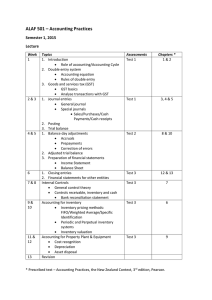

2730 AS/unitec

advertisement

COLLEGE OF CHARTERED ACCOUNTANTS > 2005 Academic Requirements Unitec New Zealand Introduction On 1 July 1995, the Institute of Chartered Accountants of New Zealand (Institute) implemented the current admission requirements for membership of the College of Chartered Accountants (CA). The admission requirements comprise three components: • Academic • Practical experience • Professional competence On successful completion of the academic component you should apply immediately to the Institute to become a Provisional member as the first step to achieving full membership. Details of the practical experience requirements and professional competence programme are available from Registry Services at the Institute (refer below for contact details) and the Institute’s website. Purpose of this document This document is a publication of the Institute of Chartered Accountants of New Zealand. It also appears on the Institute’s website, www.icanz.co.nz. The document is not a publication of Unitec New Zealand and, therefore, does not include the regulations or requirements for Unitec New Zealand (Unitec) qualifications or courses. The information contained in this document will assist you in planning your programme of study to meet the Institute’s academic requirements for admission to the College of Chartered Accountants. Registry Services Institute of Chartered Accountants of New Zealand PO Box 11 342 Level 2 Cigna House 40 Mercer Street Wellington Email: registry@icanz.co.nz Fax: +64 4 473 6303 Telephone: +64 4 460 0606 Website: www.icanz.co.nz 1 This document contains details of: • the academic requirements for admission to the College of Chartered Accountants • the codes and titles of courses and programmes available at Unitec that meet the Institute’s academic requirements. If you need advice about specific courses offered at Unitec please contact: Anthony Ling BBus Accountancy Major Co-ordinator School of Accountancy, Law and Finance Unitec New Zealand Private Bag 92025 AUCKLAND Telephone: 09-815 4321 x 8402 Fax: 09-815 2904 Email: aling@unitec.ac.nz Unitec New Zealand: Statement of Institute-recognised programmes for 2005 This statement outlines the academic requirements for entry to the Institute’s College of Chartered Accountants. Students beginning their accountancy studies1 at Unitec during 2005 may complete the requirements outlined in this statement, which is valid until 2014. Students completing these requirements after 2014 should contact the Institute to seek confirmation that their programme of study will be recognised. Students who have completed degree-level accounting courses at Unitec between 1996 and 2004 can: i) complete the Institute’s academic requirements in place at the time they began. Contact UNITEC or the Institute for details of earlier requirements; or ii) complete the requirements outlined in this document, which are valid until 2014. Students who completed degree-level accounting courses at Unitec before 1996 can: i) complete the Institute’s academic requirements in place between 1996 and 2004 (provided these requirements are met within ten years of commencement), or ii) complete the requirements outlined in this document, which are valid until 2014. For information about Institute recognition of courses completed at other tertiary institutions but not cross-credited to a Unitec qualification, please contact the Institute. Requirements for the Institute of Chartered Accountants of New Zealand The Institute requires students to complete: 1. four years of bachelor’s degree-level study, including completion of a bachelor’s degree. 2. specific courses to cover the Institute’s: a. advanced elective topics’, and b. compulsory topics. 3. 35-40% of four years of study in accounting, 35-40% business-related studies, and 20-30% liberal (i.e. general, non-business) studies. At least one (unspecified) liberal/general course must be taken above introductory level (i.e. at either intermediate or advanced level). • Courses are categorised according to the classification schedule agreed between the Institute and Unitec. • The percentage requirements are waived for students completing extended tertiary study in accounting (i.e. post-graduate qualifications), two bachelor degrees, or double/conjoint degrees. 1 ‘beginning accountancy studies’ requires successfully passing a degree-level course in accountancy at an approved tertiary education institution. 2 3 1. Four years of degree-level study including a bachelor’s degree The four years of bachelor’s degree-level study, including completion of a bachelor’s degree, can be satisfied by completing the following programmes: • • • 2.a Advanced Elective Topics Students must complete2 courses covering FOUR of the six topics specified below at the advanced level level, including TWO from topics 1 – 3 Bachelor of Business (Accountancy) plus Diploma in Professional Accountancy Bachelor of Business (Accountancy major plus one other major). Bachelor of Business (Accountancy) plus Postgraduate Diploma in Professional Accountancy* Advanced elective topics Courses within the Institute-recognised programme at Unitec 1. Financial accounting incl. 2 from the first 3 Students completing programmes marked with an asterisk (*) are exempted from the need to satisfy the percentage requirements. Choose 4 from 6 Students are responsible for structuring their programme to ensure they include the compulsory and advanced elective topics (see the following pages) and satisfy the percentage requirements (if applicable). ALAF 7201 Advanced Financial Accounting 2. Management accounting ALAF 7212 Advanced Management Accounting 3. Auditing Advanced Auditing ALAF 7209 4. Taxation ALAF 7208 Advanced Taxation 5. Business finance/ ALAF 6290 Corporate Finance ALAF 6206 Accounting Information Systems treasury 6. Accounting information systems Other Unitec programmes, in addition to that listed above, may be recognised by the Institute as meeting four years of degree-level study and bachelor’s degree. Contact Unitec for details of alternative programmes. Any topic from 1-5 not taken to advanced level must be taken at the “minimum coverage” level indicated at 2.b. (overleaf). 2 For the compulsory and advanced elective topics (sections 2.a and 2.b), a course is recognised by the Institute as ‘completed’ if the final mark achieved is fifty per cent or higher. 4 5 2.b Compulsory Minimum Coverage of Accounting Topics Students must complete2 courses covering the accounting sub-disciplines 1-5 listed in the following table. For topics 1-5, “advanced” level coverage (refer to section 2.a) will automatically fulfil the compulsory minimum accounting topic coverage requirements. Any topic from 1-5 not taken to advanced level must be met by completion of the recognised course below. Compulsory minimum accounting 2.b Courses within the Institute-recognised Percentage requirements For the purpose of satisfying the percentage requirements, courses shall be categorised in accordance with the following classification table: Key: A = Accounting B = Business-related L = Liberal (general) coverage topics programme at Unitec 1. Financial accounting ALAF 6201 Financial Accounting Course code Course title 2. Management accounting ALAF 6212 Management Accounting Advanced elective and compulsory topics Classification 3. Auditing ALAF 6208 Professional Studies ALAF 6201 Financial Accounting 4. Taxation ALAF 6208 Professional Studies ALAF 6206 Accounting Information Systems A 5. Business finance/treasury ALAF 5290 Principles of Managerial Finance ALAF 6208 Professional Studies A ALAF 6212 Management Accounting A ALAF 7201 Advanced Financial Accounting A ALAF 7208 Advanced Taxation A ALAF 7209 Advanced Auditing A ALAF 7212 Advanced Management Accounting A ALAF 5290 Principles of Managerial Finance A, B ALAF 6290 Corporate Finance A, B ALAF 5230 Information Systems and Applications B ALAF 5270 Economic Principles B ALAF 5320 Law of Business Obligations B ALAF 5401 Business Statistics B ALAF 6320 Law of Business Entities B APMG 5340 Management in the Marketplace B contd. Compulsory Business-Related Topics Students must complete2 courses covering the following topics specified by the Institute: Compulsory business-related topics Courses within the Institute-recognised programme at Unitec Economics ALAF 5270 Economic Principles Organisational management APMG 5340 Management in the Marketplace Quantitative methods/statistics ALAF 5401 Business Statistics Information technology ALAF 5230 Information Systems and Applications Commercial law ALAF 5320 Law of Business Obligations and ALAF 6320 Law of Business Entities Exemptions granted by Unitec for courses listed in sections 2.a and 2.b of this document will not be recognised by the Institute. Students who receive exemptions from Unitec for any courses listed in sections 2.a and 2.b will be required to complete a higher-level course than exempted to cover the topic area. 6 3. A Other ALAF 5200 Accounting for Business A ALAF 5206 Accounting Applications A ALAF 7213 Cost Management Systems Design A ALAF 7217 Case Studies in Accounting A ALAF 7218 Negotiated Topic in Accountancy A ALAF 7292 Financial Statement Analysis A ALAF 7216 Industry Based Learning (Accountancy) A,B ALAF 7219 Industry Based Learning (Accountancy) A,B 7 8 ALAF 5400 The Business Environment B ALAF 6291 Investments B ALAF 6295 International Business B ALAF 6330 Finance Law B ALAF 7290 Advanced Corporate Finance B ALAF 7295 Financial Risk Management B ALAF 7316 Industry Based Learning (Finance) B ALAF 7317 Case Studies in Finance B ALAF 7318 Negotiated Topic in Finance B ALAF 7319 Industry Based Learning (Finance) B ALAF 7320 Current Legal Issues B APMG 5341 Human Resource Management B APMG 5342 Applied Management B APMG 5350 Service Operations B APMG 5370 Sales and Marketing Practice B APMG 5371 E-Business to Business Marketing B APMG 5372 Services Marketing B APMG 5390 Entrepreneurial Management B APMG 6340 Strategic Thinking for Managers B APMG 6341 HRM Strategy B APMG 6342 Organisational Behaviour B APMG 6343 Employee Relations and Legislation B APMG 6350 Design of Service Operations B APMG 6351 Managing Service Operations B APMG 6352 Global Supply Chain Management B APMG 6370 Marketing Planning B APMG 6371 Market Research Methods B APMG 6372 Buyer Behaviour B APMG 6373 Sales Management B APMG 6374 Relationship Management B APMG 7340 Strategy and Change B APMG 7341 Global Issues in HRM B APMG 7343 Current Issues in Management B APMG 7346 Industry Based Learning (HRM) B APMG 7348 Negotiated Topic in HRM B APMG 7349 Industry Based Learning (HRM) B APMG 7350 Global Issues in Service Management B APMG 7356 Industry Based Learning (Service Operations) APMG 7358 Negotiated Topic in Service Operations B B APMG 7359 Industry Based Learning (Service Operations) B APMG 7370 Marketing Strategy B APMG 7371 International Marketing B APMG 7373 Strategic Sales Management B APMG 7386 Industry Based Learning (Marketing) B APMG 7388 APMG 7389 COMM 7434 ISCG 5231 ISCG 5234 ISCG 5236 ISCG 6230 ISCG 6231 ISCG 6234 ISCG 6236 ISCG 6239 ISCG 7232 ISCG 7235 ISCG 7236 ISCG 7239 ISCG 7246 ISCG 7248 ALAF 6292 COMM 5430 COMM 5432 COMM 5433 COMM 5435 COMM 5438 COMM 6431 COMM 6432 COMM 6433 COMM 6434 COMM 6435 COMM 6436 COMM 6437 Negotiated Topic in Marketing Industry Based Learning (Marketing) Communication Law Information Systems Infrastructure Information Systems in Business Data and Databases Database Design Project Planning and Control Systems Analysis and Design 1 Management Information Systems E-Commerce Systems Analysis and Design 2 Information Technology Management Applied Information Technology Management Industry Based Learning (Information Systems) Industry Based Learning (Information Systems) Negotiated Topic in Information Systems Economics of Money and Financial Markets Professional Communication Persuasion and Speech Communication Lateral and Creative Thinking Cultural Anthropology Psychology Intercultural Communication Interpersonal Communication Technology and Media Communication and Ethics Public Relations Leisure and Event Communication News Writing for the Media B B B B B B B B B B B B B B B B B L L L L L L L L L L L L L 9 COMM 7432 COMM 7435 EAPL 5301 EAPL 5302 ISCG 5235 LANG 5179 LANG 5197 LANG 6176 LANG 6177 LANG 7110 10 International Communication Management Organisational Communication Management Academic Writing (EAL) English in Practice Introductory Programming East Asia In History – An Overview East Asian Popular Culture and its Impact on the West Introduction to Contemporary East Asian Societies Doing Business in East Asia Research Project L L L L L L L L L L