438 3rd Unaudited.FH11 - Everest Finance Limited

advertisement

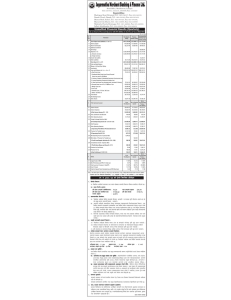

EVEREST FINANCE LIMITED

Narayanpath-7, Siddhartha Nagar, Rupandehi

Tel: 071-526507 Fax: 071-526508, E-mail: efl@ntc.net.np

Unaudited Financial Results (Quarterly)

As at 3rd Quarter of the Fiscal Year 2069/2070

S.

No.

Particulars

1

Total Capital and Liabilities ( 1.1 to 1.7 )

1.1 Paid up Capital

1.2 Reserve and Surplus

1.3 Debenture and Bonus

1.4 Borrowings

1.5 Deposits (a+b)

a.Domestic Currency

b.Foreign Currency

1.6 Income Tax Liability

1.7 Other Liabilities

2

Total Assets ( 2.1 to 2.7 )

2.1 Cash and Bank Balance

2.2 Money at Call and Short Notice

2.3 Investment

2.4 Loans and Advances

a. Real Estate Loan

b. Home/ Housing Loan

c. Margin Type Loan

d. Term Loan

e. Overdraft Loan/ TR Loan/ WC Loan

f. Others

2.5 Fixed Assets

2.6 Non Banking Assets

2.7 Other Assets

3

Profit and Loss Account

3.1

3.2

Interest Income

Interest Expenses

A . Net Interest Income (3.1-3.2)

Fees,Commission and Discount

Others Operating Income

Foreign Exchange Gain/Loss (Net)

B.Total Operting Income(A+3.3+3.4+3.5)

Staff Expenses

Other Operating Expenses

C.Operating Profit Before Provision (B-3.6-3.7)

Provision for Possible Losses

D.Operating Profit(C-3.8)

Non Operating Income/Expenses (Net)

Write Back of Provision for Possible Loss

E.Profit from Regular Activisties (D+3.9+3.10)

Extraordinary Income/Expenses (Net)

F.Profit before Bonus and Taxes(E+3.11)

Provision for Staff Bonus

Provision for Tax

G.Net Profit/Loss (F-3.12-3.13)

3.3

3.4

3.5

3.6

3.7

3.8

3.9

3.10

3.11

3.12

3.13

Rs. in '000'

This Quarter

Ending

Previous

Quarter

Ending

Corresponding

Previous Year

Quarter Ending

661,936.20

84,208.00

18,691.28

521,771.91

521,771.91

37,265.01

661,936.20

170,569.74

548.17

445,496.90

17,730.53

71,696.05

225,481.13

130,589.19

27,666.85

17,654.54

608,929.00

84,208.00

16,685.00

471,319.00

471,319.00

36,717.00

608,929.00

154,602.00

548.00

405,453.00

27,534.00

59,413.00

196,292.00

122,214.00

24,814.00

23,512.00

488,503.00

74,853.00

16,638.00

350,335.00

350,335.00

46,677.00

488,503.00

153,614.00

548.00

286,670.00

5,114.00

56,538.00

106,576.00

118,442.00

18,728.00

28,943.00

Up to

This Quarter

Up to

Previous

Quarter

50,065.37 30,187.00

34,264.60 21,800.00

15,800.77 8,387.00

4,168.75 2,524.00

19,969.53 10,911.00

4,152.05 2,863.00

7,948.91 4,643.00

7,868.57 3,405.00

4,634.39 3,323.00

3,234.17

82.00

3,234.17

82.00

3,234.17

82.00

294.02

7.45

882.05

22.36

2,058.11

52.18

Up to

Corresponding

Previous

Year Quarter

38,348.00

24,659.00

13,689.00

1,894.00

15,583.00

2,590.00

4,682.00

8,311.00

5,209.00

3,102.00

3,102.00

3,102.00

282.00

846.00

1,974.00

At the End At the End of

At the End of

Corresponding

of Previous Previous Year

This Quarter

Quarter

Quarter

4

Ratios

4.1

4.2

4.3

4.4

4.5

Capital Fund to RWA

Non Performing Loan (NPL) to Total Loan

Total Loan Loss Provision to Total NPL

Cost of Funds

Credit to Deposit Ratio (Calculated as per NRB Directives)

20.24%

1.99

149.34%

9.93

71.18%

23.10%

1.96

150.04%

9.94

70.85%

28.84%

4.15

123.10%

11.07

64.88%

Note : If the statutory and supervising authority notify to change the unaudited Financial Statements, the final figure

may change accordingly.

lwtf]kq btf{ tyf lgisfzg lgodfjnL, @)^% cg';"rL !$ -lgod @@ sf] pklgod -@_ ;+u ;DalGwt_

cf= j= @)^(÷)&) sf] t]>f] q}dfl;s ljj/0f

!= ljQLo ljj/0f

s_cf=j @)^(÷)&) sf] t]>F] q}dfl;s cjwLsf] af;nft o;} ;fy k|sflzt ul/Psf] 5 .

v_ k|d'v ljQLo cg'kftx?

P E Ratio

M #^=$!

k|lt z]o/ g]6jy{

M !!=(*

k|lt z]o/ s'n ;DklQsf] d"No M &**=^#

t/ntf cg'kft

M #%=%#

@= Aoj:yfksLo ljZn]if0fM

pQm q}dfl;s cjwldf ;+:yfsf] df}Hbft / t/ntf tflnsfdf c;fwf/0f kl/jt{g 5}g . sDkgLsf] Joj;flos of]hgf

cg'?k g} sfo{x? x'b}5g\ . lgs6 eljiodf ;+:yfsf] df}Hbft, gfkmf jf gub k|jfxdf s'g} tflTjs c;/ kg]{ b]lv+b}g .

#= sfg"gL sf/jfxL ;DaGwL ljj/0f M gePsf]

$ ;+ul7t ;+:yfsf] z]o/ sf/f]jf/ ;DaGwL ljZn]if0fM lwtf]kq ahf/df ;+:yfsf] z]o/ sf/f]af/ lgodfg';f/ ;fdfGo k|s[tLaf6}

ePsf] 5 . q}dfl;s cjwLdf ;+:yfsf] z]o/sf] clwstd d"No ?= *( / Go"gtd d"No ?= *( sfod eO{ hDdf ! lbgdf !

j6f sf/f]af/ dfkm{t @$ lsQf z]o/sf] sf/f]af/ ePsf] 5 .

%= ;d:of tyf r'gf}tL M ;+:yfn] axg ug'k{ /]sf] ;d:of tyf r'gf}ltx? ahf/df /x]sf] cGo ljQLo ;+:yf ;/x g} 5g\ . cfOkg]{ ;d:of

tyf r'gf}lt ;dfwfgsf pkfox? Aff/] ;+rfns ;ldltn] ;do ;dodf ;dLIff u/L /0flglt agfO{ ;f] lg/fs/0fsf] pkfo cjnDag

ug]{ u/]sf] 5 .

^= ;+:yfut ;'zf;gM ;+:yfut ;'zf;gsf nfuL Joj:yfkgn] sd{rf/L j[lQ lasf;, cfjZos sfo{sIf / ;fdfu|Lx?sf] ;d"lrt Joj:yf

/ sfo{sf nflu plrt jftfj/0f tof/ ug]{ u/]sf] 5 . g]kfn /fi6« a}s

+ åf/f lgb]l{ zt ;+:yfut ;'zf;g ;DalGw kl/kqsf] k"0f{kfngf

ul/Psf] 5 .

&= ;To, tYo ;DaGwdf sfo{sf/L k|dv

' sf] pb\3f]if0fM cfhsf ldlt;Dd o; k|ltj]bgdf pNn]lvt hfgsf/L tyf ljj/0fx?sf] z'4tf

;DaGwdf d JolQmut ?kdf pQ/bfloTj lnG5 . ;fy} d of] pb\3f]if ub{5' sL d}n] hfg] a'em];Dd o; k|ltj]bgdf pNn]lvt ljj/0fx?

;To, tYo / k"0f{ 5g\ / nufgLstf{x?nfO{ ;";l" rt lg0f{o lng cfjZos s'g} ljj/0f, ;"rgf tyf hfgsf/Lx? n'sfOPsf] 5}g .