Explanatory Note – settlement prices publication End-of-Day report

At the end of each business day, ICE Endex establishes settlement prices for the markets it

operates. These settlement prices are published as part of the End of Day Report, an

automatically derived report publishing the full curve of tradable contracts available at ICE

Endex. The settlement prices are used by the Clearing House, ICE Clear Europe Limited (ICE

Clear), to calculate margins for the relevant contracts.

Given their theoretical nature, these prices are considered less useful as a basis for supplying

intermediary services to non-professional clients (e.g. as a parameter in commercial delivery

contracts). A reasonable professional understanding of the price formation process on

wholesale energy markets is expected with anyone using the prices as published in the report.

The purpose of this note is to explain the methodology of establishing these settlement prices.

This is for information only, and on the condition that errors and/or omissions shall not be

made the basis for any claim, demand, or cause of action.

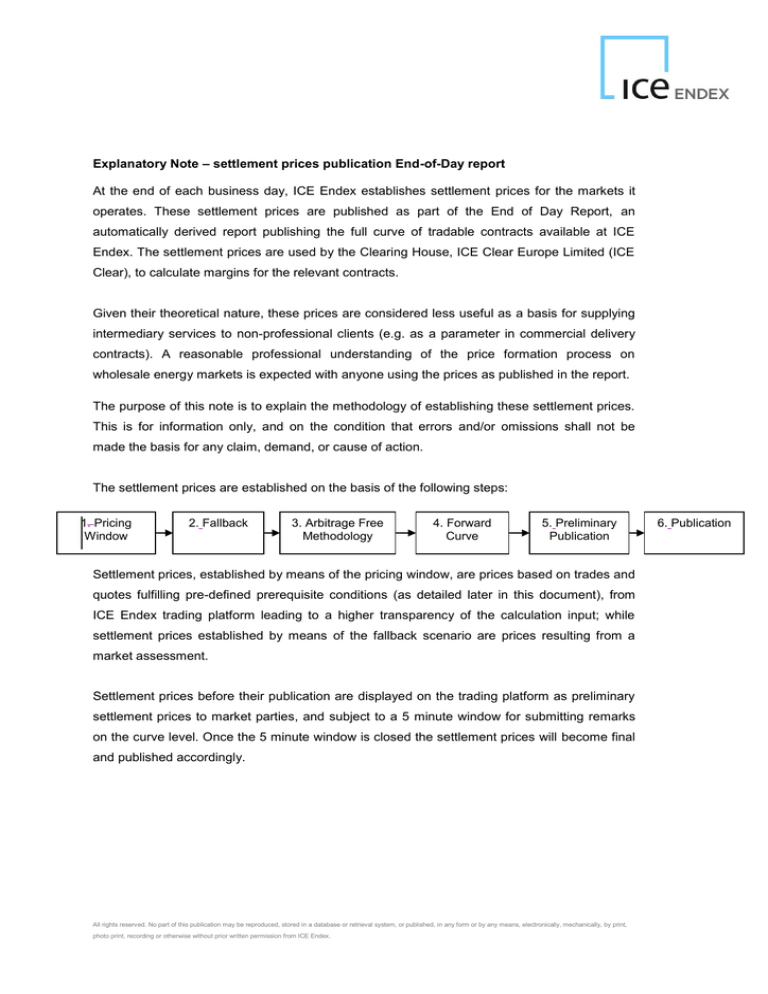

The settlement prices are established on the basis of the following steps:

1. Pricing

Window

2. Fallback

3. Arbitrage Free

Methodology

4. Forward

Curve

5. Preliminary

Publication

Settlement prices, established by means of the pricing window, are prices based on trades and

quotes fulfilling pre-defined prerequisite conditions (as detailed later in this document), from

ICE Endex trading platform leading to a higher transparency of the calculation input; while

settlement prices established by means of the fallback scenario are prices resulting from a

market assessment.

Settlement prices before their publication are displayed on the trading platform as preliminary

settlement prices to market parties, and subject to a 5 minute window for submitting remarks

on the curve level. Once the 5 minute window is closed the settlement prices will become final

and published accordingly.

All rights reserved. No part of this publication may be reproduced, stored in a database or retrieval system, or published, in any form or by any means, electronically, mechanically, by print,

photo print, recording or otherwise without prior written permission from ICE Endex.

6. Publication

1. Pricing Window Methodology

In general, the basic principle of establishing a pricing window means that settlement prices

will be determined by a combination of actual trades as well as firm orders on screen during a

pre-defined time period, which complies with the conditions as set per individual market.

These conditions include the following:

start- and end time of the pricing window;

minimum traded volume requirements;

minimum volume size of orders;

maximum settlement spread for combination of best bid-best ask orders;

cumulated minimal duration of valid best bid-best ask orders;

minimum numbers of distinctive market parties that supports the best order;

volume weighting of trades;

weighting factor between average trade price and average mid order price.

Orders from distinctive market parties are taken into account if the standard deviation of this

order is less than 0.20 of the best bid or best offer respectively. All orders during the pricing

window that are within the 0.20 standard deviation from the best order will be used for counting

how many distinct market parties are active per individual strip. Input from the pricing window

of the respective strip will be deemed as valid only if the required minimum number of

distinctive market parties is reached (e.g.: For Dutch Power Base load this parameter is set to

a minimum of 4 market parties).Further details on the parameters for the individual markets

can be found at http://www.theice.com.

Only transactions, bids, and offers in the order book of the ICE Endex Futures Exchange are

taken into account for calculating the prices; block trades, EFPs and EFSs reported by means

of the Block Trade Facility are disregarded. Trades which have been cancelled during the

pricing window will not be included in the calculations either. As part of its responsibilities as

operator of a regulated market, ICE Endex will monitor market developments during the pricing

window and will not consider individual prices or orders in case they are not in line with the

actual conditions of the market. In case of fast moving market conditions, the applicable

maximum settlement spreads will double.

All rights reserved. No part of this publication may be reproduced, stored in a database or retrieval system, or published, in any form or by any means, electronically, mechanically, by print,

photo print, recording or otherwise without prior written permission from ICE Endex.

Scenarios

In theory, 4 different scenarios could occur during the pricing window. These scenarios are

described below and the examples are valid for a pricing session for Dutch Power Base Load

contracts (single strip such as a Monthly strip).

1. At least one valid trade occurs and valid cumulative 3 minutes order spreads for

settlement are listed on screen:

1

settlement price = weighting factor*Average Trade Price + weighting

factor*Average Mid Order Price

TIME

15.46 - 15.50

15:51 - 15:53

15.54

15.55

15.56 - 15.59

Average Trade Price

Average Mid Order Price

2

Best Bid

Best Ask

59,80 (5 MW)

59,80 (5 MW)

60.40 (10 MW)

60.25 (10 MW)

Trade

60.25 / 10 MW

60.04 / 5 MW

59.64 (5MW)

60.18

60.02

60.24 (5 MW)

Settlement Price

60.14

2. At least one valid trade but no valid cumulative 3 minutes order spreads on screen:

settlement price = Average Trade Price

TIME

15.54

15.55

15.55 - 15.59

Average Trade Price

Average Mid Order Price

Best Bid

Best Ask

3

59.64 (2MW)

60.18

-

Trade

60.25 / 10 MW

60.04 / 5 MW

60.24 (3 MW)

Settlement Price

60.18

3. No valid trades but valid cumulative 3 minutes order spreads are on screen:

settlement price = Average Mid Order Price

TIME

15.46 - 15.48

15:51 – 15:52

15.55 - 15.57

Average Trade Price

Average Mid Order Price

Best Bid

Best Ask

59,80 (5 MW)

59.80 (5 MW)

59.64 (5MW)

60.40 (10 MW)

60,25 (10 MW)

60.24 (5 MW)

60.02

Settlement Price

Trade

60.02

1

Average Trade Price = volume weighted average of traded prices

Average Mid Order Price = mean value of average Best Bid and Best Ask

3

Minimum volume requirement not met

2

All rights reserved. No part of this publication may be reproduced, stored in a database or retrieval system, or published, in any form or by any means, electronically, mechanically, by print,

photo print, recording or otherwise without prior written permission from ICE Endex.

4. No valid trades and no valid orders on screen:

Fall back scenario comes in place to establish settlement prices (i.e. prices from

alternative sources)

TIME

Best Bid

Best Ask

4

59,80 (5 MW)

60.40 (10 MW)

15.46 - 15.48

Average Trade Price

Average Mid Order Price

-

Settlement Price

Trade

Alternative

source

2. Fallback Methodology

In the event there are insufficient valid quotes and transactions during the pricing window

Market Supervision will apply an alternative methodology in the following ranking order of

preference:

(1) Implied Price;

If applicable, the implied price of the missing strip will be used as preliminary

settlement price.

(2) Trading activity during the day;

The market activities (quotes, trades and market trend) during the day will be used as

input.

(3) External sources;

The latest market activities (quotes, trade and market trend) as available by external

data provider(s) will be used as input.

(4) Correlated Market as proxy;

The market trend of the market of which price formation in the past has shown to be

most heavily correlated will be used as input.

(5) Price assessment;

This is a discretionary assessment combining multiple sources (from market parties,

market trend and/or previous settlement) of input.

3. Basics of the arbitrage free methodology

Since the settlement prices are established by ICE Endex for margin purposes of the Clearing

House, in some circumstances the settlement prices, as determined by either the pricing

window or alternative sources, may need to be adjusted in order to be free of arbitrage. These

conditions are required by the Clearing House in order to have a secure and correct margining

process. Contracts with overlapping delivery periods will need to be priced in line. With

All rights reserved. No part of this publication may be reproduced, stored in a database or retrieval system, or published, in any form or by any means, electronically, mechanically, by print,

photo print, recording or otherwise without prior written permission from ICE Endex.

reference to possible arbitrage opportunities, the following contracts are directly linked to each

other:

Calendar vs. Quarters;

Calendar vs. Months;

Season vs. Quarters (in case of Gas futures);

Season vs. Months (in case of Gas futures);

Quarter vs. Months.

ICE Endex will apply an arbitrage free methodology by means of calculating a weighted

average price based on each contract underlying value. If there are prices available which are

determined by the pricing window, these prices prevail over the prices derived from the fallback

procedure when applying the arbitrage free methodology.

As a further explanation, the following scenario’s and results are provided for information:

- Scenario 1:

only 1 price is from the fallback, while all others are from the pricing window. In

this case, the price from the fallback will be the implied price;

- Scenario 2:

more than 2 prices are from the fallback, while the others are from the pricing

window. In this case, all the prices from the fallback will have an equal

arbitrage correction;

- Scenario 3:

all prices are from the fallback. In this case, all the prices will have an equal

arbitrage correction;

- Scenario 4:

all prices are from the pricing window. In this case, all prices will have an equal

arbitrage correction. This is the only scenario whereas prices from pricing

window are adjusted.

Scenario 1:

April, May and June are set by the pricing window while Q2 is missing, the price for the Q2

contract will be the implied price:

Preliminary results

April

May

June

Q2

38.01*

35.96*

39.07*

-

Implied Price

Final Results

37.66

38.01

35.96

39.07

37.66

All rights reserved. No part of this publication may be reproduced, stored in a database or retrieval system, or published, in any form or by any means, electronically, mechanically, by print,

photo print, recording or otherwise without prior written permission from ICE Endex.

Scenario 2: Q2 and April are set by the pricing window while May and June are from fallback.

Therefore the May and Jun will be adjusted accordingly:

Preliminary results

April

May

June

Q2

38.01*

35.96

39.07

37.77*

Implied Price

Final Results

37.66

38.01

36.12

39.23

37.77

Scenario 3: April is set by the pricing window while Q2, May and June are from an alternative

source. Therefore the Q2, May and June will be adjusted accordingly:

Preliminary results

April

May

June

Q2

38.01*

35.96

39.07

37.77

Implied Price

Final Results

37.66

38.01

36.04

39.15

37.71

Scenario 4: Q2, April, May and June are from an alternative source (the same applies if all

contracts are priced by the pricing window):

Preliminary results

Apr

May

Jun

Q2

38.01

35.96

39.07

37.77

Implied Price

Final Results

37.66

38.07

36.02

39.13

37.72

In exceptional cases there will be a possibility of overlapping arbitrage opportunities.

For these specific cases, a priority order has been defined as follows:

Round 1: Months vs. Quarter;

Round 2: Quarters vs. Calendar;

Round 3: Quarters vs. Season.

Each round is executed in a consecutive order, for which the outputs of the preceding round

are fixed and no longer adjustable by succeeding rounds. The arbitrage free prices will be used

as input for the calculation of the full curve, providing settlement prices for all contracts

tradable at ICE Endex.

All rights reserved. No part of this publication may be reproduced, stored in a database or retrieval system, or published, in any form or by any means, electronically, mechanically, by print,

photo print, recording or otherwise without prior written permission from ICE Endex.

4. Forward Curve

The size of the curve is determined by the amount of calendar contracts available for trading in

a market, the December contract always being the last tradable contract and therefore the last

contract month of the curve. For example, ICE Endex offers 5 Calendars for trading in TTF

Natural Gas. In January, the forward curve will be composed of 59 months (taking into account

that the January contract already expired in December), while in October the forward curve will

be composed of 50 months.

The cascading of the settlement prices into monthly settlement prices is done by building a

forward curve in monthly granularity, excluding the cost to carry, with specific load factors for

shaping the curve, whereby the strip closest to its monthly cascading underlying month has the

priority. Therefore the following cascading priority order is used for building the curve:

(1) Quarter to month;

(2) Season to month;

(3) Calendar to month.

The cascading process is to ensure that the forward curve retains the respective inter-strip

arbitrage free value.

Each round is executed in a consecutive order, for which the outputs of the preceding round

are fixed and no longer adjustable by succeeding rounds. The arbitrage free prices will be used

as input for the calculation of the full curve, providing settlement prices for all contracts

tradable at ICE Endex.

5. Preliminary publication of settlement prices

The curve is supplied to the market as preliminary settlement first, through the trading platform.

As from this moment, the members have a 5 minute window of opportunity to give remarks and

comments on the curve. If no comments or remarks are received in this 5 minute window, the

curve will be final. If comments were received that were considered valid and Market

Supervision has decided to amend the preliminary settlement, the new settlement prices will

again be published on the trading platform with a 5-minute window opportunity to give remarks.

If no comments or remarks are received in this second 5 minute window, the curve will be set

on final. If however in this second 5 minute window comments were received that were valid

and Market Supervision had to amend the settlement, the new settlement will directly become

final.

All rights reserved. No part of this publication may be reproduced, stored in a database or retrieval system, or published, in any form or by any means, electronically, mechanically, by print,

photo print, recording or otherwise without prior written permission from ICE Endex.

To allow for timely processing, comments and remarks on the preliminary settlement prices

must be addressed directly to the Market Supervision team in Amsterdam reachable at +31 20

305 5140.

6. Publication of settlement prices

After ICE Endex has established a settlement price for all contracts (in strips of months), the

settlement prices are automatically published in the End of Day Report at the ICE Report

Centre, www.theice.com. The settlement prices are used by the ICE Clear to calculate margins

for the relevant contracts.

Given their theoretical nature, these prices are considered less useful as a basis for supplying

intermediary services to non-professional clients (e.g. as parameter in commercial delivery

contracts). A reasonable professional understanding of the price formation process on

wholesale energy markets is expected with anyone using the prices as published in the report.

All rights reserved. No part of this publication may be reproduced, stored in a database or retrieval system, or published, in any form or by any means, electronically, mechanically, by print,

photo print, recording or otherwise without prior written permission from ICE Endex.