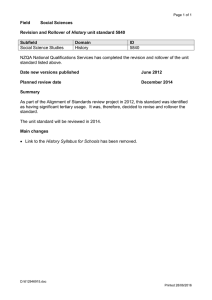

TPCR4 Rollover: Final Proposals

advertisement