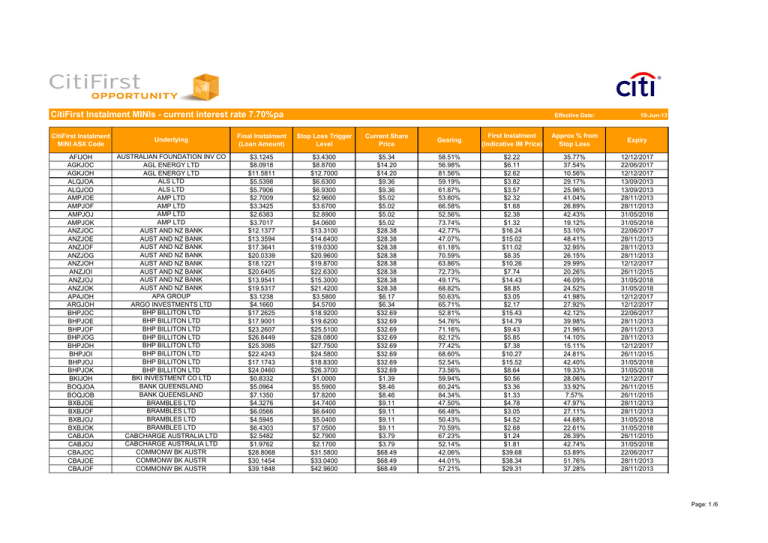

CitiFirst Instalment MINIs - current interest rate 7.70%pa

Effective Date:

19-Jun-13

CitiFirst Instalment

MINI ASX Code

Underlying

Final Instalment

(Loan Amount)

Stop Loss Trigger

Level

Current Share

Price

Gearing

First Instalment

(Indicative IM Price)

Approx % from

Stop Loss

Expiry

AFIJOH

AGKJOC

AGKJOH

ALQJOA

ALQJOD

AMPJOE

AMPJOF

AMPJOJ

AMPJOK

ANZJOC

ANZJOE

ANZJOF

ANZJOG

ANZJOH

ANZJOI

ANZJOJ

ANZJOK

APAJOH

ARGJOH

BHPJOC

BHPJOE

BHPJOF

BHPJOG

BHPJOH

BHPJOI

BHPJOJ

BHPJOK

BKIJOH

BOQJOA

BOQJOB

BXBJOE

BXBJOF

BXBJOJ

BXBJOK

CABJOA

CABJOJ

CBAJOC

CBAJOE

CBAJOF

AUSTRALIAN FOUNDATION INV CO

AGL ENERGY LTD

AGL ENERGY LTD

ALS LTD

ALS LTD

AMP LTD

AMP LTD

AMP LTD

AMP LTD

AUST AND NZ BANK

AUST AND NZ BANK

AUST AND NZ BANK

AUST AND NZ BANK

AUST AND NZ BANK

AUST AND NZ BANK

AUST AND NZ BANK

AUST AND NZ BANK

APA GROUP

ARGO INVESTMENTS LTD

BHP BILLITON LTD

BHP BILLITON LTD

BHP BILLITON LTD

BHP BILLITON LTD

BHP BILLITON LTD

BHP BILLITON LTD

BHP BILLITON LTD

BHP BILLITON LTD

BKI INVESTMENT CO LTD

BANK QUEENSLAND

BANK QUEENSLAND

BRAMBLES LTD

BRAMBLES LTD

BRAMBLES LTD

BRAMBLES LTD

CABCHARGE AUSTRALIA LTD

CABCHARGE AUSTRALIA LTD

COMMONW BK AUSTR

COMMONW BK AUSTR

COMMONW BK AUSTR

$3.1245

$8.0918

$11.5811

$5.5398

$5.7906

$2.7009

$3.3425

$2.6383

$3.7017

$12.1377

$13.3594

$17.3641

$20.0339

$18.1221

$20.6405

$13.9541

$19.5317

$3.1238

$4.1660

$17.2625

$17.9001

$23.2607

$26.8449

$25.3085

$22.4243

$17.1743

$24.0460

$0.8332

$5.0964

$7.1350

$4.3276

$6.0566

$4.5945

$6.4303

$2.5482

$1.9762

$28.8068

$30.1454

$39.1848

$3.4300

$8.8700

$12.7000

$6.6300

$6.9300

$2.9600

$3.6700

$2.8900

$4.0600

$13.3100

$14.6400

$19.0300

$20.9600

$19.8700

$22.6300

$15.3000

$21.4200

$3.5800

$4.5700

$18.9200

$19.6200

$25.5100

$28.0800

$27.7500

$24.5800

$18.8300

$26.3700

$1.0000

$5.5900

$7.8200

$4.7400

$6.6400

$5.0400

$7.0500

$2.7900

$2.1700

$31.5800

$33.0400

$42.9600

$5.34

$14.20

$14.20

$9.36

$9.36

$5.02

$5.02

$5.02

$5.02

$28.38

$28.38

$28.38

$28.38

$28.38

$28.38

$28.38

$28.38

$6.17

$6.34

$32.69

$32.69

$32.69

$32.69

$32.69

$32.69

$32.69

$32.69

$1.39

$8.46

$8.46

$9.11

$9.11

$9.11

$9.11

$3.79

$3.79

$68.49

$68.49

$68.49

58.51%

56.98%

81.56%

59.19%

61.87%

53.80%

66.58%

52.56%

73.74%

42.77%

47.07%

61.18%

70.59%

63.86%

72.73%

49.17%

68.82%

50.63%

65.71%

52.81%

54.76%

71.16%

82.12%

77.42%

68.60%

52.54%

73.56%

59.94%

60.24%

84.34%

47.50%

66.48%

50.43%

70.59%

67.23%

52.14%

42.06%

44.01%

57.21%

$2.22

$6.11

$2.62

$3.82

$3.57

$2.32

$1.68

$2.38

$1.32

$16.24

$15.02

$11.02

$8.35

$10.26

$7.74

$14.43

$8.85

$3.05

$2.17

$15.43

$14.79

$9.43

$5.85

$7.38

$10.27

$15.52

$8.64

$0.56

$3.36

$1.33

$4.78

$3.05

$4.52

$2.68

$1.24

$1.81

$39.68

$38.34

$29.31

35.77%

37.54%

10.56%

29.17%

25.96%

41.04%

26.89%

42.43%

19.12%

53.10%

48.41%

32.95%

26.15%

29.99%

20.26%

46.09%

24.52%

41.98%

27.92%

42.12%

39.98%

21.96%

14.10%

15.11%

24.81%

42.40%

19.33%

28.06%

33.92%

7.57%

47.97%

27.11%

44.68%

22.61%

26.39%

42.74%

53.89%

51.76%

37.28%

12/12/2017

22/06/2017

12/12/2017

13/09/2013

13/09/2013

28/11/2013

28/11/2013

31/05/2018

31/05/2018

22/06/2017

28/11/2013

28/11/2013

28/11/2013

12/12/2017

26/11/2015

31/05/2018

31/05/2018

12/12/2017

12/12/2017

22/06/2017

28/11/2013

28/11/2013

28/11/2013

12/12/2017

26/11/2015

31/05/2018

31/05/2018

12/12/2017

26/11/2015

26/11/2015

28/11/2013

28/11/2013

31/05/2018

31/05/2018

26/11/2015

31/05/2018

22/06/2017

28/11/2013

28/11/2013

Page: 1 /6

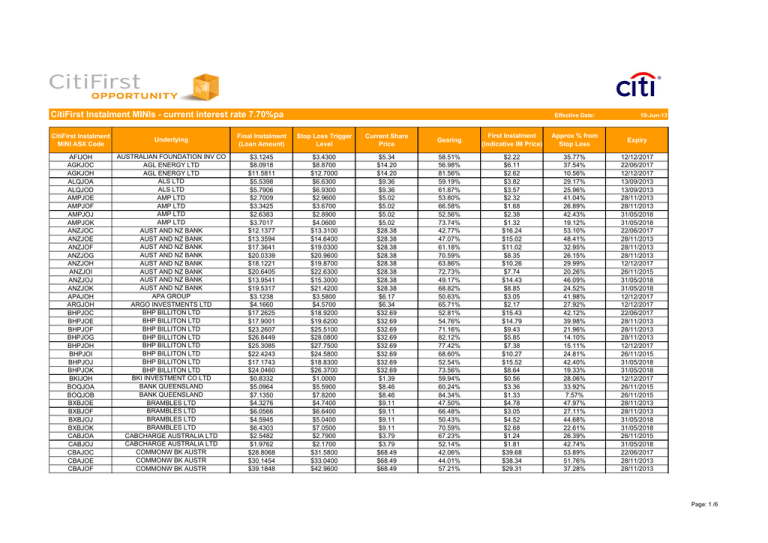

CitiFirst Instalment MINIs - current interest rate 7.70%pa

Effective Date:

19-Jun-13

CitiFirst Instalment

MINI ASX Code

Underlying

Final Instalment

(Loan Amount)

Stop Loss Trigger

Level

Current Share

Price

Gearing

First Instalment

(Indicative IM Price)

Approx % from

Stop Loss

Expiry

CBAJOG

CBAJOH

CBAJOI

CBAJOJ

CBAJOK

CCLJOH

COHJOA

COHJOB

CPUJOA

CPUJOB

CSLJOE

CSLJOF

CSLJOJ

CSLJOK

CWNJOA

CWNJOB

DJWJOH

FLTJOA

FLTJOB

FMGJOE

FMGJOJ

FMGJOK

ILUJOC

ILUJOD

ILUJOH

MFFJOH

MINJOA

MLTJOH

MQGJOE

MQGJOG

MQGJOJ

MQGJOK

MTSJOE

MTSJOF

NABJOC

NABJOD

NABJOE

NABJOF

NABJOG

COMMONW BK AUSTR

COMMONW BK AUSTR

COMMONW BK AUSTR

COMMONW BK AUSTR

COMMONW BK AUSTR

COCA-COLA AMATIL

COCHLEAR LTD

COCHLEAR LTD

COMPUTERSHARE LT

COMPUTERSHARE LT

CSL LTD

CSL LTD

CSL LTD

CSL LTD

CROWN LTD

CROWN LTD

DJERRIWARRH INVESTMENTS LTD

FLIGHT CENTRE LTD

FLIGHT CENTRE LTD

FORTESCUE METALS

FORTESCUE METALS

FORTESCUE METALS

ILUKA RESOURCES

ILUKA RESOURCES

ILUKA RESOURCES

MAGELLAN FLAGSHIP FUND LTD

MINERAL RESOURCES LTD

MILTON CORPORATION LIMITED

MACQUARIE GROUP

MACQUARIE GROUP

MACQUARIE GROUP

MACQUARIE GROUP

METCASH LTD

METCASH LTD

NATL AUST BANK

NATL AUST BANK

NATL AUST BANK

NATL AUST BANK

NATL AUST BANK

$45.2076

$44.4721

$41.9640

$34.1278

$47.7809

$7.2530

$34.7596

$48.3375

$5.2176

$7.3047

$30.3544

$42.4879

$30.1352

$42.1933

$6.0872

$6.7293

$2.6038

$17.3279

$24.4629

$2.3860

$1.7054

$2.3775

$4.8755

$7.1717

$5.1256

$0.6249

$6.6295

$11.4565

$18.9267

$23.1661

$21.7186

$30.4061

$2.1127

$2.6908

$12.8390

$9.9133

$18.5584

$17.7320

$20.4648

$47.3100

$48.7500

$46.0000

$37.4200

$52.3900

$7.9500

$39.8400

$55.4000

$5.7200

$8.0100

$33.2800

$46.5700

$33.0400

$46.2700

$6.6700

$7.3800

$3.1100

$19.0000

$26.8200

$2.6200

$1.8700

$2.6100

$5.5900

$8.2100

$5.8700

$0.7500

$7.6000

$13.7000

$20.7500

$25.3900

$23.8200

$33.3400

$2.3200

$2.9500

$14.0800

$10.8700

$20.3500

$19.4400

$21.4100

$68.49

$68.49

$68.49

$68.49

$68.49

$12.58

$58.36

$58.36

$10.10

$10.10

$58.00

$58.00

$58.00

$58.00

$12.39

$12.39

$4.39

$38.82

$38.82

$3.30

$3.30

$3.30

$10.22

$10.22

$10.22

$1.31

$8.50

$18.50

$42.18

$42.18

$42.18

$42.18

$3.51

$3.51

$29.74

$29.74

$29.74

$29.74

$29.74

66.01%

64.93%

61.27%

49.83%

69.76%

57.66%

59.56%

82.83%

51.66%

72.32%

52.34%

73.26%

51.96%

72.75%

49.13%

54.31%

59.31%

44.64%

63.02%

72.30%

51.68%

72.05%

47.71%

70.17%

50.15%

47.70%

77.99%

61.93%

44.87%

54.92%

51.49%

72.09%

60.19%

76.66%

43.17%

33.33%

62.40%

59.62%

68.81%

$23.28

$24.02

$26.53

$34.36

$20.71

$5.33

$23.60

$10.02

$4.88

$2.80

$27.65

$15.51

$27.86

$15.81

$6.30

$5.66

$1.79

$21.49

$14.36

$0.91

$1.59

$0.92

$5.34

$3.05

$5.09

$0.69

$1.87

$7.04

$23.25

$19.01

$20.46

$11.77

$1.40

$0.82

$16.90

$19.83

$11.18

$12.01

$9.28

30.92%

28.82%

32.84%

45.36%

23.51%

36.80%

31.73%

5.07%

43.37%

20.69%

42.62%

19.71%

43.03%

20.22%

46.17%

40.44%

29.16%

51.06%

30.91%

20.61%

43.33%

20.91%

45.30%

19.67%

42.56%

42.75%

10.59%

25.95%

50.81%

39.81%

43.53%

20.96%

33.90%

15.95%

52.66%

63.45%

31.57%

34.63%

28.01%

28/11/2013

12/12/2017

26/11/2015

31/05/2018

31/05/2018

12/12/2017

13/09/2013

13/09/2013

26/09/2013

26/09/2013

28/11/2013

28/11/2013

31/05/2018

31/05/2018

26/09/2013

26/09/2013

12/12/2017

26/11/2015

26/11/2015

28/11/2013

31/05/2018

31/05/2018

22/06/2017

26/09/2013

12/12/2017

12/12/2017

26/09/2013

12/12/2017

28/11/2013

28/11/2013

31/05/2018

31/05/2018

28/11/2013

28/11/2013

22/06/2017

26/09/2013

28/11/2013

28/11/2013

28/11/2013

Page: 2 /6

CitiFirst Instalment MINIs - current interest rate 7.70%pa

Effective Date:

19-Jun-13

CitiFirst Instalment

MINI ASX Code

Underlying

Final Instalment

(Loan Amount)

Stop Loss Trigger

Level

Current Share

Price

Gearing

First Instalment

(Indicative IM Price)

Approx % from

Stop Loss

Expiry

NABJOH

NABJOJ

NABJOK

NCMJOG

NCMJOJ

ORGJOE

ORGJOF

ORGJOH

ORGJOJ

ORGJOK

ORIJOE

ORIJOJ

ORIJOK

QBEJOC

QBEJOF

QBEJOH

QBEJOJ

QBEJOK

RIOJOC

RIOJOE

RIOJOF

RIOJOG

RIOJOH

RIOJOJ

RIOJOK

SFYJOA

SFYJOB

SGPJOA

SGPJOB

STOJOE

STOJOF

STOJOJ

STOJOK

STWJOA

STWJOB

STWJOC

STWJOD

SUNJOE

SUNJOF

NATL AUST BANK

NATL AUST BANK

NATL AUST BANK

NEWCREST MINING

NEWCREST MINING

ORIGIN ENERGY

ORIGIN ENERGY

ORIGIN ENERGY

ORIGIN ENERGY

ORIGIN ENERGY

ORICA LTD

ORICA LTD

ORICA LTD

QBE INSURANCE

QBE INSURANCE

QBE INSURANCE

QBE INSURANCE

QBE INSURANCE

RIO TINTO LTD

RIO TINTO LTD

RIO TINTO LTD

RIO TINTO LTD

RIO TINTO LTD

RIO TINTO LTD

RIO TINTO LTD

SPDR S&P/ASX 50 FUND

SPDR S&P/ASX 50 FUND

STOCKLAND

STOCKLAND

SANTOS LTD

SANTOS LTD

SANTOS LTD

SANTOS LTD

SPDR S&P/ASX 200 FUND

SPDR S&P/ASX 200 FUND

SPDR S&P/ASX 200 FUND

SPDR S&P/ASX 200 FUND

SUNCORP GROUP LT

SUNCORP GROUP LT

$17.8722

$15.4588

$21.6384

$10.1243

$7.2629

$6.0187

$8.4241

$5.7283

$6.6009

$9.2392

$13.4022

$11.1954

$15.6695

$6.8847

$8.2616

$5.4679

$7.9250

$11.0850

$31.2883

$32.8200

$38.8800

$45.9459

$43.7430

$26.9652

$37.7493

$25.5664

$30.4146

$2.3121

$2.4033

$6.7625

$8.4823

$6.4604

$9.0486

$37.1122

$29.3284

$23.4436

$33.6364

$4.9296

$6.8952

$19.6000

$16.9500

$23.7300

$11.1000

$7.9600

$6.6000

$9.2300

$6.2800

$7.2400

$10.1300

$14.6900

$12.2800

$17.1800

$7.5500

$9.0600

$6.0000

$8.6900

$12.1600

$34.3000

$35.9700

$42.6200

$48.0900

$47.9600

$29.5700

$41.3900

$28.0300

$33.3400

$2.5300

$2.6300

$7.4200

$9.2900

$7.0800

$9.9200

$40.6900

$32.1500

$25.7000

$36.8800

$5.3900

$7.5500

$29.74

$29.74

$29.74

$11.15

$11.15

$12.85

$12.85

$12.85

$12.85

$12.85

$20.46

$20.46

$20.46

$14.95

$14.95

$14.95

$14.95

$14.95

$53.55

$53.55

$53.55

$53.55

$53.55

$53.55

$53.55

$48.46

$48.46

$3.60

$3.60

$12.65

$12.65

$12.65

$12.65

$45.74

$45.74

$45.74

$45.74

$12.27

$12.27

60.09%

51.98%

72.76%

90.80%

65.14%

46.84%

65.56%

44.58%

51.37%

71.90%

65.50%

54.72%

76.59%

46.05%

55.26%

36.57%

53.01%

74.15%

58.43%

61.29%

72.61%

85.80%

81.69%

50.36%

70.49%

52.76%

62.76%

64.23%

66.76%

53.46%

67.05%

51.07%

71.53%

81.14%

64.12%

51.25%

73.54%

40.18%

56.20%

$11.87

$14.28

$8.10

$1.03

$3.89

$6.83

$4.43

$7.12

$6.25

$3.61

$7.06

$9.26

$4.79

$8.07

$6.69

$9.48

$7.03

$3.87

$22.26

$20.73

$14.67

$7.60

$9.81

$26.58

$15.80

$22.89

$18.05

$1.29

$1.20

$5.89

$4.17

$6.19

$3.60

$8.63

$16.41

$22.30

$12.10

$7.34

$5.37

34.10%

43.01%

20.21%

0.45%

28.61%

48.64%

28.17%

51.13%

43.66%

21.17%

28.20%

39.98%

16.03%

49.50%

39.40%

59.87%

41.87%

18.66%

35.95%

32.83%

20.41%

10.20%

10.44%

44.78%

22.71%

42.16%

31.20%

29.72%

26.94%

41.34%

26.56%

44.03%

21.58%

11.04%

29.71%

43.81%

19.37%

56.07%

38.47%

12/12/2017

31/05/2018

31/05/2018

26/11/2015

31/05/2018

28/11/2013

28/11/2013

12/12/2017

31/05/2018

31/05/2018

28/11/2013

31/05/2018

31/05/2018

28/11/2013

28/11/2013

12/12/2017

31/05/2018

31/05/2018

22/06/2017

28/11/2013

28/11/2013

28/11/2013

12/12/2017

31/05/2018

31/05/2018

13/09/2013

13/09/2013

26/09/2013

26/09/2013

28/11/2013

28/11/2013

31/05/2018

31/05/2018

13/09/2013

13/09/2013

26/11/2015

26/11/2015

28/11/2013

28/11/2013

Page: 3 /6

CitiFirst Instalment MINIs - current interest rate 7.70%pa

Effective Date:

19-Jun-13

CitiFirst Instalment

MINI ASX Code

Underlying

Final Instalment

(Loan Amount)

Stop Loss Trigger

Level

Current Share

Price

Gearing

First Instalment

(Indicative IM Price)

Approx % from

Stop Loss

Expiry

SUNJOG

SUNJOJ

SUNJOK

TAHJOA

TAHJOD

TAHJOE

TCLJOJ

TCLJOK

TLSJOC

TLSJOE

TLSJOF

TLSJOG

TLSJOH

TLSJOI

TLSJOJ

TLSJOK

TOLJOA

TOLJOB

TOLJOC

TSEJOA

TSEJOJ

WBCJOC

WBCJOE

WBCJOF

WBCJOG

WBCJOH

WBCJOJ

WBCJOK

WDCJOE

WDCJOF

WDCJOG

WDCJOJ

WDCJOK

WESJOE

WESJOF

WESJOG

WESJOH

WESJOI

WESJOJ

SUNCORP GROUP LT

SUNCORP GROUP LT

SUNCORP GROUP LT

TABCORP HLDGS

TABCORP HLDGS

TABCORP HLDGS

TRANSURBAN GROUP

TRANSURBAN GROUP

TELSTRA CORP

TELSTRA CORP

TELSTRA CORP

TELSTRA CORP

TELSTRA CORP

TELSTRA CORP

TELSTRA CORP

TELSTRA CORP

TOLL HLDGS LTD

TOLL HLDGS LTD

TOLL HLDGS LTD

TRANSFIELD SERVICES LTD

TRANSFIELD SERVICES LTD

WESTPAC BANKING

WESTPAC BANKING

WESTPAC BANKING

WESTPAC BANKING

WESTPAC BANKING

WESTPAC BANKING

WESTPAC BANKING

WESTFIELD GROUP

WESTFIELD GROUP

WESTFIELD GROUP

WESTFIELD GROUP

WESTFIELD GROUP

WESFARMERS LTD

WESFARMERS LTD

WESFARMERS LTD

WESFARMERS LTD

WESFARMERS LTD

WESFARMERS LTD

$8.4091

$6.2899

$8.7978

$1.7174

$2.1363

$1.9366

$3.4509

$4.8252

$1.9960

$4.1039

$3.6176

$3.2374

$3.1245

$2.7928

$2.4477

$3.4308

$3.0283

$3.9049

$3.6592

$0.5507

$0.4615

$11.7672

$15.5419

$21.7928

$19.9331

$18.6462

$14.6463

$20.5048

$5.6444

$7.8937

$6.8598

$5.9087

$8.2761

$21.0854

$29.5155

$27.1392

$18.7470

$26.5583

$25.7879

$9.2200

$6.9000

$9.6500

$1.8800

$2.3400

$2.1200

$3.7800

$5.2900

$2.1900

$4.4900

$3.9600

$3.3800

$3.4300

$3.0600

$2.6800

$3.7600

$3.3200

$4.2900

$4.0100

$0.6400

$0.5100

$12.9000

$17.0400

$23.8800

$20.8600

$20.4400

$16.0600

$22.4800

$6.1800

$8.6500

$7.5200

$6.4800

$9.0800

$23.1100

$32.3500

$28.4000

$20.5500

$29.1200

$28.2700

$12.27

$12.27

$12.27

$3.26

$3.26

$3.26

$6.89

$6.89

$4.64

$4.64

$4.64

$4.64

$4.64

$4.64

$4.64

$4.64

$5.03

$5.03

$5.03

$0.73

$0.73

$29.45

$29.45

$29.45

$29.45

$29.45

$29.45

$29.45

$11.30

$11.30

$11.30

$11.30

$11.30

$38.46

$38.46

$38.46

$38.46

$38.46

$38.46

68.53%

51.26%

71.70%

52.68%

65.53%

59.40%

50.09%

70.03%

43.02%

88.45%

77.97%

69.77%

67.34%

60.19%

52.75%

73.94%

60.20%

77.63%

72.75%

75.44%

63.22%

39.96%

52.77%

74.00%

67.68%

63.31%

49.73%

69.63%

49.95%

69.86%

60.71%

52.29%

73.24%

54.82%

76.74%

70.56%

48.74%

69.05%

67.05%

$3.86

$5.98

$3.47

$1.54

$1.12

$1.32

$3.44

$2.06

$2.64

$0.54

$1.02

$1.40

$1.52

$1.85

$2.19

$1.21

$2.00

$1.13

$1.37

$0.18

$0.27

$17.68

$13.91

$7.66

$9.52

$10.80

$14.80

$8.95

$5.66

$3.41

$4.44

$5.39

$3.02

$17.37

$8.94

$11.32

$19.71

$11.90

$12.67

24.86%

43.77%

21.35%

42.33%

28.22%

34.97%

45.14%

23.22%

52.80%

3.23%

14.66%

27.16%

26.08%

34.05%

42.24%

18.97%

34.00%

14.71%

20.28%

12.33%

30.14%

56.20%

42.14%

18.91%

29.17%

30.59%

45.47%

23.67%

45.31%

23.45%

33.45%

42.65%

19.65%

39.91%

15.89%

26.16%

46.57%

24.28%

26.50%

26/11/2015

31/05/2018

31/05/2018

26/09/2013

26/09/2013

26/11/2015

31/05/2018

31/05/2018

22/06/2017

28/11/2013

28/11/2013

28/11/2013

12/12/2017

26/11/2015

31/05/2018

31/05/2018

26/09/2013

26/09/2013

26/11/2015

26/11/2015

31/05/2018

22/06/2017

28/11/2013

28/11/2013

28/11/2013

12/12/2017

31/05/2018

31/05/2018

28/11/2013

28/11/2013

26/11/2015

31/05/2018

31/05/2018

28/11/2013

28/11/2013

28/11/2013

12/12/2017

12/12/2017

26/11/2015

Page: 4 /6

CitiFirst Instalment MINIs - current interest rate 7.70%pa

Effective Date:

19-Jun-13

CitiFirst Instalment

MINI ASX Code

Underlying

Final Instalment

(Loan Amount)

Stop Loss Trigger

Level

Current Share

Price

Gearing

First Instalment

(Indicative IM Price)

Approx % from

Stop Loss

Expiry

WESJOK

WESJOL

WORJOA

WORJOB

WORJOC

WOWJOC

WOWJOE

WOWJOF

WOWJOG

WOWJOH

WOWJOI

WOWJOJ

WOWJOK

WPLJOC

WPLJOE

WPLJOF

WPLJOH

WPLJOI

WPLJOJ

WPLJOK

YM1JOA

YM1JOB

WESFARMERS LTD

WESFARMERS LTD

WORLEYPARSONS

WORLEYPARSONS

WORLEYPARSONS

WOOLWORTHS LTD

WOOLWORTHS LTD

WOOLWORTHS LTD

WOOLWORTHS LTD

WOOLWORTHS LTD

WOOLWORTHS LTD

WOOLWORTHS LTD

WOOLWORTHS LTD

WOODSIDE PETRO

WOODSIDE PETRO

WOODSIDE PETRO

WOODSIDE PETRO

WOODSIDE PETRO

WOODSIDE PETRO

WOODSIDE PETRO

BETASHARES AUS TOP 20 EQ YLD

BETASHARES AUS TOP 20 EQ YLD

$28.2492

$20.1838

$13.9540

$14.6393

$15.6155

$14.2676

$17.5251

$18.5413

$23.1766

$21.6111

$17.8885

$16.3918

$22.9525

$16.6443

$29.2402

$24.7972

$24.3778

$21.7551

$18.3480

$25.6912

$5.7895

$8.1033

$30.9800

$22.1300

$15.3000

$16.0500

$17.1200

$15.6400

$19.2100

$20.3200

$24.2500

$23.7000

$19.6100

$17.9700

$25.1700

$18.2500

$32.0600

$27.1900

$26.7300

$23.8500

$20.1200

$28.1700

$6.3500

$8.8800

$38.46

$38.46

$19.30

$19.30

$19.30

$32.03

$32.03

$32.03

$32.03

$32.03

$32.03

$32.03

$32.03

$34.83

$34.83

$34.83

$34.83

$34.83

$34.83

$34.83

$10.90

$10.90

73.45%

52.48%

72.30%

75.85%

80.91%

44.54%

54.71%

57.89%

72.36%

67.47%

55.85%

51.18%

71.66%

47.79%

83.95%

71.19%

69.99%

62.46%

52.68%

73.76%

53.11%

74.34%

$10.21

$18.28

$5.35

$4.66

$3.68

$17.76

$14.50

$13.49

$8.85

$10.42

$14.14

$15.64

$9.08

$18.19

$5.59

$10.03

$10.45

$13.07

$16.48

$9.14

$5.11

$2.80

19.45%

42.46%

20.73%

16.84%

11.30%

51.17%

40.02%

36.56%

24.29%

26.01%

38.78%

43.90%

21.42%

47.60%

7.95%

21.94%

23.26%

31.52%

42.23%

19.12%

41.74%

18.53%

31/05/2018

31/05/2018

26/09/2013

26/09/2013

26/11/2015

22/06/2017

28/11/2013

28/11/2013

28/11/2013

12/12/2017

26/11/2015

31/05/2018

31/05/2018

22/06/2017

28/11/2013

28/11/2013

12/12/2017

26/11/2015

31/05/2018

31/05/2018

26/11/2015

26/11/2015

The information is made available by Citigroup Global Markets Australia Pty Limited ("Citigroup Global Markets") ABN 64 003 114 832 and AFSL 240992, Participant of the ASX Group. This information does not take into account

the investment objectives or financial situation of any particular person. Investors should be aware that there are risks of investing and that prices both rise and fall. Investors should read the Product Disclosure Document which details

all of the risks of investing in CitiFirst MINIs. Investors should also seek their own independent financial advice based on their own circumstances before making a decision.

The terms set forth herein are intended for discussion purposes only and subject to the final expression of the terms of transaction as set forth in a definitive agreement and/or confirmation. Any prices provided herein (other than

those that are identified as being historical) are indicative only and do not represent firm quotes as to either price or size. All opinions and estimates included in this document constitute our judgment as of this date and are subject to change

This material does not purport to identify the nature of the specific market or other risks associated with a particular transaction. Before entering into a derivative transaction, you should ensure that you fully understand the terms

of the transaction, relevant risk factors, the nature and extent of your risk of loss and the nature of the contractual relationship into which you are entering. You should also carefully evaluate whether the transaction is appropriate

for you in light of your experience, objectives, financial resources, and other relevant circumstances and whether you have the operational resources in place to monitor the associated risks and contractual obligations over the term of the

The ultimate decision to proceed with any investments is solely with you. We are not acting as your advisor or agent. Therefore prior to entering into the investment decision you should determine, without reliance

upon us or our affiliates, the economic risks and merits, as well as the legal, tax and accounting characterizations and consequences of the transaction, and independently determine that you are able to assume these risks. In this regard,

by acceptance of these information, you acknowledge that you have been advised that (a) we are not in the business of providing legal, tax or accounting advice, (b) you understand that there may be legal, tax or accounting risks

associated with the transaction, (c) you should receive legal tax and accounting advice from advisors with appropriate expertise to assess relevant risks, and (d) you should apprise senior management in your organization

as to the legal, tax and accounting advice (and, if acceptable, risks) associated with this transaction and our disclaimers as to these matters.

Page: 5 /6

CitiFirst Instalment MINIs - current interest rate 7.70%pa

CitiFirst Instalment

MINI ASX Code

Underlying

Final Instalment

(Loan Amount)

Effective Date:

Stop Loss Trigger

Level

Current Share

Price

Gearing

First Instalment

(Indicative IM Price)

Approx % from

Stop Loss

19-Jun-13

Expiry

If you are acting as a financial adviser or agent, you should evaluate these considerations in light of the circumstances applicable to your principal and the scope of your authority. If you believe you need assistance

in evaluating and understanding the terms or risks of a particular financial product, you should consult appropriate advisers before entering into the transaction.

We and/or our affiliates (together, the "Firm") may from time to time take proprietary positions and/or make a market in instruments identical or economically related to derivative transactions entered into with you, or may have

an investment banking or other commercial relationship with and access to information from the issuer(s) of financial products underlying derivative transactions entered into with you. We may also undertake proprietary activities,

including hedging transactions related to the initiation or termination of a derivative transaction with you, that may adversely affect the market price, rate, index or other market factors(s) underlying a derivative transaction

entered into with you and consequently the value of the transaction. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise disseminated in whole

or in part without our written consent unless required to by judicial or administrative proceeding.

© Citigroup 2012. All Rights Reserved. Citi and the Red Arc Device are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.

Any unauthorized use, duplication, redistribution or disclosure is prohibited by law and will result in prosecution.

Page: 6 /6