Making Sense of Managed Care Regulation in California

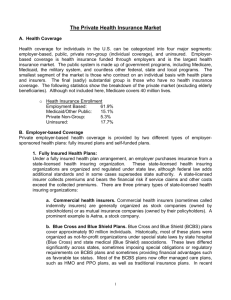

advertisement