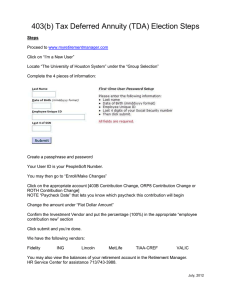

403(b) Plan Fundamentals

advertisement