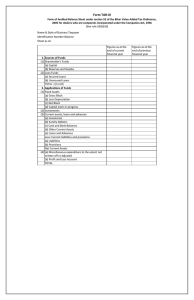

2014 financials

advertisement