Advanced Premium Tax Credits

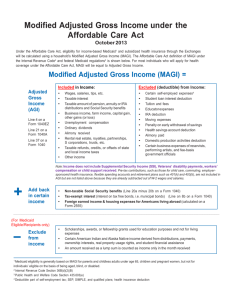

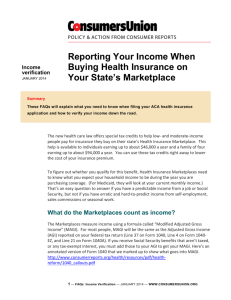

advertisement

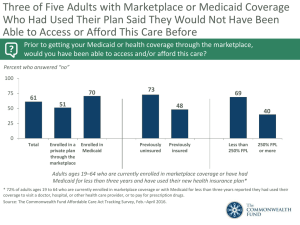

Informational Series How Does Applying Through the Marketplace Make My Health Insurance Affordable? What is the Health Insurance Marketplace? The call center is 800-318-2596. The website is www.healthcare.gov. The Health Insurance Marketplace is a new way for individuals, families, and small businesses to compare health insurance options and purchase a plan. You can go to the Marketplace website to get information about all the available plans. All health insurance companies on the marketplace describe their plans in the same way, so you can easily make an “apples-to-apples” type of comparison. You can learn what services they cover and what out-of-pocket expenses you will be responsible for. After you choose a plan you’ll be able to enroll yourself directly through the website, by calling a toll-free phone hotline or by contacting a trained Assister or licensed insurance producer in your state. What Makes this Insurance ‘Affordable?’ Many people will be able to get Advance Premium Tax Credits (APTC) to reduce their monthly premium costs when they buy insurance through the Marketplace. You may be eligible for an APTC if your Modified Adjusted Gross Income (MAGI) is between 100% and 400% of the Federal Poverty Level. Additionally, people with a household income between 100% and 250% of the Federal Poverty Level may also be eligible for Cost Sharing Reductions (CSR) to reduce their out-of-pocket costs. Visit https://www.maineoptions.org/Individuals-Families/Compare-Quote-Plans to get an estimated APTC and premium amount. The chart below shows eligible income levels based on household size for both the APTC and CSR. You will need to verify the APTC amount when you enroll for coverage. Open Enrollment is from November 15, 2014 to February 15, 2015. Qualifying for Lower Premiums & Out-of-Pocket Costs on the Marketplace* Private Marketplace health plans Number of people in your household You may qualify for lower premiums on a Marketplace insurance plan if your yearly income is between... 1 2 3 4 5 6 $11,670 $46,680 $15,730 $62,920 $19,790 $79,160 $23,850 $95,400 $27,910 $111,640 $31,970 $127,880 $11,760 $29,175 $15,730 $39,325 $19,790 $49,475 $23,850 $59,625 $27,910 $69,775 $31,970 $79,925 See next row if your income is at the lower end of this range. You may qualify for lower premiums AND lower out-of-pocket costs for Marketplace insurance if your yearly income is between... 080715-00-0003 *Source: Centers for Medicare and Medicaid Services (CMS) Community HEALTH OPTIONS TM (855) 624-6463 HealthOptions.org PO Box 1121 • Lewiston, ME • 04243 How Do I Calculate My Income for the Marketplace Application? Many people will be able to get Advance Premium Tax Credits (APTC) to reduce their monthly premium costs when they buy insurance through the Marketplace. If your Modified Adjusted Gross Income (MAGI) is between 100% and 400% of the Federal Poverty Level, you might be eligible for these Premium Tax Credits. Under the Affordable Care Act, eligibility for income-based Medicaid1 and subsidized health insurance through the Exchanges will be calculated using a household’s Modified Adjusted Gross Income (MAGI). The Affordable Care Act definition of MAGI under the Internal Revenue Code2 and federal Medicaid regulations3 is shown below. For most individuals who will apply for health coverage under the Affordable Care Act, MAGI will be equal to Adjusted Gross Income. This document summarizes relevant federal regulations; it is not personalized tax or legal advice. Consult the Health Insurance Marketplace for your state, your local Medicaid agency, or a legal or tax advisor for assistance in determining your MAGI. Modified Adjusted Gross Income (MAGI) From November 2013 Center for Labor Research and Education, University of California, Berkeley laborcenter.berkeley.edu Include: Adjusted Gross Income (AGI) Line 4 on a Form 1040EZ Line 21 on a Form 1040A Line 37 on a Form 1040 • Wages, salaries, tips, etc. • Taxable interest • Taxable amount of pension, annuity or IRA distributions and Social Security benefits4 • Business income, farm income, capital gain, other gains (or loss) • Unemployment compensation • Ordinary dividends • Alimony received • Rental real estate, royalties, partner- ships, S corporations, trusts, etc. • Taxable refunds, credits, or offsets of state and local income taxes • Other income Deduct: • Certain self-employed expenses5 • Student loan interest deduction • Educator expenses • IRA deduction • Moving expenses • Penalty on early withdrawal of savings • Health savings account deduction • Alimony paid • Domestic production activities deduction • Certain business expenses of reservists, performing artists, and fee-basis government officials Note: Check the IRS website for detailed requirements for the income and deduction categories above. Do not include Veterans’ disability payments, workers’ compensation or child support received. Pre-tax contributions, such as those for child care, commuting, employer-sponsored health insurance, flexible spending accounts and retirement plans such as 401(k) and 403(b), are not included in AGI but are not listed above because they are already subtracted out of W-2 wages and salaries. Add Back Certain Income Exclude from income (For Medicaid eligibility) • Non-taxable Social Security benefits (Line 20a minus 20b on a Form 1040) • Tax-exempt interest (Line 8b on a Form 1040) • Foreign earned income & housing expenses for Americans living abroad (calculated on a Form 2555) • Scholarships, awards, or fellowship grants used for education purposes and not for living expenses • Certain American Indian and Alaska Native income derived from distributions, payments, ownership interests, real property usage rights, and student financial assistance • An amount received as a lump sum is counted as income only in the month received Medicaid eligibility is generally based on MAGI for parents and childless adults under age 65, children and pregnant women, but not for individuals eligible on the basis of being aged, blind, or disabled. 2Internal Revenue Code Section 36B(d)(2)(B) 3Public Health and Welfare Code Section 435.603(e) 4“Social Security benefits” includes disability payments (SSDI), but does not include Supplemental Security Income (SSI), which should be excluded. 5Deductible part of self-employment tax; SEP, SIMPLE, and qualified plans; health insurance deduction 1