EQUITY

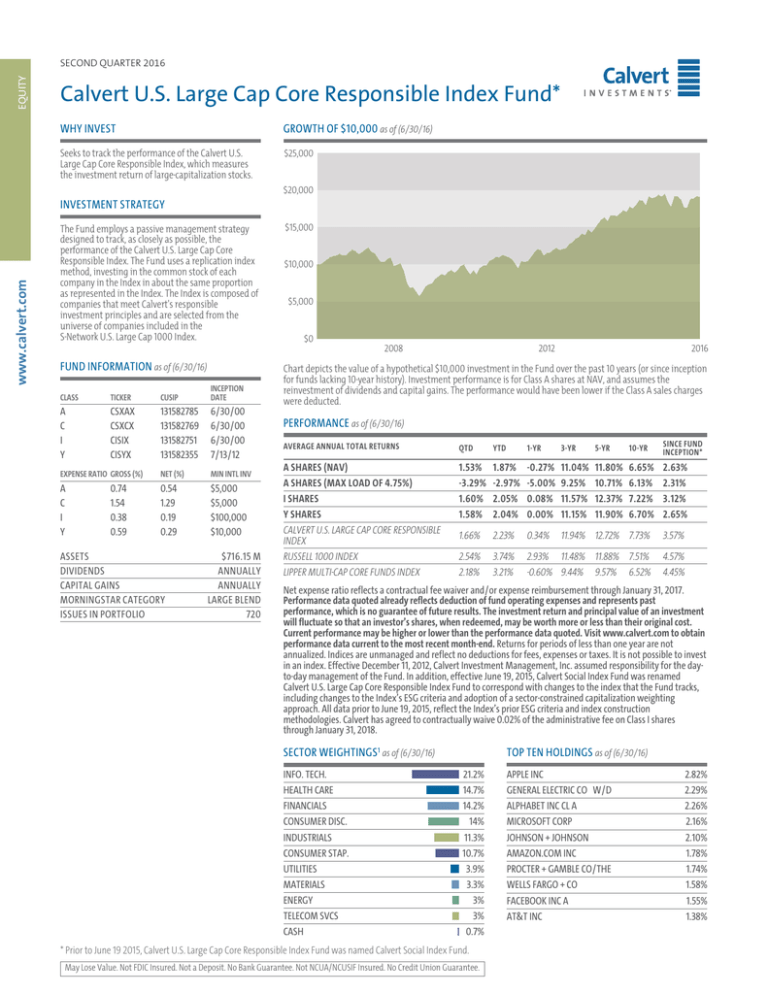

SECOND QUARTER 2016

Calvert U.S. Large Cap Core Responsible Index Fund*

WHY INVEST

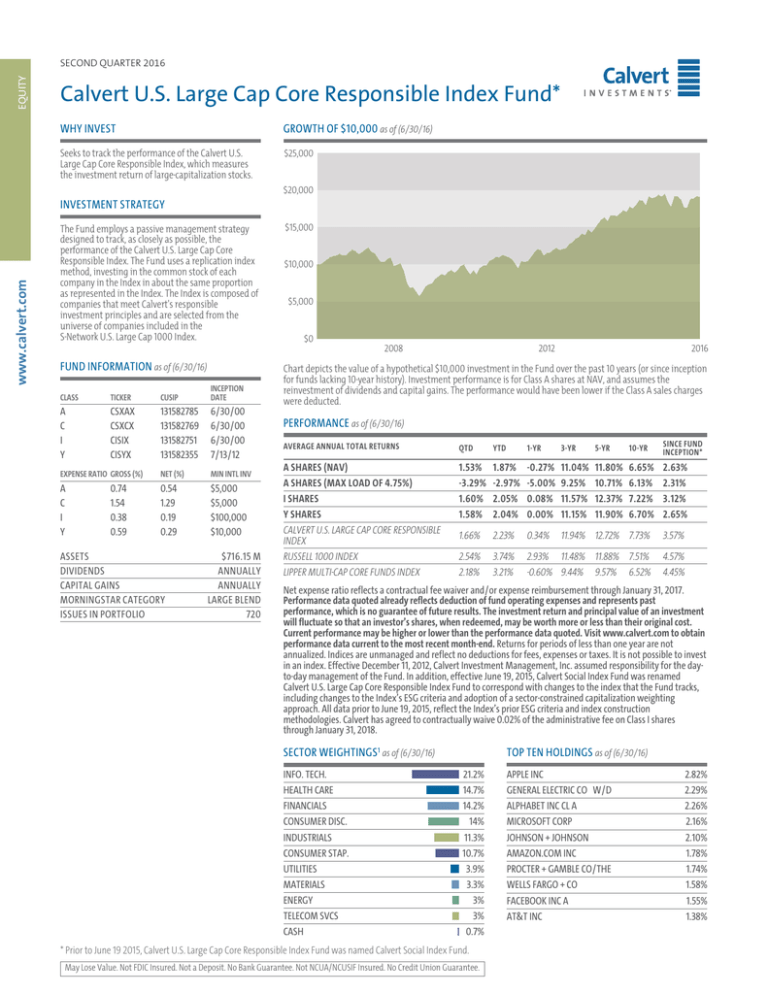

GROWTH OF $10,000 as of (6/30/16)

Seeks to track the performance of the Calvert U.S.

Large Cap Core Responsible Index, which measures

the investment return of large-capitalization stocks.

$25,000

$20,000

www.calvert.com

INVESTMENT STRATEGY

The Fund employs a passive management strategy

designed to track, as closely as possible, the

performance of the Calvert U.S. Large Cap Core

Responsible Index. The Fund uses a replication index

method, investing in the common stock of each

company in the Index in about the same proportion

as represented in the Index. The Index is composed of

companies that meet Calvert's responsible

investment principles and are selected from the

universe of companies included in the

S-Network U.S. Large Cap 1000 Index.

FUND INFORMATION as of (6/30/16)

CLASS

TICKER

CUSIP

INCEPTION

DATE

A

C

I

Y

CSXAX

CSXCX

CISIX

CISYX

131582785

131582769

131582751

131582355

6/30/00

6/30/00

6/30/00

7/13/12

EXPENSE RATIO GROSS (%)

NET (%)

MIN INTL INV

A

C

I

Y

0.54

1.29

0.19

0.29

$5,000

$5,000

$100,000

$10,000

0.74

1.54

0.38

0.59

ASSETS

DIVIDENDS

CAPITAL GAINS

MORNINGSTAR CATEGORY

ISSUES IN PORTFOLIO

$716.15 M

ANNUALLY

ANNUALLY

LARGE BLEND

720

$15,000

$10,000

$5,000

$0

2008

2012

2016

Chart depicts the value of a hypothetical $10,000 investment in the Fund over the past 10 years (or since inception

for funds lacking 10-year history). Investment performance is for Class A shares at NAV, and assumes the

reinvestment of dividends and capital gains. The performance would have been lower if the Class A sales charges

were deducted.

PERFORMANCE as of (6/30/16)

AVERAGE ANNUAL TOTAL RETURNS

QTD

YTD

1-YR

3-YR

5-YR

10-YR

SINCE FUND

INCEPTION*

A SHARES (NAV)

A SHARES (MAX LOAD OF 4.75%)

I SHARES

Y SHARES

CALVERT U.S. LARGE CAP CORE RESPONSIBLE

INDEX

RUSSELL 1000 INDEX

LIPPER MULTI-CAP CORE FUNDS INDEX

1.53%

-3.29%

1.60%

1.58%

1.87%

-2.97%

2.05%

2.04%

-0.27%

-5.00%

0.08%

0.00%

11.04%

9.25%

11.57%

11.15%

11.80%

10.71%

12.37%

11.90%

6.65%

6.13%

7.22%

6.70%

2.63%

2.31%

3.12%

2.65%

1.66%

2.23%

0.34%

11.94% 12.72% 7.73%

3.57%

2.54%

2.18%

3.74%

3.21%

2.93% 11.48% 11.88% 7.51%

-0.60% 9.44% 9.57% 6.52%

4.57%

4.45%

Net expense ratio reflects a contractual fee waiver and/or expense reimbursement through January 31, 2017.

Performance data quoted already reflects deduction of fund operating expenses and represents past

performance, which is no guarantee of future results. The investment return and principal value of an investment

will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be higher or lower than the performance data quoted. Visit www.calvert.com to obtain

performance data current to the most recent month-end. Returns for periods of less than one year are not

annualized. Indices are unmanaged and reflect no deductions for fees, expenses or taxes. It is not possible to invest

in an index. Effective December 11, 2012, Calvert Investment Management, Inc. assumed responsibility for the dayto-day management of the Fund. In addition, effective June 19, 2015, Calvert Social Index Fund was renamed

Calvert U.S. Large Cap Core Responsible Index Fund to correspond with changes to the index that the Fund tracks,

including changes to the Index’s ESG criteria and adoption of a sector-constrained capitalization weighting

approach. All data prior to June 19, 2015, reflect the Index’s prior ESG criteria and index construction

methodologies. Calvert has agreed to contractually waive 0.02% of the administrative fee on Class I shares

through January 31, 2018.

SECTOR WEIGHTINGS 1 as of (6/30/16)

INFO. TECH.

HEALTH CARE

FINANCIALS

CONSUMER DISC.

INDUSTRIALS

CONSUMER STAP.

UTILITIES

MATERIALS

ENERGY

TELECOM SVCS

CASH

TOP TEN HOLDINGS as of (6/30/16)

21.2%

14.7%

14.2%

14%

11.3%

10.7%

3.9%

3.3%

3%

3%

0.7%

* Prior to June 19 2015, Calvert U.S. Large Cap Core Responsible Index Fund was named Calvert Social Index Fund.

May Lose Value. Not FDIC Insured. Not a Deposit. No Bank Guarantee. Not NCUA/NCUSIF Insured. No Credit Union Guarantee.

APPLE INC

GENERAL ELECTRIC CO W/D

ALPHABET INC CL A

MICROSOFT CORP

JOHNSON + JOHNSON

AMAZON.COM INC

PROCTER + GAMBLE CO/THE

WELLS FARGO + CO

FACEBOOK INC A

AT&T INC

2.82%

2.29%

2.26%

2.16%

2.10%

1.78%

1.74%

1.58%

1.55%

1.38%

EQUITY

LIPPER LEADER RATINGS as of (6/30/16)

★★★★

The fund received the following ratings in the Large

Blend category for Class A shares (load waived) as of

6/30/16, based on risk-adjusted returns:2

Stars

Time Period # of Funds

★★★★

3 Year

1392

★★★★

5 Year

1206

★★★

10 Year

895

★★★★

Overall

MORNINGSTAR STYLE BOX

The Morningstar Style Box™

reveals a fund's current

investment strategy. For

equity funds, the vertical

axis shows the market

capitalization of the stocks

owned; the horizontal axis

shows investment style

(value, blend, or growth).

WHAT ARE THE RISKS

Investment in mutual funds involves risk, including

possible loss of principal invested. You could lose

money on your investment in the Fund or the Fund

could underperform because of the following risks:

the market prices of stocks held by the Fund may fall.

An index fund has operating expenses; a market

index does not. Although expected to track its target

index as closely as possible while satisfying its

investment criteria, the Fund will not be able to

match the performance of the index exactly. It is not

possible to invest directly in an index. Large-cap

companies may be unable to respond quickly to new

competitive challenges, such as changes in

technology, and also may not be able to attain the

high growth rate of successful smaller companies,

especially during periods of economic expansion.

Lipper ratings for Consistent Return reflect funds’ historical risk-adjusted returns, adjusted for volatility, relative

to peers as of 6/30/16. Lipper ratings for Preservation reflect funds’ historical loss avoidance relative to other

funds within the same asset class, as of 6/30/16. Preservation ratings are relative, rather than absolute, measures,

and funds named Lipper Leaders for Preservation may still experience losses periodically; those losses may be

larger for equity and mixed equity funds than for fixed income funds. Lipper ratings for Expense reflect funds’

expense minimization relative to peers with similar load structures as of 6/30/16. The Calvert U.S. Large Cap Core

Responsible Index Fund, (Class A) in Lipper’s Multi-Cap Core Funds classification, received the following ratings for

the Overall, 3 , 5 and 10 year periods, respectively (number of funds rated follows the score in parentheses):

Consistent Return: Lipper Leader (622), Lipper Leader (622), Lipper Leader (544), 4 (347); Preservation: Lipper Leader

(11692), Lipper Leader (11692), Lipper Leader (9814), 4 (6167); Expense: Lipper Leader (220), Lipper Leader (220),

Lipper Leader (202), Lipper Leader (151). 3

PORTFOLIO MANAGEMENT

CALVERT INVESTMENT MANAGEMENT, INC. (ADVISOR)

Calvert Investment Management, Inc. is the investment advisor to the Calvert funds and oversees funds covering

a broad range of asset classes. Calvert's in-house Equities and Fixed Income teams manage a full spectrum of

equity and fixed income strategies. In addition, Calvert's Equities team oversees premier sub-advisors who

provide expertise in their areas of specialization.

Laurie Webster, CFA

Fund Since 2015

Industry Since 1985

Dale Stout, CFA

Fund Since 2015

Industry Since 2002

Lise Bernhard

Fund Since 2015

Industry Since 1984

ABOUT CALVERT INVESTMENTS

WHO WE ARE

Calvert Investments is a global leader in Responsible Investing. Our mission is to deliver competitive long-term

performance to our clients and enable them to achieve positive impact.

WHAT WE OFFER

Serving financial advisors and their clients, as well as a wide array of institutional investors, Calvert’s investment

strategies feature integrated environmental, social, and governance (ESG) research and corporate engagement.

HOW WE STAND APART

At Calvert Investments, our integrated responsible investment approach sets us apart from many other

investment managers.

1. Source: Indices from IDC, FactSet and Lipper. Sector weightings provided by MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or

financial products. This report is not approved, reviewed or produced by MSCI.

2. Morningstar ratings are subject to change on a monthly basis. Past performance is no guarantee of future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance, placing more

emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next

35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted average of the

performance figures associated with its three-, five-, and ten-year (if applicable) Morningstar Rating metrics. Morningstar Rating is for the A share class only; other classes

may have different performance characteristics. ©2016 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/ or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are

responsible for any damages or losses arising from any use of this information.

3. The Lipper ratings are subject to change every month and are based on an equal-weighted average of percentile ranks for the Total Return metric over 3, 5, and 10 year

periods (if applicable). The highest 20% in each peer group are named Lipper Leaders, the next 20% receive a score of 4, the middle 20% receive a score of 3, the next 20% a

score of 2, and the lowest 20% a score of 1. Lipper ratings are not intended to predict future results, and Lipper does not guarantee the accuracy of this information. More

information is available at www.lipperleaders.com. Lipper Leader Copyright 2016, Reuters, All Rights Reserved.

*Except as otherwise noted, in the Average Annual Total Returns Table, all performance results labeled Since Fund Inception are calculated from the date of inception of the

fund's earliest class of shares (the "Initial Fund Inception Date"). For share classes launched subsequent to the Initial Fund Inception Date, returns prior to the share class'

inception date are linked to the performance of that fund's Class A shares at NAV (i.e., without deduction of any front-end sales charge). Actual share class performance

would have been lower (Class C and Class R shares) or higher (Class Y and Class I shares) for any such period, depending on whether that share class has higher or lower

expenses than Class A shares. Actual share class inception dates appear under Fund Information.

Calvert funds are available at NAV for RIAs and Wrap Programs. Not all share classes are available to all investors. See a fund's prospectus for details.

For more information on any Calvert fund, please contact your financial advisor, call Calvert at 800.368.2748, or visit www.calvert.com for a free summary prospectus and/ or

prospectus. An institutional investor should call Calvert at 800.327.2109. An investor should consider the investment objectives, risks, charges, and expenses of an investment

carefully before investing. The summary prospectus and prospectus contain this and other information. Read them carefully before you invest or send money.

Calvert mutual funds are underwritten and distributed by Calvert Investment Distributors Inc., member FINRA, a subsidiary of Calvert Investments, Inc. FS10933

Printed on New Leaf Reincarnation paper containing 100% post-consumer waste.

www.calvert.com

MORNINGSTAR RATING as of (6/30/16)