NGL Feb Value Trade Lessons Learned

advertisement

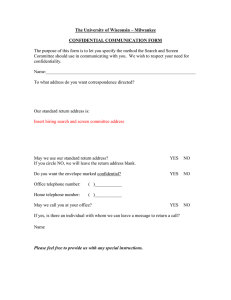

NGL Feb Value Trade Lessons Learned BP Confidential February Trade Strategy • Entering Feb, NAGP owned nearly 50% of available physical propane bbls at the TET location • Feb-March spread was trading at a 6 cent premium • Two key fundamentals led to the belief that the FebMar spread would widen by month end: – Need to maintain a minimum inventory level of apx. 2 million bbls at TET – High level of imports hedged with paper TET swaps • View was that gulf coast propane would become short as importers went to the market to cover hedges • Strategy was to sell a portion of the acquired bbls at a higher Feb price, rolling the balance to March BP Confidential TET Propane Inventory TET System C3 Inventory 12,000 10,000 April/May 1.6 mln held 6,000 4,000 2,000 End Feb 2.1 mln held BP Confidential 2/04 1/04 12/03 11/03 10/03 9/03 8/03 7/03 6/03 5/03 4/03 0 3/03 MBBLS 8,000 Feb-04 TET Hedged Imports by Location Gulf Coast: East Coast: Mexico: 2,741 MBBLS 1,642 MBBLS 852 MBBLS Total: 5,235 MBBLS BP Confidential Date 2003 BP Confidential 2/27 2/25 2/23 2/21 2/19 2/17 2/15 2/13 2/11 2/9 2/7 2/5 2/3 2/1 1/30 1/28 1/26 1/24 1/22 1/20 1/18 1/16 1/14 1/12 1/10 1/8 1/6 1/4 1/2 Spread (cpg) February / March TET C3 Spread: 2003 Feb / Mar TET C3 Spread 50 45 40 35 30 25 20 15 10 5 0 Expected outcome at trade entry • Peak BP TET Inventory build: 4 mln bbls • TET Minimum Dead Stock: 1.6 – 2 mln bbls • Volume Sold in February: 40% - 60% (1.6 – 2.4) • Feb/March backwardation: 20 – 30 cents/gal • Profit/Loss: - $5M to + $15M (20% chance of loss) BP Confidential Possible Value of Trade 70 60 50 40 MM $'s P/L 30 20 Expected Value of Trade 10 (10) (20) (30) 10 0% 20% 20 40% 60% 80% Backw ardation 100% BP Confidential 30 40 February 2004 Timeline 2004 Position Summary v. TEPPCO Inventory v. C3 Price 8,000 35 7,000 30 6,000 25 4,000 15 3,000 10 2,000 TEPPCO Inv. Feb C3 Position BP Confidential Feb / Mar Spread 2/26 2/24 2/22 2/20 2/18 2/16 2/14 2/12 2/10 2/8 2/6 2/4 2/2 1/31 1/29 1/27 1/25 1/23 1/21 1/19 1/17 1/15 1/13 0 1/11 1/9 5 1/7 1,000 (CPG) 20 TEPPCO Pipeline goes dow n 1/5 (MBBLS) 5,000 February Weather Summary Difference in HDD 2003 vs 2004 200 150 HDD 100 50 0 -50 -100 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Day In February Boston Washington DC BP Confidential Cleveland La Guardia 25 26 27 28 29 Actual Outcome • Peak BP TET Inventory build: -Peak BP Build: 5.1 mln bbls • TET Minimum Dead Stock: -Actual Dead Stock: 1.6 – 2 mln bbls .7 mln bbls • Volume Sold in February: -Actual February Sales: • Feb/March backwardation: -Final Feb/March Spread: • Profit/Loss: 4 mln bbls 40% - 60% (1.6 – 2.4) 17% ( .9 mln bbls) 20 – 30 cents/gal 34 cents/gal ($5M) to + $15M (20% chance of loss) -MTM Trade Loss: ($10M) BP Confidential Possible Value of Trade 70 60 50 40 MM $'s P/L 30 20 Expected Value of Trade 10 (10) Outcome of Trade (20) (30) 10 0% 20% 20 40% 60% 80% Backw ardation 100% BP Confidential 30 40 Lessons Learned BP Confidential Trading Strategy • Method to establish dead stock level flawed • Too much focus on year to year similarities, not enough on differences (e.g nat gas price) •Lack of system levers a significant disadvantage (e.g no TET marketing position) •Transparency of TET inventory position (Inventory reports & OTC) •Use of a potential weather hedge (short Z6 market) •Extend trading play across all TET grades •Spread limit on ability to short March/April •Aggregating group position in advance - critical •Use of index sales as opposed to fixed price BP Confidential Controls • MVAR limit – Calc’s based on 90-day volatility of Feb-Mar spread – MVAR averaged just over $1 M throughout March – No change in MVAR associated with trade strategy • Calendar Spread limit – Calculated based on minimum of net monthly longs and shorts – Calendar spread limited by net shorts not Feb length – Stayed within limit by increasing flat price exposure in Feb – Well within total flat price + calendar limit of 7 MMBBL’s – Calendar spread limit prevented using additional shorts as downside protection BP Confidential Controls (Continued) • Rolling unsold barrels – Typical process for marking inventory is 100% at prompt – Barrels that can’t be sold during the month are marked at prompt during the month, and then rolled at the end of the month – Following this protocol would have shown unrealistic gains in daily P&L – Bench chose to do 2 mid-month rolls rather than wait until the end of the month – These rolls were done manually, resulting in calculation errors that had to be corrected several days later BP Confidential Compliance: Key risks • Regulatory - No violations under current framework, but could increase the risk of regulatory intervention • Legal/credit – No specific legal concerns identified, but could increase the risk of an “aggrieved short” failing to make payment or filing a claim for damages • Reputational – Primary risk. BP Confidential Compliance: Lessons Learned • Involve compliance group early. Only consulted once initial play was on, and exit would have resulted in significant financial loss. • Education is required. The potential risks were unclear to those making decisions on the bench. • Reputational issues outside of NAGP should be considered and key stakeholders consulted. • A credit strategy is critical. As Feb price and volume increased many counterparties exceeded their credit limit, reducing NAGP’s ability to liquidate physical inventory BP Confidential Communication with NGLBU Primary concerns of BU: • Financial losses from trading – BU was unaware of potential for a $10M loss – Not informed when “sizable” positions are on – Concerned over applicability of current DOA’s • Reputational risk – NAGP only consulted internal compliance group, no dialogue with NGLBU over compliance issues – BU is concerned about “regulatory issues” – Having to answer customer questions BP Confidential Communication with NGLBU Primary concerns of BU (continued): • Assurance that trading team has access to all information and optionality within the BU that can be used to increase chance of success – Information from within BU could have helped NAGP better understand dead stock flexibility – Use of physical optionality within asset base • BU Indirect financial impacts on business – Did Feb price spike have a negative impact on liftings which cost the BU money? To be discussed separately BP Confidential Actions going forward • • • • Peer Review – Done Hire new NGL Risk Manager – Done Compliance/regulatory training for NGL’s – Requested Evaluating control “trigger points” that would necessitate discussion between NAGP and NGLBU – In progress • Implement weekly meetings with Marketing & Logistics to review trading positions and share opportunities – Pending • Review NAGP DOA’s, establish clear accountabilities, implement improved communication protocols Pending BP Confidential Back-up Slides BP Confidential 1/ 26 /0 1/ 4 28 /0 1/ 4 30 /0 4 2/ 1/ 04 2/ 3/ 04 2/ 5/ 04 2/ 7/ 04 2/ 9/ 0 2/ 4 11 /0 2/ 4 13 /0 2/ 4 15 /0 2/ 4 17 /0 2/ 4 19 /0 2/ 4 21 /0 2/ 4 23 /0 2/ 4 25 /0 2/ 4 27 /0 2/ 4 29 /0 4 3/ 2/ 04 3/ 4/ 04 3/ 6/ 04 3/ 8/ 04 Price CPG Residential & Wholesale C3 Prices Propane Prices 175 155 135 115 95 75 55 Date Residential BP Confidential Wholesale 2003 BP Confidential Date 2004 2/27 2/25 2/23 2/21 2/19 2/17 2/15 2/13 2/11 2/9 2/7 2/5 2/3 2/1 1/30 1/28 1/26 1/24 1/22 1/20 1/18 1/16 1/14 1/12 1/10 1/8 1/6 1/4 1/2 Spread (cpg) February / March TET C3 Spread: 2003 v. 2004 Feb / Mar TET C3 Spread 50 45 40 35 30 25 20 15 10 5 0 C3 Supply & Demand: 2003 v. 2004 6,000 5,000 4,625 4,000 3,425 3,000 2,290 1,768 2,000 1,486 1,000 (1,000) (804) (1,200) (2,000) (2,029) (3,000) (4,000) (3,797) (5,000) Dec 2004 Chem Demand v. 2003 Jan 2004 Imports / (Exports) v. 2003 BP Confidential Feb Net Supply / (Demand) Delta Position Summary Feb TET C3 Position 6 ,0 0 0 5,0 0 0 MBBLS 4 ,0 0 0 3 ,0 0 0 2 ,0 0 0 1,0 0 0 - long feb/mar long feb c3/wti long feb feb c3 BP Confidential Date Possible Value of Trade 70 60 50 40 MM $'s P/L 30 20 10 (10) (20) (30) 10 0% 20% 20 40% 60% 80% Backw ardation 100% BP Confidential 30 40 Feb-04 TET C3: as a % of Crude Feb-04 TET C3 as a % of Crude 110% 100% 90% 80% 70% TET C3 Average BP Confidential Max Min 2/23/04 2/16/04 2/9/04 2/2/04 1/26/04 1/19/04 1/12/04 1/5/04 12/29/03 12/22/03 12/15/03 12/8/03 12/1/03 60% BP Confidential Date 3/22/2004 3/15/2004 3/8/2004 3/1/2004 7 2/23/2004 2/16/2004 2/9/2004 2/2/2004 1/26/2004 1/19/2004 1/12/2004 1/5/2004 Spread in cpg Mar / Apr C3 Spread March/April Spread C3 8 Mar vs Apr C3 6 5 4 3 2 1 0 PIRA C3 Inventory Chart: Total US BP Confidential PIRA C3 Inventory Chart: Gulf Coast BP Confidential