- National Bureau of Economic Research

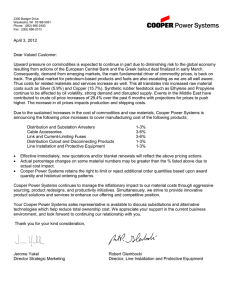

advertisement