Experimental Criminal Law - Max Planck Institute for Research on

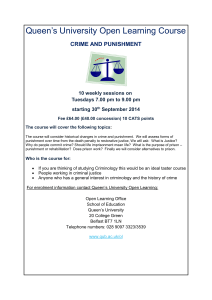

advertisement