Doing Business in Canada – GST/HST Information for Non

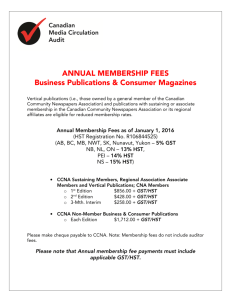

advertisement