Education Technology

Coverage Report

“Market Intelligence for Business Owners”

Capstone Partners

Investment Banking Advisors

BOSTON | CHICAGO | LONDON | LOS ANGELES | PHILADELPHIA | SAN DIEGO | SILICON VALLEY

Q2 2013

Education Technology

Coverage Report

MERGER & ACQUISITION ACTIVITY

CAPSTONE PARTNERS LLC

176 Federal Street

3rd Floor

Boston, MA 02110

Mergers & acquisitions in the education technology industry remained elevated in 2012,

with an estimated 48 transactions completed in the sector. Through mid‐May of 2013,

there have been 21 transactions closed, indicating the industry is on‐track for another

strong showing this year. Target companies include both large and established

businesses as well as those in the early stages of development.

Education Technology Transactions

www.capstonellc.com

60

57

51

50

44

Education Technology

Contacts

Jacob Voorhees

Director, Principal

Head of Education Practice

(617) 619‐3323

jvoorhees@capstonellc.com

David Michaels

Managing Director

Head of Technology Practice

(858) 926‐5950

dmichaels@capstonellc.com

Sophea Chau

Vice President

(617) 619‐3307

schau@capstonellc.com

Daniel Schultz

Vice President

(617) 619‐3368

dschultz@capstonellc.com

48

43

40

35

30

21

20

10

0

2007

2008

2009

2010

2011

2012

YTD 2013

Sources: Capital IQ; CB Insights and Capstone Partners LLC research

YTD through May 31, 2013

Historically, M&A activity in the industry has been hampered somewhat by targets that

were either too small or negatively affected by the recession and the very tight funding

environment in education. Furthermore, many companies in the space have struggled to

overcome a prolonged sales cycle and complex procurement systems that can make the

market difficult to penetrate. The very nature of the business has created innovative and

entrepreneurial companies, but the operating environment has made it challenging for

these companies to reach their full potential.

Industry pundits believe the edtech industry may have reached the tipping point, where

market demand and adoption is coalescing with maturing technologies and companies to

create a new era of rapid growth, which in turn will prompt a new wave of mergers and

acquisitions in the industry. In addition to these market‐specific conditions, M&A activity

in the space should benefit from macro factors that include a more stable economy,

corporate and private equity buyers with ready access to cash, a favorable borrowing

climate with available acquisition financing and low interest rates, and rising business

valuations. Considering these market‐specific and macro factors, Capstone expects M&A

activity in the edtech industry to accelerate for the remainder of 2013 and in the coming

year.

1

Q2 2013

Education Technology

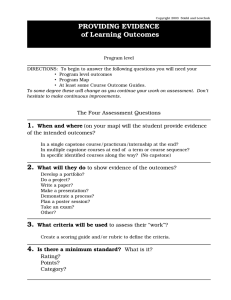

EDTECH TRENDS DRIVE MERGERS & ACQUISITIONS

The edtech space is evolving at an increasingly rapid rate, presenting abundant opportunities for mergers and acquisitions as companies and investors position themselves to capitalize on the trends that are underpinning the market.

There is a massive transformation taking place in the education market and

technology is accelerating its transition, with the ultimate goal of a richer learning

experience at a lower cost. As a result, the edtech space is evolving at an

increasingly rapid rate, presenting abundant opportunities for mergers and

acquisitions as companies and investors position themselves to capitalize on the

trends that are underpinning the market. These trends include the following:

Providing educational services that are individualized, yet widely available. This is

an on‐going goal that will take many years to achieve. Buyers are attracted to

companies with supporting expertise, including:

Artificial intelligence and other technologies that enable personalized and

adaptive learning, with instruction tailored to the skill level and needs of

each individual student.

On‐line courses and programs for traditional schools, as well as entirely‐

online schools so students can learn when and where they want.

Support services such as virtual one‐to‐one student counseling and

personalized tutoring.

Open Educational Resources (OERs) and Massive Open Online Courses

(MOOCs), designed to enable both students and teachers.

Creating technology‐based tools that support the new education paradigm. An

education that is flexible and collaborative requires sophisticated support tools and

technology, such as the following:

Use of social media to enable idea sharing, as well as communications

between educators, administrators, students and the community at large.

An increased use of educational games, which are gaining acceptance as a

learning tool and are helping to engage students in learning.

Better analytics, including both cross‐platform “big data” to help improve

educational outcomes, as well as student‐specific evaluations.

Security solutions that will address the ever‐growing security and privacy

threats inherent with cloud and mobile computing.

Features like touch screen, voice recognition and verbal commands that

students are accustomed to and now expect in the education realm.

Building the infrastructure to allow for widespread deliverability. With “mobile” at

its core to allow students to learn when and where they want, the new education

model includes the following:

Cloud computing to allow for greater availability, flexibility, reliability and

collaboration while promoting lower IT and application costs.

A move towards BYOD models to save money while allowing students to

learn on their preferred mobile platform.

E‐books and open textbooks that can help reduce costs while customizing

content.

The increased adoption of apps for laptops, tablets and smartphones

used for marketing, information dissemination and notifications.

2

Q2 2013

Education Technology

M&A ACTIVITY EXTENDS ACROSS VARIOUS SEGMENTS & BUYER TYPES

Among such corporate acquirers, we are observing a bit of a land grab, as buyers make strategic acquisitions to establish or strengthen their position in the market. The edtech industry is highly fragmented and largely composed of small to mid‐sized

companies, many of which are just now reaching the critical mass necessary to

attract buyer interest. At the same time, the space is evolving rapidly with students

and educators demanding both efficient and effective solutions. As a result,

companies in the industry are realizing the need to partner with, or acquire, industry

players in order to keep up with the changes in the space and to offer a competitive

product or service.

Edtech continues to attract buyers from within the industry, as well as from

traditional education companies who are feeling the edtech pressure. For instance,

educational publishing giant, Pearson, has been buying and incubating promising

edtech startups to help Pearson compete in the increasingly tech‐influenced

educational market. Last May, Pearson acquired Certiport, a maker of IT and digital

literacy products, for $140 million, followed by the acquisition of online learning

services provider EmbanetCompass for $650 million. Pearson also has a stake in

Nook Media and TutorVista, and is launching its own Edtech incubator program.

Other examples of publisher acquisitions in the space include the purchase of Deltak

Edu by John Wiley & Sons for $220 million, and the purchase of Tribal Nova by

Houghton Mifflin Harcourt.

We have also seen corporate buyer interest from outside the education industry, as

witnessed by the acquisition of Tutor.com by media and Internet giant, IAC and the

purchase of LearnLive by Thomson Reuters, a leading source of information for

businesses and professionals. Among such corporate acquirers, we are observing a

bit of a land grab, as buyers make strategic acquisitions to establish or strengthen

their position in the market.

The private equity community has also been very active in the edtech space,

attracted by the growth potential of the sector. Vista Equity Partners has been the

most active private equity group in the sector recently. Vista completed a buyout of

Essential Learning, LLC in March 2012 and acquired Silverchair Learning Systems in

May 2012. The two businesses were merged and the combined company was

renamed Relias Learning, LLC. Relias then acquired Care2Learn in May 2013. Several

other prominent private equity firms have holdings in the edtech industry, including

Providence Equity (Blackboard), Thoma Bravo (Archipelago Learning, Inc.) and Weld

North Holdings (JBHM Education Group, e2020 and The Learning House).

The following table of selected transactions in the industry shows that buyers are

interested in a variety of opportunities in the edtech space, from companies that

develop and provide technology to the technology‐enabled providers themselves.

There have been acquisitions in every segment of the industry, including content,

infrastructure, delivery, and assessment tools. Valuation multiples in the industry are

robust, indicating that many of these companies are not acquired based on their

current operating results, but rather for their potential to better position the buyer

for future growth as the industry evolves. The following table exemplifies the

heightened level and wide range of activity in the edtech space.

3

Q2 2013

Education Technology

SELECT EDUCATION TECHNOLOGY M&A TRANSACTIONS

Enterprise

Value (mm)

EV / LTM

Date

Target

Acquiror

Target Business Description

Revenue EBITDA

5/06/13

Online HealthNow, Inc. (dba Care2Learn)

Relias Learning, LLC

Provides online continuing education and healthcare compliance training solutions to the healthcare industry.

‐

‐

‐

4/23/13

ThinkBinder

Echo360

A communication/collaboration app where students and teachers create online study groups and share files, links and whiteboards.

‐

‐

‐

4/23/13

NewMindsets Inc.

ClevrU Corporation

An online publisher.

‐

‐

‐

4/22/13

Learning Catalytics

Pearson plc

A cloud‐based system, allows educators to create interactive questions for students to answer with a laptop or mobile device. ‐

‐

‐

4/16/13

Tricore, Inc.

Dowden Health Media, Inc.

An adult learning company, provides customized educational, marketing and training solutions, including online.

‐

‐

‐

4/14/13

Sakai (division of rSmart)

Asahi Net International

A learning management system with users at 350 academic & commercial institutions worldwide.

‐

‐

‐

4/13/13

Tribal Nova, Inc.

Houghton Mifflin Harcourt

Publishes educational programs, games and apps for pre‐K and operates online learning portals.

‐

‐

‐

4/08/13

Mendeley Ltd.

Elsevier B.V.

Offers researchers and students a social network to search for and share research papers and articles.

$85.0

‐

‐

4/01/13

LiveMocha, Inc.

Rosetta Stone Ltd.

Operates an online language learning community.

$8.5 2.4x ‐

3/22/13

PlaySay

Babbel

Develops mobile language learning tools.

‐

‐

‐

3/22/13

McGraw‐Hill Education, Inc.

Apollo Global Management, LLC Offers educational materials and learning solutions for students, instructors, professionals and institutions.

$2,548.0 1.2x 6.9x 3/18/13

SchoolRack

Leading Capital

A learning management system for class sites with discussion boards, grades, assignments, and parent and student messaging. ‐

‐

‐

3/15/13

Lore Noodle Education

A learning management system primarily for the higher education market.

‐

‐

‐

3/08/13

Wiggio Inc.

Desire2Learn Incorporated

Provides an online group collaboration tool used by college students.

‐

‐

‐

3/05/13

Root‐1, Inc.

Edmodo, Inc.

Develops practice‐based learning solutions.

‐

‐

‐

2/28/13

Silverpoint

Finalsite

Provides web design, development and support services to K‐12

and college clients.

‐

‐

‐

2/10/13

ActiveGrade, LLC

Haiku Learning Systems

Offers a web‐based gradebook for standards‐based grading.

‐

‐

‐

1/24/13

Degree Compass

Desire2Learn Incorporated

Offers a virtual and adaptive counseling tool that helps students complete their degrees on time. ‐

‐

‐

1/07/13

Tutor.com

InterActiveCorp (IAC)

An online site for anywhere, anytime 1:1 help for K‐12 subjects, AP courses, test prep and writing assistance. ‐

‐

‐

1/02/13

Calvert Education Services

Camden Partners Holdings, LLC

Operates a 100‐year‐old distance learning business.

‐

‐

‐

12/31/12

LearnLive

Technologies, Inc.

Thomson Reuters Corporation A platform that automates the delivery, management & certification of accredited eLearning programs for accounting & legal firms.

‐

‐

‐

12/03/12 NetLearning, Inc.

Call24, Inc.

Provides eLearning solutions to healthcare professionals.

‐

‐

‐

11/21/12 EmbanetCompass, LLC

Pearson plc

Develops and support online degree and learning programs in North America.

$650.0 ‐

‐

11/12/12 Digital University, Inc.

TrainCo Holdings Corporation, LLC

Provides online training and education to professionals in the financial industry.

‐

‐

‐

11/12/12 LectureTools Inc.

Echo360

Offers a suite of student response system, presentation and study tools, and assessment tracking geared for college classrooms.

‐

‐

‐

11/07/12 Sapling Learning, Inc.

Macmillan New Ventures LLC

Develops software for instructor requirements for educational content development, student assessment and online instruction.

‐

‐

‐

11/07/12

Computer Software Innovations, Inc.

Harris Computer Systems, Inc.

Provides lesson planning software and cloud‐based communication and collaboration solutions to the K‐12 market.

$17.9 0.3x 11/05/12

Efficient Learning Systems, Inc.

John Wiley & Sons Inc. An e‐learning system provider in areas like professional finance and accounting.

$24.0

‐

‐

11/01/12 Epsilen, LLC

ConnectEdu, Inc.

Offers eLearning solutions for higher education institutions.

‐

‐

‐

10/31/12 Varitronics, LLC

Renaissance Equity Partners

Provides education technology solutions.

$8.4 ‐

‐

10.9x 4

Q2 2013

Education Technology

SELECT EDUCATION TECHNOLOGY M&A TRANSACTIONS (CONTINUED)

Date

Target

Enterprise

Value (mm)

EV / LTM

Acquiror

Target Business Description

Revenue EBITDA

10/25/12 Deltak edu, Inc.

John Wiley & Sons Inc. Designs and develops online learning and higher education programs.

$220.0 4.1x ‐

10/23/12 Pan Am Education LLC

Pivotal Group, Inc.

Provides online English language training around the world.

‐

‐

‐

9/26/12

TextTheMob and ClassMetric

Poll Everywhere

Learning management systems that provide real‐time data on student understanding and comprehension.

‐

‐

‐

9/24/12

JBHM Education Group, LLC

Weld North LLC

Provides professional development services for schools and teachers for tech integration. ‐

‐

‐

‐

‐

‐

‐

‐

‐

$53.8 6.5x ‐

9/19/12

EmCert Incorporated

Medic‐CE.com, LLC

Provides e‐learning and continuing education solutions for emergency medical services and fire/rescue professionals.

9/10/12

ValoreBooks

SimpleTuition, Inc.

Operates an online marketplace for new and used textbook purchases and rentals.

8/07/12

Campus Labs, LLC

Higher One Holdings, Inc. Provides software for assessment in higher education.

8/01/12

Key Curriculum Press, Inc.

McGraw‐Hill Education, Inc.

Develops and publishes math instructional materials and software for elementary, middle and high school mathematics teachers.

‐

‐

‐

7/26/12

Liaison International, Inc.

Polaris Partners

Provides IT products and services to institutions of higher education.

‐

‐

‐

6/10/12

OnlineEducation.com LLC QuinStreet, Inc. Provides online education services.

‐

‐

‐

5/28/12

Global English Corporation

Pearson plc

A provider of cloud‐based, on‐demand business English learning, assessment and performance support software. $90.0

‐

‐

5/18/12

Princeton Review Inc., Higher Ed. Readiness

Charlesbank Capital Partners, LLC

Provides in‐person and online test preparation courses, including classroom‐based and small group instruction and individual tutoring.

$33.0 ‐

‐

5/17/12

Archipelago Learning, Inc. PLATO Learning, Inc.

Provides subscription‐based software‐as‐a‐service education products for K‐12 and college students.

$301.0 4.1x

13.7x 5/16/12

Certiport, Inc.

Pearson plc

Provides performance‐based certification practice test and program management solutions to academic institutions and IT professionals.

$140.0

2.9x

‐

5/09/12

Intel‐Assess, Inc. Wireless Generation

Develops assessment programs for school districts. (nka Amplify Education, Inc.)

‐

‐

‐

5/04/12

Silverchair Learning Systems, LLC

Vista Equity Partners

Provides training and education programs for employees in senior care organizations in the United States.

‐

‐

‐

5/09/12

GoGo Lingo

Rosetta Stone Ltd.

Provides a gameful learning environment aimed at motivating 3‐7 year olds to learn and practice languages. ‐

‐

‐

4/16/12

Sophia Learning, LLC

Capella University, Inc.

Operates an online social learning community that helps students to learn in their own way.

‐

‐

‐

4/11/12

Atomic Learning, Inc.

Boathouse Capital; Renovus Capital Partners

Provides tech integration training for K‐12 and colleges. $19.0

‐

‐

‐

‐

‐

3/26/12

Moodlerooms, Inc.

Blackboard Inc.

Provides an online learning platform for K‐12, higher education, corporations and government agencies. 3/15/12

Essential Learning, LLC.

Vista Equity Partners

Provides online learning, staff compliance training and continuing education for the behavioral and mental health industry.

‐

‐

‐

3/13/12

Nolij Corporation

Perceptive Software, Inc.

Provides Web‐based document imaging, data integration and forms processing for public and private colleges and universities. $31.9 ‐

‐

2/17/12

Inscape Holdings Inc.

John Wiley & Sons, Inc. A leading provider of assessment and training products that develop critical interpersonal business skills. $85.0

‐

‐

2/16/12

PrepMe, LLC

Naviance, Inc.

Provides online learning and test preparation courses which enable students to study in a customized and interactive manner.

‐

‐

‐

2/08/12

Peer2Peer Holding Company LLC

Aristotle Circle

An online tutoring network that connects students who need help with other students in their area. ‐

‐

‐

1/23/12

SunGard Higher Education, Inc.

Datatel, Inc. (nka Ellucian, Inc.)

Provides software and services to colleges and universities that enable them to teach, learn, manage and connect.

$1,775.0 ‐

‐

1/17/12

Axiologix Education VOIP ACQ, Inc.

Corporation (OTCPK:AXLX)

A development stage company that sells and markets educational software serving kindergarten through higher education.

‐

‐

‐

1/11/12

Academic Earth

A platform for educational videos that hosts full courses and lectures from leading universities around the world. ‐

‐

‐

Ampush Media

LTM = last twelve months; EV = enterprise value

Sources: Capstone Partners LLC research; Capital IQ; public filings and press releases

Mean

3.1x

10.5

Median

2.9x

10.9

Harmonic Mean

1.3x

9.7x

5

Q2 2013

Education Technology

PUBLIC COMPANY TRADING & OPERATING DATA

Price

5/31/13

% 52 Wk

High

Market

Cap

Enterprise

Value

Revenue

LTM

EBITDA

Margin

1‐Yr Rev

Growth

$30.34

96.9%

1,384.8 1,588.5 468.3 71.9 15.3%

23.6%

3.4x

22.1x

$1.42

94.7%

66.6 213.6 152.1 17.2 11.3%

(10.2)%

1.4x

12.4x

John Wiley & Sons Inc.

$39.70

76.4%

2,355.4 2,805.8 1,769.5 334.3 18.9%

(0.2)%

1.6x

8.4x

K12, Inc.

$29.72

96.2%

1,086.9 993.2 815.5 80.1 9.8%

22.4%

1.2x

12.4x

$9.57

77.9%

652.0 462.3 592.2 80.1 13.5%

21.5%

0.8x

5.8x

16,909.6 8,222.7 921.0 11.2%

5.0%

2.1x

18.4x

267.7 NM NA

(4.7)%

0.8x

NM

4,596.0 1,618.0 35.2%

23.3%

3.2x

9.2x

16.5%

10.1%

1.8x

12.7x

Company

Blackbaud Inc.

Cambium Learning Group, Inc.

LeapFrog Enterprises Inc.

Pearson plc

$12.03

60.9% 15,047.5 Rosetta Stone, Inc.

$17.02

93.0%

366.0 226.7 The McGraw‐Hill Companies, Inc.

$54.55

93.1% 14,952.2 14,880.8 EV / LTM

Revenue EBITDA

$ in Millions, except per share data

Mean

EV = enterprise value; LTM = last twelve months

Median

13.5%

13.3%

1.5x

12.4x

Harmonic Mean

14.0%

NA

1.4x

10.6x

NM = not meaningful

Source: Capital IQ as of May 31, 2013

STOCK PRICE PERFORMANCE

Edtech vs. S&P 500 (1‐Year)

Edtech vs. S&P 500 (10‐Year)

135

210

130

190

125

170

127.6

120

150

115

130

168.6

165.0

114.9

110

110

105

90

100

70

95

50

Capstone Edtech Index

^SPX ‐ Share Pricing

Capstone Edtech Index

^SPX ‐ Share Pricing

Share data based on relative performance (%)

Source: Capital IQ as of May 31, 2013

6

Q2 2013

Education Technology

CAPSTONE PARTNERS: A SAMPLING OF COMPLETED EDUCATION TRANSACTIONS

Capstone Partners maintains the most active education & training practice in the middle market, having represented

clients across various specialties, from education technology providers to educational programs. This market presence

allows Capstone to provide education technology companies with real‐time transaction feedback and immediate access to

key decision makers among the industry’s most active acquirers and investors.

A Premier Provider

of Early Education

& Childcare Services

has been

acquired by

have acquired

has been

acquired by

has been

acquired by

ANAPHORA, LLC

have acquired

has divested

a division to

FL-EX HOLDINGS, INC.

has secured

financing from

has secured

financing from

has been

acquired by

has been

acquired by

CMS SMALL-CAP

PRIVATE EQUITY FUND

An

Company

has recapitalized with

has been

acquired by

has been

acquired by

has been

acquired by

has been

acquired by

has been

acquired by

has been

acquired by

has been

acquired by

has been

acquired by

has recapitalized with

7

Q2 2013

Education Technology

THE EDUCATION TECHNOLOGY TEAM

Jacob Voorhees, Director and Principal, Head of Education Practice

jvoorhees@capstonellc.com • (617) 619‐3323

Jacob is a founding member of Capstone Partners. He focuses on asset positioning,

strategy articulation, due diligence and negotiations coordination. Formerly, Jacob was

with Andersen Corporate Finance LLC, where he focused his efforts on the software and

direct marketing industries. He started his career in New York City with Rabobank

International, a multi‐national Dutch investment bank headquartered in Utrecht, the

Netherlands. While at Rabobank International, Jacob worked in the mergers and

acquisitions group focusing on cross‐border transactions in the consumer products, food

and beverage industries.

The M&A Advisor named Jacob to its prestigious 40‐UNDER‐40 deal makers list in

2012. Jacob received an MBA from the Sloan School of Management at Massachusetts

Institute of Technology (MIT) and a BS from Cornell University. Jacob is qualified as a

General Securities Representative.

David Michaels, Managing Director, Head of Technology & Telecom Practice

dmichaels@capstonellc.com • (858) 926‐5950

David Michaels is a Managing Director of Capstone where he is responsible for managing

the firm’s Technology & Telecom Group (TTG). David founded SagePoint Advisors in

2008, a boutique investment banking firm focused on providing M&A advisory services

to technology and telecom companies. Prior to founding SagePoint, David was a Co‐

Founder, Partner and Managing Director at Montgomery & Co., a leading investment

bank focused on serving emerging‐growth technology companies. David co‐founded

Montgomery’s investment banking business in 1996 and played an instrumental role in

building the business to over $50 million in revenues and 80 employees. Mr. Michaels

also ran the firm’s Communications and Digital Media Technology practice areas prior to

his departure.

David has intimate knowledge of the strategic landscape, market dynamics and

technology underpinnings of several high technology market segments including Mobile

Software & Services, Consumer Internet, E‐Commerce, Enterprise SaaS, Cloud &

Infrastructure Software and Consumer, IT & Telecom Hardware. Prior to joining

Montgomery in 1994, David worked as an investment banker at Bankers Trust and prior

to that, as a structural engineer at General Dynamics, Mr. Michaels received an MBA in

entrepreneurship from the Anderson School of Management at UCLA and holds a BS in

Mechanical Engineering from the University of Michigan.

8

Q2 2013

Education Technology

Sophea Chau, Vice President

schau@capstonellc.com • (617) 619‐3307

Sophea joined Capstone in 2008 and specializes in mergers & acquisitions, private

placements and financial advisory services. Her responsibilities include providing financial

and valuation analysis, performing due diligence and drafting all marketing materials.

Prior to joining Capstone, Sophea was an analyst at FTN Midwest Securities, a full‐service

investment banking firm based in Cleveland. While working in their New York office, she

focused on M&A advisory for middle‐market companies in a variety of industries,

including healthcare, pharmaceutical services and marketing & advertising. Sophea is on

the Board of the Columbia University Club of New England and is the Chairperson of the

Boston Columbia College Young Alumni group. Sophea holds a Bachelor of Arts in

Economics from Columbia University.

Daniel Schultz, Vice President

dschultz@capstonellc.com • (617) 619‐3368

Daniel oversees Capstone’s national business development and industry coverage

activities, working closely with current and prospective clients of the firm on matters

related to corporate sales, recapitalizations, mergers & acquisitions and growth

financings. In his role, Dan is able to deliver specific market intelligence to clients

regarding M&A, financing, strategic, industry and competitive trends. Prior to

spearheading the firm’s business development and market initiatives, he was a Vice

President in Capstone’s M&A group, managing numerous successful transactions across a

variety of industries. Dan also gained hands‐on transaction experience as an investment

banker at Headwaters MB. He started his career with Ernst & Young’s National

Professional AABS practice in New York and later worked in Assurance and Advisory

Business Services in the Denver office. Dan received a BE in Biomedical Engineering with a

Business Minor from Vanderbilt University. He earned an MBA and a Master of

Accountancy from the Daniels College of Business at the University of Denver.

Teak Murphy, Vice President

tmurphy@capstonellc.com • (858) 926‐5950

Teak joins Capstone as a Vice President in the Technology & Telecom Group, based out of

San Diego. Prior to Capstone’s acquisition of SagePoint Advisors, Teak worked at

SagePoint as a Senior Associate advising technology companies on mergers, acquisitions

and strategic capital raises. Prior to joining SagePoint, Teak worked as a Senior Associate

with Enterprise Partners Venture Capital, the largest Southern California based VC firm,

where he evaluated investment opportunities and worked closely with senior

management and board members to successfully grow portfolio companies. Prior to

Enterprise Partners, Teak worked as an Associate in technology investment banking at

Montgomery & Co. where he spent three years working closely with SagePoint's founder

David Michaels on buy‐side and sell‐side M&A transactions. Prior to Montgomery, Teak

worked at Cowen & Co. advising technology companies on M&A and IPO transactions.

Teak graduated from the University of Southern California with honors, receiving a BS in

Business Administration/Finance.

9

ABOUT CAPSTONE PARTNERS

Capstone Partners LLC is a leading international investment banking firm dedicated to serving the corporate finance needs of middle

market business owners, investors and creditors. The firm provides merger & acquisition, private placement, corporate restructuring,

valuation and financial advisory services. Capstone maintains various industry specialties including one in the Education & Training

sector. The firm also possesses merchant banking capabilities to actively co‐invest in transactions.

Additional information about Capstone Partners can be found at www.capstonellc.com.

LEADERSHIP TEAM

BOSTON

John Ferrara

Founder, President

(617) 619‐3325

jferrara@capstonellc.com

CHICAGO

Ted Polk Managing Director (312) 674‐4531 tpolk@capstonellc.com LOS ANGELES

David Bench Managing Director (949) 460‐6431 dbench@capstonellc.com SAN DIEGO & SILICON VALLEY

David Michaels

Managing Director

(858) 926‐5950

dmichaels@capstonellc.com

BOSTON

Kevin Jolley Managing Director (617) 619‐3330 kjolley@capstonellc.com LONDON

John Snead

Managing Director +44 7979 704302

jsnead@capstonellc.com PHILADELPHIA

Eric Williams

Managing Director

(215) 854‐4065

ewilliams@capstonellc.com

CORPORATE RESTRUCTURING

Brian Davies

Managing Director

(617) 619‐3328

bdavies@capstonellc.com

Capstone Partners

Investment Banking Advisors

www.capstonellc.com

World Class Wall Street Expertise. Built for the Middle Market.

© 2013 Capstone Partners LLC. All rights reserved.