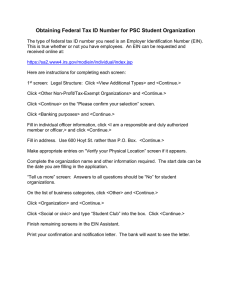

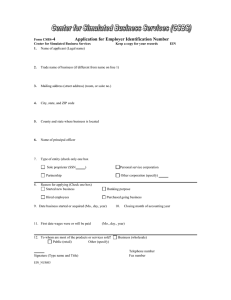

Return of Organization Exempt From Income Tax

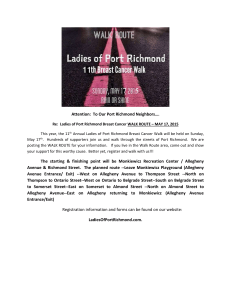

advertisement