No. US2015-08

December 17, 2015

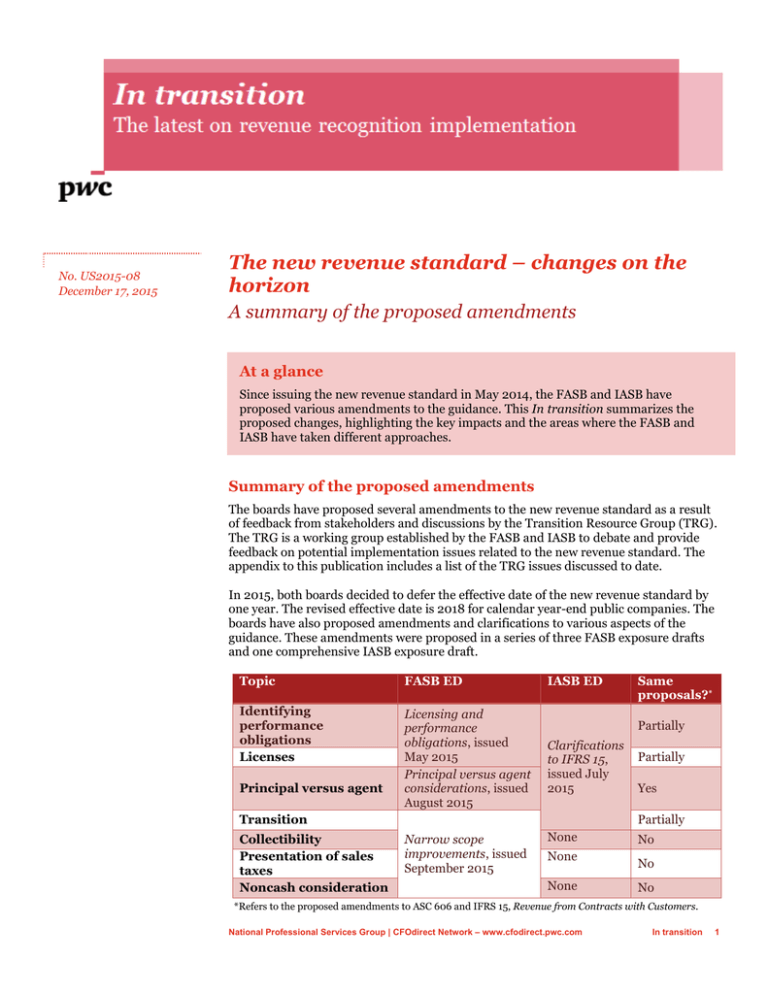

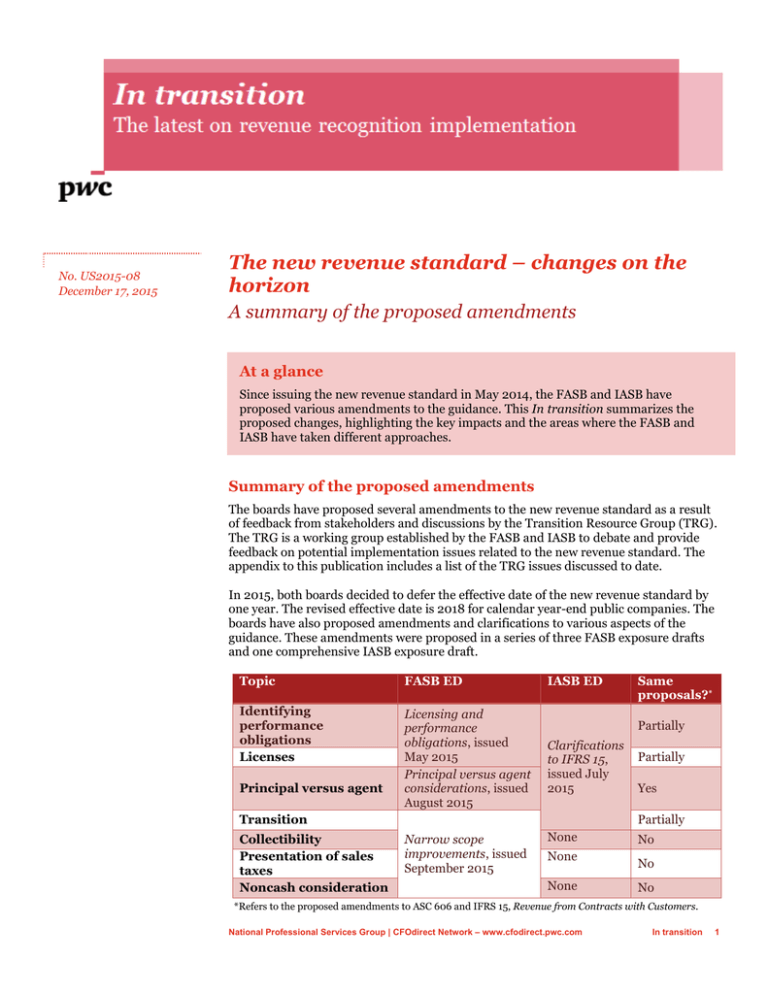

The new revenue standard – changes on the

horizon

A summary of the proposed amendments

At a glance

Since issuing the new revenue standard in May 2014, the FASB and IASB have

proposed various amendments to the guidance. This In transition summarizes the

proposed changes, highlighting the key impacts and the areas where the FASB and

IASB have taken different approaches.

Summary of the proposed amendments

The boards have proposed several amendments to the new revenue standard as a result

of feedback from stakeholders and discussions by the Transition Resource Group (TRG).

The TRG is a working group established by the FASB and IASB to debate and provide

feedback on potential implementation issues related to the new revenue standard. The

appendix to this publication includes a list of the TRG issues discussed to date.

In 2015, both boards decided to defer the effective date of the new revenue standard by

one year. The revised effective date is 2018 for calendar year-end public companies. The

boards have also proposed amendments and clarifications to various aspects of the

guidance. These amendments were proposed in a series of three FASB exposure drafts

and one comprehensive IASB exposure draft.

Topic

FASB ED

Identifying

performance

obligations

Licenses

Licensing and

performance

obligations, issued

May 2015

Principal versus agent

considerations, issued

August 2015

Principal versus agent

IASB ED

Partially

Clarifications

to IFRS 15,

issued July

2015

Transition

Collectibility

Presentation of sales

taxes

Noncash consideration

Same

proposals?*

Partially

Yes

Partially

Narrow scope

improvements, issued

September 2015

None

None

None

No

No

No

*Refers to the proposed amendments to ASC 606 and IFRS 15, Revenue from Contracts with Customers.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

1

Identifying performance obligations

A key aspect of the new revenue standard is identifying the performance obligations, which are the unit of account for

applying the guidance. Various stakeholders provided feedback that it is not clear how to determine whether a good or

service is separately identifiable from other promises in a contract. Additionally, some stakeholders raised concerns

about the cost and complexity of applying the guidance to shipping and handling services, and immaterial performance

obligations. In response, the FASB proposed amendments to clarify its guidance. The IASB proposed more limited

changes to the related examples.

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Determining

whether a good or

service is

“separately

identifiable” from

other promises in

the contract

The FASB’s proposal clarifies the principle for

determining whether a good or service is

“separately identifiable” from other promises in

the contract. The revised principle states that

the objective is to determine whether the nature

of an entity’s promise is to transfer individual

goods or services to the customer, or to transfer

a combined item (or items) to which the

individual goods and services are inputs. The

FASB also proposed new examples and

amendments to the existing examples

illustrating these principles.

The IASB’s initial proposal did not include

changes to the principle in the guidance.

However, at its December 15, 2015 meeting,

the IASB decided to pursue further

convergence with the FASB’s proposed

language. The IASB also proposed to add new

examples, and amend existing examples, to

clarify how to apply the guidance. The new

and amended examples are similar, but not

identical, to those proposed by the FASB.

However, the IASB committed to working

with the FASB to pursue further convergence

on the examples.

Potential impact:

The FASB’s proposed amendments help clarify how to apply the guidance on identifying

performance obligations in various scenarios, such as when a vendor sells a piece of equipment

and a related installation service. The amendments may result in differences between the US

GAAP and IFRS standards. The boards have suggested that the financial reporting outcomes are

expected to be the same despite the potential differences.

Shipping and

handling activities

The FASB’s proposal would allow entities to

elect to account for shipping and handling

activities that occur after the customer has

obtained control of a good as a fulfilment cost

rather than an additional promised service.

The IASB did not propose a similar

amendment. Entities are therefore required to

consider whether shipping and handling

services give rise to a separate performance

obligation.

Potential impact:

The FASB’s proposed amendment would reduce the cost and complexity of applying the revenue

standard for some US GAAP reporting entities. However, the introduction of this election may

result in diversity in practice that could, in some instances, have a material impact to the

financial statements. It would also create a difference between entities applying US GAAP that

elect the expedient and entities applying IFRS.

Immaterial goods

or services

The FASB’s proposal clarifies that entities are

not required to identify promised goods or

services that are immaterial in the context of the

contract.

The IASB did not propose a similar

amendment; however, the IASB included

additional discussion in the basis for

conclusions stating that entities should

consider the overall objective of IFRS 15 as

well as materiality in identifying promised

goods or services in a contract.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

2

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Potential impact:

The FASB’s intent is to not require US GAAP reporting entities to incur time and cost to identify

and track immaterial items. The IASB did not propose a similar amendment; however, the IASB

has indicated that IFRS does not require entities to account for immaterial items.

Next steps:

The comment period for the FASB’s exposure draft ended on June 30, 2015. The FASB redeliberated its proposal in

October, affirming its decisions on the above matters. The FASB also decided that if revenue is recognized before

shipping and handling services are performed or the transfer of immaterial goods or services, entities should accrue

the related costs. The FASB directed the staff to draft a final Accounting Standards Update (“ASU”).

The comment period for the IASB’s exposure draft ended on October 28, 2015. The IASB redeliberated its proposal in

December and generally affirmed its decisions on the above matters, but agreed to pursue further convergence with

the FASB on amendments to the “separately identifiable” guidance and related examples. The IASB expects to issue its

final amendments in 2016.

Licenses

The new revenue standard includes specific guidance on the accounting for licenses of intellectual property (“IP”). This

guidance addresses whether the license is a right to access or a right to use the entity’s IP, which determines whether

revenue is recognized over time or at a point in time. The standard also states that revenue from sales-based and usagebased royalties promised in exchange for a license of IP should not be recognized until the subsequent sale or usage

occurs. This is an exception to the general guidance for variable consideration, which requires entities to estimate

variable fees, subject to a constraint.

The license guidance has raised a number of questions and implementation challenges. These include:

How to determine the nature of an entity’s promise in granting a license; that is, whether the license is a right to

access or a right to use IP

Whether the sales-based and usage-based royalty exception applies where the royalty relates to both a license

and other goods or services

Whether restrictions of time, geography, or use in a license impact the number of promises in the contract; that

is, whether a contract can include multiple distinct licenses

How to apply the license guidance in the event a license is not distinct from other goods or services

As a result, both the FASB and IASB proposed amendments to the license guidance.

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

The nature of a

company’s promise

in granting a

license

Under the FASB’s proposal, licenses would be

classified as either “symbolic” IP (for example,

brand names or logos) or “functional” IP (for

example, software or completed media content).

All licenses of symbolic IP would be recognized

over time as a “right to access” license.

Functional IP would be recognized at a point in

time as a “right to use” license unless the

functionality of the IP is expected to

substantively change as a result of activities of

The IASB proposed limited amendments to

clarify the existing principle. The proposal

clarifies that an entity’s activities significantly

affect the IP (a criterion to determine if the

license is a “right to access” IP) if (a) the

entity’s activities change the form or

functionality of the IP or (b) the utility of the

IP is substantially derived from or dependent

upon those activities (e.g., a brand name). The

IASB also proposed amendments to the

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

3

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

the entity that do not transfer a good or service

to the customer. The FASB also proposed new

examples and amendments to the existing

examples.

existing examples to illustrate the clarified

principle.

Potential impact:

The FASB’s proposal is intended to make the guidance more operational and reduce diversity by

establishing a “bright line” between functional and symbolic IP. The amendments would result

in divergence between the US GAAP and IFRS standards. The boards have indicated that they

believe the financial reporting results will be the same in most cases. We believe there will be

some instances where the conclusion would differ under US GAAP and IFRS. For example,

under US GAAP, revenue from a license of symbolic IP would be recognized over time even if the

licensor is clearly performing no activities related to the IP. The licensor would recognize

revenue at a point in time under IFRS, however, since it is no longer supporting the IP.

The exception for

licenses of IP with

sales- and usagebased royalties

The FASB’s proposal would not require an

The IASB proposed the same amendment.

entity to split a royalty into the portion that is

subject to the royalty exception and the portion

that is not. The amendment clarifies that the

royalty exception applies when the predominant

item to which the royalty relates is a license.

Potential impact:

The boards’ proposal helps clarify in which circumstances the royalty exception applies. The

boards do not intend to provide further guidance on the definition of “predominant,” so this

assessment will require judgment.

Determining

whether

contractual

restrictions impact

the number of

promises in a

contract

The FASB proposed an amendment to clarify

that contractual restrictions of time, geography,

or use are attributes of the license and do not

affect the number of promised goods or services

in a contract.

The IASB did not propose a similar

amendment; however, the IASB included

additional discussion in the basis for

conclusions stating that restrictions of time,

geography, or use are attributes of the license

and do not affect the number of promised

goods or services in a contract.

Potential impact:

There continues to be debate regarding how the guidance on restrictions should be interpreted.

The topic was discussed at the TRG’s November meeting where TRG members expressed

differing views. The guidance in this area will have a significant impact to entities that license IP

if those licenses contain contractual restrictions.

Determining

whether the license

guidance applies

when the license is

not distinct

The FASB’s proposal clarifies that an entity may

need to consider the nature of a license, even if

it is not distinct from other goods or services in

the contract. An example is a ten-year term

license that is combined with a two-year service

into a single performance obligation. In that

situation, it could be necessary to assess

whether the license is a “right to use” IP

(revenue recognized at a point in time) or a

The IASB did not propose a similar

amendment; however, the IASB included

discussion in the basis for conclusions stating

that, in some cases, an entity might need to

consider the nature of its promise in granting

a license, even when the license is not distinct.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

4

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

“right to access” IP (revenue recognized over

time) to determine the pattern of recognition

for the combined performance obligation.

Potential impact:

The FASB’s and IASB’s guidance would differ in this area; however, we do not believe the

different wording will result in significant differences in accounting conclusions.

Next steps:

The comment period for the FASB’s exposure draft ended on June 30, 2015. The FASB redeliberated its proposal in

October, affirming its decisions on the majority of the above matters. As noted above, the impact of license restrictions

continues to be debated and was recently discussed at the TRG’s November meeting. We expect the boards to discuss

this issue further as they finalize their proposed amendments to the licensing guidance.

The comment period for the IASB’s exposure draft ended on October 28, 2015. The IASB redeliberated its proposal in

December, largely affirming its decisions on the above matters. The IASB expects to issue its final amendments in

2016.

Principal versus agent

When more than one party is involved in a revenue transaction, the new revenue standard requires an entity to

determine whether it is the principal (providing the goods or services itself) or an agent (arranging for another party to

provide those goods or services). A principal reports revenue based on the gross amount received from the customer

and an agent reports only its fee or commission (that is, net of the amount it remits to the other party). The standard

states that an entity is a principal if it controls a good or service before it is transferred to the customer. Stakeholders

expressed concerns with how to identify the unit of account for the assessment, how to apply the control principle to

services, and the relationship between the control principle and the indicators in the guidance. As such, both boards

agreed to make targeted improvements to clarify the guidance and the related examples.

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Identifying the

“unit of account”

for the principal

versus

agent assessment

The FASB’s proposal clarifies the “unit of

The IASB proposed the same amendments.

account” for the principal versus agent

assessment and requires an entity to first

identify the specified good or service being

provided to the customer. The amendments

clarify that an entity may be a principal for one

or more specified goods or services in a contract

and an agent for others.

Applying the notion

of control to

services performed

by another party

The FASB’s proposal clarifies that a principal

can control a service if it directs another party

to perform the service for the customer on its

behalf. The proposal also clarifies that an entity

can control a good or service when it provides a

significant service to integrate other goods or

services into the specified good or service for

which the customer has contracted.

The relationship

between the notion

The FASB’s proposal clarifies that the indicators The IASB proposed the same amendments.

assist an entity in evaluating whether it controls

The IASB proposed the same amendments.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

5

Issue

US GAAP – FASB proposals

of control and the

indicators

a good or service before it is transferred to a

customer (that is, the indicators do not override

or replace the control evaluation). The proposal

reframes the existing indicators to provide

evidence of when an entity is a principal, rather

than when an entity is an agent, and to add

explanatory language on how each indicator

supports the control evaluation.

IFRS – IASB proposals

Potential impact:

We do not expect that the proposed amendments would result in pervasive changes in gross

versus net reporting conclusions as compared to existing guidance. It is possible, however, that

some conclusions could change under the new revenue standard based on the control principle

and other clarifications to the guidance. Entities should plan sufficient time to review and

understand the terms of their contracts with customers and vendors, which can often be

complex, to ensure appropriate conclusions are reached under the new revenue standard.

The boards have remained converged in their proposed amendments to the standard relating to

principal versus agent considerations. However, the boards included differing discussion in the

basis for conclusions regarding the accounting by an entity that is a principal, but does not know

the price for which the intermediary (agent) sells goods or services to the customer. The FASB’s

discussion suggests the principal should generally recognize revenue equal to the amount it

receives from the intermediary (i.e., on a net basis), while the IASB’s discussion suggests it could

be appropriate for the principal to estimate the transaction price.

Next steps:

The comment periods for the FASB’s and IASB’s exposure drafts ended on October 15 and 28, respectively. The boards

jointly redeliberated the principal versus agent proposals in December, and largely affirmed their decisions on the

above matters. At that meeting, the boards voted to eliminate the “credit risk” indicator because it does not readily

link to the control principle and is typically less relevant to the evaluation. Both boards expect to issue their final

amendments in 2016.

Transition

The new revenue standard includes two transition alternatives: the modified retrospective transition approach and the

full retrospective transition approach. The standard also includes some practical expedients to simplify transition. Both

boards proposed clarifications and new practical expedients in response to stakeholder feedback in order to further ease

transition.

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Contract

modifications

The FASB proposed a “use of hindsight”

practical expedient intended to simplify the

transition for contracts modified multiple times

prior to the initial application of the standard.

An entity applying the expedient would

determine the transaction price of a contract at

the date of initial application and perform a

single, standalone selling price allocation (with

the benefit of hindsight) to all of the satisfied

The IASB proposed the same practical

expedient; however, the date the expedient is

applied is the beginning of the earliest period

presented. At its December 15, 2015 meeting,

the IASB decided to allow entities, as an

alternative, to apply this practical expedient at

the date of initial application.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

6

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

and unsatisfied performance obligations in the

contract from inception.

Potential impact:

The boards have made similar, but not identical, proposals intended to ease transition for

contracts that have been modified multiple times. The difference in the proposals is primarily

that the FASB proposed one date at which the expedient can be applied, whereas the IASB will

permit a choice of dates at which the expedient can be applied.

Completed

contracts at

transition

An entity using the modified retrospective

transition approach will not apply the new

standard to contracts that are complete as of the

date of initial application. The FASB’s proposed

amendments change the definition of a

“completed contract” to a contract for which all,

or substantially all, of the revenue was

recognized under previous revenue guidance

before the date of initial application.

Additionally, the proposed amendments would

permit entities to apply the new standard to

either all contracts or only contracts that are not

complete under the modified retrospective

transition approach.

The IASB did not propose a change to the

definition of completed contracts. A

completed contract is a contract for which the

entity has transferred all of the goods or

services identified in accordance with previous

revenue guidance. At its December 15, 2015

meeting, the IASB voted to permit entities to

apply the new standard either to all contracts

or only contracts that are not complete under

the modified retrospective transition

approach.

The IASB also proposed to permit entities

using the full retrospective transition

approach to not restate contracts that are

completed contracts as of the beginning of the

earliest period presented.

Potential impact:

The FASB’s proposal to change the definition of a “completed contract” is intended to resolve

certain implementation issues that were raised at the TRG’s July meeting. The different

definitions of a "completed contract," however, could lead to reduced comparability between US

GAAP and IFRS reporters upon transition. More contracts are likely to meet the IASB’s

definition of a completed contract than the FASB’s definition. Further, IFRS reporters might

encounter fact patterns where they will continue to recognize revenue based on the previous

revenue guidance related to a “completed contract” after adoption of the new revenue standard.

Disclosure

requirements for

the full

retrospective

transition approach

The FASB proposed a technical correction to

clarify the disclosure requirements for entities

applying the full retrospective transition

method. Entities applying that method will

record a cumulative effect adjustment in the

earliest period presented and disclose the

impact of applying the standard to the periods

retrospectively adjusted, but are not required to

disclose the effect of the accounting change for

the year of adoption.

The disclosure requirements under IFRS do

not require entities to disclose the effect of the

accounting change in the year of adoption;

therefore, no technical correction was

necessary.

Potential impact:

The FASB’s proposed technical correction provides relief to entities applying the full

retrospective transition method as they will not be required to track the differences between

applying the current guidance and the new standard in the year of adoption.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

7

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Next steps:

The comment period for the FASB’s exposure draft ended on November 16, 2015 and the FASB is in the process of

reviewing responses received. The comment period for the IASB’s exposure draft ended on October 28, 2015. The

IASB redeliberated its proposal in December and decided to permit certain transition expedients that align with the

FASB’s proposals, as noted above, to ease transition for entities reporting under both US GAAP and IFRS. Both boards

expect to issue their final amendments in 2016.

Collectibility

The new standard requires an entity to assess whether collection of consideration is probable. If collection is not

probable, the standard provides specific guidance for recognizing revenue for any consideration received. Some

stakeholders expressed concerns that the accounting for contracts that fail the collectibility criterion is punitive and

stakeholders expressed differing views about how the collectibility assessment should be performed. The FASB decided

to propose amendments to the guidance to address these concerns. The IASB did not propose amendments in this area

as it believes the discussion in the standard and the basis for conclusions provides adequate guidance.

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Assessing

collectibility of

contract

consideration

The FASB’s proposal clarifies that entities

should consider, as part of the collectibility

assessment, their ability to mitigate their

exposure to credit risk, for example by ceasing

to provide goods or services in the event of

nonpayment. The proposed amendments also

clarify when revenue should be recognized for

nonrefundable consideration received if a

contract fails the collectibility assessment. The

FASB has proposed new examples and

amendments to the existing example to

illustrate the collectibility guidance.

The IASB did not propose a similar

amendment; however, the IASB included

additional discussion in the basis for

conclusions stating that entities should

consider, as part of the collectibility

assessment, their ability to mitigate exposure

to credit risk throughout the contract, for

example, by ceasing to provide goods or

services or requiring advance payments.

Potential impact:

The FASB’s proposal is intended to narrow the population of contracts that fail the collectibility

assessment. The FASB’s amendments would result in differences between the US GAAP and

IFRS standards. Based on the IASB’s clarifications in the basis of conclusions, we do not expect a

significant difference in financial reporting outcomes in most cases. The FASB’s proposed

amendments to Example 1, however, would result in differing conclusions regarding the timing

of transfer of control for the same fact pattern in the two standards.

Next steps:

The comment period for the FASB’s exposure draft ended on November 16, 2015. The FASB is in the process of

reviewing responses received and expects to issue its final amendments in 2016.

The comment period for the IASB’s exposure draft ended on October 28, 2015. The IASB redeliberated its proposal in

December and affirmed its decision not to amend the collectibility guidance. The IASB expects to issue its final

amendments in 2016.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

8

Sales tax presentation

The new revenue standard requires taxes collected from customers to be assessed on a jurisdiction-by-jurisdiction basis

to determine if these amounts should be presented net against revenue or gross (as revenue and an operating expense).

Assessing each tax on a jurisdiction-by-jurisdiction basis might be a complicated and time consuming process,

particularly for US GAAP reporters that previously could elect to present these taxes on a gross or net basis. The FASB

decided to propose an amendment providing a practical expedient in this area. The IASB decided not to provide a

practical expedient, largely because there is not a similar policy election under IFRS today.

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Sales tax

presentation

The FASB’s proposal would allow an entity to

The IASB did not propose a similar

make an accounting policy election to present

amendment.

all sales taxes collected from customers on a net

basis. Entities that do not elect the new practical

expedient would evaluate each type of tax on a

jurisdiction-by-jurisdiction basis to determine

which amounts to exclude from revenue (as

amounts collected on behalf of third parties)

and which amounts to include. Entities would

be required to disclose the policy, if elected.

Potential impact:

The FASB’s proposal could reduce cost and complexity for certain US GAAP reporters. However,

it is a change from today’s US GAAP, which allows entities to elect to present such amounts on a

gross or net basis. The proposal would also result in a specific difference between entities

applying US GAAP that make the election (if sales tax would have otherwise been reported on a

gross basis) and entities applying IFRS.

Next steps:

The comment period for the FASB’s exposure draft ended on November 16, 2015. The FASB is in the process of

reviewing responses received and expects to issue its final amendments in 2016.

The comment period for the IASB’s exposure draft ended on October 28, 2015. The IASB redeliberated in December

and affirmed its decision not to provide a similar election. The IASB expects to issue its final amendments in 2016.

Noncash consideration

The new revenue standard states that entities should measure noncash consideration received from a customer at fair

value. Stakeholders questioned at which date fair value should be measured and how to apply the constraint on variable

consideration to noncash consideration. As a result, the FASB proposed amendments to address these matters. The

IASB did not propose an amendment as it believes measurement date should be addressed more comprehensively in a

separate project to avoid unintended consequences.

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Determining the

measurement date

for noncash

consideration

The FASB’s proposal specifies that the

measurement date for noncash consideration is

at contract inception and amends the related

example.

The IASB did not propose a similar

amendment.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition

9

Issue

US GAAP – FASB proposals

IFRS – IASB proposals

Determining how

to apply the

variable

consideration

guidance to

contracts with

noncash

consideration

The proposal clarifies that the guidance on

constraining the estimate of variable

consideration applies to variability resulting

from reasons other than the form of

consideration. Therefore, the variable

consideration guidance would not apply, for

example, to variability related to changes in

stock price when consideration is in the form of

equity instruments.

The IASB did not propose a similar

amendment.

Potential impact:

The FASB’s proposal is a significant change from existing US GAAP related to equity

instruments received in exchange for goods or services [ASC 505-50, Equity-Based Payments to

Non-Employees]. Under current guidance, the fair value of an equity instrument is typically

measured when the entity’s performance is complete.

The FASB’s proposal would require entities to recognize changes in the fair value of noncash

consideration after contract inception as a gain or loss in earnings (that is, excluded from

revenue from contracts with customers). This may raise additional accounting questions, such as

the implication of changes in the fair value of noncash consideration that occur prior to an

entity’s performance.

The proposal would also result in a difference between the US GAAP and IFRS standards; in

particular, it would result in the same example (i.e., Example 31, Entitlement to Noncash

Consideration) having differing conclusions under the two standards. There might also be more

diversity in practice under IFRS given that there will not be specific guidance regarding

measurement date.

Next steps:

The comment period for the FASB’s exposure draft ended on November 16, 2015. The FASB is in the process of

reviewing responses received and expects to issue its final amendments in 2016.

The comment period for the IASB’s exposure draft ended on October 28, 2015. The IASB redeliberated in December

and affirmed its decision not to amend the noncash consideration guidance. The IASB expects to issue its final

amendments in 2016.

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition 10

Appendix – TRG agenda topics

In addition to the earlier editions of our In transition publication, please visit our Revenue Recognition page on

http://www.CFOdirect.com for additional information on the topics listed below. Replays and minutes of the TRG

meetings are available on the TRG page of the FASB’s website.

July 18, 2014

Date

TRG

Agenda

Ref #

1

Gross versus Net Revenue

2

Gross versus Net Revenue: Amounts Billed to

Customers

3

January 26, 2015

October 31, 2014

4

March 30, 2015

Topic discussed

6

7

8

9

Sales-Based and Usage-Based Royalties in

Contracts with Licenses and Goods or Services

Other than Licenses

Impairment Testing of Capitalized Contract

Costs

Customer Options for Additional Goods and

Services and Nonrefundable Upfront Fees

Presentation of a Contract as a Contract Asset

or a Contract Liability

Determining the Nature of a License of

Intellectual Property

Distinct in the Context of the Contract

Anticipated next steps

FASB and IASB have proposed

amendments

FASB has proposed a practical

expedient for taxes collected from

customers

FASB and IASB have proposed

amendments

No further action expected

No further action expected

No further action expected

FASB and IASB have proposed

amendments

FASB and IASB have proposed

amendments

12

Contract Enforceability and Termination

Clauses

Identifying Promised Goods or Services

13

Collectibility

FASB has proposed amendments

14

Variable Consideration

No further action expected

15

Noncash Consideration

FASB has proposed amendments

16

Stand Ready Obligations

No further action expected

17

Islamic Finance Transactions

No further action expected

23

Costs to Obtain a Contract

24

Contract Modifications

26

Contributions

No further action expected

FASB and IASB have proposed

amendments

No further action expected

27

Series of Distinct Goods or Services

28

Consideration Payable to a Customer

29

Warranties

No further action expected

Topic discussed at July 13, 2015 TRG

meeting. See Agenda Ref #37.

No further action expected

30

Significant Financing Component

No further action expected

31

Variable Discounts

No further action expected

32

Exercise of a Material Right

No further action expected

33

Partially Satisfied Performance Obligations

No further action expected

10

No further action expected

FASB has proposed amendments

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition 11

Date

TRG

Agenda

Ref #

35

36

37

July 13, 2015

38

39

40

41

42

November 9, 2015

43

Topic discussed

Accounting for Restocking Fees and Related

Costs

Credit Cards

Consideration Payable to a Customer

Portfolio Practical Expedient and Application of

Variable Consideration

Application of the Series Provision and

Allocation of Variable Consideration

Practical Expedient for Measuring Progress

toward Complete Satisfaction of a Performance

Obligation

Measuring Progress when Multiple Goods or

Services are Included in a Single Performance

Obligation

Completed Contracts at Transition

Determining When Control of a Commodity

Transfers

45

Licenses – Specific application issues about

restrictions and renewals

46

Pre-production Activities

47

48

Whether Fixed Odds Wagering Contracts are

Included or Excluded from the Scope of Topic

606

Customer Options for Additional Goods and

Services

Anticipated next steps

No further action expected

No further action expected

No further action expected

No further action expected

No further action expected

No further action expected

No further action expected

FASB has proposed amendments

No further action expected

No further discussion expected; Boards

will consider feedback as they finalize

proposed amendments

No further discussion expected; FASB

may consider amending ASC 340-10

No further discussion expected; FASB

may consider a technical correction

No further action expected

National Professional Services Group | CFOdirect Network – www.cfodirect.pwc.com

In transition 12

PwC has developed the following publications and

resources related to the new revenue recognition

standard, covering topics relevant to a broad range of

constituents.

– PwC Global Guide: Revenue from contracts with

customers

– In transition US2015-06, Transition Resource Group

discusses variable consideration, transition, the

series guidance, scope, and more

– In transition US2015-05, FASB and IASB agree to

clarify principal versus agent guidance

– In transition US2015-04, TRG holds fourth meeting

since issuance of new revenue standard

– In transition US2015-03, FASB and IASB decide on

additional changes to revenue standard

– In transition US2015-02, FASB and IASB debate

potential changes to revenue standard

– In transition US2015-01, Transition Resource Group

holds third meeting since issuance of new revenue

standard

– In transition US2014-01, Transition Resource Group

debates revenue recognition implementation issues

– Point of View: Preparing for the new revenue

standard — Are you ready?

For more information on this publication please

contact:

Brett Cohen

Partner

(973) 236-4110

brett.cohen@pwc.com

Tony Debell

Partner

+44 20 8213 5336

tony.m.debell@uk.pwc.com

Dusty Stallings

Partner

(973) 236-4062

dusty.stallings@pwc.com

Angela Fergason

Managing Director

(408) 817-1216

angela.fergason@pwc.com

Catherine Benjamin

Director

(973) 236-4568

catherine.benjamin@pwc.com

– In the loop: Reporting revenue—new model, new

strategy?

– In depth US2014-01, Revenue standard is final—A

comprehensive look at the new model and related

industry-specific supplements

Click on the titles to obtain a copy of each publication.

PwC clients who would like to obtain any of these

publications or have questions about this In Transition

should contact their engagement partner.

© 2015 PricewaterhouseCoopers LLP, a Delaware limited liability partnership. All rights reserved. PwC refers to the United States member firm, and

may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. This

content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.