Tees Valley Industrial CCS (ICCS) Cluster Conference

advertisement

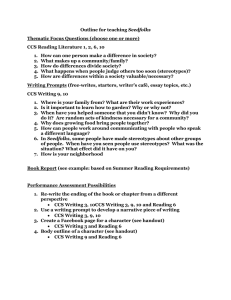

Tees Valley Industrial CCS (ICCS) Cluster Conference Meeting Norway 18th August 2015 John Brady NEPIC Leadership Team PEG NEBR Innovation Manufacturing & Productivity Skills & Resources Initiate a CCS project in partnership with Industry including some significant emitters Energy Supply Chain Marketing & Communications TIG Influence UK Government and other key stakeholders by working on, and presenting a coherent proposal/business case (including funding mechanism) to facilitate an ICCS project whilst protecting the competitive position of any participating company. Geographical Position Why we need Industrial CCS: Industry coming under pressure from customers and Government to reduce carbon – 80% reduction in CO2 by 2050. At its maximum output, regional yearly emissions as high as 13M tonnes CO2 The only technology available to significantly reduce industrial carbon emissions Can’t meet legally binding carbon targets without Industrial CCS Technologically proven at a commercial scale on industrial plants It’s an industry ‘game changer’ and builds on 2 existing CCS competition projects. Need to protect and build the existing industry Opportunity to attract new investments Protecting and Building the Process Industry Across the region, 35K directly employed, further 200K indirectly Generates > £26bn of regional GDP (> 30%) Regions largest industrial sector High GVA £92,000 for UK Chemical industry - higher than automotive and aerospace High wages Process chemical industry wages higher in Teesside than the average UK chemical wage and the average UK wage Consistent trade surplus - £4bn exports Recent Teesside Investments > £3bn Company Expenditure SSI £1.9 billion Air Products £600 million Sembcorp and SITA £200 million SNF Oil & Gas £150 million BOC Linde £100 million Huntsman Tioxide £65 million Lotte Chemicals UK £60 million The Present and Project Initiation Tees Valley bid for a CCS project as part of UK Government CCS competition but were unsuccessful TVU as our local LEP, bid for and awarded £1Million as part of City Deal to initiate an industrial CCS project – report back by summer 2015 Number of core elements but essentially:- capex/opex for capture technology at 4 industrial sites - construct and recommend a business case - recommend a funding mechanism to support investment - potential storage options/costs - first injection and storage targeted for early 2020’s - communications strategy Only place in the UK progressing an industrial CCS scheme Delivery Partners Pale Blue Dot - Project Co-ordinator & Business Cases AMEC/Foster Wheeler - Engineering Contractor Societe Generale - Commercial Advisor Madano - Communications Partner The Current Industrial Partners SSI – Blast Furnace ca 3-4M tonnes/pa Lotte – PET, ca 50K tonnes/pa Growhow – Ammonia plant, ca 600K tonnes/pa BOC – SMR, ca 250K tonnes/pa NEPIC (as PICCSI) National Grid Co-ordinated by Tees Valley Unlimited as the local LEP Transport and Storage Options Onshore transport Pipe using existing pipe corridors Pressure – gaseous vs dense phase Truck to pipe network from smaller emitters Location of compressors likely to be close to SSI site Major environmental and ownership issues to be identified Optimal sizing to be determined Offshore Storage Two stores selected: Goldeneye – Shell agreed to provide information 5/42 – National Grid agreed to provide information Need Third Party Access Terms and Conditions – storage tariff Business Case and Investment Mechanism Business Case outputs including but not limited to: Business model inc Capex and Opex for 4 industrial sites Stress test for major cost elements Third Party Access Terms and Conditions for storage Ownership structure and risk sharing proposal Contract arrangements for oversized pipe and storage Commercial advisor outputs including but not limited to: Report on commercial issues associated with CCS in industry Independent report on bankability of project Potential finance sources plus what is needed to access these Mechanism which attracts investment into industrial CCS and would allow companies to finance FEED and reach FID IP Protection Business Case and Investment Mechanism contd Economics of ICCS different to that of power: Cost of CCS can be supported in number of ways including CFD Competitive nature of globally traded commodity products means that industrial emitters are unable in the long term to afford additional cost of abatement and remain competitive Lack of an investment mechanism means no private company will develop ICCS without support Many Tees Valley industries considered relatively high credit risk Limited ‘green premium’ on products and a marginal impact of the UU ETS Some Resulting Conclusions ICCS in Tees Valley is technically feasible and with public support is be commercially supportable. A significant opportunity to export considerable volumes of CO2 Current study based on capacity to store ca 15M tonnes/year, but the initial reference case based upon ca 3Mt/year Infrastructure will have an operational life of at least 40 years and given existing and future ‘supplies’, reasonable to expect to operate well beyond the 20 year evaluation period Significant economies of scale result from additional users Cost of capture ranges are very varied - £50-205/tonne and dependent upon different industries and different scales Two initial investment mechanisms emerged as focus of further work: An emitter CFD model which provides for a volume based mechanism A storage driven model which helps to resolve a number of challenges associated with option 1 Communications Strategy www.teessidecollective.co.uk Use Of CO2 As A Raw Material Building Block Commercial processes: React with Ammonia React with Phenol React with an epoxide Urea Salicylic Acid (Aspirin) Cyclic carbonate ( new market demand ?) Electrolyte for lithium ion battery Advanced lithium-ion battery plant located in Sunderland, with production of 60,000 units a year The first British-built LEAF EVs now being built in Sunderland from 2014, with initial annual production capacity of around 50,000 vehicles. Infrastructure To Support Electric Vehicles Charge your Car was launched in North East England in 2010. North East has over 300 charging points and is the most connected region in the UK. In 2014, the North East region is a home to over 1,000 charging points, at key locations on streets, in car parks, at residential and commercial locations such as retail and leisure facilities. Further Uses of CO2……. NET Power www.netpower.com is a new oxyfuel power cycle that combusts coal, natural gas, and biomass. It generates electricity that is cost-competitive with the best fossil fuels plants while producing zero air emissions. The system uses supercritical CO2 as a working fluid instead of steam thereby avoiding efficiency losses that steam experiences when it transitions between a liquid and a vapour. Solidia Technologies www.solidiatech.com Solidia claim their material decreases CO2 emissions by up to 70% of what the industry is currently achieving How – they harden the cement in the concrete with CO2 instead of water - not only conserves water by orders of magnitude, it also makes a better concrete, which is stronger and more chemically durable. Thank You John Brady www.nepic.co.uk www.nebr.co.uk www.teessidecollective.co.uk