Exports of Goods and Services

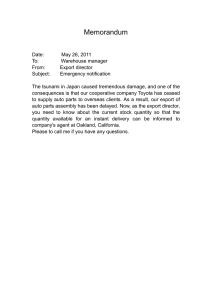

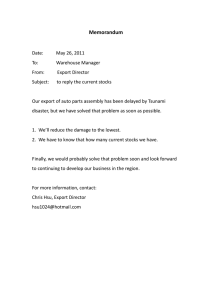

advertisement