MARE - Productivity Gains Surprisingly Strong.indd

advertisement

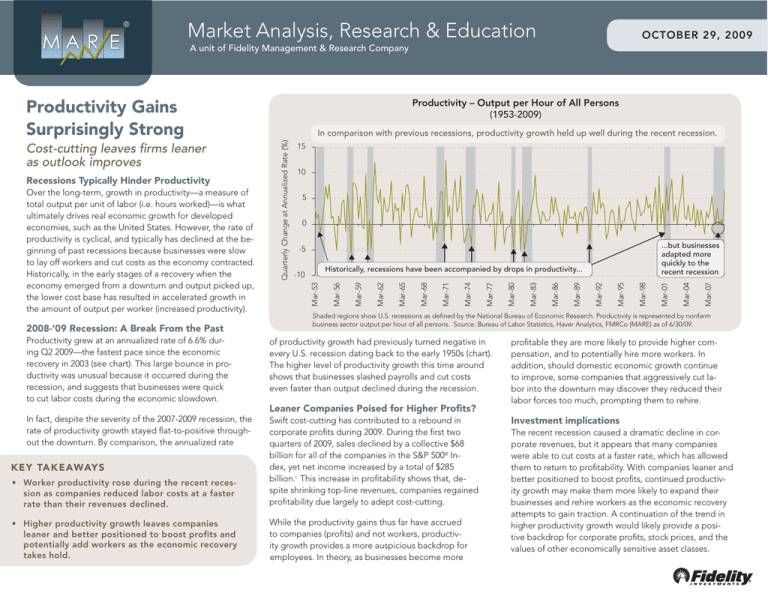

® Market Analysis, Research & Education OCTOBER 29, 2009 A unit of Fidelity Management & Research Company Productivity – Output per Hour of All Persons (1953-2009) Productivity Gains Surprisingly Strong 2008-‘09 Recession: A Break From the Past Productivity grew at an annualized rate of 6.6% during Q2 2009—the fastest pace since the economic recovery in 2003 (see chart). This large bounce in productivity was unusual because it occurred during the recession, and suggests that businesses were quick to cut labor costs during the economic slowdown. 5 0 Mar-07 Mar-04 Mar-01 Mar-98 Mar-95 Mar-92 Mar-89 Mar-86 Mar-83 Mar-80 Shaded regions show U.S. recessions as defined by the National Bureau of Economic Research. Productivity is represented by nonfarm business sector output per hour of all persons. Source: Bureau of Labor Statistics, Haver Analytics, FMRCo (MARE) as of 6/30/09. of productivity growth had previously turned negative in every U.S. recession dating back to the early 1950s (chart). The higher level of productivity growth this time around shows that businesses slashed payrolls and cut costs even faster than output declined during the recession. • Worker productivity rose during the recent recession as companies reduced labor costs at a faster rate than their revenues declined. Swift cost-cutting has contributed to a rebound in corporate profits during 2009. During the first two quarters of 2009, sales declined by a collective $68 billion for all of the companies in the S&P 500® Index, yet net income increased by a total of $285 billion.i This increase in profitability shows that, despite shrinking top-line revenues, companies regained profitability due largely to adept cost-cutting. • Higher productivity growth leaves companies leaner and better positioned to boost profits and potentially add workers as the economic recovery takes hold. While the productivity gains thus far have accrued to companies (profits) and not workers, productivity growth provides a more auspicious backdrop for employees. In theory, as businesses become more KEY TAKEAWAYS Mar-77 Mar-74 Mar-71 Mar-68 Mar-65 Mar-62 Mar-59 Historically, recessions have been accompanied by drops in productivity... -10 Leaner Companies Poised for Higher Profits? In fact, despite the severity of the 2007-2009 recession, the rate of productivity growth stayed flat-to-positive throughout the downturn. By comparison, the annualized rate ...but businesses adapted more quickly to the recent recession -5 Mar-56 Over the long-term, growth in productivity—a measure of total output per unit of labor (i.e. hours worked)—is what ultimately drives real economic growth for developed economies, such as the United States. However, the rate of productivity is cyclical, and typically has declined at the beginning of past recessions because businesses were slow to lay off workers and cut costs as the economy contracted. Historically, in the early stages of a recovery when the economy emerged from a downturn and output picked up, the lower cost base has resulted in accelerated growth in the amount of output per worker (increased productivity). 10 Mar-53 Recessions Typically Hinder Productivity Quarterly Change at Annualized Rate (%) Cost-cutting leaves firms leaner as outlook improves In comparison with previous recessions, productivity growth held up well during the recent recession. 15 profitable they are more likely to provide higher compensation, and to potentially hire more workers. In addition, should domestic economic growth continue to improve, some companies that aggressively cut labor into the downturn may discover they reduced their labor forces too much, prompting them to rehire. Investment implications The recent recession caused a dramatic decline in corporate revenues, but it appears that many companies were able to cut costs at a faster rate, which has allowed them to return to profitability. With companies leaner and better positioned to boost profits, continued productivity growth may make them more likely to expand their businesses and rehire workers as the economic recovery attempts to gain traction. A continuation of the trend in higher productivity growth would likely provide a positive backdrop for corporate profits, stock prices, and the values of other economically sensitive asset classes. ® Market Analysis, Research & Education OCTOBER 29, 2009 A unit of Fidelity Management & Research Company The Market Analysis, Research and Education (MARE) group, a unit of Fidelity Management & Research Co. (FMRCo.), provides timely analysis on developments in the financial markets. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Past performance is no guarantee of future results. [i] Source: FactSet, FMRCo (MARE) as of 6/30/09. The S&P 500®, a market-capitalization-weighted index of common stocks, is a registered service mark of the McGraw-Hill Companies, Inc. and has been licensed for use by Fidelity Distributors Corporation. All indices are unmanaged and performance of the indices include reinvestment of dividends and interest income, unless otherwise noted, are not illustrative of any particular investment and an investment cannot be made in any index. Brokerage products and services and workplace savings plan products and services offered directly to investors and plan sponsors provided by Fidelity Brokerage Services, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917. Investment and workplace savings plan products and services distributed through investment professionals provided by Fidelity Investments Institutional Services Company, Inc., 82 Devonshire Street, Boston, MA 02109. 535479.1.0