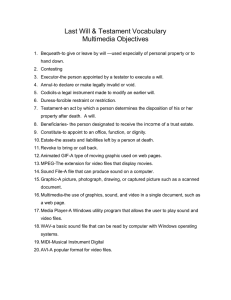

SUCCESSION ACT 1925

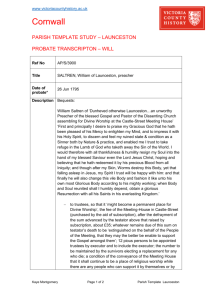

advertisement