Steady to Possibly Lower New Private Fund to Buy

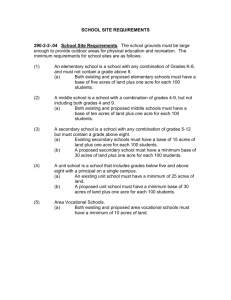

advertisement

July 9, 2015 Canadian farmland rose 13.3% in 2014, according to Stats Canada. The agency says farm equity increased in every province except in Newfoundland and Labrador-Nova Scotia. This figure is similar to the 14.3% gain reported earlier by the huge lender Farm Credit Canada. The agency says total farm assets rose by 10.4% while the debt-to-asset ratio declined to 15.0%, its lowest level since 1997. 27 states file suit over WOTUS. The suit was filed in the U.S. District Court for the district of North Dakota. They argue the new rule defining waters of the U.S. (WOTUS) by the EPA and U.S. Army Corps of Engineers violates the Clean Water Act, the National Environmental Policy Act and the U.S. Constitution. The states are asking to have the rule vacated as it takes away rights specifically granted to the states that have been repeatedly affirmed by both the Congress and federal courts. See you next week at Leading Edge in West Des Moines, Iowa. For more go to: profarmer.com and click on the Pro Farmer Services tab or call 1-888-698-0487. Powerful Insight for LandOwners Vol. 36 • Iss. 13 Midyear Outlook: Steady to Possibly Lower Steady with the likely chance for weakness is our “weather forecast” for the farmland market the second half of the year. Other land market observers and participants are also making that call — as you’ll read inside. Making a forecast for the second half of the year is more cloudy than usual this year. That’s because of the intense rains that have impacted large areas of the Corn Belt and Plains. If rain continues and crops are negatively impacted like they were in 1993, prices will rise along with farmer attitudes. Farmland values would likely remain steady in that case and possibly edge higher. But normal yields in 2015 would likely pressure land values again in 2016 into 2018. We also believe it is important the increased interest by non-farm investors is being put into actual execution. (See stories below.) This new source of demand won’t stem a wide-scale decline in values by itself, but it can certainly slow the rate of decrease. And it can help the market find a low at a higher level than otherwise. Third Farmland Investment Fund to Go Public American Farmland Company, a New Yorkbased Real Estate Investment Trust (REIT), filed June 26 with the Securities and Exchange Commission (SEC) to raise up to $100 million in an initial public offering (IPO), reports NASDAQ. The firm would be the third farmland-focused REIT to become publicly traded. The first was Gladstone Land Corporation, which began trading on the NASDAQ in January 2013. The firm is part of the Gladstone Companies investment fund firm headquartered in McLean, Virginia. The REIT purchases fresh-produce farms rather than wheat and row-crop farms growing corn, soybeans and cotton. When it launched its IPO, its farmland purchases were located in California, Oregon and Arizona. In its first-quarter 2015 results, the firm listed ownership of 34 farms, consisting of 8,789 acres in five states. On June 22, Gladstone announced it had concluded two purchase agreements to acquire five farms, consisting of 3,519 acres in California and Florida. It also indicated it was evaluating the purchase of six farms, consisting of 5,476 acres in Colorado, Florida, Georgia and Nebraska for $23 million. On June 29, the firm announced it had concluded the purchase of 2,668 acres in Florida. The second REIT to launch an IPO was Farmland Partners, Inc., of Denver, Colorado. It owned 38 farms comprising 7,300 acres at the time of its IPO on the New York Stock Exchange in April 2014. It now has 120 farms consisting of 71,188 acres located in Illinois, Nebraska, Colorado, Kansas, Arkansas, Louisiana, Mississippi, South Carolina, North Carolina, Virginia and Michigan. Its most recent purchase, announced June 29, is a 125-acre Michigan blueberry farm priced at $1.2 million. Prior to that purchase, the firm’s portfolio consisted strictly of commodity row-crop corn, soybean, wheat, rice, cotton, sunflower and milo farms. American Farmland Company is part of Optima Fund Management, headquartered in New York City. The firm reports it owns 17 farms consisting of 15,378 acres. It states the farms were valued at $171.1 million as of March 31. The 17 farms produce 21 crop varieties ranging from mature permanent, specialty/vegetable crops to commodity row crops. The farms are located in Alabama, Arkansas, California, Florida, Georgia and Illinois. New Private Fund to Buy Farmland A new private investment fund will soon be active in the farmland market. It is Homestead Capital with offices in Council Bluffs, Iowa, and San Francisco, California. The fund recently announced it had closed its inaugural fund titled Homestead Capital USA Farmland Fund 1 at $173 million. The fund’s stated objective is to acquire properties in the Mountain West, Delta, Midwest and Pacific region. It also announced it had already invested $60 million of the original fund in the four regions through eight projects. The firm’s management team combines investment managers and attorneys with experience at investment bankers such as JP Morgan and Goldman Sachs & Co. with a who’s who of past presidents of the American Society of Farm Managers and Rural Appraisers. Wisconsin Ag Land Rises 5% The value of Wisconsin agricultural Wisconsion Statewide Average Value $/a $3,935 land rose 5% in 2014, according to data reported to the state and analyzed by A. J. Brannstrom of the University of Wisconsin Center for Dair y Profitability. The average price of agricultural land sold in 2014 reached $3,935 an acre, he reports. In addition, he notes the total acres sold declined 5% and the number of sales decreased 8%. Key driving factors behind the year’s gain were strong dairy prices and low interest rates, he observes. Brannstrom analyzed data obtained from the state Department of Revenue. Transfer return records are collected A. J. Brannstrom, University of Wisconsin Center for Dairy Profitability from each real estate title transfer. He looked only at sales of bare land between non-related parties sold with warranty deeds $2,374; -8.4% or land contracts. All parcels were between 35 and 2,000 acres and were assessed for agricultural use at $2,672; +18.5% the time of sale. Transactions with sale values less than $400 an acre and more than $17,000 per acre were excluded. He $2,799; -6.5% assumes such properties are not used for agricultural purposes. Sellers who retained property rights were also excluded as were parcels with reported water frontage. In addition, properties in cities or villages were excluded. $2,969; +4.0% After sorting land transactions for study according to his criteria, he found more than 7,000 transfer $5,876; +13.0% $3,744; +10.9% returns covering 2009 to 2014 to use in his study. All sale prices are based on weighted averages. The $5,882; -7.3% weighted average tends to reduce the influence of sales with unusually high or low sale prices, he notes. $3,739; +5.8% Weighted averages are computed by first summing $5,662; +7.6% NASS districts the dollars paid for all sales and the total acres sold and then dividing the totals. He organized his data according to the nine districts districts saw declines in average sale price. The west cenused by USDA’s National Agricultural Statistics Service. tral district saw the most acreage sold, while the northThe map at right shows the weighted average district east sold the fewest acres, he says. Brannstrom notes the percentage of farmland purprice and the percentage change from the previous year. East-Central Wisconsin saw the fastest percentage chased with cash remains high at about 38% in 2014. That increase in land values over the past six years, he notes. compares to a high of 48.2% in 2012, and a low of 36.6% in This is also the fastest growing milk production region in 2011. Even at 36.6% in 2011, that is a testament to the the state. The average price per acre for bare land was strong financial position many farmer buyers enjoyed in nearly the same in the southeast, east-central and south- recent years. Individuals comprised 70% of sellers in 2014, central districts. The southwest, northeast and central while LLCs, trusts, etc. were 26%. LandOwner is published twice a month. Copyright 2015 by Professional Farmers of America, Inc., 6612 Chancellor Drive, Cedar Falls, Iowa 50613-9985 Periodicals postage paid at Cedar Falls, Iowa. Postmaster: Send address changes to: LandOwner, 102 Mackinlay Dr., Webster City, Iowa 50595 Senior Vice President, Chuck Roth • Editor, Mike Walsten • Publisher, Chip Flory • Markets Editor, Brian Grete Editorial Phone: 319-277-1278 • E-mail: landowner@profarmer.com • Editorial correspondence: 6612 Chanellor Dr., Suite 300, Cedar Falls, IA 50613 ISSN number: 1548-2901 • Subscription services phone: 1-800-772-0023 • Subscription: $249 per year LANDOWNER 2 / July 9, 2015 FNC: Harvest Incomes Key to Land Values Going Forward While current land values have generally trended lower this past year, results of farm and ranch income at year’s end could shift land market dynamics, according to Farmers National Company (FNC), Omaha, Nebraska. “Harvest results of 2015 will make it a pivotal year, which could impact the land market for several years,” says Randy Dickhut, AFM, vice president of real estate operations. “Farm and ranch income will drive the direction. A great deal could happen between now and November.” Dickhut says margin compression is occurring as a result of lower grain prices and steady input costs. He believes higher grain prices this fall would stabilize land values; however, lower prices could push values downward. While farm and ranch profits are forecast to be lower in 2015, which will impact cash flows negatively, agriculture overall remains financially strong due to past profits. Operators working to shore up financial stress due to tight cash flow could lead to a boost in sales as property owners work to right balance sheets, he says. Location and quality of land continue to be the main price drivers for individual tracts. The stability of this market is maintained by a lower supply of land for sale, contrasted with a continued demand for quality properties. FNC statistics show the volume of properties for sale is down 40% over the past six months, as compared to the past two years. “The current level of available land is having a real impact on farm and ranch operations looking to expand,” he states. “Demand is still good for quality land. The market just isn’t as aggressive as in the past few years, so values are drifting sideways to lower.” High-Quality Land Values by State Average sale price per acre While land values are down nearly 10% in most areas, price softening is happening at different rates in each region. For example, sales in the Northwest have been brisk, as the California drought is driving activity north. The Southern Delta region hasn’t seen much decline, while parts of the Midwest are experiencing significant drops in value. While current buyers are predominantly active farmers and ranchers adding land to their operations, interest from investment funds and individuals is on the rise. In addition, generational land transfers continue to play a large role in market movements, as many inheriting land choose to sell. “With the softening of land values, some investors are looking at this as an opportune time to buy,” he says. “Land is considered a low-risk long-term investment, so we will see these types of buyers jumping into the land market more and more over the next several years.” Demand for cropland and grazing land from producers remains good, but buyers are being more realistic in what they will pay given lower grain prices. Land professionals are recommending sellers be more realistic in evaluating the quality of their land and the expected selling price in order to have a successful sale. Regional FNC comments: Kansas and Oklahoma: Values remain historically strong and quality land is still in high demand but probably 10% to 15% lower than at its peak. High-quality land will meet with continued excellent demand and historically strong values. Marginal quality land will struggle to achieve the same values it experienced the past four or five years and will meet with fewer interested buyers. Iowa and Minnesota: Low commodity prices have finally started to affect land values in Iowa and Minnesota. In areas where fewer livestock is being raised, land values have definitely softened. Specific areas that have seen outbreaks of the avian flu will definitely see a downward trend, as owners have had to destroy more than 30 million birds. Dakotas and western Minnesota: While prices are down 10% to 20% from a couple of years ago, land prices are still excellent when looking back over the past 10 years. Sellers can expect to see notable buyer interest in their land, as long as it is priced right. There is a trend toward more private listings versus auctions as compared to a year ago. Eastern Corn Belt: Activity throughout this region is seeing a calming of sales during the first half of 2015, with values trending slightly downward. Based on current market factors, this trend is likely to continue throughout the summer months and into fall. A tight supply of farmland has helped reduce the negative shift and continue to support values. LANDOWNER 3 / July 9, 2015 Iowa: Fayette County — June 10: 409 acres northeast and north of West Union. Tract 1: 139 acres; 136 acres tillable; CSR2 68.9; CSR 68.7 (64.3 county average); swine farrowto-finish buildings; $10,000 per acre. Tract 2: 69 acres; 57 acres tillable; CSR2 78.4; CSR 78.3; $11,625 per acre. Tract 3: 432 acres; all tillable; CSR2 69.2; CSR 66.6; $9,500 per acre. Tract 4: 34 acres; 30 acres tillable; CSR2 53.0; CSR 56.3; $6,400 per acre. Tract 5: 119 acres; 102 acres tillable; CSR2 64; CSR 68.4; $5,800 per acre. Tract 6: 7 acres; wooded; $65,000 total. Cal E. Wilson, Hertz Real Estate Services, Waterloo, 319-234-1949. Kentucky: Christian Co. — June 6: 72 acres 4 miles west of Hopkinsville; barns; $8,011 per acre. James R. Cash, Auctioneer & Real Estate Broker, Fancy Farm, 270-623-8466. Kansas: Rawlins County — June 3: 320 acres 12 miles north of Gem; 251 acres dryland cropland; 70 acres grass; $2,017 per acre. Donald Hazlett, Farm & Ranch Realty, Inc., Colby, 800-247-7863. Minnesota: Lac Qui Parle County — May 7: 120 acres northwest of Montevideo; 107 acres tillable; CPI 82.1; $5,800 per acre. Brian Fernholz, Heller Group, 1 Stop Realty, Inc., Madison, 320-226-4504. Oklahoma: Garfield Co. — May 28: 154 acres northeast of Waukomis; 111 acres cropland; $325,000 total or about $2,110 per acre. Kim Allen, Wiggins Auctioneers, LLC, Enid, 580-541-3180. Indiana: Delaware Co. — May 14: 84 acres 1.5 miles northeast of Selma; 61 acres tillable; corn PI 147.7; 22 acres wooded; $470,000 total or about $5,595 per acre. Chris Peacock, Halderman Real Estate Services, Winchester, 765-546-0592. LANDOWNER 4 / July 9, 2015 $ Recent sales reported to... Here’s a listing of recent sales reported to us by real estate brokers and auctioneers across the country. If you have recent sales you’d like to share, call us at 319277-1278 or e-mail us at landowner@profarmer.com. Illinois: McLean County — June 26: 38 acres south of Cooksville; nearly all tillable; PI 136.1 (147 maximum per Illinois Bulletin 811); $9,600 per acre. Roy Bracey, AFM, Farmers National Company, Chenoa, 815-945-7722. Iowa: Clay County — June 26: 115 acres 2 miles south of Royal; 114 acres tillable; CSR2 96.2; CSR 80.7 (67.7 county average); $11,300 per acre. Jon Hjelm, ALC, The Acre Co., Spencer, 712-262-3529. Indiana: Porter County — June 25: 34 acres adjacent to Portage; 32 acres tillable; corn PI 150.5; $150,000 total or about $4,545 per acre. Julie Matthys, Halderman Real Estate Services, New Carlisle, 574-310-5189. Iowa: Van Buren County — June 24: 71 acres northeast of Keosauqua. Tract 1: 36 acres; 32.5 acres tillable; CSR2 66.1; CSR 58.9 (42.9 county average); $7,250 per acre. Tract 2: 35 acres; 4.5 acres tillable currently in pasture; remainder is hardwood timber; $3,700 per acre. Sullivan Auctioneers, Inc., Hamilton, Ill., 217-847-2160. Illinois: Woodford County — June 19: 132 acres west edge of El Paso. Tract 1: 54 acres; all tillable; PI 141.8 (maximum 147); $13,000 per acre. Tract 2: 78 acres; all tillable; PI 142.1; $13,000 per acre. Two different buyers. Sullivan Auctioneers, Inc., Hamilton, 217-847-2160. Illinois: McLean County — June 18: 159 acres 2 miles southeast of Stanford; 158 acres tillable; PI 138.5 (147 maximum); $10,685 per acre. Offered as two tracts; purchased as single unit. Dan Patten, Soy Capital Ag Services, Bloomington, 309-665-0962. Nebraska: Lancaster County — June 17: 149 acres 1 mile northeast of Princeton; 147 acres cropland; irrigated with 10-tower unit; power unit not included; SRPG 56.0; $8,000 per acre. Jerry Wiebusch, Farmers National Company, Lincoln, 402-421-1933. Iowa: Greene County — June 17: 148 acres 1 mile west of Churdan; nearly all tillable; CSR2 77.1; CSR 73.8 (76.4 county average); $8,100 per acre. Mike Green; Green Real Estate & Auction Co., Sac City, 712-662-4442. Illinois: Sangamon County — June 16: 159 acres south of Loami: 154 acres tillable; OPCY 161.3; $14,000 per acre. Luke Lee Gaule Auctioneers, Springfield, 217-523-7272. Kansas: Rush County — June 16: 160 acres 2 miles west of Timken; 90 acres cropland with 35 acres irrigated; fenced pasture; farmstead; $2,180 per acre. Carr Auction & Real Estate, Inc., Larned, 800-503-2277. Iowa: Grundy County — June 11: 141 acres south of Dike; all tillable; CSR2 68.9; CSR 74.3 (84.7 county average); $7,350 per acre. Buyer receives secondhalf lease payment of $20,413.50 Sept. 1; Vince Johnson, Iowa Land Sales & Farm Management, Montezuma, 641-623-5263. Outlook Provided by Pro Farmer Economy Unemployment falling as economy strengthens U.S. Monthly Unemployment Rate The unemployment rate has been in steady decline since the 2009 peak. Fundamental trends Unemployment: The U.S. monthly rate of unemployment bottomed in 2007 for a business-cycle low and then surged into September 2009. Since 2009, the unemployment rate declined from 10.0% to 5.4% as the economy recovers from the recession low. Nominal GDP per capita has risen to an all-time high as unemployment has declined. The Industrial Wheat Production Index that dates back to the 1920s and is followed by the Fed made a record high this year. Housing is also important for assessing strength of the U.S. economy. Housing starts as of May were still well below the pre-recession high, but in an uptrend. The outlook is for the rate of unemployment to work lower into next year alongside a growing economy. Demand remains a concern for wheat Weekly SRW Wheat Futures The long-term downtrend remains intact. A push above that level would have bulls targeting $6.77 and then $7.44. $7.44 $6.77 $5.72 1/4 The pivotal $5.72 1/4 level is support again. A close below that level would signal a short-term top is in place. That would open the downside $4.60 3/4. $4.60 3/4 Fundamental trends SRW: USDA’s Quarterly Grain Stocks Report showed all wheat stocks at 753 million bu. compared to trader expectations of 718 million bushels. The data caused traders to take profits the day after the report on thoughts that supplies are adequate and the U.S. lacks competitiveness globally. HRS: USDA pegged spring wheat acres at 13.05 million compared to March intentions of 12.969 million acres. Farmers in the Northern Plains found corn to be less competitive considering weather-related risk and low prices early this year. Meanwhile, Canadian spring wheat plantings were lower than planned in March. LANDOWNER July 9, 2015 / Outlook page 1 Corn Corn due for a pullback after the strong June rally Weekly Corn Futures Futures blew through the long-term downtrend and flat resistance at $4.06 1/4 to signal at least a short-term low. There isn’t much chart resistance until $5.22 3/4, so psychological levels at $4.50, $4.75 and $5.00 are bulls’ next targets. $5.22 3/4 $4.06 1/4 A close below $4.06 1/4 would point the contract back to the long-term downtrend. Fundamental trends Corn: USDA’s Acreage Report surprised traders with lower-than-expected planted corn acres. The Quarterly Grain Stocks Report showed corn stocks were also lower than expected. This caused a swift round of buying that greatly extended the prior week’s sharp rally. At the CME Group, agricultural futures hit a new record at 2.874 million Soybeans contracts traded on June 30, the day of the reports. Most of the late-June rally was on lower open interest, which suggests short-covering rather than fresh buyer interest for futures. With weather forecasts offering less above-normal precip and an overbought market, a correction in prices is likely near-term. Beans rally amid crop scare, but now face tough resistance Weekly Soybean Futures Bulls’ next upside target is $10.94 1/4. If that tough resistance is cleared, they will aim for $11.86 1/2. $10.94 1/4 $11.86 1/2 The long-term downtrend is now support, along with the 2014 low at $9.04. A drop below those levels would point beans toward a band of support from $8.75 to $7.75. Fundamental trends Beans: The past three weeks, the July/November spread weakened 12¢ to near a low made in April. This indicates limited interest by bulls in old-crop, while seller interest was restrained in new-crop futures. It also suggests limited farmer interest in hedging new-crop. With crop conditions eroding due to adverse weather, traders favored short-covLANDOWNER July 9, 2015 / Outlook page 2 $9.04 ering. But with large global supplies and the U.S. 2015 crop likely to be sizable, traders and farmers need to keep an eye on rising support levels given the overbought status of the market. Brazilian futures are also strong, but a weekly close lower would likely mean they have returned to making soybean sales for export.