PDF Packet

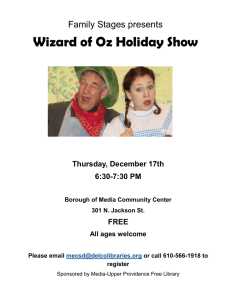

advertisement