J

T

TEXAS INSTRUMENTS INC CS

A

Dividend

J

T

12.

EATON VANCE TAX MGD GROWTH-C

A

Dividend

Sell

08/11

13.

GROWTH FUND AMER INC

A

Dividend

K

T

14.

KOPP FDS EMERGING GROWTH FD CL

None

J

T

15.

HARTFORD CAPITAL APPREC -C

A

Distribution

J

T

I6.

PUTNAM TAX EXP INC FD

MF

A

Dividend

J

T

17.

TAMARACKlNVT FUNDS MM

A

Dividend

J

T

MTG B/E SER A2

& EXPL

CS

MF

MF

A MF

I. fncomc Crain CodCR.:

(See Columns Bl and D4)

2. Value Cod"'

(Sec Columns CI and D3)

3. V nluc Method CodcR

(Sec Column C 2)

MF

SJ,001 • $2,500

J

c

J

J

c s2.501 • $5,000

D $5,001 • $15.000

HI

H2

A SJ,OOOorleAA

B

F-$50.001. $100,000

G SI00.001-$1,000,000

1 $15.000 orlCAA

K SJ5,001. $50,000

L $50.001 • $100,000

M

$100.001. $250,000

N $250,00 I

a

Pl

$1,000.001. $5,000.000

P2

s5.ooo. 001

P4

Morcthan $50,000, 000

T

PJ

•

$500.000

$25.000. 001 • $50.000 ,000

Q Appraisal

U

Book Value

s500,001. s1.ooo,ooo

R "i:'o<I (Real E<tatc Only)

v o1hcr

(if private

T

3.

MBIA SISTERS OF CHARlTY

(5)

(4)

$1.000,001. $5,000. 000

S =Af>aCSR111Cllf

W""Estimatcd

More than $5,000,000

ash Market

$25.000 . 000

E "'ii 5.001

•

$50,000

Name

FINANCIAL DISCLOSURE REPORT

Page 5of11

of Person Reporting

Date

of Report

05/12/2007

CebuU. Richard F

)

VII. INVESTMENTS and TRUSTS - income, value, tran.•a<1ion.• (Include.• tho.•e ofthe .•pou<e and dependent ,·hi/dren. See pp. 34-60 offiling in.•ln"1ion...

D

NONE

(No reportable income, assets, or transactions.)

-

·-

B.

C.

D.

Description of Assets

Income during

Gross value at end of

Transactions during reponing period

(including trust assets)

reponing period

reponing period

A.

Place "(X)" after each asset

(l)

(2)

(I)

(2)

Amount

Type (e.g.

Value

Value

div.,rent,

C o de2

or int.)

(J-P)

Code I

exempt from prior disclosure

(A-H)

(I)

(2)

(J)

(4)

Date

Method

buy, sell,

Month-

Code 2

Code I

buyer/seller

Code3

redemption)

Day

(J-P)

(A-H)

(ifprivate

Value

Gain

I9.

IRA#!

D

Dividend

M

Identity of

transaction)

(Q-W)

18.

(5)

Type (e. g.

T

FINANCING CORP CPN FICO STRIPS

SER R

20.

TAMARACK INVT FDS MM

21.

SUNAMERICA FOC DIV STRAT II

22.

SELIGMAN SMALL CAP VALUE -C

23.

Sell

10/12

J

ALLIANZ OPCAP VALUE-C

Sell

08118

K

24.

FT DOW TGT DVD SEPT 05

Sell

10/12

J

25.

FT VALUELINE TGT SEPT 05

Sell

10/12

J

26.

ALLIANZ NFJ DIVIDEND VAL CL C

Buy

08118

K

27.

FT DOUBLE PLAY

Buy

I0/12

J

28.

GROWTH FUND OF AMERICA

29.

GS CORE LARGE CAP VALUE -C

Buy

I0/12

J

30.

LORD ABBETT MID CAP VALUE -C

31.

CIT lNTERNOTES

32.

GENERAL ELEC CAP CO STEP CPN

33.

BROKERAGE ACCT#2

34.

CEF MONEY MARKET FUND

I. Income Grun C'ode11:

(Sec Column• BI and D4)

2. Value Codes

(Sec Column• Cl and DJ)

3. Value Method Codes

(Sec Column Cl)

OCT 06 FT EQ

TUST

A

Dividend

J

A Sl.OOOorlC!OI

B »Sl,001

F $50.001. $100.000

a s100,001.s1,ooo,ooo

J -$15.000

•

$2,500

T

c -$2,501 • $5,000

HI

Sl.000, 001

·

$5.000,000

K $15.00I -$50.000

L $50.001. $100.000

N -$250,001 • $500,000

0 $500,001. $1,000. 000

Pl -$1,000. 001

PJ -$25,000, 001

R '('ost (Real Estntc Only)

P4 -More than $50,000.000

v-Othcr

s =A,q, Cfl:micnt

Q

or

lcAA

Appraisal

U BookValuc

•

$50,000,000

c

W =Estimated

•

$5,000.000

D $5,00l ·Sl5,000

H2

More than $5,000, 000

M SI00,001-$250,000

P2 $5,000,001. $25,000. 000

T

ililhMarkct

E »$15,001. $50,000

Name

FINANCIAL DISCLOSURE REPORT

Page 6of11

of Person Reporting

Date of Report

Cebull, Richard F

05/12/2007

)

VII. INVESTMENTS and TRUSTS - inL'Ome, value, tran.•a<1ion.• (Include.< those ofthe .<pou.•e and dependent children. See pp. 34-60 offiling in.<1nu1ion...

D

NONE

(No reportable income, assets, or transactions.)

A.

B.

c.

D.

Description of Asseis

Income during

Gross value at end of

Transactions during reporting period

reporting period

(including trust asselS)

Place

"(X)" after each asset

(2)

(l)

(2)

Amount

Type(e.g.

Value

Value

div., rent.-

Code 2

or int.)

(J-P)

Code I

(A-H)

e:xempt from prior disclosure

reporting period

(l)

(!)

Type(e.g.

(2)

Dale

Method

buy, sell,

Monll!-

Code 3

redemption)

Day

(4)

(3)

Gain

Identity of

Code 2

Code I

(A-H)

(if private

(J-P)

(Q-W)

35.

GENERAL ELECTRIC CS

36.

JOHNSON

37.

A

Dividend

J

T

A

Dividend

J

T

PFIZER INC CS

A

Dividend

J

T

38.

GLACIER CAPITAL TR A

A

Interest

39.

CAPITAL WORLD GROWTH

A

Distribution

J

T

40.

MERRILL LYNCH PRD CAPITAL TR

A

Interest

J

T

41.

IRA#2

E

lnt./Div.

Pl

T

42.

COLUMBUS BANK & TRUST CO

43.

" " "

44.

LASALLE BANK MIDWEST

45.

lll

llf

46.

COUNTY BANK

47.

H II II

48.

& JOHNSON

CS

02101

J

Buy

213

J

Buy

06/09

L

Redemption

12/20

L

Buy

06/16

L

Redemption

12121

L

Buy

6/23

L

Redemption

12128

L

WASHINGTON MUTUAL BANK

Buy

6/09

L

49.

ADVANTAGE BANK

Buy

6/06

L

50.

AMERICAN WEST BANK

Buy

6109

L

51.

C ENTRAL PROGRESS IVE BANK

Buy

6109

L

I. fncomc Gain Codc8:

(SceColumnsBI andD4)

2. Value Codes

(Sec ColumnR CJ and 03)

3. Vatuc Method Code"

(Sec Column C2)

A

Ill

A =$1.000or leAA

B =$1,001 - $2.500

c=$2,501 - $5,000

D =$5,00 I - S 15,000

F=$50.001-$100,000

G=$100,00l -$1,000,000

HI =$1,000,001-$5,000,000

H2 =More than $5.000.000

J =$15,000or less

K=$15,001 -$50,000

L =$50.001 -$100,000

M =$100.001 -$250.000

N -$250.001 - $500,000

0-$500,001 - $1.000,000

Pl =$1.000,001 - $5,000.000

P2 -$5,000,001 -$25,000. 000

P3 ···$25,000,001 -$50,000.000

R

P4=More than $50,000, 000

Q-Appraisal

U-BookValue

OSI (Real Estate Only)

V=Othcr

buyer/seller

trnnsaction)

Redemption

& INC

(5)

Value

S = A.qscainncn t

W=Estimatcd

T

ash Market

E =$15.001 -$50,000

Name of Person

FINANCIAL DISCLOSURE REPORT

Page 7of11

NONE

05/12/2007

CebuD, Richard F

VII. INVESTMENTS and TRUSTS

0

Date of Report

Reporting

)

- int•ome, value, transactions (lndude.• lhose of the spouse and dependent t•hildwr. See pp. 34-60 offiling instruction...

(No reportable income, assets, or transactions.)

A.

B.

c.

D.

Description of Assets

Income during

Gross value at end of

Transactions during reponing period

reponing period

reponing period

(including trust a'iSets)

Place "(X)" after each asset

exempt from prior disclosure

(!)

(2)

(I)

(2)

Amount

Code l

Type (e.g.

Value

Value

div., rent,

Code2

or int)

(J-P)

(A·H)

(I)

(5)

(4)

(3)

(2)

Type (e.g.

Date

Method

buy, sell,

Month-

Code2

Code I

buyer/seller

Code 3

redemption)

Day

(J-P)

(A-H)

( if private

Value

Identity of

Gain

(Q-W)

52.

COPPER STARBANK

53.

WELLS FARGO

54.

transaction)

Buy

12/22

M

Sell

06106

j

D

HOME DEPOT INC CS

Sell

06/06

K

E

55.

WAL-MART STORES INC CS

Sell

6106

j

D

56.

AMERICAN MUTUAL FUND CL A

Sell

6106

M

F

Sell

6106

K

c

Sell

6106

j

A

Sell

6106

M

E

Sell

6106

K

D

57.

& CO CS

BOND FUND OF AMERICA INC. MF

58.

EURO PACIFIC GROWTH FUND CL A

59.

FUNDAMENTAL INVESTORS INC MF

60.

GOLDMAN SACHS GROWTH

&

INCOME FUND-CL A MF

61.

GOLDMAN SACHS INTERNA T!ONAL

EQUITY FUND-CL A MF

62.

GOLDMAN SACHSBALANCED FD CL

A MF

63.

GROWTH FUND OF AMERICA CL A MF

64.

INCOME FUND OF AMERICA CL A MF

65.

INVESTMENT CO OF AMERICA MF

66.

NEW PERSPECTIVE UNFD INC MF

67.

PUTNAM FUND FOR GROWTH

&

INCOME -CL A MF

68.

PUTNAM GWBAL EQUITY FUND CL A

I. Income Crain Codes:

(SccColumru1BI andD4)

2. Value Codci<

(Sec Columns Cl llnd DJ)

J. Value Method Codes

(Sec Column C 2)

A=$1.000orlc&tt

B-$1 .001 • $2,500

c -$2,501 -$5,000

D -$5.001 • $15,000

F -$50.001 • $100,000

G-$100,001 -$1,000,000

HI -$1.000.001 -$5.000.000

H2

J -$15,000or ICM

K -$15.001 - $50,000

L-$50,001 • $100,000

M-$100,001 -$250,000

N $250.001 -$500.000

0-$500,001 • Sl.000,000

Pl -$1.000.001 • $5.000.000

n s5,ooo .001 • s25,ooo.ooo

R -CoRt (Real E•talc Only)

P4

T-Cruih Market

V-Othcr

S =A<u1e;qsmcn1

PJ

s25,ooo,001 . s5o,ooo.ooo

Q -Apprai&'I

U BookValuc

More than $50,000 ,000

W=Estimatcd

More than $5,000,000

E

15,001. $50,000

Name of Person Reporting

FINANCIAL DISCLOSURE REPORT

Page 8of11

CebuU, Richard F

VII. INVESTMENTS and TRUSTS

0

NONE

Date

of Report

0511212007

ini·ome, value, trun.•action.• (lnduJe.• tho.•e ofthe .<pouse and dependent i·hildren. See pp. 34-60 offiling instnution.•.)

-

(No reportable income, assets, or transactions.)

-·

A.

B.

c.

D.

Description of Assets

Income during

Gross value at end of

Transactions during reporting period

(including trus1 assets)

reporting period

Place "(X)" after each asset

(2)

(l)

(2)

Amount

Type(e.g.

Value

Value

div.trent,

Code2

Method

buy, sell,

or int.)

(J-P)

Code3

redemption)

Code l

(A-H)

exempt from prior disclosure

reporting period

(!)

(l)

Type(e.g.

(2)

(4)

(3)

Date

Value

Gain

Monch-

Code2

Day

(J-P)

Code I

(A-H)

(Q-W)

(5)

Identity of

buyer/seller

(if private

transaction)

-

MF

69_

PUTNAM HEALTH SCIENCES TRUST

Sell

6106

K

PUTNAM INTERNATIONAL NEW

Sell

6106

J

PUTNAM CLASSIC EQUITY MF FUND

Sell

6106

K

D

72.

PUTNAM RESEARCH FUND MF

Sell

6106

K

B

73.

PUTNAM DIVERSIFIED INCOME CL A

MF

Sell

6106

L

74.

PUTNAM VISTA FUND INC - CL A MF

Sell

6106

K

75_

PUTNAM VOYAGER FUND INC-CL A

Sell

6106

J

76.

PUTNAM INVESTORS FUND CL A

Sell

6106

J

A

Sell

06106

K

c

70.

71.

77.

CL A MF

OPPORTUNlTIES FUND-CL A MF

CL A

MF

D

WASHINGTON MUTUAL INVESTORS

FUND INC .MF

78.

JC PENNEY

79.

GENERAL ELECTRIC CAP CORP MED

80.

FORD MOTOR CREDIT CO GLOBAL

81.

VAN KAMPEN FOCUS PORTFOLIOS

82.

D

& CO

BD

TERM NTS

LANDMARK SEC

387TRUST

INTERNATIONAL

BANK FOR

RECONSTRUCTION & DEVELOPMENT

83.

PASSPORT MONEY MARKET

84.

FIRST INTERSTATE

J. Income Gain CodC8:

(Sec Columns Bl and D4)

2.Value Codes

(Sec Columns Cl and DJ)

J.Value Method Code

(Sec Column C2J

BANK(Ckg, Sav)

Interest

A

A =$1.000 or le

B

F $50.00I -$I 00,000

G SI00,001-$1,000 .000

J $15.000

T

J

$1,001 -$2.500

c

2.501 -$5.000

D $5,001-$15,000

HI

s1.ooo,001 -S5.ooo.ooo

H2

More than $5.000,000

K $15.001 -$50,000

L s50.001 -s100.ooo

M

N $250.001 -$500.000

0 $500.00I - $1.000,000

Pl

$1.000,00 I -$5.000.000

P2 $5.000.001-$25.000.000

PJ $25,000,001 -$50,000 .000

R =<:oRt (Real Estate Only)

P4

More than $50,000.000

S = A.<u!cssmcnt

T =<:ru<h Market

v

Q

OT

leAA

Appraisal

U BookValue

other

W=Eslimatcd

$100.001 -$250.000

E $15.001 -$50.000

Name or Penon Reporting

FINANCIAL DISCLOSURE REPORT

Page 9of11

Date

CebuU, Richard F

or Report

05/12/2007

)

VII. INVESTMENTS and TRUSTS - im•ome, value, tran.•aetion.• (lndude.• tho.•e of the spouse and dependent children. See pp. 34-60 offiling in.•ITUL1ion...

0

NONE

(No reportable income, assets, or transactions.)

A.

Description of Assets

exempt from prior disclosure

C.

D.

Gross value at end of

reponing period

Transoctions during reponing period

reponing period

(including 1ru..i assets)

Place "(X)" after each asset

B.

Income during

(I)

Amount

CodeI

(A-1-1)

(2)

(I)

(2)

Type(e.g.

div., rent,

or int.)

Value

Value

C ode2

Method

Type (e.g.

buy, sell,

(J-P)

Code3

(I)

(3)

(2)

(5)

(4)

Date

Value

Gain

Identity of

MonthDay

Code2

CodeI

buyer/seller

redemption)

(J-P)

(A-H)

(if private

transaction)

Acct Closed

09/10

(Q-W)

85.

1st SECURITY BANK (ckg)

86.

NEW YORK LIFE INS POL. CV

J. rncomc c-.,run Code11:

(Sec Column• Bl nnd D4)

2. Vaine Code.

(Sec Column• Cl and DJ)

3. Value Method CodcR

(Sec Column C 2)

None

Dividend

B

u

K

A41.000orl"""

B

r -s50,001 -s100.ooo

G-$100.001-$1.000.000

J-$15,000 orlc,.

K-$15,001 -$50.000

L 450,00I-SI00,000

M

N -$250,00I - $500.000

0-$500,001 -$1.000.000

Pl -$1.000.001 -$5.000 .000

n -s5.ooo,001- S25.ooo.ooo

P3

R..Co81 (Real E"atc Only)

P4 -More lhan $50,000.000

T --=Ca.;;h Market

V

S=A.>ll'lc:;iRmCnt

Q

$25,000.001 - $50.000.000

ApprniMI

u BookValuc

l,001-$2,500

Other

C

$2,50I - $5,000

HI -$1,000.001-$5.000,000

W=E11timatcd

D-$5.001-$15,000

H2 -More than $5.000, 000

SI00,001-$250.000

E

15,001 -$50.000

FINANCIAL DISCLOSURE REPORT

Page 10of11

Name or Person Reporting

Date or Report

Cebull, Richard F

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

05112/2007

(lndiL'at£partofReport.)

FINANCIAL DISCLOSURE REPORT

Page 11 of 11

Name of Person

Reporting

Date of Report

0511212007

Cebull, Richard F

IX. CERTIFICATION.

I certify that aH Information given above (including information pertaining to my spouse aud minor or dependent children, if auy) b

accurate, true, and complete to the best of my knowledge aud belief, and that any information not reported was withheld because it met applicable statutory

provisions permitting non-disclosure.

I further certify that earned income from ouulde employment and honorarla and the acceptance of gifts which Jiave been reported are in

compliance with the provisions of 5 U.S.C. app. § 501 et. seq., 5 U.S.C. § 7353, and Judicial Conference regulations.

--

Date

!

:7 /

I

I

/;z /{J ·f7

,

NOTE: ANY INDIVIDUAL WliO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL

AND CRIMINAL SANCTIONS (5 U.S.C. app. § 104)

FILING INSTRUCTIONS

Mail signed original and 3 additional copies to:

Committee on Financial Disclosure

Administrative Office of the United States Courts

Suite 2-301

One Columbus Circle, N.E.

Washington, D.C. 20544