incorporating short interruptions and time dependency of

advertisement

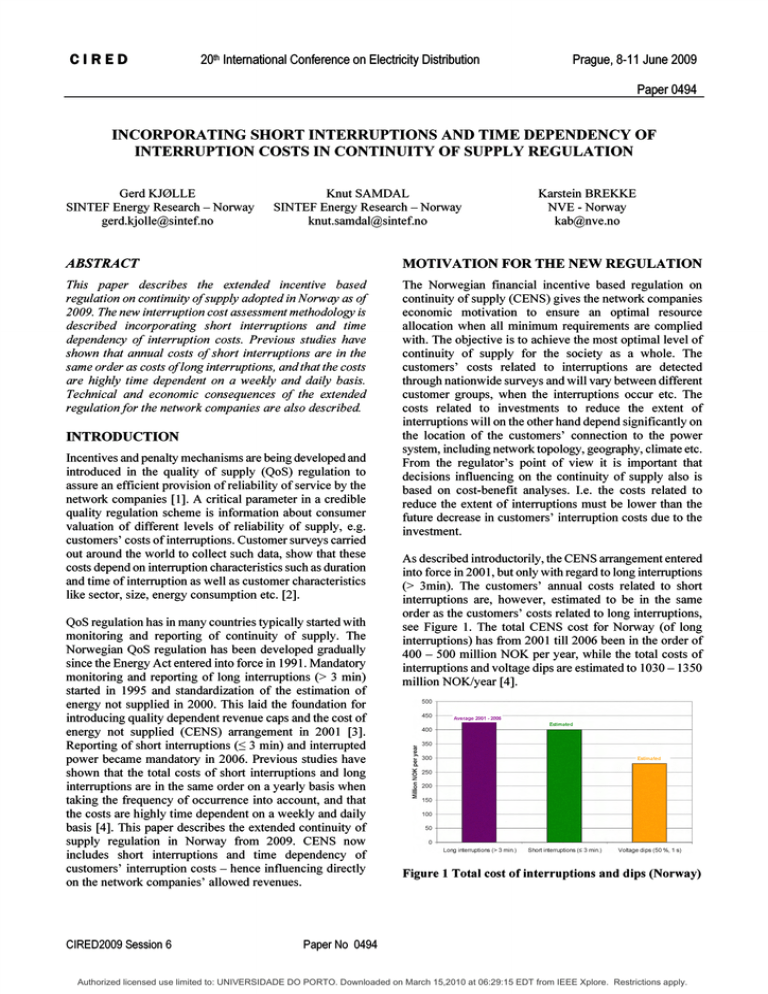

CI RED 20th International Conference on Electricity Distribution Prague, 8-11 June 2009 Paper 0494 INCORPORATING SHORT INTERRUPTIONS AND TIME DEPENDENCY OF INTERRUPTION COSTS IN CONTINUITY OF SUPPLY REGULATION GerdKJ0LLE SINTEF Energy Research - Norway gerd.kjolle@sintef.no Karstein BREKKE NVE- Norway kab@nve .no KnutSAMDAL SINTEF Energy Research - Norway knut.samdal@sintef.no ABSTRACT MOTIVATION FOR THE NEW REGULATION This paper describes the extended incentive based regulation on continuity ofsupply adopted in Norway as of 2009. The new interruption cost assessment methodology is described incorporating short interruptions and time dependency of interruption costs. Previous studies have shown that annual costs of short interruptions are in the same order as costs oflong interruptions, and that the costs are highly time dependent on a weekly and daily basis. Technical and economic consequences of the extended regulation for the network companies are also described The Norwegian fmancial incentive based regulation on continuity of supply (CENS) gives the network companies economic motivation to ensure an optimal resource allocation when all minimum requirements are complied with. The objective is to achieve the most optimal level of continuity of supply for the society as a whole. The customers' costs related to interruptions are detected through nationwide surveys and will vary between different customer groups, when the interruptions occur etc. The costs related to investments to reduce the extent of interruptions will on the other hand depend significantly on the location of the customers' connection to the power system, including network topology, geography, climate etc. From the regulator's point of view it is important that decisions influencing on the continuity of supply also is based on cost-benefit analyses . I.e. the costs related to reduce the extent of interruptions must be lower than the future decrease in customers ' interruption costs due to the investment. INTRODUCTION Incentives and penalty mechanisms are being developed and introduced in the quality of supply (QoS) regulation to assure an efficient provision of reliability of service by the network companies [1]. A critical parameter in a credible quality regulation scheme is information about consumer valuation of different levels of reliability of supply, e.g. customers ' costs of interruptions. Customer surveys carried out around the world to collect such data, show that these costs depend on interruption characteristics such as duration and time of interruption as well as customer characteristics like sector, size, energy consumption etc. [2]. QoS regulation has in many countries typically started with monitoring and reporting of continuity of supply. The Norwegian QoS regulation has been developed gradually since the Energy Act entered into force in 1991. Mandatory monitoring and reporting of long interruptions (> 3 min) started in 1995 and standardization of the estimation of energy not supplied in 2000. This laid the foundation for introducing quality dependent revenue caps and the cost of energy not supplied (CENS) arrangement in 2001 [3]. Reporting of short interruptions (:::; 3 min) and interrupted power became mandatory in 2006. Previous studies have shown that the total costs of short interruptions and long interruptions are in the same order on a yearly basis when taking the frequency of occurrence into account, and that the costs are highly time dependent on a weekly and daily basis [4]. This paper describes the extended continuity of supply regulation in Norway from 2009. CENS now includes short interruptions and time dependency of customers ' interruption costs - hence influencing directly on the network companies ' allowed revenues . CIRED2009 Session 6 As described introductorily, the CENS arrangement entered into force in 2001, but only with regard to long interruptions (> 3min). The customers' annual costs related to short interruptions are, however, estimated to be in the same order as the customers' costs related to long interruptions, see Figure 1. The total CENS cost for Norway (of long interruptions) has from 2001 till 2006 been in the order of 400 - 500 million NOK per year, while the total costs of interruptions and voltage dips are estimated to 1030 - 1350 million NOKlyear [4]. 500 ,---450 - - - - - - - - - - - - - - -------, Average 2001 · 2006 400 " 350 ~ 300 i - - - - Estimated ~ 250 z ~ 200 :E 150 100 50 Lorg interruptions (> 3 mm) Short interruptions (S 3 min.) Voltage dips (50 %, 1 5) Figure 1 Total cost of interruptions and dips (Norway) Paper No 0494 Authorized licensed use limited to: UNIVERSIDADE DO PORTO. Downloaded on March 15,2010 at 06:29:15 EDT from IEEE Xplore. Restrictions apply. C IRE D 20th International Conference on Electricity Distribution Prague, 8-11 June 2009 Paper 0494 If costs related to short interruptions are not part of the regulation, the network companies will have disincentives to consider the consequences for society of short interruptions. The main reason for the regulator to include these in the CENS arrangement from 2009 is the fact that the associated annual costs are in the same order as costs of long interruptions. This change will lead to a more optimum level of the continuity of supply for the society as a whole. INTERRUPTION COST ASSESSMENT (CENS) The CENS arrangement has so far been based on the mandatory reporting of long interruptions (> 3 minutes) for end-users at all voltage levels> 1 kV and a standardized method for estimation of energy not supplied (ENS) [3, 5]. Collection of interruption data and calculation of ENS and CENS is made in accordance with the FASIT standard [6]. CENS comprises both notified and non-notified interruptions. Since 2003 the customers have been divided in six groups: industry, commercial, large industry, public, agriculture, residential. The cost rates utilized in the regulation up to 2009 have been calculated for an average duration ofthe two types of interruptions for each customer group based on data from a nationwide customer survey in 2001 - 2003 [5]. Cost data from the survey are provided for interruptions occurring at a reference time which is a working day in January. To summarize: the CENS arrangement has up to 2009 been based on long interruptions and fixed cost rates for an average interruption duration and referred to a specific time of the year, week and period of the day. After eight years of experience with fixed cost rates irrespective of duration and time of occurrence of interruptions, the cost assessment is now changed to incorporate these aspects. This is described in the following sections. INCORPORATING SHORT INTERRUPTIONS To incorporate short interruptions (:S 3 minutes) in the CENS arrangement the cost rates are established as a function of the interruption duration. The customer survey conducted in 2001 - 2003 provided interruption cost data for six customer groups related to hypothetical interruptions of 1 minute, 1 hour, 4 hours and 24 hours duration (8 hours for the residential group). These data are normalized per respondent in the survey with the corresponding interrupted power at the reference time. The interrupted power is defmed as the estimatedpower in kW that would have been supplied at the time of interruption if the interruption did not occur [6]. The normalized cost data are used to establish continuous cost functions based on linear interpolation between the discrete surveyed data (arithmetic mean). Table 1 gives the cost functions in use from 2009 at reference time, which is given in Table 2 for the different groups. Table 1 Interruption cost functions in NOK1/kW at interrup tiIon d ura fIon re f erence time, r = In 0 Customer group Agriculture Residential Industry Commercial Public Large Industry Cost function All durations (r) 10.6' r + 4 8.8 . r + 1 r = 0 -4 hours r> 4 hours 18.4 . r + 166 55.6' r+ 17 33.1·r+280 97.5' r+ 20 14.6 . r + 1 4.1' r+44 3.1 . r + 23 7.7·r+6 tion scenarios The cost of an interruption of duration r at reference time, ere!, can now be calculated as follows: (NOK) (1) where Cref = Interruption cost for an interruption at reference time cret<:r) = Cost rate in NOK/kW for duration r (Table 1) Pref= Interrupted power in kW at reference time. The use of cost functions as described above gives a consistent method for handling interruption duration in the CENS arrangement including short and long interruptions. TIME DEPENDENCY IN INTERRUPTION COSTS The customer survey also gave information about variation in interruption costs by season, weekdays and time of day. The time dependency in the interruption cost was found to be significant, especially for the industrial, commercial and public sectors over the week and by time of day. Weekly and daily variation in the cost per interruption (monetary value) is shown in Figure 2 and Figure 3 respectively. This information is used to establish correction factors for the cost of an interruption at any time j, determined by the relative variation in cost in hour h, on day d and in month m, assuming that these are independent. Hence, the cost of an interruption of duration r occurring at any time j can be determined according to (2): 1 9 NOK:::::: 1 Euro per January 2009 CIRED2009 Session 6 Paper No 0494 Authorized licensed use limited to: UNIVERSIDADE DO PORTO. Downloaded on March 15,2010 at 06:29:15 EDT from IEEE Xplore. Restrictions apply. 20th International Conference on Electricity Distribution CI RED Prague, 8-11 June 2009 Paper 0494 ..---.: 10.0 ~ !¥ ~ -20.0 ~ _ -30.0 Residential \ ~ Publi c ~ All variables are the same as described above. \"" '---- . . - Agricu'....e ~ -40.0 = cre/r)· f Ch . f Cd . f Crn . P'e/ Sundaylholidays I'~ -+mmercial ~ co "dustry c J Otherwo~ Thursday -10.0 I- ~ - H 0.0 "--- The interruption cost assessment in the period 200 I - 2008 was in principle determined according to (5): .............. - \ . ~g~ '<fl. ·50.0 ~ -60.0 Figure 2 Deviation (%) in cost from working day ! - - - - - - - - - - - - - - - , 10.0 +------------7"~==~--i 0 .0 t=::;;::;;~~;;:;:?:t';::~~~==;~~~;:;~ ~ -10.0 ~ ~ -20 .0 +----'-'--r----r.f---""~r_~~.......;:::::_- I E ,go ·30 .0 ..g -+- Co mmercial ~ -40 .0 *- ndustry .50.0 t-_~/ r-----~~..---, ----j """' ReSidential ~ Ag ri culture -60.0 t -- / "- - -70 .0 1--- - - - ...... Public - ----j ....... Largei ndustryr---- (5) (NOK) -70.0 20.0 , - -- (4) <= cre/(r)' f Ch' f Cd' f Crn' ; / ~ (NOK) 20.0 - - - - , - - - - -' where C/ = Interruption cost for an interruption at timej (NOK) crer' = Fixed cost rate in NOK/kWh at reference time, for an average duration of2.85 hrs for non-notified and 1.3 hrs for notified interruptions respectively Figure 4 gives a comparison of interruption costs for two different interruptions calculated according to (4) and (5), the new and old method respectively. The figure illustrates that the old method in (5) occasionally overestimates or underestimates the cost, depending on type ofcustomer, the duration and the time of occurrence of the interruption. 7000 - - - - - - - - - Hours 6000 Cj = c/r). Pj (NOK) (2) - 4000 - 3000 - 2000 - - 1000 - - < r- r: =cre/r) . f Cj 'T'~ 0 where Cj = Interruption cost for an interruption at timej (NOK) clr) = Cost rate in NOK/kW for duration r at timej Pj = Interrupted power in kW at timej fcj = Correction factor for normalized cost at time j fCj = Correction factor for cost (in monetary terms) at time j : = f Ch . f Cd . f Crn - J", ,, Satu rday . 4 pm , 2 hrs J (3) In order to determine the time variation fcj in the normalized cost one should take into account the variation in the normalization factor (interrupted power) as shown in (2). The time dependency in the interruption cost is thus handled through correction factors which are based on the information about deviation in cost in monetary terms from the cost at reference time as shown in Figs . 2 and 3. Inserting (3) in (2), the cost of an interruption of duration r occurring at a timej can now be expressed as follows : CIRED2009 Session 6 . 2001 - 2008 6000 ~ = cre/(r) · fcj . ~ f Cj [C F~ ,m~ r-t- Figure 3 Deviation (%) in cost from reference time ., - M Tuesday . pm, 0.5 hr Comme rci al at 'I J", et IT'~d" . M .,at Saturday . 4 pm, 2 tn pm, 0.5 hr 'I .. S aturday. Re6ldent lal '1' J", ,, 4 pm, 2 hI'S .---- Tuesday , M ., et z pm, 0.5 hr Public Figure 4 Comparison of methods for interruption costs CENS REGULATIONS FROM 2009 The CENS arrangement from 2009 comprises both short and long interruptions based on the mandatory reporting of interruptions according to the FASIT specification [6, 7]. The cost of a single interruption should be calculated using the method in (4), taking account of duration and time of occurrence of the interruption. The cost functions and correction factors are given for each of the six customer groups in the regulations [8]. The monthly variation is represented by a factor per month , while there are three factors describing the weekly variation divided in Mondays through Fridays, Saturdays and Sundays/holidays respectively. The daily variation is separated in six periods of the day. If the duration of an interruption affects more than one of the periods covered by the correction factors , a weighted average for the time periods should be used . Paper No 0494 Authorized licensed use limited to: UNIVERSIDADE DO PORTO. Downloaded on March 15,2010 at 06:29:15 EDT from IEEE Xplore. Restrictions apply. CI RED 20th International Conference on Electricity Distribution Prague, 8-11 June 2009 Paper 0494 Furthermore, the total interruption costs must be adjusted annually to account for the inflation. For a notified interruption the cost calculated by (4) should be multiplied with a reduction factor. This factor varies from 0.7 (30 % reduction) for the Commercial and Public sectors to 0.9 for the Large industries. The interruption cost for series of interruptions caused by one and the same disturbance should be calculated as the sum ofthe cost for each separate interruption, limited to the cost of a continuous interruption lasting for the total time span covered by the series. According to the regulations, the CENS cost is not paid to the customers but is used to make a quality adjustment of the network companies' revenue caps [8]. The companies may, however, enter into individual agreements with customers of direct payment ofCENS. Such agreements are only allowed for customers with an expected use of electricity above 400 000 kWh per year and require agreedupon cost rates for non-notified and notified interruptions respectively, of varying interruption durations. Further, the cost rates must be calculated based on the expected costs for the specific customer, and the agreement shall include any assumption upon which the calculation is based. CONSEQUENCES OF NEW REGULATION Evidently the new CENS regulation gives some benefits for the customers, network companies and the society as a whole. Table I , Figure 2 and Figure 3 illustrates that the customers' interruption costs are a function ofboth duration and the time of occurrence of interruptions. Annual costs of short interruptions are previously estimated to be in the same order as the costs of long interruptions (Figure I) for Norway as a whole. The new regulation provides the network companies with incentives to consider these costs. Before the regulation was settled, possible technical and economic consequences for the network companies were investigated. Reporting of short interruptions (:::; 3 min .) and interrupted power became mandatory in 2006 [7]. Despite this fact registrations of short interruptions in FASIT are still not complete. This is mainly due to lack of necessary routines and lack of facilities in some stations for registration of automatic breaker reclosure (typically in small companies). Some companies need to upgrade their equipment to be able to register the time of occurrence and duration of short interruptions. The total cost for this upgrading is grossly estimated to aboutNOK 10 mill. (:=::; 0.9 mill . Euro) for Norway as a whole. The FASIT system is used to calculate the interruption costs in addition to the collection of interruption data. It has been necessary to make changes in the software to represent cost functions and correction factors in addition to the method in (4). There are six FASIT software vendors and the total implementation costs are estimated to about NOK 1.2 mill in total for Norway. The sum of these costs and the above CIRED2009 Session 6 mentioned upgrading cost is regarded as limited compared with the benefits. CONCLUSIONS The Norwegian incentive based regulation on continuity of supply is extended from this year incorporating short interruptions and time dependency ofinterruption costs . The motivation for the regulation is described as well as the new interruption cost assessment methodology. By this regulatory step the network companies will not only have incentives to ensure a sufficient level of continuity of supply regarding long interruptions but will additionally be provided with incentives to consider the short interruptions and the time dependency in interruption costs in planning, operation and maintenance of the transmission and distribution systems. Regarding the time dependency will for instance give incentives to perform maintenance work in periods when the interruption cost is low. This lays a better foundation for optimizing the continuity of supply, in balancing network costs and the value of reliability as it is seen from the customers' point of view. There will be limited technical and economic consequences for the network companies of the new regulation. REFERENCES [I] [2] [3] [4] [5] [6] [7] CEER, 200 1, 2003 , 2005, Benchmarking reports on quality ofsupply, http: //www .energy-regu lators.eu R. Billinton et al, 2001 , Methods to consider customer interruption costs in power system analysis, CIGRE SC38.06.01 , Ref no. 191. T. Langset, F. Trengereid, K. Samdal, J. Heggset, 200 I,"Quality dependent revenue caps - a model for quality of supply regulation", Proc. CIRED 2001. K. Samdal, G. H. Kj0lle, B. Singh, O. Kvitastein, 2006, "Interruption costs and consumer valuation of reliability of service in a liberalized power market", Proceedings PMAPS 2006. G. H. Kj0lle, K. Samdal, B. Singh, O. Kvitastein, 2008, "Customer Costs Related to Interruptions and Voltage Problems: Methodology and Results", IEEE Trans. on Power Systems, vol. 23, no . 23, 1030 - 1038 J. Heggset, G. H. Kjolle, K. Sagen, 2009, "FASIT - a tool for collection, calculation and reporting of reliability data", Paper acceptedfor CIRED 2009. Regulations relating to the quality of supply in the Norwegian power system, Reg. No. 1557 of 30 Nov. 2004, Norwegian Water Resources and Energy Directorate (NVE), http: //www.nve.no [8] Regulations governing fi nancial and technical reporting, income caps f or network operations and transmission tariffs, Reg. No. 302 of II March 1999, changed as of 7 Dec. 2007, NVE, http ://www.nve .no. Paper No 0494 Authorized licensed use limited to: UNIVERSIDADE DO PORTO. Downloaded on March 15,2010 at 06:29:15 EDT from IEEE Xplore. Restrictions apply.