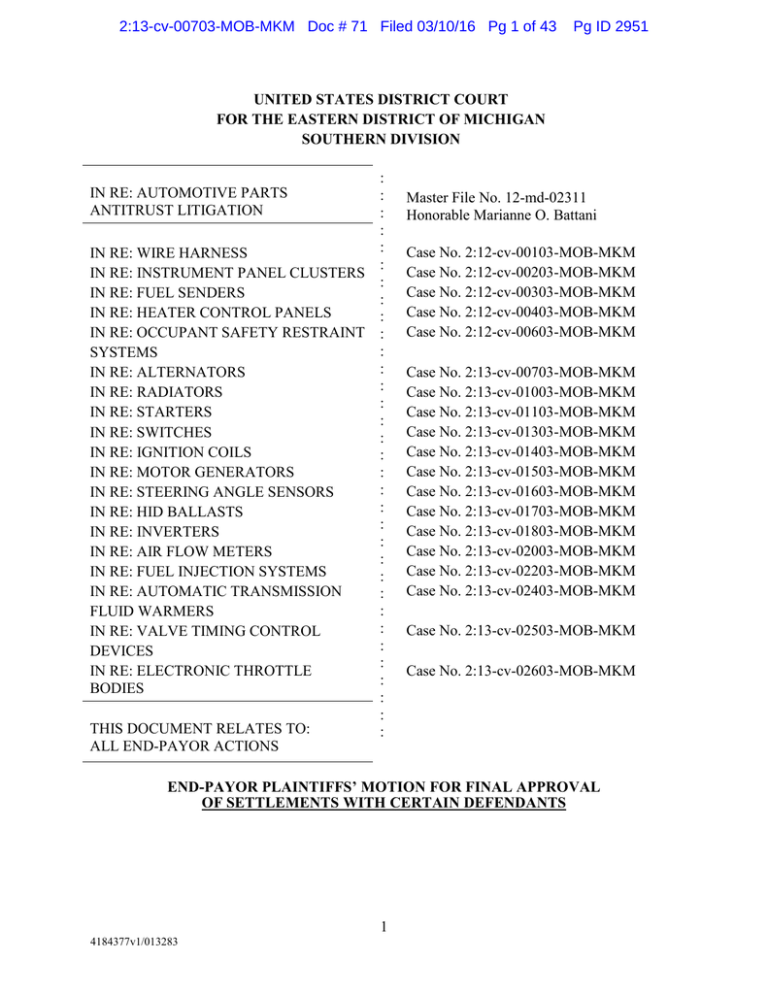

1 UNITED STATES DISTRICT COURT FOR THE

advertisement