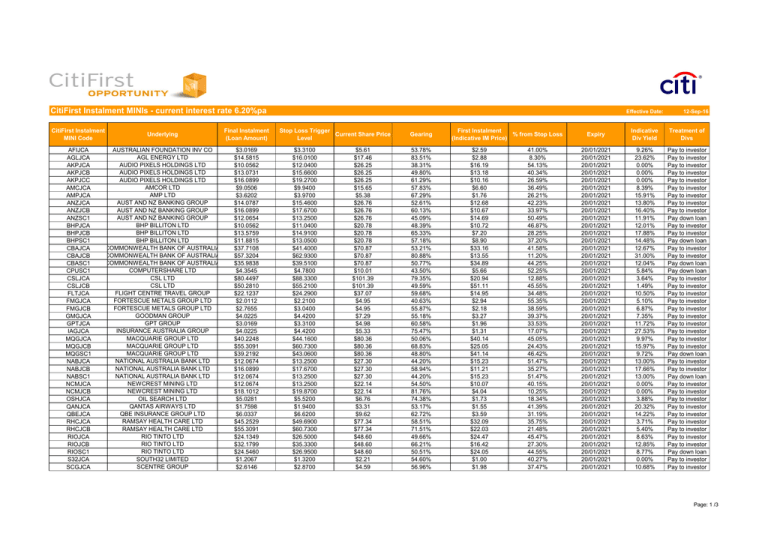

CitiFirst Instalment MINIs - current interest rate 6.20%pa

CitiFirst Instalment

MINI Code

Underlying

Final Instalment

(Loan Amount)

AFIJCA

AGLJCA

AKPJCA

AKPJCB

AKPJCC

AMCJCA

AMPJCA

ANZJCA

ANZJCB

ANZSC1

BHPJCA

BHPJCB

BHPSC1

CBAJCA

CBAJCB

CBASC1

CPUSC1

CSLJCA

CSLJCB

FLTJCA

FMGJCA

FMGJCB

GMGJCA

GPTJCA

IAGJCA

MQGJCA

MQGJCB

MQGSC1

NABJCA

NABJCB

NABSC1

NCMJCA

NCMJCB

OSHJCA

QANJCA

QBEJCA

RHCJCA

RHCJCB

RIOJCA

RIOJCB

RIOSC1

S32JCA

SCGJCA

AUSTRALIAN FOUNDATION INV CO

AGL ENERGY LTD

AUDIO PIXELS HOLDINGS LTD

AUDIO PIXELS HOLDINGS LTD

AUDIO PIXELS HOLDINGS LTD

AMCOR LTD

AMP LTD

AUST AND NZ BANKING GROUP

AUST AND NZ BANKING GROUP

AUST AND NZ BANKING GROUP

BHP BILLITON LTD

BHP BILLITON LTD

BHP BILLITON LTD

COMMONWEALTH BANK OF AUSTRALIA

COMMONWEALTH BANK OF AUSTRALIA

COMMONWEALTH BANK OF AUSTRALIA

COMPUTERSHARE LTD

CSL LTD

CSL LTD

FLIGHT CENTRE TRAVEL GROUP

FORTESCUE METALS GROUP LTD

FORTESCUE METALS GROUP LTD

GOODMAN GROUP

GPT GROUP

INSURANCE AUSTRALIA GROUP

MACQUARIE GROUP LTD

MACQUARIE GROUP LTD

MACQUARIE GROUP LTD

NATIONAL AUSTRALIA BANK LTD

NATIONAL AUSTRALIA BANK LTD

NATIONAL AUSTRALIA BANK LTD

NEWCREST MINING LTD

NEWCREST MINING LTD

OIL SEARCH LTD

QANTAS AIRWAYS LTD

QBE INSURANCE GROUP LTD

RAMSAY HEALTH CARE LTD

RAMSAY HEALTH CARE LTD

RIO TINTO LTD

RIO TINTO LTD

RIO TINTO LTD

SOUTH32 LIMITED

SCENTRE GROUP

$3.0169

$14.5815

$10.0562

$13.0731

$16.0899

$9.0506

$3.6202

$14.0787

$16.0899

$12.0654

$10.0562

$13.5759

$11.8815

$37.7108

$57.3204

$35.9838

$4.3545

$80.4497

$50.2810

$22.1237

$2.0112

$2.7655

$4.0225

$3.0169

$4.0225

$40.2248

$55.3091

$39.2192

$12.0674

$16.0899

$12.0674

$12.0674

$18.1012

$5.0281

$1.7598

$6.0337

$45.2529

$55.3091

$24.1349

$32.1799

$24.5460

$1.2067

$2.6146

Effective Date:

Stop Loss Trigger

Current Share Price

Level

$3.3100

$16.0100

$12.0400

$15.6600

$19.2700

$9.9400

$3.9700

$15.4600

$17.6700

$13.2500

$11.0400

$14.9100

$13.0500

$41.4000

$62.9300

$39.5100

$4.7800

$88.3300

$55.2100

$24.2900

$2.2100

$3.0400

$4.4200

$3.3100

$4.4200

$44.1600

$60.7300

$43.0600

$13.2500

$17.6700

$13.2500

$13.2500

$19.8700

$5.5200

$1.9400

$6.6200

$49.6900

$60.7300

$26.5000

$35.3300

$26.9500

$1.3200

$2.8700

$5.61

$17.46

$26.25

$26.25

$26.25

$15.65

$5.38

$26.76

$26.76

$26.76

$20.78

$20.78

$20.78

$70.87

$70.87

$70.87

$10.01

$101.39

$101.39

$37.07

$4.95

$4.95

$7.29

$4.98

$5.33

$80.36

$80.36

$80.36

$27.30

$27.30

$27.30

$22.14

$22.14

$6.76

$3.31

$9.62

$77.34

$77.34

$48.60

$48.60

$48.60

$2.21

$4.59

Gearing

53.78%

83.51%

38.31%

49.80%

61.29%

57.83%

67.29%

52.61%

60.13%

45.09%

48.39%

65.33%

57.18%

53.21%

80.88%

50.77%

43.50%

79.35%

49.59%

59.68%

40.63%

55.87%

55.18%

60.58%

75.47%

50.06%

68.83%

48.80%

44.20%

58.94%

44.20%

54.50%

81.76%

74.38%

53.17%

62.72%

58.51%

71.51%

49.66%

66.21%

50.51%

54.60%

56.96%

First Instalment

% from Stop Loss

(Indicative IM Price)

$2.59

$2.88

$16.19

$13.18

$10.16

$6.60

$1.76

$12.68

$10.67

$14.69

$10.72

$7.20

$8.90

$33.16

$13.55

$34.89

$5.66

$20.94

$51.11

$14.95

$2.94

$2.18

$3.27

$1.96

$1.31

$40.14

$25.05

$41.14

$15.23

$11.21

$15.23

$10.07

$4.04

$1.73

$1.55

$3.59

$32.09

$22.03

$24.47

$16.42

$24.05

$1.00

$1.98

41.00%

8.30%

54.13%

40.34%

26.59%

36.49%

26.21%

42.23%

33.97%

50.49%

46.87%

28.25%

37.20%

41.58%

11.20%

44.25%

52.25%

12.88%

45.55%

34.48%

55.35%

38.59%

39.37%

33.53%

17.07%

45.05%

24.43%

46.42%

51.47%

35.27%

51.47%

40.15%

10.25%

18.34%

41.39%

31.19%

35.75%

21.48%

45.47%

27.30%

44.55%

40.27%

37.47%

12-Sep-16

Expiry

Indicative

Div Yield

Treatment of

Divs

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

9.26%

23.62%

0.00%

0.00%

0.00%

8.39%

15.91%

13.80%

16.40%

11.91%

12.01%

17.88%

14.48%

12.67%

31.00%

12.04%

5.84%

3.64%

1.49%

10.50%

5.10%

6.87%

7.35%

11.72%

27.53%

9.97%

15.97%

9.72%

13.00%

17.66%

13.00%

0.00%

0.00%

3.88%

20.32%

14.22%

3.71%

5.40%

8.63%

12.85%

8.77%

0.00%

10.68%

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay down loan

Pay down loan

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Page: 1 /3

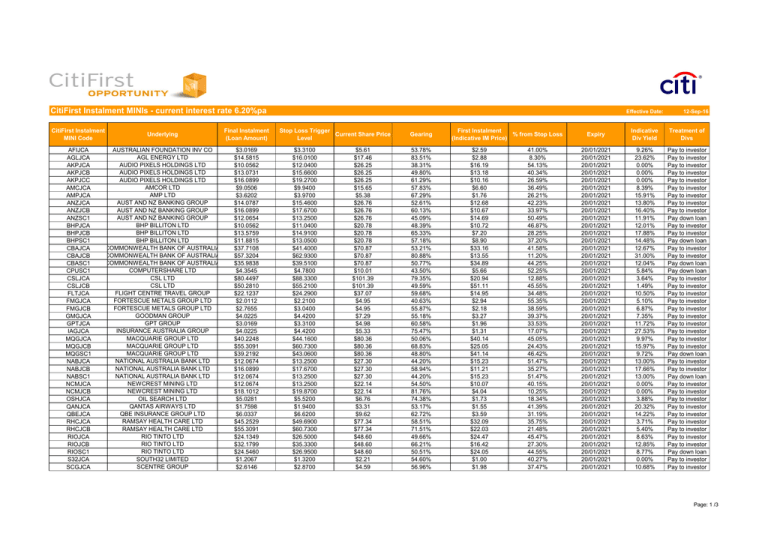

CitiFirst Instalment MINIs - current interest rate 6.20%pa

CitiFirst Instalment

MINI Code

Underlying

Final Instalment

(Loan Amount)

SCGJCB

SCGSC1

SFYJCA

SGPJCA

STOJCA

SUNJCA

SUNJCB

SYDJCA

SYDSC1

TCLJCA

TCLJCB

TCLSC1

TLSJCA

TLSJCB

TLSSC1

WBCJCA

WBCJCB

WBCSC1

WESJCA

WESJCB

WESSC1

WFDSC1

WOWJCA

WOWJCB

WOWSC1

WPLJCA

WPLJCB

SCENTRE GROUP

SCENTRE GROUP

SPDR S&P/ASX 50 FUND

STOCKLAND

SANTOS LTD

SUNCORP GROUP LTD

SUNCORP GROUP LTD

SYDNEY AIRPORT

SYDNEY AIRPORT

TRANSURBAN GROUP

TRANSURBAN GROUP

TRANSURBAN GROUP

TELSTRA CORP LTD

TELSTRA CORP LTD

TELSTRA CORP LTD

WESTPAC BANKING CORP

WESTPAC BANKING CORP

WESTPAC BANKING CORP

WESFARMERS LTD

WESFARMERS LTD

WESFARMERS LTD

WESTFIELD CORP

WOOLWORTHS LTD

WOOLWORTHS LTD

WOOLWORTHS LTD

WOODSIDE PETROLEUM LTD

WOODSIDE PETROLEUM LTD

$3.5197

$2.5076

$28.1574

$2.5141

$2.7152

$6.5365

$9.5534

$4.0225

$4.5253

$5.0281

$8.0450

$7.0393

$3.2180

$2.8157

$2.6602

$16.0899

$19.1068

$15.0843

$24.1349

$27.6546

$19.1602

$5.8692

$12.0674

$16.5927

$12.7428

$16.0899

$20.1124

Effective Date:

Stop Loss Trigger

Current Share Price

Level

$3.8600

$2.7500

$30.9200

$2.7600

$2.9800

$7.1800

$10.4900

$4.4200

$4.9700

$5.5200

$8.8300

$7.7300

$3.5300

$3.0900

$2.9200

$17.6700

$20.9800

$16.5600

$26.5000

$30.3600

$21.0400

$6.4400

$13.2500

$18.2200

$14.0200

$17.6700

$22.0800

$4.59

$4.59

$50.27

$4.62

$4.00

$12.59

$12.59

$6.85

$6.85

$10.86

$10.86

$10.86

$5.06

$5.06

$5.06

$29.54

$29.54

$29.54

$42.65

$42.65

$42.65

$9.90

$22.85

$22.85

$22.85

$28.32

$28.32

Gearing

76.68%

54.63%

56.01%

54.42%

67.88%

51.92%

75.88%

58.72%

66.06%

46.30%

74.08%

64.82%

63.60%

55.65%

52.57%

54.47%

64.68%

51.06%

56.59%

64.84%

44.92%

59.28%

52.81%

72.62%

55.77%

56.81%

71.02%

First Instalment

% from Stop Loss

(Indicative IM Price)

$1.07

$2.08

$22.11

$2.11

$1.28

$6.05

$3.04

$2.83

$2.32

$5.83

$2.82

$3.82

$1.84

$2.24

$2.40

$13.45

$10.43

$14.46

$18.52

$15.00

$23.49

$4.03

$10.78

$6.26

$10.11

$12.23

$8.21

15.90%

40.09%

38.49%

40.26%

25.50%

42.97%

16.68%

35.47%

27.45%

49.17%

18.69%

28.82%

30.24%

38.93%

42.29%

40.18%

28.98%

43.94%

37.87%

28.82%

50.67%

34.95%

42.01%

20.26%

38.64%

37.61%

22.03%

12-Sep-16

Expiry

Indicative

Div Yield

Treatment of

Divs

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

20/01/2021

19.71%

10.13%

11.56%

11.63%

3.89%

11.23%

22.39%

9.90%

12.04%

7.80%

16.16%

11.91%

16.83%

13.81%

12.92%

13.98%

18.02%

13.01%

10.05%

12.40%

7.92%

8.43%

13.82%

23.81%

14.74%

8.47%

12.62%

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

Pay down loan

Pay down loan

Pay to investor

Pay to investor

Pay down loan

Pay to investor

Pay to investor

The information is made available by Citigroup Global Markets Australia Pty Limited ("Citigroup Global Markets") ABN 64 003 114 832 and AFSL 240992, Participant of the ASX Group and Chi-X Australia. This information does not take into account

the investment objectives or financial situation of any particular person. Investors should be aware that there are risks of investing and that prices both rise and fall. Investors should read the Product Disclosure Document which details

all of the risks of investing in CitiFirst MINIs. Investors should also seek their own independent financial advice based on their own circumstances before making a decision.

The terms set forth herein are intended for discussion purposes only and subject to the final expression of the terms of transaction as set forth in a definitive agreement and/or confirmation. Any prices provided herein (other than

those that are identified as being historical) are indicative only and do not represent firm quotes as to either price or size. All opinions and estimates included in this document constitute our judgment as of this date and are subject to change without

This material does not purport to identify the nature of the specific market or other risks associated with a particular transaction. Before entering into a derivative transaction, you should ensure that you fully understand the terms

of the transaction, relevant risk factors, the nature and extent of your risk of loss and the nature of the contractual relationship into which you are entering. You should also carefully evaluate whether the transaction is appropriate

for you in light of your experience, objectives, financial resources, and other relevant circumstances and whether you have the operational resources in place to monitor the associated risks and contractual obligations over the term of the transaction.

The ultimate decision to proceed with any investments is solely with you. We are not acting as your advisor or agent. Therefore prior to entering into the investment decision you should determine, without reliance

upon us or our affiliates, the economic risks and merits, as well as the legal, tax and accounting characterizations and consequences of the transaction, and independently determine that you are able to assume these risks. In this regard,

by acceptance of these information, you acknowledge that you have been advised that (a) we are not in the business of providing legal, tax or accounting advice, (b) you understand that there may be legal, tax or accounting risks

Page: 2 /3

CitiFirst Instalment MINIs - current interest rate 6.20%pa

CitiFirst Instalment

MINI Code

Underlying

Final Instalment

(Loan Amount)

Effective Date:

Stop Loss Trigger

Current Share Price

Level

Gearing

First Instalment

% from Stop Loss

(Indicative IM Price)

Expiry

Indicative

Div Yield

12-Sep-16

Treatment of

Divs

associated with the transaction, (c) you should receive legal tax and accounting advice from advisors with appropriate expertise to assess relevant risks, and (d) you should apprise senior management in your organization

as to the legal, tax and accounting advice (and, if acceptable, risks) associated with this transaction and our disclaimers as to these matters.

If you are acting as a financial adviser or agent, you should evaluate these considerations in light of the circumstances applicable to your principal and the scope of your authority. If you believe you need assistance

in evaluating and understanding the terms or risks of a particular financial product, you should consult appropriate advisers before entering into the transaction.

We and/or our affiliates (together, the "Firm") may from time to time take proprietary positions and/or make a market in instruments identical or economically related to derivative transactions entered into with you, or may have

an investment banking or other commercial relationship with and access to information from the issuer(s) of financial products underlying derivative transactions entered into with you. We may also undertake proprietary activities,

including hedging transactions related to the initiation or termination of a derivative transaction with you, that may adversely affect the market price, rate, index or other market factors(s) underlying a derivative transaction

entered into with you and consequently the value of the transaction. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise disseminated in whole

or in part without our written consent unless required to by judicial or administrative proceeding.

© Citigroup 2015. All Rights Reserved. Citi and the Red Arc Device are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.

Any unauthorized use, duplication, redistribution or disclosure is prohibited by law and will result in prosecution.

Page: 3 /3