Impacts of investment horizon on the estimation of beta

advertisement

UNIVERSITY OF

ILLINOIS LIBRARY

AT URBANA-CHAMPAIQN

BOOKSTACKS

•nUl OKULAT.ON

from

the library

on ° r ef

J^n

*

=

<^

Date stamped

be *aVaec. a

minimum

r^y each lost book.

beloW

*°'

$75.0O

Ss 00*or

„„

fee Of

----i

^

«

^:s^

.-

,or dl.«lp"««Tr

""Ion on

MS> 04191

DEC 101997'

date.

previous due

r«.»ons

fr -

m

Digitized by the Internet Archive

in

2011 with funding from

University of

Illinois

Urbana-Champaign

http://www.archive.org/details/impactsofinvestm761leec

BR

FACULTY WORKING

PAPER NO.

761

Impacts of Investment Horizon on the Estimation of

Beta Coefficients, Jensen Measure and Efficient

Frontier:

Lognormal vs. Normal Distribution Approach

Cheng

F.

Lee

College of

Commerce and Business

Bureau

Economic and Business Research

of Illinois, Urbana-Champaign

of

University

Administration

^

I

I

1^5

I

BEBR

FACULTY WORKING PAPER NO. 761

College of Commerce and Business Administration

University of Illinois at Urbana-Champaign

March 1981

Impacts of Investment Horizon on the Estimation of

Beta Coefficient, Jensen Measure and Efficient

Frontier: Lognormal vs. Normal Distribution

Approach

Cheng F. Lee, Professor

Department of Finance

Acknowledgment

The author is grateful to 1979 summer research

support from the Investors in Business Education, College of

Commerce and Business Administration, University of Illinois at

Champaign-Urbana

:

UBRARY

I).

OF

I.

8RBAHA -CHAMPAIGN

Abstract

Based upon the lognormal distribution assumption the impacts of in-

vestment horizon on the estimation of beta coefficient, Jensen measure

and efficient frontier are analyzed in detail.

It is found that invest-

ment horizon is one of the most important factors in estimating beta coefficient, Jensen measure and efficient frontier.

the standard Jensen measure estimate is biased.

It is also shown that

An unbiased Jensen mea-

sure is derived in accordance with the property of intercept for a log-

linear regression.

Empirical results are used to support the analytical

results derived in this paper.

I.

Introduction

Portfolio theory developed by Markowitz (1957) and Tobin (1958,

1965) is essentially based upon the assumptions that portfolio's rates

of return are normally distributed and the investor's utility function

is quadratic.

Recently Elton and Gruber (1974) have developed a port-

folio theory in terms of lognormally distributed investment relatives.

Gressis, Philippatos and Hayya (1976) have shown that the investment

horizon will generally affect the portfolio analysis.

In addition, Levy

(1972), and Lee (1976A, 1976B) and Levhari and Levy (1977) have analyzed

the impact of investment horizon on the systematic risk estimates and

the investment performance measure estimates.

However, these analyses

have not explicitly taken the problem associated with alternative dis-

tribution assumptions into account.

The main purpose

of'

this paper is to analyze the possible impacts

of statistical distribution and investment horizon on the estimates of

beta coefficient, Jensen performance measure, and efficient frontier

parameter estimates of a portfolio.

Sharpe's (1963) diagonal model

is used to examine how the investment horizon can affect the composi-

tion of an efficient portfolio.

In the second section, a lognormal

capital asset pricing model (CAPM) with investment horizon parameter

is derived in accordance with the resiilts developed by Lee (1976) and

Bawa and Chakrin (1979); some portfolio theories on the efficient portfolio determination under a lognormal market are reviewed in accordance

with the results developed by Elton and Gruber (1974), Ohlson and Ziemba

(1976) and Levy (1973),

In the third section, the regression for

the bivariate lognormal distribution is discussed in accordance with

-2-

Heien (1968) and Goldberger (1968).

The implications of these results

on the Jensen investment performance measure in terms of investment ho-

rizon will be explored in some detail.

In the fourth section the im-

pacts of investment horizon on the beta estimates and the performance

measure estimates under both normal distribution and lognormal distribution capital asset pricing model will be explored and the implications

of these results to the efficient portfolio in terms of the Sharpe's

(1963) diagonal model will be examined.

Data of 45 firms randomly se-

lected from the New York Stock Exchange (NYSE) will be used to do some

To study the bias of Jensen measure, 464 firms will

empirical studies.

be used to do the empirical analysis.

Finally, the results of this pa-

per will be summarized and some concluding remarks will be indicated.

II.

Investment Horizon and the Lognormal CAPM

In a paper examining the relationship between investment horizon

and the systematic risk estimate, Lee (1976B) has derived a lognormal

CAPM in terms of a statistical concept.

Bawa and Chakrin (1979)

[BC]

have also derived a lognormal CAPM in terms of portfolio analysis identical to that derived by Lee (1976B) and drawn some possible implications

to the

risk-return relationship test.

However, BC do not consider the

problem associated with investment horizon.

Following Lee (1976B) and Jensen (1969), the risk-return relationship for the capital asset pricing model can be defined as

(1)

E( R.) =

H

H

R (l- 6j> + E

f

H

W HV

-3-

where H - the true investment horizon,

the rate of return on secu-

R.

rity j, „R » the market rate of return, JR,

HI

n m

the risk-free rate of in-

the system risk.

terest, and „6.

Equation (1) implies the risk return tradeoff is linear when the

true investment horizon is known.

generally is unknown.

However, the true investment horizon

If the observed horizon is defined as N, then the

relationship between JR. and

JR..

and JR

,

and JR

,

,

and JR, and JR

f

can

be defined as:

R* - (1 +

(2)

where

(3)

"

X

+ JR

R ) - (1

H ±

fi

- JR* A

X

i

)

(i - j, m,

f)

« H/N, after substituting (2) into (1), we have

[E( R*)]

A

- (JR*)* (1- g.) + [E( R*)]

H

N

N

X

Vj).

Equation (3) can be rewritten as:

(4)

e

[/f

r*) =

(n

x

u-

[e( r*)]

e.)

1/x

a

n

fi

h6j

.

]

If the observed rates of return, JR. and JR

are log normally dis-

tributed, following Aitchison and Brown (1957), we have

2

(5)

E(JR*) - exp(c /2 +

var(JR*) - exp(2u

where

p

» E(log JR

*

1

(a)

^)

+

a

2

[exp(aj)-l]

)

*

2

)

(b)

and a. - var(log JR ).

To apply the Cramer's rule to (5), we obtain

(6)

2

2

E(log JR*) = log[p R*/ /o R* +

w

var(log

m v

m

N

R

m)

m

2

2

y

R*]

= log[E(JR* )] - log[E

Mm

(a)

m

2

(Rj]

m

(b)

.

-4-

For deriving cov[(log vjR.)»

log

r»

(log

^

^.

and

be bivariate normally distributed with mean vector

jJl

u

(u n

1

,

W »

y~) and covariance matrix

Z

The bivariate distribution of R

i__

g(rlf r 2 )

(7)

= log

)], we let r

°11

a

°21

a

[

12

- v

]

-1

.

22

(r-, r_)' can be written as

,

exp {-i/2[(R- u ) V(R-u)]}.

2ir|wj

Using the definition of covariance and g(r., r ), it can be shown

2

that

2

(8)

cov[ R*,

N

From

(8)

,

- «p.(y

1

+

P

2

){exp[l/2(a

2

1

+o

2

+2cr

2

12

)] -

exp[l/2(o

2

1

+o

2

2

it can also be shown that

o

(9)

jjR*]

12

- logtCcovC^*,

R*)/exp(y

N

1

+ p^expd/ZCo^+Oj 2 ))) + 1].

After substituting equations (6a) and (6b) into (9), we have

o

(10)

12

=

logttK^Jx^)]}

From (5b) and (8)

,

- logClCjRj) e

r*)].

(n

the finite and the systematic risk can be de-

fined as

Derivation of the density function for a bivariate normal distribution can be found in Hogg and Craig (1969)

2

3

The derivation of this result is available from the author.

Following Jensen (1969) and Cheng and Deets (1973), the finite

systematic risk can be defined as:

N 6.

= cov( R.

N

,

,Jl

)/var(„R

).

) },

-5-

2

exp[l/2(a

(11)

= C,

8

J

where

C.

+a

1

{

2

2

+2a.,)] - «p[l/2(o- +c )]

£

i

2

±2-=

2

J

+

» exp(u,

}

[«p(oJ)-l]

2

+ a,).

u )/exp(2u,

2

Using the definition lognormal distribution, we have

E^*)

(12)

= exp(aJ/2 +

2

ECjjR*) =

exp(o /2 +

from equations (11) and (12)

^

(13)

u^

(a)

vj

(b)

we have

,

= (ECjjR^/ECjjR*))

Substituting equation (13) and

^

(14)

E

R*)

(h

(

eXp(a

12

)

- l)/(exp(aj) - 1)]

=1 into equation (4), we have

X

«p< g i2 )

R

: H f m

[(exp(a

2

)

1

-

j}

- 1

- HR f

5^0

]

[

E

y£>

Bawa and Chakrin (1979) have used equation (14) to explore the possible

Implications of the lognormal CAPM on the risk-return relationship tradeoff test.

If X is a nonnegative rational number, then both Jl

*X

and ^l

lognormal, hence

(15)

E( R

* X)

N

= exPt x2a 2 / 2

t

i

var^^)

E<jjR*

X

)

= exp(2X

yi

= exp[X 2 a 2 /2

2

varEjjR*^) = exp(2Xu

2

+

^1

X

+

+

2

^

(a)

2

)

[expCA

2

^

2

)

- 1]

(c)

Xu,,]

X

2

^

(b)

2

2

)

2

[exp(X a

2

)

- 1]

(d)

*X

are

-6-

Following the same procedure used in this section, we can obtain

3

=

^.{\)

(16)

[VJVeCj***)]

2

[exp(X a

12

- l/exp(A

)

2

2

)

- 1]

0;L

can be used to investigate the possible relationship between the

(A)

estimated systematic risk and the investment horizon.

This issue will

be explored in section IV of this paper.

III.

Jensen Performance Measure Under Bivariate Lognormal CAPM

Lee (1976A) has derived an approximate CAPM for Equation

(4)

in

terms of logarithm transformation as

log

(17)

N

R* - log

+

where „Y- " 1/2A

„(3.

HY j

^

(1° g

= a.

+

R

e!

(log

* 2

R

l0 S »*£ >

N m "

(1-8.) and

e.

N

R* - log

+

whether

A

y.

j

is the disturbance term.

H

y.

A

This spec-

is smaller than one.

of (17) can generally be used to test

is significantly different from zero.

the estimated

R*)

e

ification is subject to specification bias unless

Nevertheless, the estimated

N

If A is larger than one,

will be affected by the omitted higher order terms ex-

J

cept that all omitted terms are not correlated with the quadratic excess

market rate of return.

This is one source of specification error.

The

model defined in equation (17) has been used by Treynor and Mazuy (1966)

and Jensen (1972) in determining the unbiased measure of stock selection

ability.

Even the standard specification as defined in equation (14) is

correct, there still exists some problem in estimating so-called Jensen

performance measure in terms of a bivariate log normal regression as defined in Equation (18)

-7-

(18)

log(Z

where

Z

±

1

)

+

= o

^ l^

=

tt

t

log(Z

g.

and

with mean zero and variance a

\

2

=

+

)

e

N^tVft*

£

jt

±S normall y distributed

2

.

e

Based upon Heien (1968) and Goldberger (1968), the log-linear re-

gression as indicated in equation (18) can be written as

Z

(19)

where y

x

= y Z

J

exp(£

j

= anti log a.;

2

variance a..

)

2

e.

is normally distributed with mean zero and

Under this assumption, it is clear that

6

E(Z

(20)

X

)

2

= t Z J1 exp(l/2 o*

)

2

Both Goldberger (1968) and Heien (1968) have shown that the ordinary

least square (OLS) estimate of a

- 6

should be defined as

- 1/2 a~

(21)

a

= (log Z

where log

Z.

is average excess rates of return for jth security and

log

Z.

)

= a

- 111 a'

log Z„ is average excess market rates of return, therefore, the first

item of EHS in equation (21) is the so-called Jensen investment perfor-

mance measure plus the residual variance of jth security.

the unbiased estimated Jensen measure should be defined as

*

Unbiased Jensen Measure (UJM) = a. + 1/2 a

(22)

4

See Appendix A.

2

.

Therefore,

Equations (21) and (22) imply that the traditional Jensen measure esti-

mate is not independent of the non-systematic risk of an individual security or a portfolio.

In other words, a

biased against a security (or

portfolio) with larger residual variance (non-systematic risk).

Most

recently, Professor Roll (1978) has shown that the Jensen measure is

not an unambiguity measure for investment performance.

His conclusion

is essentially based upon the problem of index measurement.

Our results

here are based upon the assumption that the market index is free from

the measurement problem.

Merton (1970) and Jensen (1972, 385-386) have used the lognormal

and the discrete interval assumption to derive an equilibrium CAPM and

draw a similar conclusion to those derived in this section.

In sum,

Merton and Jensen concluded that the theoretical intercept of CAPM is

2

2

- 1/2 [c. - g.a ].

J

J

m

If Merton and Jensen's results are used,

then the

unbiased Jensen measure can be defined as

a

(22*)

2

Unbiased Jensen measure = a. + l/2[a. -

go 2

]

The difference between Merton and Jensen's results and the result de-

rived in this paper is to be studied in the future research.

IV.

Investment Horizon, Systematic Risk, Jensen Measure

and Efficient Portfolio

Cheng and Deets (1973), Levhari and Levy (1976) and Lee (1976A,

1976B) have shown that investment horizon does have some impact on

the estimates of systematic risk; Levy (1972) and Levhari and Levy

C1977) have demonstrated that both Sharpe investment performance measure

-9-

and Treynor performance measure can be affected by the investment horizon.

By using the Markowitz (1959) model, Gressis, Philippatos and

Hayya (1976) have shown that the efficient portfolio determination is

However, the lognormal dis-

not independent of the investment horizon.

tribution assumption has not been explicitly integrated with investment

horizon to investigate the impact of investment horizon on the estimated

systematic risk and the estimated investment performance measures.

The relationship between the estimated systematic risk and invest-

ment horizon under a lognormal assumption can be analyzed in accordance

There exist two components,

with the results indicated in equation (16).

A

i.e., [E( R* )/E( R*

N

N

the change of

(13).

A

2

X

and [exp(A a

)]

If A = 1,

g.(A).

12

l/exp^

-

2

^

2

- 1] to affect

)

then equation (16) reduces to equation

S.(A) with respect to the change of

then the change of

If X / 1,

)

can be analyzed as follows.

From equations (15a) and (15c)

2

E( R*

(23)

X

)

N

-fi-jL-

we have

,

2

°1 +X »1

/

£——

2

A

2

(a

2

-o

1

2

)

+ (u -p

1

)A

2

]

e

*A

E( R

N

Taking derivative of

E

(24)

"3A

[

—

fe"]

N m )

>

i

~-r—

<A

with respect to

then

>

= e

E( R

In equation (24),

A,

[X(0

1

~ a2

>

+

<V U 2 )]

the first item is always larger than zero, hence, the

sign is determined by the second term.

equation, it can be shown that

From the second tarn cf this

-10-

(i)

when

X

increases,

j^—] will increase if

[-

X >

a. 2

l-a 2 2

V?>

when

(ii)

X increases,

jr—] will reduce if

[

E

Vm

X

^2 -li l^

X < "

a

>

Now, the relationship between

and

_e

2

" 2

l

_a

2

is explored.

X

It can

-1-1

be shown that

,2

A

* -1)J

(e

(25)

,2

A O.

O. „

[2Xcx,,e

^""12

"][e

3X

i

.2

2

X

A

-

2

-l]-[2Xo/e

2* 2

-1)

(e

The numerator of equation (24) can be simplified as

(a-b) -

2X[c

(26)

a^(a-c)]

i2

X

2

(a

a = e

where

,2

12

+o

2

1

)

2

b = e

X

c a e

2

a

12

The sign of equation (26) is jointly determined by X

iu is a non-linear function of these variables.

equation (25) can hardly be determined.

2

and X a

2

2

,

o-

2

and

2

a.

and

Therefore, the sign of

2

If the magnitude of both X a

are relatively small, it can be shown that

,2

AC

0".

X

]

[e

'

-112

X

2

2

q

X

-1) is approximately equal to

-l)/(e

(e

—

a

a.

12 5

Under this cir-

j.

"l

cumstance, the impact of X on N 8(X) is essentially determined by the

term

*X

[E(-jR.

,

)/E(^l

*X

From equation (24), it has been shown that the

)].

relationship between

2

and (u_-u .) / (a. -a

X

2

)

is the key factor in deter-

mining the change of beta coefficient as the observation unit change.

2

If the magnitude of X o

tionship between

and

X

2

and X

N B(X)

2

a-

?

is not negligible,

becomes ambiguous.

then the rela-

6

To investigate the impact of investment horizon on the efficient

portfolio, 45 securities as listed in Appendix B are randomly selected

from the New York Stock Exchange (NYSE)

January, 1966-December, 1979.

in equation (26)

.

The sample period is during

Sharpe's (1963) diagonal model as defined

is used to formulate the efficient portfolio for 12

alternative investment horizons.

(26)

N Jt

w

j

jNmt

jt

„R.^ = rates of return for jth security in period

N jt

where

= market rates of return in period

„R

N mt

a. and 3.

t

are intercept and slope for jth security.

sents the observation horizon for R._ and R .

mt

Jt

the N represents either one month, two months,

t

Note that N repre-

In this empirical study,

..., or twelve months.

—

The information required for Sharpe's diagonal model is ^a^j N B.» N o.

and

a

2

.

2

The compositions of all possible efficient portfolios

See Apnendix B for the derivation.

*

Tnis is due to the fact that the higher order terms are not negligible.

-12-

under twelve different investment horizons are listed in Appendix C.

Appendix C indicates that number of possible efficient portfolio is not

independent of the investment horizons used to construct the efficient

These results also indicate that the estimated parameters

frontier.

for efficient portfolio are not independent of the different observation

horizons used (see Table

g

I)

.

The main reason for this difference is

due to the fact that the estimated beta coefficients are not independent

of observation horizons.

The results of estimated beta for 12 different

investment horizons are listed in Table II.

to those found by Cheng and Deets

others.

These findings are similar

(1973), Levhari and Levy (1977) and

These results have supported the results as indicated in equa-

tion (16).

To investigate how the bias associated with the estimated OLS

Jensen measure, data of 464 firms during the periods of 1966-72 and

1972-79 are used to estimate the bias Jensen measure.

Fisher index is

used to calculate the market rates of return and the monthly 90 day

treasury bill rate is used as the proxy of risk-free rate.

Both the stan-

dard Jensen measure and the unbiased Jensen measures as defined in equations

(22) and (22') are calculated.

The summary results of these three dif-

ferent kinds of Jensen measures are listed in Table IV.

ot

,

1

a

2

,

In table III,

and a^ are average biased and unbiased estimated Jensen measures

respectively.

By comparing

a.

with a_ and a,, it can be concluded that

45 firms used in investigating the impacts of investment horizon

on the composition of efficient frontier is randomly selected for these

464 firms.

g

The portfolios listed in Table I is one of possible set of efficient portfolios listed in Appendix C.

-13-

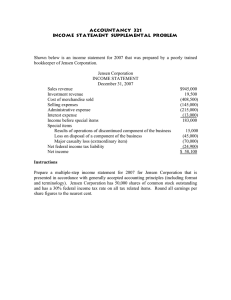

Table I

Estimated Parameters of Efficient Portfolios

Number

of

Periods, N

1

2

3

4

5

6

7

8

9

10

11

12

Coefficient of

variation

M(k)

a GO

.00030

.00312

.00357

.00849

.01040

.01270

.01549

.01998

.00629

.05316

.01170

.04140

.03241

.04544

.05871

.05404

.06504

.07375

.07095

.06620

.07643

.07625

.09079

.08693

<vv

108.03

14.56

16.45

6.37

6.25

4.76

4.58

3.31

12.15

1.43

7.75

2.10

Number of securities

included in the

portfolio

13

17

11

14

13

12

14

13

11

16

8

16

-14-

4a\mco

r~.mooH030ro<yiO>^3-a-co^tS J>oocnr^-d vOoot^.rH(noou^rHco-*'ir>f

s

v

,

|

»030r-ioO'^)r-»rH-*oOrHOinooinaococsa3i-ii-i'OioiOQO<rr».i-ic 4Hcvioi^m

rH rH

OO

rH

O

rHCMO^OOOO^HrHiH

r-H

3 ,-lvOOOC^OiHOr-liHOOO

I

•^u-»(nWi-irr»rHr^.~a-csiu-iin\Ofnsrr».OcviCT>oor~.i^oooo>oroaou^tMooiNtM

CMrHOOf>4mp^ooi~.~3-i030incv4rrtOO'-OoOOrr)CSaOaO~3' 0'-tOvOi^OO~*Oinm~*

|

rHcsvOsi-maoLnCT<a>fvimom^Oi-iOi-icM"^o>t»»ocnooosi-i^.Ovor~cNp^m(Tv

QOrs-Tinsr)!}OH>o*-*oo\t>.a\N9>ina-tOMjirio>*co*inHiOH^-T-t

CSC^OOiHOOrHOr-lOi-IOOOOOi-liHiHO^tfOOOiHOi-IOOt-tOOO

OvO\OvOrHiH<rcMmr*oOvor~»ooa»fr)i-(a»ONr^r^oO'-H

u*>f>ir-»-*CNi-^iOr»iOi-l

tHCSOOiHOOCNlOrHOOOOOOi-Hi-lrHi-l OHM OOOtOOOOHOOO

NNioos»iflooifli'in-s »o\oOMt>'Havoinin>oNHMnooBi «»-ii eoin

I

>

,

I

,

moco^oooOvta>ooi-iino<tc^oomr~r-ivni-i«svor-»ao»3-tno\co<T>vo>»inr»(M

inin(jiinoNNino\*iflNN(nvooocnH<'i'ioostint»iiNinrsNooH'*Nrs.»M

iHiHOrHOiNOtHOHOOHOOOHOrHOOi-liHOOtHOOOOiHOOO

r-|vOLnrjvo»iOcSi-ir».vrir>»oo^)tr>rHcsr>jomor-»r-(csr^o>3-(ri?r>Oi^vOfN.r-i

\ooo-*JiH-*-j-*riris 'i-»oui'efiNr(Hvoin(»i'<rnirtOina\>ovori^o\

iOiOa>eMcocscscjNO\e>4r-»-*

a

R

O

N

|

»3vor»oo^030>-ltHO(Mvo(y>[-^aocNj'00\-*Of<

O rHCOOOJMOr-IOOOOOO

i-ICMOOr-HOr-li-lrHCNJOr-lOOOO

,

•H

I

M

O

33

a

4J

c

0)

^nN<tnHWi-(inHoiNNHMrta<Kn9MONvOH<ta»oo<MnNn-t

cnt~«oo-*oo^Oi-ia>aN-^-inrH»r»»cs-*r»\ooiricSrHa\momrHu-)HO\H>-irHiH

ONMMinr iNwnina<a ri'*(nifl>jONHinHM<rNOOnrnoooN-t

^(nininto-joiji'aNHfi-jav^i^-ja-s-MOOHMOtnH^oiNO^ooinm

,

|

i

r-|CSOrHc-li-HOlMOr-<OOOOOOrHOrH^HO^Hf^OOCSO^OOMOOO

a

en

r)i-i3^ oc fCT>^0'OcNioo^>*cst^voin<soof <>a"^o^o-a"^o ir ^o>tv»-^ou*i

o«

WNinHrN(n

<JiNffl^'-IMr>t>-0-TONMMHsJM<fO\NtnNO>0\OOiri<

(1r>N fHHNO\Of-IOO^HrvvOntOOifl-frisl'in!v1-»NNffl(»l*-JHNin

i

s

s

i

,

,

g

a

<

r-llHOOtHrHOi>40CSOrHr-<OOrHrHr-lr-lrHOi-l<NOOrHOr-(Oi-|i-(000

H

u

o

mcN)rH5J>f-|vni-(r-ieMONCMi^^-r^p-cNrH«)i-icr>oooini^rH-or^ma»i^c ocnfnoo

IM Or»-(OOi\00\NO\-t-Jffir>M

m*<NNTa\DHClMMOONiflO>>00»<

,

<4-4

r

rsNo\a?iN\OHrNO(^00\o<'NHH»N*Nni>OMO'0^nin-tinirnn

iHtSOOHrHOCSOr-IOrHOrHOrH^lrHHrHOi-llHOOHOrHOOOOOO

0)

y-i

<U

,

a

>a*

o

O^Or^-^r-j^tn^moo^omasmm^ri-ioo^i-toooOt-itN^vOvoa^vocsvo^

N'CNM^-'e»orsaaNNa*irto*3in\ooifi-jrs(M^crNirnoMflifl<n

Orir>-J l*)vOa^iA<'iniNO\NiAiO

•J*|NOiONBOWvflulOaS>>JrlOH

HlMOiHrHHOCMOrHOiHOOOrHrHr-H^HrHOrHCSOOrHOrHOOOOOO

Hoaffl(OjiifiHioi'iiANisnnN*vOHvotoH>oainNtn^o>orio-*n

)^vf

cnoooo»ovoi^-i-(^ooi-iOcoooa>cvio\fo-*iocofricMvoi^co<rHvomr»»i-ic

icnrHOcnp^oooo-<fCT>ooi ~owcooc^io>r>»o^o>fr>'^voou^

**>j-tonrirHNrvciOMj\o>*H-to»3M'iaoON-»iflOinoM>.\OsfOtn-tin-»i'ivofl> o

,

,

CJ

«

u

<D

m

,r

B

co

N

i

1-lCMOi-li-li-tOiHOiHOOOOOi-lrH^trHiHOrHCvlf-lrHiHOt-IOOrHOOO

oNanoi^^HNvo Has r^poo>cso-a ic ootHr>sa»ooi-icOi-ir-»oc ivocMu*i

in\ONOMninHa><t<rOHO»NoaavONotsaaHt>a»aortamMno

><^^>fn^>'H >-* >t *>^oOi-li-ir*> u^

rni-t C\or~^OOvOCMr^i-ii^>i-l^'Oi~«-d"i^>

OvOvocsr^ooaoc too>-ldir»i>iiM^i3\OOOi-ir~ -i'Aor^.>aii'i>j''no>(oiorno

iHN*Ni') 'ioairt( vDcs^voc JOcnvO

vo<tN<n-*Haoo\ao>oaoM

-

cr

r

,

ir

ir

Lr

v

-

s

,

>

1

,

,

i

iHCM^OiHtHOINOi-IOrHOiHOr-lrHrHtH^OtHtMOrHrHOiHOOr-tOOO

cso>H"^tni-i<T>a»oofnCT«CT>~a-iHa<noCT>^Oi-<OvOrH%a-<r-*cniO(yioooor»oo

,

CSCSiOv0(T)U iv0!T»00i-HtT1^DrHC0iHi-HOi-l"^r~»r~-c *l-*CSO\^0O^r^^iH0>0>u^

,

a-j\oo-tiNtsocia-»tNi>.inafOMM^'<fvOri-t>t-ii'iNifnoi/>iriNaN

oooivfiioei-ti'iiflaioi^ci'Of.vOHOfiN^oai'i^uiriH-ji^r^O'OHio

r

iHt-»00r~^CS'^i-lrHOr )f-t30rH00cnOcsu^CNl0^i-Hr^ONiHc0OOv000c0'>0vO'3'

O^rHOr-t^HrHrHOOrHOOO

OrHO^-lrH^4^HrHi-|i-IOrMO

HN(0-3,|^iOh-a^OHNlrl>fl'lvOr»

-15-

HOHvOO<rNNr)lfln

&

v0i-40r-l^^0v00

00 CO >n

OCSr-lrHOOOrHiHrHO

M

OMB-J^rnMvOOOuiOi

OtMOi-lrHOOOrHCSO

•

•••••••••

0.-tr^oo«*csrMa\cocMin

WH

NflOUINhNrlH

SIHOo-JOOONHOAm

OCSrHf-IOOOr-lr-li-IO

r-cr\oor~»i-it-ieNiciiMa»

«

o*tno*o\Mninoin

••••••••••

OCSOOOOOOHOO

•

ervmuicssi-Lnr^ooi/'ictoo

3

CO

••••«••••

sfrHCr»CM\Ost-*CT\I^C0\O

•

OCSOr-HOOOOi-lrHO

vOmo*lu">r-H30CSr>.oO^

CO

X!

B

ONNONflN-t'JIOO

•••••«•••

OfOiHHOOOOiHtHO

4-1

\OM\Offi-TO\MriHOn

l-l

voor~»tsa\mi-iiHfococ*i

M

d

o

a

•

0)

>

S

M

H

<U

0)

i-H

-H

*J

.n

e

o

O

td

H

HMOHHNOOOl'lNO

3

C

•

••••••••••

Oi-tOrHOOOOrH<NO

S

0)

3

•

sq T3

a

to^ovooONO^ooovon

ao^-^Ocn^inr^cN^-cn

•*Nffl>OOif|rH\Oin*

^•r^oom-^-i-icvivovoiM o

5

T3

OrHOrHOOOOrHrHO

<

a

0)

ex

a.

•^r-HONvocsOi-tmi-^ei-*

OHs-jOflPi^moifl

•

••••••••••

OCSOrHOOOOrHiHO

A

•

•

•

A

tn

a

H

a

<a

j:

4J

a

o

a

o o

4-1

3

aa

u

<u

a

ONmmt>ivomcs»io-t

tscMtSr-Hno^oi^r-^oo-a'

NOHCO-fN9l>»HrlO

muK'rsin^oNoo^OMO

vOC0C0HrH<7\C0>Onr»«sf

OiHOr-Hr-IOOOi-lrHO

a

(OrsONH'O^OOvOH^'H

>evOH00Hifl'*n-TOH

in^fflNooHifiJiOHn

O00in<fffi<fiflOU1HN

>O-Jt>(nH0M>.rv^H*

•••«••••••

•

O^HOrHHOOOrHCSO

HvONNXOrs^tsCMVI

t^soi/"imcNr-»r-»vj3-3-cHO

mr^co-a-vor^ovOi-HO-*

HNvONdiOmHMICO

r~.-*r».cMOo >covoom\o

••••••••••

O.HO.-li-IOOOi-lr-IO

>

fi

a

•u

« C

o O

a

tn

a (U

u c

T-i

o

4-1

0)

(U

A

u

M

t3

«

c

o o

N

0> •H

a H

tO

O

•-H

23

•

J8

mvOr^cocriOrHcMfO-a-m

«

J=

a)

a

-16-

Table III

1966-72

-.00223

.00738

.00042

.00808

.00151

.00839

1973-79

.00093

.00898

.00422

.01060

.00573

.01105

Jensen Performance Measure

a

l

= a±

a

3

+ ll2

\]

+ 1/2 [a 2 .

Bj <£]

-17-

the standard OLS Jensen measure estimate is an under -estimated Jensen

measure.

Therefore, the standard Jensen measure estimate does not

fairly evaluate the performance of mutual fund, portfolio and individual securities.

To study the possible ranking bias of using standard

biased Jensen estimates instead of unbiased Jensen measure estimates.

Both ranking correlation and product-moment correlation are used to

A

check the ranking differences caused by using

A

A

o,

instead of a„ and ou.

It is found that all correlation coefficients are higher than .945.

These results imply that the standard Jensen measure estimate can still

be used to rank the performance of mutual fund, portfolios and individual

securities.

V.

Summary

In this paper, the empirical relationships between investment hori-

zon and portfolio analysis are analyzed in accordance with both normal

and lognormal assumptions.

Especially, the lognormal distribution is

used to investigate possible impact of investment horizon on the esti-

mated beta in terms of an analytical functional relationship.

In addi-

tion, the possible bias of estimated Jensen measure in terms of a bi-

variate log linear specification is analyzed.

Finally, some empirical

efficient portfolio estimates in terms of different investment horizons

are used to show that investment horizon is an Important factor in portfolio analysis.

It is also shown that the standard Jensen measure does

exhibit estimation bias.

-18-

References

Aitchison, J., and J. A. C. Brown (1957). The Log Normal Distribution .

Cambridge: Cambridge University Press.

"Optimal Portfolio Choice and

Bawa, V. S., and L. M. Chakrin (1979).

Equilibrium in a Lognormal Securities market," Management Science ,

forthcoming

"Systematic Risk and the Horizon

K. Deets (1973).

, and M.

Problem," Journal of Financial and Quantitative Analysis , 8, pp.

299-316.

Cheng, P. L.

"Portfolio Theory When InvestElton, E. J., and M. J. Gruber (1974).

Journal of Finance ,

Distributed,"

are

Lognormally

ment Relatives

1265-1273.

29, pp.

Goldberger, A. S. (1968). "On the Interpretation and Estimation of

Cobb-Douglas Functions," Econometrica , 35, pp. 464-472.

Gressis, N. , G. C. Philippatos, and J. Hayya (1976). "Multiperiod

Portfolio Analysis and Inefficiency of the Market Portfolio,"

Journal of Finance , 31, pp. 1115-1126.

"A Note on Log-Linear Regression," Journal of

Helen, D. M. (1968).

American Statistical Association , 63, pp. 1034-1038.

Introduction to Mathematical Statistics

Hogg, R., and A. Craig (1969).

2nd ed. New York: John Wiley and Sons.

"Risk, the Pricing of Capital Assets, and the

Jensen, M. C. (1969).

Evaluation of Investment Portfolio," Journal of Business , April,

pp. 167-247.

Jensen, M. C. (1972), "Optimal Utilization of Market Forecasts and the

Evaluation of Investment Performance," Szegol/Shell (eds.),

Mathematical Methods In Investment and Investment (North Holland,

Amsterdam)

"Capital Markets: Theory and Evidence," The Bell Journal

,

of Economics and Management Science , 3, pp. 357-398.

"Investment Horizon and the Functional Form of

Lee, Cheng F. (1976A).

the Capital Asset Pricing Model," The Review of Economics and

Statistics , 58, pp. 356-363.

"On the Relationship Between the Systematic

Lee, Cheng F. (1976B).

Risk and the Investnent Horizon," Journal of Financial a t ,d Quantitative Analysis , 11, pp. 803-815.

.

-19-

Levhari, D., and H. Levy (1977).

"The Capital Asset Pricing Model and

the Investment Horizon," The Review of Economics and Statistics ,

49, pp. 92-102.

"Stochastic Dominance Among Lognormal Prospects,"

(1973).

International Economic Review , 14, pp. 601-614.

Levy, H.

"Portfolio Performance and Investment Horizon,"

Management Science , August, pp. 645-653.

Levy, H. (1972).

Markowitz, Harry M. (1957). Portfolio Selection .

Monograph 16, John Wiley and Sons, New York.

Cowles Foundation

Merton, R. C. (1970), "A Dynamic General Equilibrium Model of the Asset

Market and Its Application to the Pricing of the Capital Structure

of a Firm." Working paper No. 497-70, Sloan School of Management

School, MIT.

Ohlson, J. A., and W. T. Ziemba (1976).

"Portfolio Selection in a Lognormal Market When the Investor Has a Power Utility Function,"

Journal of Financial and Quantitative Analysis , 11, pp. 57-71.

"Ambiguity When Performance is Measured by the Securities

(1978).

Market Line," Journal of Finance , 33, pp. 1051-1069.

Roll, R.

"A Simplified Model for Portfolio Analysis,"

(1963).

Management Science , January, pp. 277-293.

Sharpe, W. F.

Tobin, J. (1965).

"The Theory of Portfolio Selection," in F. H. Hahn

and F. P. R. Brechlin (Eds.), The Theory of Interest Rates , London:

MacMillan, pp. 3-51.

Tobin, J. (1958).

"Liquidity Preference as Behavior Towards Risk,"

The Review of Economic Studies , 25, pp. 65-86.

Treynor, J. L. and K. K. Mazuy (1966).

"Can Mutual Funds Outguess the

Market?" Harvard Business Review, July-August, pp. 131-136.

M/E/179

-20-

APPENDIX A

If the regression of equation (18) is a normal linear regression

with the assumption that each

2

e.^.

jt

is N(0,o ).

e

theory it is known that if e. is normal then e

this circumstance, the expected

Z

From the distribution

J

is log-normal.

Under

as indicated in (20) is not equal

To make the expected disturbance for the multiplicative

to Y.Z.6..

specification as indicated in equation (19) equal to one, equation (19)

can be reparameterized as

(i)

z[ = Y Z exp(e

j 2

- l/2o*

:j

Equation (i) implies that

*

E(Z^) = Y Z E[Exp( £j - l/2c*)]

± 2

= Y Z

J 2

Taking the log transform of equation (i), we have

i

(ii)

log Z » a

1

where

u. = log e.

J

.

+

3.

- l/2a

u.

2

+

v

±

2

8

3

In equation (ii),

log Z

is N(-l/2a

2

2

,

a ).

If we applied the ordinary least

square (OLS) estimation method to equation (ii)

,

we actually estimate

the specification of equation (iii) instead of (ii)

(iii)

log Z

1

where a

= a

+

g

log Z

= a. - l/2a

.

2

+ log

e

= (log Z^ - 6. log Z

2

)

-21-

This is equation (21)

.

Further discussion on the issues discussed here

can be found in Heien (68) and Goldberger (1968).

-22-

APPENDIX B

2

\ a

e

A

e

2

12 l = \ a

2

u

2

+ yfCA

a

2

12 )

+

^\

+

1 ,.2„ 2.3

jj-(X a

)

1

2

2

)

+

.-•

(a)

2

°1

.

- 1 - X,2 a,

2

.

+

2

2

2.2

1 ,,2

yj-(X aj^ )

If A a., and X cn

2

,2

U

a. _

12 - ,

12

1 _

,2

e

l

*

2

a

,

- 1

.

+

...

,. v

(b)

approach zero, then the higher order terms are

negligible, and therefore

e

.

2

l

-23-

APPENDIX B

Sample List for 45 Firms

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

32.

33.

34.

35.

36.

37.

38.

39.

40.

41.

42.

43.

44.

45.

NWT

TWA

PBI

WLA

SMC

JOY

BGG

TF

FIR

PVE

PFE

GR

CLL

ACF

UCL

HML

AD

RVS

TXT

NG

IGL

DG

REP

DE

JWL

CK

SUO

MLR

CCC

RHR

HFC

SOH

LOU

PAC

NFK

RCC

RGS

JCP

TU

CIT

ENS

NMK

NAS

AIC

SUN

Northwest Inds Inc

Trans World Airls Inc

Pitney Bowes Inc

Warner Lambert Co

Smith A

Corp

Joy Mfg Co

Briggs & Stratton Corp

Twentieth Centy Fox Film Corp

Firestone Tire & Rubr Co

Phillips Van Heusen Corp

Pfizer Inc

Goorich B F Co

Continental Oil Co

A C F Inds Inc

Union Oil Co Calif

Hammermill Paper Co

Amsted Inds Inc

Reeves Bros Inc

Textron Inc

National Gypsum Co

International Minerals & Chem

Associated Dry Goods Corp

Republic Corp

Deere & Co

Jewel Cos Inc

Collins & Aikman Corp

Sheel Oil Co

Midland Ross Corp

Continental Group Inc

Rohr Inds Inc

Household Fin Corp

Standard Oil Co Ohio

Louisville Gas & Elec Co

Pacific Tel & Teleg Co

Norfolk & Westn Ry Co

Royal Crown Cola Co

Rochester Gas & Elec Corp

Penney J C Inc

Trans UN Corp

C I T Final Corp

Enserch Corp

Niagara Mahawk Pwr Corp

National Svc Inds Inc

American lavt Co

Sun Inc

-24-

D

vO

^-s

T")

pei

m

oO

i-i

O

m

1-1

pd

u

Ed

*u

u

o

Ph

m o

o O O o o

vO CM CM vO m

ov sr 00 en o

vO m 00 vO H

«* CM rH o O

rH

H

O o o oO

rH en CM o CM

CM CO m en p^

r~

sr in 00

co sr O o vO

en en en cm ri

oOOc o

i—i

i-i

-3-

G

T",

D

<u

o

m

vT

en

CO

O

o

sr

00

CM

m

rH

O

u-i <7 00 i-H r-t

Ov in <r rH

i-H vO CO

VO vT

00 00 CO p- vO VO

O o

oOoOOO

o o o O o o

o

ov

u

•H

y

H

CO CM CO m

o av vO

in 00 m o p^

o o 00

m

00 m

«T sT en

pr^ p^

o

O

oooooo oooo O o o

O Oo O oooooooooo o o O o o o

en p- o o

00 00

m m av m en oo

m

m rH

mo

m 00

O OV

rH rH m CM s» CM

O in r^ vo CM o

r- vo CM av CM O av p~ CM

CM oo r»

o

m

ov

O

m

p~

vO vO O

sr sr sr sr <r co co en CM CM CM rH

OOooooooooOooo o

O O o O o ^T

O o o o o OOo o oooo c o o o o o o

m en

CO CM p~ m rH m vo vO rH

^ vO m •J

rH rs CM CM m sr m <r av OV VO CM p~ CO rH o

CO rH en cm rH o o o av 00

en sr en av

CM rH

o O ov av r^ r~ p^ r» vO vO vO vO

rH

rH rH rH o o O O o o o o o o O O

o O O O oooooooooo o O o

en O ST p- m © vO

-* -* o VO o CM o

P00 vO in

av cm en OV OV CO O vo o rH

rH av cc co cm rH O o OV 00 00 p^ m en o

sr

in m «* -* ST st CO CO en CM CM CM CM CM

O o o o o ooOOoo ooo O O o

ooo o oooOOooooo oOo

in rH oo sr r» m co ov en p^ CM CO vO vO 00

m

o CM m 00

<• rH m

Ov r- CO O VO m CM O <r en m

00 vO

CM vO m en vC vo m CM OV CM nui-j

O o av m <3

iO vO vO vO vO in m m m

CM rH O O av av ov oo

rH o o o o o o o o o o o C O o o o

rH

oo c O ooo ooooooo oC o oo o

o

ov

ov

^N

o

m

^-r

r-1

Ed

m

VO

CO 00 r-» -* CO CM r- CM av sr en vo i-H OV CM CM

-3en p- P-- vO av

rH Sf vO «tf -3" vO vO vO

p- rH av r». CM 00 r~ vo

en i-H

CO

Ov rH

00

en en av av Ov 00 CO CO 00 00 00

sr CO OV OV r» VO

00 in >d- en CM i-H rH i-H i-H rH rH

CM 00

T-l

vO sr o»

p~

Ov

vO 00 >*

CM

Ov

sr en CM CM

ps p-

o a

ST

r— VO

en

m O

o <r

rH rH

o O o ooO

m

o

m

r-.

si-3"

p-.

-*T

-3r-~

P--

P--

~3-

r>.

p~-

r--

i-l

i-H

r-~

i-H

>3-

>3-

i-H

p--

u-.

u-i

r--

r>-

i-H

i-H

<-t

l-»

-3-

-3-

p~-

i—i

<-i

u-i

f-i

r-»

p--

«3-

•<r

»3-

-3-

r-»

r~. !>•

i-H

i-H

en

<

<

m

o

o

Ov

o

<

m

o

o

<M

st

U-I

w

^N

T-l

>

BJ

01

Ed

iH

£

M

0)

•rl

X

rH

Q

Z

Ed

PH

En

<

"f]

o

o

M

En

CO

*J

oo CO CM vO CO en en I-- r-» en VO

en CM sr en CM p~

sr sr 00

00 p~ en rH av r-» sr en rH

rH

LO <r sr sr sr sr

vO vO u-i

O m m

oo oo O o

oo oooo

Ov av

Ov av

rH CO

CO

CO

sr

CO

av

sr CM CM rH

-3-

m

m

CM

00

rrH

in

rH

m

oo o oO

vO O

co m

p~ p~ CM

m

CM

<r rH

vr

m

o

o O <r

o o <r

oo o O o

Ov O en

Ov

CO m CM o

rA

Ov m <r

av

vO en

i-H

C

p-.

/—

T-l

01

iH

VA

•H

UH

Ed

O

er.

P-»

-er

<4H

W

ren

en

CM

i-H

O

T-t

vO

ren

O

o

o

P--

r-»

r-t

i-H

T-t

r-t

sl-

i-H

m

00

rH av rH

CO CM 00 Ps P-CM rH 00 00 00

vO vO

mmm

oO o o o

o C O oo

o

p- sr p~

co

vO rH

av

sr en

sr CM

Cj

f-t r-t

m

o

m o

o

o O oO o

o o o Oo

Ps

vO

CO

sr

vO

en

CO

sr

CM sr -H rH sr

vO

sr

00

P^ Ps

sr sr sr sr sr

onm

m m

a O o o o a o

oo o oo oo

rH m p» m av av CM

av m CO p- sr av rH

CM vO p~ ST r-i un

en CO <r

CM en en

i-H

on

CMCMCMCMCMCMCMCMCMCMrHrHrHrHrHrHrHrHrHrHrHrHOOOOOOO

i-H

rH

CM

i-H

00

00

o o

Oo o Oo o

to

r->

rH rH

CM

o

c^copsvosrcncni-Hooavcop--p-'ininsrsrcMrHi-HOavavoop»srcnco

ooooooooooooooooooooooooooooo

(0

Ed

CD

o

p-«

o

^

o

o o o o o o

o o o oo o

*~\

o

C

o

p-«

r-t

-3-

o

en 00 00 -3- av

vO CM

CO -»

av VO av p-- en

rH ^r CM CM f-* CO

CM

rH t-\ r-t

a-.

-3-

T")

£

»

i-H

r-t

01

iH

in en CO 00 CO vO CM vO -3"

00

iH

*r cm «* CO

CM i-H pn r-» p"»

rH rH vo

sr sr en co en CO CM CM CM

o CM CM

mo

CM CM

o o O o oOOoooooo o oo

oo O oo OOooooooo o o

C m en av Ps CM vO CM

<r p~ CO o p- r~ av

rH en av

^O vO vO 00 <r <r en rH CO m en sr

CO PS r^

VO

CM vO rH i— CO en av vO vO

O vO

'O vO vO vO

CM o O a. av CO p~ p~ r~

rH o o O o o O o O o o o O o

rH

oO O o o O c oOoo ooo O o

vO O

vO o

av Ov m m CM in CO o rH CO

en

rH CM CO Ov m m en <t en vO en o 00 av

PN <f en o av p- vO m m

CM o O o av CO

en en en CI CM CM CM CM CM CM CM CM CM CM rH

o O o o oo ooo oo oo© oc

o O o o c o o o o o o o c: o o o

en CM CM o o CO <T 00 CO m en en 00 o

en CO en en 00 vT 00 ^o p~ vO m oo rH sr o en

in CM av Ov m en o av vO m sr en rH o o av

co ps vO vO o >o VO m m in m m m in m sr

a o O O o o o o o O o oc o o o

o o o o o oo oo Oo oo oO o

CO CO av en CM av en CM N rs vO en o rH

m CO CM

CM CM in vO r^ av <r OO en en p^ sr -o

m

O

T-v

o

o

u

rH

Ci

O o o O o o o o O o o

CO m

rH m CM rH av 00 CO in

sr CM sr sr

vO CO rH sr vC av

en VO VO vO o sr sr CM rH vO m

av ps vO sO o in in m in sr sr

o oCO oc o o o oo

o oo Ooo o o o c o

en en

m CO

rH

rH 1^ sr av

o

O m o o sr vO m o a

en en en CM CM CM rH O o o o av CO

rH c o

rH rH —t —t iH rH rH rH rH

O OO c O O C o O o oo o

oO C o o o o o O a o o o

o O

•o

o

vO

o

co rn

CO o

rH rH

oO

av

m

en rH

r-H

a-,

a-.

<-t

T-H

Ed

Oo oo Ooo o o o O oo o O o

sr rH Ps

in

sr sr en

sr sr sr

p^

en CM 00

o-> vO

en

en

CO

sr av en CO

sr r~ m o 00 rH

m CM

vO m m en

CM o CO

sr sr en en en en en en

oo ooo OOo o oo

oo oooo o o o o o

vO av p~ vO CM CO en vO sr CM m

sr en o m CO av Ps sr en CO CO

CO CO CO p~ VO m in sr sr en CM

oo O O o

c O o oo o

oo o o c ooo O O o

oo o Qaooo o o o

p-.

in

rCM

en

vO

'O

CM

en

P~

sr

CM

CO

m

PS

sr sr

CM CM

en en

rH

sr

CM

CO

O oo o o o o

oooo o o o

o

vO

CM

o

o

o

o

o

o

oo

o o

o o o

o

o o c o

o

o

o

o

sr vO v© vO

sr CM p^ p^ VO CO

rH rH

o

o

c

o

o

/

CO

N

1-'

/

u

«

O

•H

<rH

0>

i-H

J3 -H

O

CM en sr

iH

u-v

vO r- CO a.

o

rH

i-H

i-l

CM en sr

rH

rH

m

i-H

vO

rH

o

i-H

m

o

VO p~ CO av

rH

CO av

r-t CM en sr

CM en CO

rH i-H CM CM CM CM CM CM CM CM

-25,-,,,-_

.-..HOOONHOOHNriNNOSfflOOmfl

nmHOHNO<»HH<tin

inr»-f-ioocni-i<j\cnofMvo»-iroeMo>cnr^o\vosrr-it-(Ovo«3'«a-ONOOON

_

^^•ooooioHiflsrcooNiooirinoeoflM^iO^ovoi/iirKnHOi^to*

vOP^r^vO-*i-liHiH.Hi-li-li-(r-lr-*i-li-IOOOOOOOOOOOOOO

piooooooooooooooooooooooooooooo

sroOi-Htn(yiu-i<T>fHvoiOsrr^ONmp~o\csfnvoeMmr^c^(r)vor>.vOiHi-io

0-*fr)f*i^r-*«*r«->a-ocrifOvoO^-4'ON»3r ini-lvooor--oofOr^cMcMst

fOcnaicsr»voer>ooirimp^csvoor^.mmc i<Hi-icoocx3ooio<T>r-»vovo<-*

p».aNOor>-o»*cocoroesi-ii-ioOCT><Tioooooooooor~r~-f^r— »o >o < •* <*

,

w

f--CNJ<NfMCNi-)i-4f-(i-lr-li-lrHiHrHOOOOOOOOOOOOOOOO

oooooooooooooooooooooooooooooo

o*ooONOvoiocMi^oofn«Nvor^\ocMoor^ini-(OOooo>iriONC>

0000iHCM0>ir^CNmc*>CMiH0' )O>3'r»l%»N0r JC >li-l0 \r-f-IOO

-

>

,

«a

s

-

r*oOfOr-ir»«cnf^i-iaiONvovo-jj'eMi-toooooooNO\(Tia<<j\

m*vfi<»NNN(MHHHHHHHHHHHHHOOOOO

.HOOOOOOOOOOOOOOOOOOOOOOOOO

vovor>.ooaiiHCMvoomoofnoooooNtHOONr-i

CTlrl^OHHHtOWNnflOOO^OM^^I^N

mct-a-o^reNr^Oi-HOc^i-iONONr-ioooNi-H

Nin^o^oirKt-jnpiHHffiM^^voiAin

ftonflrioo

iH \o en o

en

r>»

r-.

r-IOOOOOOOOOOOOOO

MNNNHHplHHr

in -* •* sr

oooooooooooooooooooooooooo

oor^esoOrHcooooor^crif^

fncnoNvomuivomocsrHi^u1CslOiHtMOOOvOm«*CMiH

NMnvfi0MXIHO9M0«t0v0v0

\oooooocor^r-»r^r-.r^r^

O000

Hr-lf-IOOOOOOOOOOO

-

cHOOOOOOOOOOOOOOOOOOOOOOOOO

H»0niflNO<O\HOHH0\Mn0NOiOmNM)0ri00»0*

<J'00C-Jsi CNCMiH00OC>0 >\0O0 iU-*r^>3 r^C"!CT>r-t-d-C'lr»i-lrH

>

>

>

>

fHOfncyivotnoooociHaNONONOor^ONfOr-iroooovooom-tffn

i-nooovovOPOcSrHiHi-wooosavONOOoocor^r^^vommu-im

eSCSi-li-liHiHt-liHi-liHi-liHOOOOOOOOOOOOOO

oooooooooooooooooooooooooo

oovovocnocsrHOmcsoNvor^- o

oo o <r t^j.-* v£>cMe-)<-oor^mc">

* vo r-»'oo soa\r^>a-r~-voc">sr

o

i-iCT\cnrHoou">\©cidOCT»i-»r--\£>

c

o

o

i-i

Or«-i-IOr-t<TivOCM00vOvOCS<-( i-!OOOCT\cr*oooooooor»»r^r-»r^

iHi-li-iiHOOOOOOOOOO

i-HOOOOOOOOOOOOOOOOOOOOOOOOOO

ON

lo^oi^ovoOrHoxav-tffOoeMoococnOP^^OP-i^HsoOiHcn

00£Mt >icr>Ofn^r^oc><a3P~tHr-if~-o\rHO-*r^p».cno>iHcsr>»csi

>

w

a!

pP-

w

<1

i-Hcrioor^-tf^-iriiHOONCrir^r^xOvovo^rioiornfifif^c^rHiHO

C»lrHr-liHiHiHi-tr-lfHOOOOOOOOOOOOOOOOOO

OOOOOOOOOOOOOOOOOOOOOOOOOOO

00ocn©eNincT*r*.i-iu">,Hvooor»co-tf cnor-ii-i\Osroo»a o>iooo

v

-

,

irivovooOiHOcr>roooir)inOi-imoo>r^p~minr*.<-o\o-»c

OiHOOr~.r~voinrHmcofOorr)or^srOOr^f^srfOcOi-(p«.r^vo

J

vor-»cn\oooo-4 -*c Ji-ii-l<HCTicr>oooooooop-»r^i^r~-f^r^vOvO\£)

>

-

OOsrrOe^rHiHi-l^r-liHiHOOOOOOOOOOOOOOO

iHOOOOOOOOOOOOOOOOOOOOOOOOOO

oo

10v051-»(00>^l^Hr*00»*009\OMnOHI/>PsMnP1CMNOO

rio>

OW(or^vcrNNOOHO<OHOM^srmsfNvo(na\'toM^H(

mc>i(ninp^r~.mr ivoocT\aO'X)«3 cNcTN'>oocMc<ir^voioOi-iOo>

r

,

oo\0-^-t*iiHOo\crioooor-r-»\ovo\ciomminin«*>cr-*<i rooOiH

-

iHrHiHiHi-HrHOOOOOOOOOOOOOOOOOOOOO

OOOOOOOOOOOOOOOOOOOOOOOOOOO

.tn'*Hoo*r<>^^sr<3 o<fO

>>MH«J00'*<»ninOHh-»-»NOini'l''1O>-*( 1tSON{M03(O\0O»

Ht

0'*vocMro\coOvOfHvovor«\ovovovomoooooooovo\omrocneMcsirHi-lo

oo\p»MisNvoo\<*it>iiNH<*i-(0<*ioM>

,

'i

|

,

p».oNCsr^fnoomvrc^cMcsirHiHOOcriCT\<yioooop>«t^f~t>»r».i^r^r-.r-»i>»p^r~.

ir>«*^*CNes|r-lr-lr-)rHiHfHrHiHi-lrHOOOOOOOOOOOOOOOOO

OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOO

r^tHc>lO\OOc*iroc^CN4i-(f-lOrHCTicncncorooiHO« *io>i-*oor«-csicrif*loocT>

!-(CMi-iMr^iH-*r-iooNr>-cni-i-*o^<a'cr>cM»a"mf-»«»esi-tcNcscNoocM^

>

r

r

T

,

)OOvovooOf

fiNMOo>o\oorNMNiNiO(Ovo>oini'i>d

,

)csoor».ONr~\oc

irOr-ir,«i*-vovoeNii

,

oocsir)crii-icOCT\r

»m

in(nr innMcMtMCMNHH

iHtHrHrHOOOOOOOOOOOOOOOOOOOOOOOOOOOO

•a

,

<3't

,

OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOO

.-icMm-3 invor--ooo>>Or-iCNic ">«3-inv£> r»oocriOr-(CNco<-mvor-ooa>Ot-lcM

-

,

ECKMAN

IX

NDERY

|S

INC.

JUN95