Slide 2

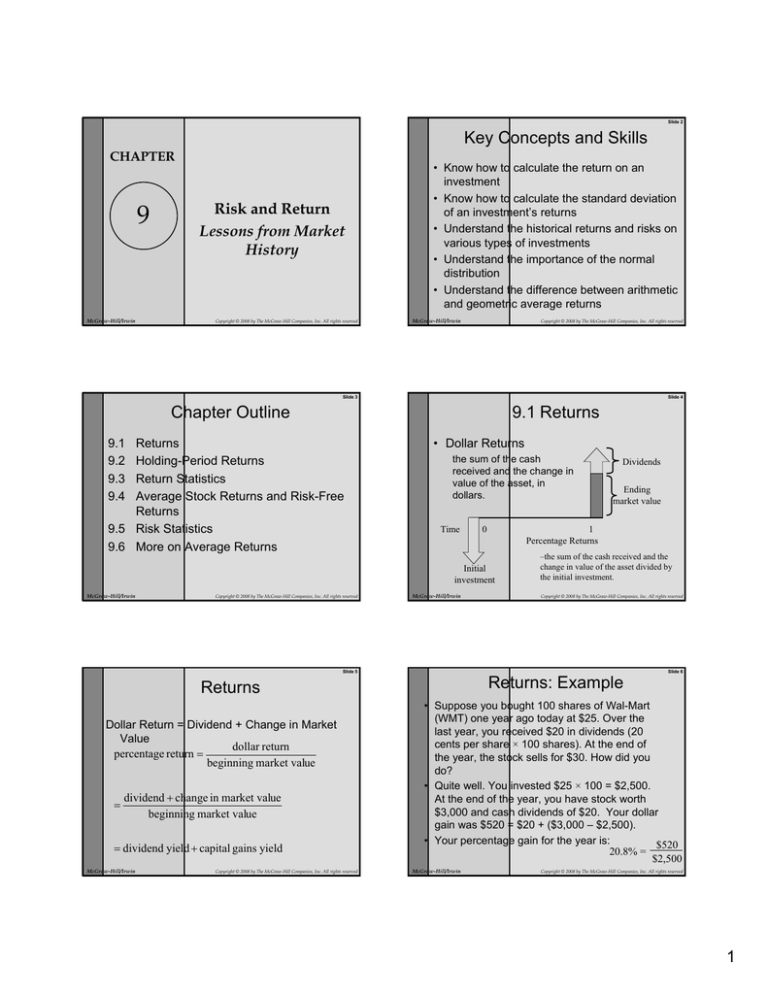

Key Concepts and Skills

CHAPTER

9

McGraw-Hill/Irwin

Risk and Return

Lessons from Market

History

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

• Know how to calculate the return on an

investment

• Know how to calculate the standard deviation

of an investment’s returns

• Understand the historical returns and risks on

various types of investments

• Understand the importance of the normal

distribution

• Understand the difference between arithmetic

and geometric average returns

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Slide 3

Slide 4

Chapter Outline

9.1 Returns

9.1

9.2

9.3

9.4

Returns

Holding-Period Returns

Return Statistics

Average Stock Returns and Risk-Free

Returns

9.5 Risk Statistics

9.6 More on Average Returns

• Dollar Returns

the sum of the cash

received and the change in

value of the asset, in

dollars.

Time

0

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

Ending

market value

1

Percentage Returns

Initial

investment

McGraw-Hill/Irwin

Dividends

–the sum of the cash received and the

change in value of the asset divided by

the initial investment.

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Slide 5

Slide 6

Returns: Example

Returns

Dollar Return = Dividend + Change in Market

Value

dollar return

percentage return =

beginning market value

=

dividend + change in market value

beginning market value

= dividend yield + capital gains yield

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

• Suppose you bought 100 shares of Wal-Mart

(WMT) one year ago today at $25. Over the

last year, you received $20 in dividends (20

cents per share × 100 shares). At the end of

the year, the stock sells for $30. How did you

do?

• Quite well. You invested $25 × 100 = $2,500.

At the end of the year, you have stock worth

$3,000 and cash dividends of $20. Your dollar

gain was $520 = $20 + ($3,000 – $2,500).

• Your percentage gain for the year is:

$520

20.8% =

$2,500

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

1

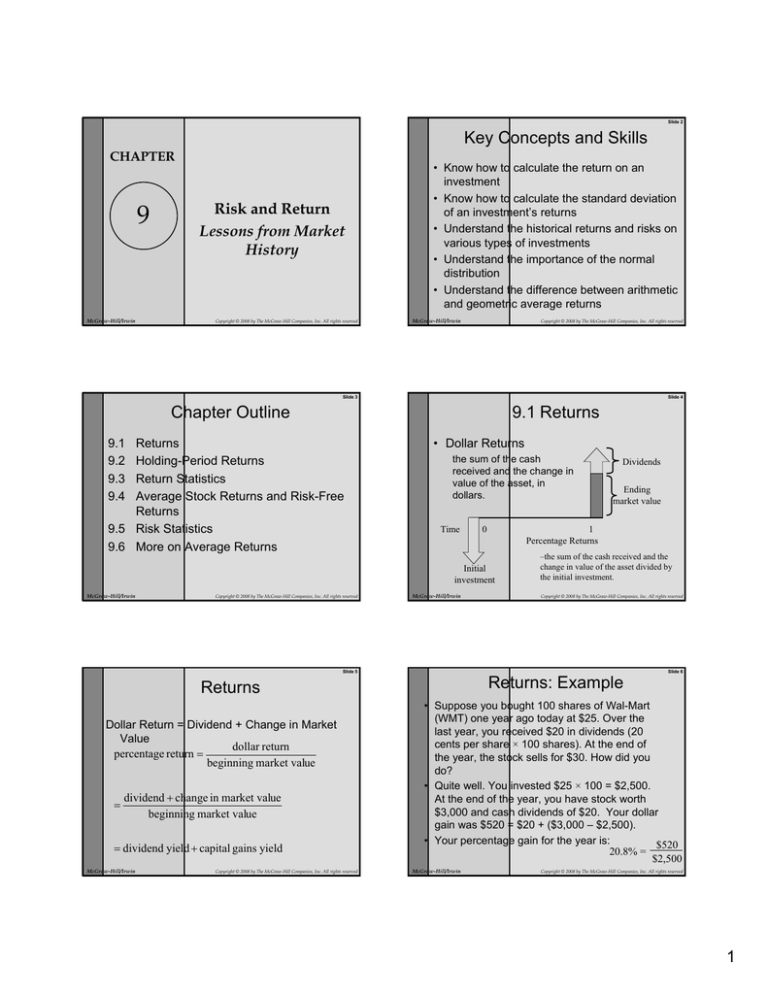

Slide 7

Slide 8

Returns: Example

9.2 Holding Period Returns

Dollar Return:

$520 gain

• The holding period return is the return

that an investor would get when

holding an investment over a period

of n years, when the return during

year i is given as ri:

$20

$3,000

Time

0

1

Percentage Return:

20.8% =

-$2,500

McGraw-Hill/Irwin

holding period return =

= (1 + r1 ) × (1 + r2 ) × "× (1 + rn ) − 1

$520

$2,500

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

Slide 9

Year Return

1

10%

2

-5%

3

20%

4

15%

Your holding period return =

= (1 + r1 ) × (1 + r2 ) × (1 + r3 ) × (1 + r4 ) − 1

= (1.10) × (.95) × (1.20) × (1.15) − 1

= .4421 = 44.21%

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Slide 10

Holding Period Returns

Holding Period Return: Example

• Suppose your investment provides

the following returns over a four-year

period:

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

• A famous set of studies dealing with rates of

returns on common stocks, bonds, and Treasury

bills was conducted by Roger Ibbotson and Rex

Sinquefield.

• They present year-by-year historical rates of

return starting in 1926 for the following five

important types of financial instruments in the

United States:

–

–

–

–

–

Large-company Common Stocks

Small-company Common Stocks

Long-term Corporate Bonds

Long-term U.S. Government Bonds

U.S. Treasury Bills

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Slide 11

9.3 Return Statistics

• The history of capital market returns can be

summarized by describing the:

– average return

( R + " + RT )

R= 1

T

– the standard deviation of those returns

( R1 − R ) 2 + ( R2 − R ) 2 + " ( RT − R ) 2

SD = VAR =

T −1

Slide 12

Historical Returns, 1926-2004

Series

Average

Annual Return

Standard

Deviation

Large Company Stocks

12.3%

20.2%

Small Company Stocks

17.4

32.9

Long-Term Corporate Bonds

6.2

8.5

Long-Term Government Bonds

5.8

9.2

U.S. Treasury Bills

3.8

3.1

Inflation

3.1

4.3

– 90%

– the frequency distribution of the returns

Distribution

0%

+ 90%

Source: © Stocks, Bonds, Bills, and Inflation 2006 Yearbook™, Ibbotson Associates, Inc., Chicago (annually updates work by

Roger G. Ibbotson and Rex A. Sinquefield). All rights reserved.

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

2

Slide 13

Slide 14

9.4 Average Stock Returns and Risk-Free

Returns

Risk Premia

• The Risk Premium is the added return (over and

above the risk-free rate) resulting from bearing risk.

• One of the most significant observations of stock

market data is the long-run excess of stock return

over the risk-free return.

• Suppose that The Wall Street Journal

announced that the current rate for one-year

Treasury bills is 5%.

• What is the expected return on the market of

small-company stocks?

• Recall that the average excess return on small

company common stocks for the period 1926

through 2005 was 13.6%.

• Given a risk-free rate of 5%, we have an

expected return on the market of small-company

stocks of 18.6% = 13.6% + 5%

– The average excess return from large company common

stocks for the period 1926 through 2005 was:

8.5% = 12.3% – 3.8%

– The average excess return from small company common

stocks for the period 1926 through 2005 was:

13.6% = 17.4% – 3.8%

– The average excess return from long-term corporate

bonds for the period 1926 through 2005 was:

2.4% = 6.2% – 3.8%

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Slide 15

Slide 16

The Risk-Return Tradeoff

9.5 Risk Statistics

• There is no universally agreed-upon

definition of risk.

• The measures of risk that we discuss

are variance and standard deviation.

18%

Small-Company Stocks

Annual Return Average

16%

14%

Large-Company Stocks

12%

10%

8%

– The standard deviation is the standard

statistical measure of the spread of a sample,

and it will be the measure we use most of this

time.

– Its interpretation is facilitated by a discussion

of the normal distribution.

6%

T-Bonds

4%

T-Bills

2%

0%

5%

10%

15%

20%

25%

30%

35%

Annual Return Standard Deviation

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Slide 17

Slide 18

Normal Distribution

• A large enough sample drawn from a

normal distribution looks like a bell-shaped

curve.

Probability

The probability that a yearly return

will fall within 20.2 percent of the

mean of 12.3 percent will be

approximately 2/3.

– 3σ

– 48.3%

– 2σ

– 28.1%

– 1σ

– 7.9%

0

12.3%

+ 1σ

32.5%

68.26%

+ 2σ

52.7%

+ 3σ

72.9%

Return on

large company common

stocks

95.44%

99.74%

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Normal Distribution

• The 20.2% standard deviation we

found for large stock returns from

1926 through 2005 can now be

interpreted in the following way: if

stock returns are approximately

normally distributed, the probability

that a yearly return will fall within 20.2

percent of the mean of 12.3% will be

approximately 2/3.

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

3

Slide 19

Example – Return and Variance

Year

Actual

Return

Average

Return

Deviation from

the Mean

1

.15

.105

.045

.002025

.09

.105

-.015

.000225

3

.06

.105

-.045

.002025

4

.12

.105

.015

.000225

.00

.0045

Totals

Variance = .0045 / (4-1) = .0015

McGraw-Hill/Irwin

9.6 More on Average Returns

• Arithmetic average – return earned in an

average period over multiple periods

• Geometric average – average compound return

per period over multiple periods

• The geometric average will be less than the

arithmetic average unless all the returns are

equal.

• Which is better?

Squared

Deviation

2

Slide 20

Standard Deviation = .03873

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

– The arithmetic average is overly optimistic for long

horizons.

– The geometric average is overly pessimistic for short

horizons.

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Slide 21

Geometric Return: Example

Slide 22

Geometric Return: Example

• Recall our earlier example:

Year Return Geometric average return =

1

10% (1 + r ) 4 = (1 + r ) × (1 + r ) × (1 + r ) × (1 + r )

1

2

3

4

g

2

-5%

4 (1.10) × (.95) × (1.20) × (1.15) − 1

=

r

g

3

20%

4

15% = .095844 = 9.58%

So, our investor made an average of 9.58% per year,

realizing a holding period return of 44.21%.

• Note that the geometric average is

not the same as the arithmetic

average:

Year Return

r1 + r2 + r3 + r4

1

10% Arithmetic average return =

4

2

-5%

3

20% = 10% − 5% + 20% + 15% = 10%

4

4

15%

1.4421 = (1.095844) 4

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Slide 23

Slide 24

Forecasting Return

• To address the time relation in forecasting

returns, use Blume’s formula:

⎛ N −T ⎞

⎛ T −1 ⎞

R (T ) = ⎜

⎟ × Arithmetic Average

⎟ × GeometricA verage + ⎜

⎝ N −1 ⎠

⎝ N −1⎠

where, T is the forecast horizon and N is the number of

years of historical data we are working with. T must be

less than N.

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

Quick Quiz

• Which of the investments discussed has

had the highest average return and risk

premium?

• Which of the investments discussed has

had the highest standard deviation?

• Why is the normal distribution informative?

• What is the difference between arithmetic

and geometric averages?

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

4

Slide 25

Contact Information

• Office: RCOB 18, U of West Georgia

• Office Phone and Voicemail: (770)3018648 (cell) or (678)839-4816 (office)

• Class Webpage: Ulearn/WEBCT Vista

• E-mail: Ulearn/WEBCT Vista (pref.) or

chodges@westga.edu (alt.)

• MSN Instant Messenger:

mba8622@hotmail.com

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved

5