Printed on 09-14-2016

NEI Northwest Global Equity Fund

Fund Category

Global Equity

Benchmark

MSCI World NR (CAD)

Investment Objective

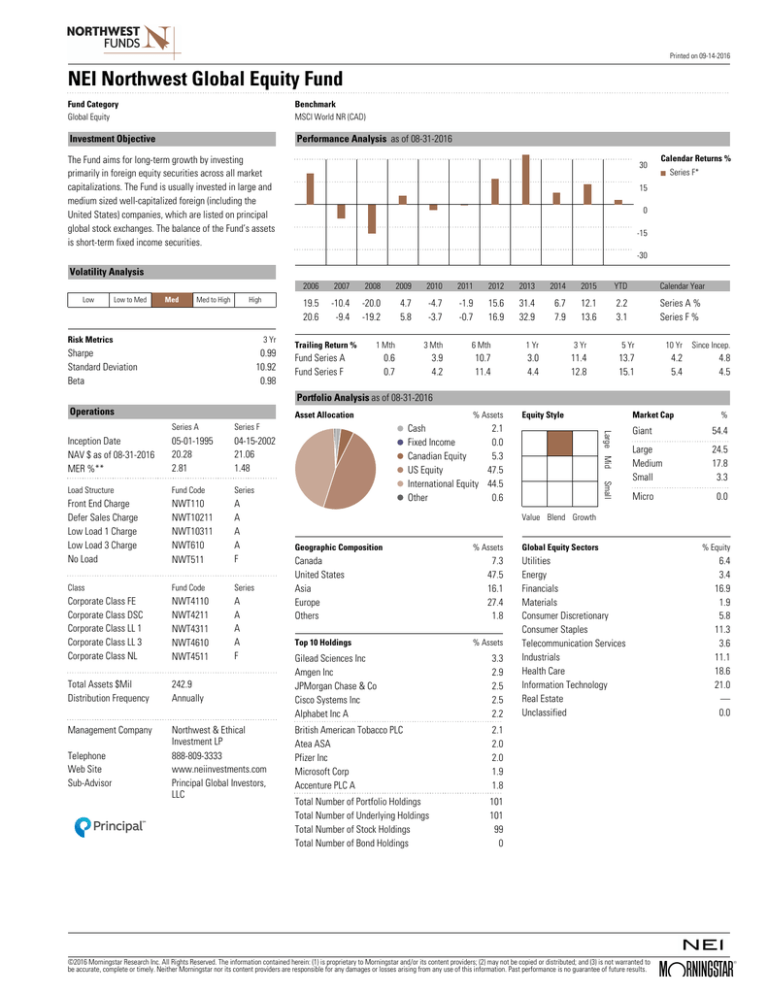

Performance Analysis as of 08-31-2016

The Fund aims for long-term growth by investing

primarily in foreign equity securities across all market

capitalizations. The Fund is usually invested in large and

medium sized well-capitalized foreign (including the

United States) companies, which are listed on principal

global stock exchanges. The balance of the Fund’s assets

is short-term fixed income securities.

30

Calendar Returns %

Series F*

15

0

-15

-30

Volatility Analysis

Low

Low to Med

Med

Med to High

High

Risk Metrics

3 Yr

0.99

10.92

0.98

Sharpe

Standard Deviation

Beta

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

YTD

Calendar Year

19.5

20.6

-10.4

-9.4

-20.0

-19.2

4.7

5.8

-4.7

-3.7

-1.9

-0.7

15.6

16.9

31.4

32.9

6.7

7.9

12.1

13.6

2.2

3.1

Series A %

Series F %

Trailing Return %

1 Mth

3 Mth

6 Mth

1 Yr

3 Yr

5 Yr

10 Yr

Since Incep.

0.6

0.7

3.9

4.2

10.7

11.4

3.0

4.4

11.4

12.8

13.7

15.1

4.2

5.4

4.8

4.5

Fund Series A

Fund Series F

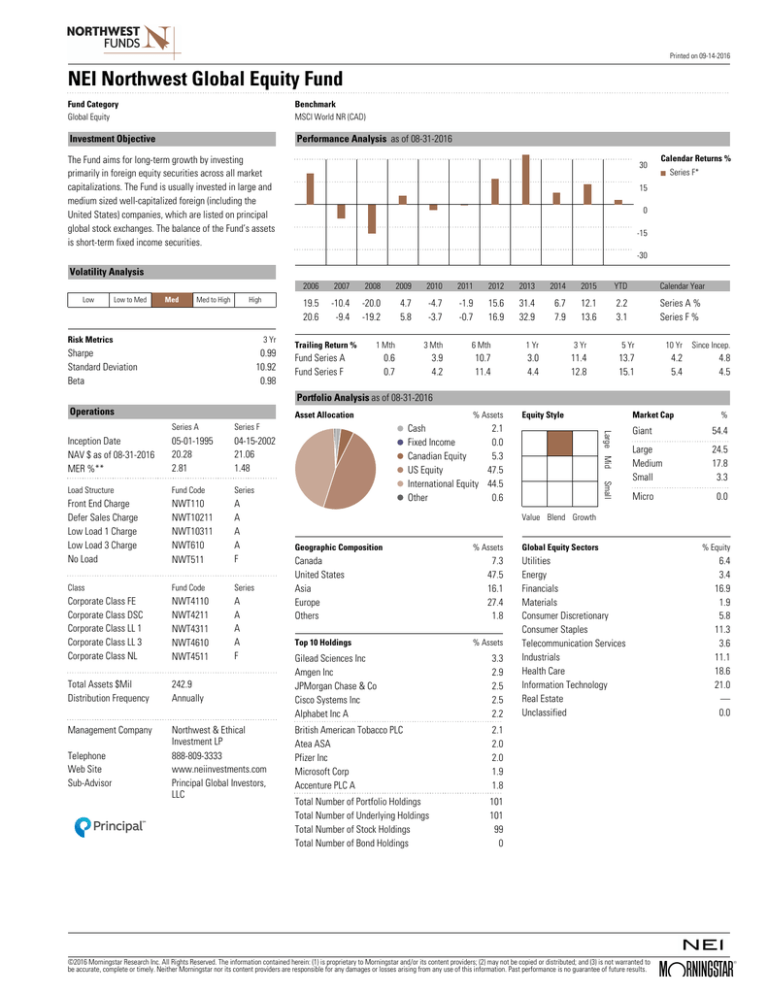

Portfolio Analysis as of 08-31-2016

Operations

Asset Allocation

Inception Date

NAV $ as of 08-31-2016

MER %**

05-01-1995

20.28

2.81

04-15-2002

21.06

1.48

Load Structure

Fund Code

Series

Front End Charge

Defer Sales Charge

Low Load 1 Charge

Low Load 3 Charge

No Load

NWT110

NWT10211

NWT10311

NWT610

NWT511

A

A

A

A

F

Class

Fund Code

Series

Corporate Class FE

Corporate Class DSC

Corporate Class LL 1

Corporate Class LL 3

Corporate Class NL

NWT4110

NWT4211

NWT4311

NWT4610

NWT4511

A

A

A

A

F

Total Assets $Mil

Distribution Frequency

242.9

Annually

Management Company

Northwest & Ethical

Investment LP

888-809-3333

www.neiinvestments.com

Principal Global Investors,

LLC

Telephone

Web Site

Sub-Advisor

% Assets

Equity Style

Cash

2.1

Fixed Income

0.0

Canadian Equity

5.3

US Equity

47.5

International Equity 44.5

Other

0.6

Market Cap

Small

Series F

Large Mid

Series A

%

Giant

54.4

Large

Medium

Small

24.5

17.8

3.3

Micro

0.0

Value Blend Growth

Geographic Composition

Canada

United States

Asia

Europe

Others

Top 10 Holdings

% Assets

7.3

47.5

16.1

27.4

1.8

% Assets

Gilead Sciences Inc

Amgen Inc

JPMorgan Chase & Co

Cisco Systems Inc

Alphabet Inc A

3.3

2.9

2.5

2.5

2.2

British American Tobacco PLC

Atea ASA

Pfizer Inc

Microsoft Corp

Accenture PLC A

2.1

2.0

2.0

1.9

1.8

Total Number of Portfolio Holdings

Total Number of Underlying Holdings

Total Number of Stock Holdings

Total Number of Bond Holdings

101

101

99

0

Global Equity Sectors

Utilities

Energy

Financials

Materials

Consumer Discretionary

Consumer Staples

Telecommunication Services

Industrials

Health Care

Information Technology

Real Estate

Unclassified

©2016 Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to

be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

% Equity

6.4

3.4

16.9

1.9

5.8

11.3

3.6

11.1

18.6

21.0

—

0.0

?

Printed on 09-14-2016

NEI Northwest Global Equity Fund

Disclosure

*Series F units are only available if the registered dealer

has entered into a Series F Distribution Agreement with

NEI Investments. No direct sales commissions or

redemption charges are payable by the investor to NEI

Investments on the purchase or sale of Series F units.

**MER for the period ended September 30, 2015

** NEI, at its discretion, currently waives some of its

management fees or absorbs some expenses of certain

NEI funds. This may continue for an indeterminate period

of time and may also be terminated at any time. The

management expense ratios (“MERs”) published above

are calculated after any applicable waivers and

absorptions have been taken into account, based on

audited total expenses (excluding commissions and other

fund transaction costs) for the year ended September 30,

2015. The MERs before waivers or absorptions are

reflected in each fund’s Annual Management Report of

Fund Performance.

The indicated rates of return are the historical annual

compounded total returns including changes in net asset

value and reinvestment of dividends and distributions,

but does not include any sales, redemption or other

account charges or administrative fees payable by the

This document is provided for informational purposes

only and it is not intended to provide specific advice

including, without limitation, investment, financial, tax or

similar matters. Please consult with your own

professional advisor on your particular circumstances.

Commissions, trailing commissions, management fees

and expenses all may be associated with mutual fund

investments. Please read the prospectus and/or Fund

Facts document before investing.

investor which would reduce returns. Mutual funds are

not guaranteed, their values change frequently and past

performance may not be repeated.

Portfolio holdings may change due to ongoing portfolio

transactions of the investment fund.

Northwest Funds, Ethical Funds and NEI Investments are

registered trademarks of Northwest & Ethical

Investments L.P.

©2016 Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to

be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

?