China Aviation Oil 2014 Annual Report

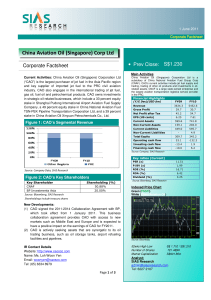

advertisement