productivity - Industrial Ecology - University of California, Irvine

S e s s s s i i o n 2 : : A s s s s e s s s s m e n t t s s o f f C h a n g e

Changing to Pb-free Profoundly

Impacts the Manufacturing Production

Process

By

Richard Brooks & David Day

Indium Corporation of America

Vahid Goudarzi

Abstract — The paper will outline the issues related to the implementation of a Pb-free solder paste into a standard Sn/Pb manufacturing facility and product. The Pb-free study includes the compatibility and impact to the various manufacturing processes that include, screen printing, component placement, reflow process, and solder joint quality. These parameters must be fully characterized to ensure that the lead-free solder paste meets the manufacturing and product quality requirements. In addition, a lower peak reflow temperature is critical to reduce the thermal stress on components, since the lead-free alloy composition (Sn/Ag/Cu) liquifies at about 34 ° C higher than the current leaded material (Sn/Pb).

Several implementation issues were discovered during the pilot phases and resolved prior to fullscale production manufacturing. Some of the problems revealed were BGA voiding, chip component tombstoning, and component integrity as it relates to termination plating and moisture sensitivity.

I NTRODUCTION

Motorola Corporation concern. Silver is a known toxin. Silver can kill up to 650 different viral, bacterial and fungal organisms, as well as most marine life. The SAC alloy also fails the EPA testing for leaching in standard landfills. Therefore, the elimination of Pb may not be the answer to the problem, but only creating additional problems to ones that already exist. Recycling should be the long-term solution to the problem. So, expect additional legislations and higher landfill costs to come in the near future.

The issue is, Pb-free manufacturing will become a reality in the near future, so we better be ready for it.

Recent legislation in Europe has further led OEMs to consider the implementation of Pb-free products into the industry. In the last year, the elimination of lead from the consumer electronics has mainly been pursued in Japan. As a result, major Japanese

OEMs are removing lead from their products and making them environmentally friendly. There are a number of lead-free alloy compositions available for consumer electronic products. Electronic

Industry groups (NEMI, IDEALS, JEITA) have evaluated several of these lead-free materials and they have chosen the Sn/Ag/Cu alloy for the midterm solution. The Sn/Ag/Cu alloy (is being called

SAC, for S n – A g - C u) reflows at a temperature of

217 o C, which is approximately 34 o C higher than the standard Sn/Pb alloys. There are several issues besides the higher reflow temperatures that are of

Pb-Free Implementation and Concerns

What are the concerns when implementing a Pbfree soldering process (or Pb-free reduce by using a SAC alloy)? The first and most critical concern is the component integrity. The components will have to withstand higher processing temperatures, of which most are not specified. Therefore, in order to implement a Pb-free solder paste into production, the components must first be evaluated and qualified to survive higher process temperatures. Most recently, IPC is attempting to develop new standards for the Pb-free soldering process (020B specification). As an assembly manufacturer, it is required to work with the component supplier on all new product designs in order to implement a Pb-free soldering process.

A second concern with implementing a Pb-free soldering process is the qualification of a Pb-free solder paste that is capable of handling a very large process window. Ideally, the manufacturer would like to have a solder paste that is capable of reflowing at very low temperatures (230 o very high temperatures (260 o

C) and at

C). The former is potentially more important because if a very low processing temperature is capable then a low peak reflow temperature is possible and the component integrity may not be an issue. The following section details one possible Pb-free solder paste

31

evaluation method for determining the reflow process window.

Reflow Profile Process Window

Phase 1 – Bare board wetting

To evaluate the reflow process window of a solder paste, various peak temperatures and liquidus times should be experimented. A minimum of three reflow profiles can be used with a low peak temperature of 230 of 245 o o C, a medium temperature peak

C and a high temperature of 260 profile is shown in Figure 1.

o C. An example of a standard Pb-free reflow soldering and is considered to be a failure. The lack of coalescence in Figure 2 can be attributed to the oxidation of the solder particles through the reflow process at the higher process temperatures or the inability to provide adequate fluxing at the lower process temperatures.

Figure 3 shows full coalescent solder particles after the reflow process. This should be considered the minimum requirement for an acceptable solder joint after the reflow process.

Reflow Temp 217 ° C

0 1 2 3 4 5

Time (min)

6 7 8

Figure 1 – Typical Pb-free reflow profile

The criteria to compare the reflow performance of the Pb-free solder paste materials should be based on the wetting performance of the solder paste in air atmosphere using various PCB finishes at the different reflow profiles.

Figure 2 - Non-coalescent Solder

The wetting performance of the lead-free solder pastes can be determined based on the coalescent of the solder particles after the reflow process.

Figure 2 shows poor performance of a solder paste, as the solder powder did not completely coalesce

Figure 3 - Fully coalescent solder

Phase 2 – Component wetting

The reflow performance of a Pb-free solder paste must also be evaluated in soldering performance on standard components. A typical production or test board can be used that contains standard components. The test boards should be reflowed again using the various reflow profiles (low, medium and high peak temperatures).

The following cross-sections exhibit very good wetting results of component soldering when using a Pb-free solder paste with a wide process window.

Figure 4 shows the cross-section of a component at the low reflow peak of 230 o C.

Figure 4 – Component soldered at peak of 230 o C

32

Figure 5 – Component soldered at peak of 245 o

Figure 5 provides a sample of a component soldered at a peak temperature of 245 temperature of 260 o C.

o C. And

Figure 6 shows a component soldered at a peak

Figure 6 – Component soldered at 260 o C

C

Figure 7 shows a cross section of a component that was soldered at a peak temperature of 210 o C using a typical lead containing solder paste (63Sn/37Pb).

In this case, it was observed from the crosssections, that the component solder joint fillets for both the Pb-free and the Sn/Pb alloys are comparable.

Figure 7 – Sn/Pb soldered component at 210 o C

Though comparable solder joints can be observed in this case, however, this was not always true with

Pb-free alloys. The solder paste must wet to a variety of component and PCB terminations.

Component terminations changed drastically as the

Pb-free initiative began to snowball, but it was also believed that the components would lag in the implementation of a Pb-free termination. During the process of component terminations migrating toward Pb-free solutions, the solder paste must be able to wet to all types of exotic metallurgy. Also, during this migration, we must also be aware of the forward and backward compatibility of the various

PCB and component terminations.

The following table (Table 1) provides some idea as to the various component and PCB terminations available today.

PCB finishes

HASL

Comp finishes

Various Sn/Pb comp

Various OSP

Immersion Ag

Sn

Au

ENIG Ag

Pd/Ni Pd/Ni

Immersion Sn

Pb-free HAL

Ni/Pd

Ni/Au

Ag/Pd

Ni/Au/Cu

Pd/Ni

Table 1 – PCB & Component terminations

Determining the Product Readiness

After evaluation of the various solder pastes and the ability to solder components at the required higher temperatures, a product was designed to undergo the Pb-free transition. The preferred product should have a minimal thermal gradient across the entire circuit board, so that a lower process temperature can be implemented. The most critical stage of the Pb-free implementation was the selection of the components. The components must be capable to handle the higher reflow temperatures without issues. The required reflow temperatures must be implemented in the component specification. If a component cannot function at the increased process temperatures, then either a new supplier must be chosen or component analysis completed to verify the capability of the component.

Production Evaluation and Implementation

During the pilot stages and product qualification of the Pb-free soldering process, several manufacturing issues were revealed that had to be resolved prior to full-scale production.

Some of the typical problems observed during the product pilot stages are given below:

33

o Reduce wetting or spreading o Increase in tombstone components o Increase in BGA voiding on Sn/Pb bumps o Component integrity during soldering o Component MSL rating o Soldering to Gold plated contacts or connectors

The following sections will detail the resolutions to the manufacturing product issues.

Reduced wetting or spreading

The implementation of a Pb-free soldering process is different than the standard Sn/Pb process. The most obvious observed difference in the soldering is the visual wetting difference. The Pb-free solder will not wet completely out to the solder pads.

This may only be a cosmetic difference but the operators must be trained to inspect for the difference. If the reduced wetting is believed to cause a problem, for example exposed copper on the PCB, then an increase in stencil apertures may be required to resolve the issue.

Tombstone defects

One of the largest problems found in the initial pilot stages was the increase in small chip component tombstone performance. Initially, it was thought that the reduced wetting of the Pb-free

(SAC) alloy would enable an improvement in the tombstone performance, but this was not the case.

Compared to the Sn/Pb alloys, the Pb-free SAC alloys have higher surface tension and thus a stronger pulling force on the chip component.

Figure 8 shows an example of a typical tombstone failure.

Figure 8 – 0402 tombstone failure

Therefore, the chip component pad design is critical for optimum soldering performance. It was noted that the reduction of overall pad length assisted in improving the tombstone performance.

Also a reduction of paste deposition may also be considered in order to optimize the soldering performance.

From Figure 8, it was observed that a via-in-pad design was utilized. This was also noted to increase the tombstone occurrence and was eliminated in future designs. The use of HDI technology can be considered for designs that require this application.

Additionally, the reflow profile was also found to have an impact on the tombstone performance.

The critical part of profile was observed to be the ramp or soak portion of the heating cycle.

Therefore, the optimization of the profile is also necessary to improve the soldering performance of small chip capacitors and resistors.

BGA Solder Voids

The next major problem found in implementing a

Pb-free solder paste was the compatibility with

Sn/Pb solder bumps on BGAs or CSPs. The problem discovered was very large solder voids in the solder joint. See Figure 9 below as an example of the typical BGA solder joint formation using a Pb-free paste and Sn/Pb (lower melting) ball.

Figure 9 – BGA solder void

The problem is simple and easy to understand.

The Sn/Pb ball on the BGA component reflows prior to the higher temperature (Pb-free) solder paste wetting and this is a problem. The typical solder paste makeup for the Pb-free solder paste contains solvents and activators that are active and volatilize at temperatures higher than 180 o C. Thus, as the BGA solder ball begins to reflow, the solder paste is still actively wetting and volatizing within the solder ball.

Several experiments were completed to evaluate the main effects of the BGA voids. It was found that modifying the reflow profile had the greatest

34

effect. Experimentation and modification of the ramp rate or soak time and temperatures of the reflow profile can minimize BGA voids.

Additional notes for soldering to a Sn/Pb BGA component, are that if via-in-pad applications were used in this process then even more voids may be observed. Also, a reduction in paste deposition may be attempted to reduce the void formation.

The solution to this problem is to implement Pbfree BGA solder balls for the Pb-free soldering process.

Component Integrity

The higher reflow process temperatures will have an effect on the component integrity. The following are a few observations noted during the pilot builds.

1) The higher process temperatures can discolor or degrade the appearance of the component.

This may be purely cosmetic, but needs to be understood and evaluated for the product.

2) Some components have sensitivity to absorbing moisture. These components are presently controlled in the standard production environments by placing them in dry boxes or baking them if they are exposed to long time humidity conditions. The process temperature will also have effect on the component performance. The higher the peak reflow temperature, the increased possibility of damaging the component. Therefore, experimental analysis must be completed to evaluate the effect on the components ability to perform. Thus, greater care must be taken on ALL components that are sensitive to moisture when evaluating the ability to solder at Pb-free temperatures.

Gold Connector Soldering

This was an issue that did not reveal itself until late in the product pilot stages. It is known that the Pbfree (SAC) solder alloys exhibit less wetting and spreading of the solder on the pad or component, but it was found not to be the case with Gold plated components, such as contacts or connectors.

The high temperature Pb-free solder has an affinity to wet with gold, since gold goes into solution faster than most other metals. It was found that in some cases the Pb-free solder would wet all the way up a component lead termination and intrude into the package. Figure 10 shows the Pb-free solder extending all the way through the package and on the lead. This example had caused the failure to mate with the corresponding female connector and thus a defect.

Pb-free

Figure 10 – Pb-free solder on a Gold plated connector

The resolution to the problem was to modify the paste printing apertures in order to minimize the wetting of the Pb-free solder paste on the gold plated lead.

CONCLUSIONS

A Pb-free soldering process is possible to implement on the typical electronic products today, but it is not a drop-in fit compared to Sn/Pb process. The following

1) A robust Pb-free solder paste must be first qualified for the Pb-free process. The solder paste must have a large process window and capable of soldering at a wide range of temperatures, preferably lower temperatures, but also at mid and high temperatures.

2) The components must be carefully chosen and qualified to perform at the higher process temperatures.

3) The PCB finishes and component terminations should be considered prior to initial product assembly and also the possible compatibility issues.

4) The product design must be well thought out and evaluated for a Pb-free process.

Modifications may be required to the standard pad geometries to optimize the Pbfree soldering process.

5) The Product must undergo Accelerated Life

Testing to evaluate the solder joint strength and reliability of the Pb-free solder joints, as they compare to the standard Sn/Pb solder joints.

The product design and component selections have an extreme effect on the ability to implement a Pbfree soldering process. There are several manufacturers today that have implemented Pb-

35

free products into the standard manufacturing production environment. A majority of these products are only Pb-reduced, since not all components terminations are 100% Pb-free.

Additionally, in order to implement a Pb-free manufacturing solution into production, ALL of the manufacturing processes must be characterized and optimized for peak performance. This is because the Pb-free manufacturing process window is much tighter than the standard Sn/Pb process that is required today.

REFERENCES

1. A.Butterfield, V.Visintainer, V.Goudarzi,

“Lead Free Solder Flux Vehicle Selection

Process”, SMTA International 2000 proceedings.

2. N.C.Lee, Benhlih Huang, “Prospect of Lead

Free Alternatives for Reflow Soldering”

3. E.Bradley, “Overview of No-Lead Solder

Issues, NEMI meeting, Anaheim, February 23,

1999.

36

Changing to Pb-free Profoundly

Impacts the Production Process

Rich Brooks

Indium Corporation

University of California – Irvine

April 3

rd

, 2003

www.

indium .com

©

Slide #2

Agenda

• Pb-free Initiatives and Legislation

•Japan / Europe / US

•Is Pb-free a good thing?

•NEMI alloy investigation

• Pb-free Implementation Concerns

•Manufacturing Issues

•Product Performance and Reliability www.

indium .com

©

Slide #3

Current Pb-Free Legislation

• WEEE/ROHS directives

• Japanese Home Electronics Recycling Law

• USA? Some state activity, nothing federal

www.

indium .com

©

Slide #4

Pb-Free Legislation

• EU Ratifies WEEE / ROHS directive

– Dec 2002 EU parliament passed legislation to ban use of:

• Pb, Hg, Cd, Cr VI, PBB, PBDE

– Affects ALL products that are sold after July 2006.

• Some exceptions e.g. lead free solder in telecom equipment, high lead solder applications

– Recycling program enforced June 2005.

www.

indium .com

©

Slide #5

Japanese Pb-free Activity

• No direct ban on using Pb.

• MITI proposed recycling legislation in May 1998.

– Japan home electronics recycling law requires OEMs to collect and recycle four major products since April

2001.

• These measures, as well as marketing advantage, are pushing major Japanese companies to be more environmentally conscious

www.

indium .com

©

Slide #6

Is Pb-free a Good thing?

• The fear: Pb in landfill will contaminate the groundwater supply

• The reaction:

– “The IPC… recognizes there are no data indicating environmental health hazards posed by Pb in

PWB manufacturing and electronics assembly” –

Dennis McGuirk, IPC president www.

indium .com

©

Lead Usage Status

• Solder in Electronics:

– US Dept of Interior 1999 study indicates

•Pb solder < 0.5% of all Pb used.

•Batteries comprising > 80%.

• PCB Surface Finish:

– 70-80% of PCBs produced with HASL.

Slide #7

Ref: M. Buetow, “The Latest on the Lead-Free Issue”, Technical Source, IPC 1999 Spring/Summer Catalog.

www.

indium .com

©

Slide #8

EPA

Groundwater

Leaching

Tests

• When subjected to EPA standard leaching tests:

•

ALL

Pb-free silver-containing solders fail

– “Lead-free Solders: A Push in the Wrong

Direction?” Ed Smith, K-Tec Inc.

– “Reliability & Leachate Testing of Pb-free

Solder Joints” – Thomas Woodrow, Boeing

www.

indium .com

©

Slide #9

Are we taking a wrong turn?

• Silver is toxic and a biocide

• Silver is known to kill more than 650 different viral, bacterial and fungal organisms

• It will kill most marine life

www.

indium .com

©

Slide #10

Pb-Free Initiative Summary

• Despite perceptions, Pb can and does leach into groundwater at landfill sites, particularly where water is acidic

• So too does Pb-free solder!

• Simply changing from SnPb to SnAgCu may not fix the problem

• Recycling must be the long term answer

• Expect more legislation and higher landfill costs in the years to come!

Pb-free soldering in the Electronics Industry is going to happen…

www.

indium .com

©

Slide #11

Alloy Summary

• NEMI Chosen Alloy

– 95.5Sn/3.9Ag/0.6Cu

– 217 C liquidus

• Pb-Free is now driven by both market factors and now legislation

• SnAgCu preferred short/medium term solution

– NEMI, JEITA, IDEALS all agree on Sn/Ag/Cu

• When components become completely Pb-Free,

SnAgBi may become preferred solution

– Lower process temp

– Excellent wettability www.

indium .com

©

Slide #12

Pb-Free Implementation

Concerns

• PCB Design & Component qualification

– PCB Design

– Component integrity

• Development of Manufacturing Processes

– Reflow Thermal Gradient reduction

– Pb-Free soldering compatibility

• Manufacturing Problems from Pb-free implementation

• Pb-Free Soldering Reliability

www.

indium .com

©

Slide #13

Pb-Free Reflow Concerns

• Components will be the main difficulty

– Majority of components are not spec’d to withstand reflow temperatures >240 C

• SnAgCu Alloy

– Melting temperature of 217C

– Different wetting characteristics compared to Sn/Pb

• To obtain good wetting, a reflow profile with a peak of around 235C may be required.

– Large boards with poor delta T in the oven may need as much as 255C www.

indium .com

©

Wetting Times as a Function of Temperature With a Range Of Alloys With

Un-Activated Flux: (a) Air, (b) Nitrogen

Slide #14 www.

indium .com

©

Pb-Free Compatibility Issues

Slide #15

• Changes must be made to ALL Electronic assembly materials

– Solder paste

– PC Board finishes

– Component terminations

• ALL Materials must be forward and backward compatible with ALL the different metallizations

www.

indium .com

©

Slide #16

PCB Finishes

• HASL (standard Sn/Pb)

• Pb-Free Alternatives

•

OSP –Benzotriazole or Benzimidazole

•

Immersion Ag

•

Immersion Au/Electroless Ni

•

Electroless Pd/Electroless Ni

•

Electroless Pd/Cu

•

Immersion Sn

•

HAL – Pb-free

www.

indium .com

©

Slide #17

Pb-free Components

• Pb-free surface finishes:

– Sn, Pd/Ni, Au, Ag, Ni/Pd, Ni/Au, Ag/Pt, Ag/Pd,

Pt/Pd/Ag, Ni/Au/Cu, Pd, and Ni.

• Pb-free internal connections

– Au80/Sn20 (280°C)

• Pb-free functional materials in piezoelectric elements, capacitors, glass, fuses, etc.

– More difficult to substitute.

www.

indium .com

©

Slide #18

Issue with Cross Compatibility

• Manufacturing of Sn/Pb and Pb-free components

– BGA / CSP – Sn/Pb bumps with Pb-free solder

•Air voids cannot be eliminated

• Rework and Repair

www.

indium .com

©

Slide #19

Pb-free Implementation

• Pb-free Manufacturing Issues

– Reduced wetting

– Chip component tombstoning

– BGA / CSP Voiding

– Gold plated component soldering

• Component qualification

– Temperature rating

• Rework and Repair concerns

– MSL rating www.

indium .com

©

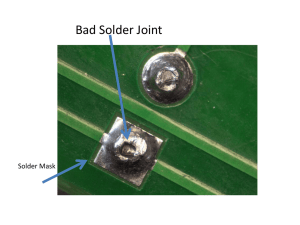

Solder Joint Inspection

Slide #20 www.

indium .com

©

Air Voids on CSPs

BGA/CSPs are more prone to voids due to leaded bumps on package & increased oxidation of powder

Slide #21

0.5 mm CSP

DIME www.

indium .com

©

Slide #22

0402 Tombstone Failures

Lead-free Solder paste is more prone to tombstone failures due to higher wetting forces.

T3 T3

T1 T2

T4

T5

Before Reflow After Reflow

T1 & T2 : Tack Force

T3 : Weight

T4 : Surface Tension (outside)

T5 : Surface Tension (underneath)

T4 is significantly higher using lead-free solder paste www.

indium .com

©

Slide #23

20X40 Pad Design Modification

Modify Pad designs to improve tombstone defects, as well as stencil modifications

0402 Stencil Aperture Openings

.015" .011" .018"

Stencil design to minimize tombstone failures on pads with blind vias

C .022"

A*

.041"

.007"

.008"

.047"

Tombstone failures are eliminated on products with

HDI technology www.

indium .com

©

Solder wicking on the Gold Contact

Solder wicking

Board to Board Connector

Slide #24

Lead-free wets more than leaded solder to the Gold Contact www.

indium .com

©

Solder wicking on the Gold Contact was eliminated by shifting solder paste

Slide #25 www.

indium .com

©

Slide #26

Effect of MSL Rating on

Defect Level

• Moisture sensitive components will have to be more carefully monitored

– MSL Ratings will be effected

•Observed several problems with moisture sensitive components in production

– Related to moisture and higher process temperatures www.

indium .com

©

Slide #27

Liquid-to-Liquid Thermal

Shock

Variables:

- Solder Paste (Pb free & Pb/Sn/Ag)

- Component Type ( 0402, 0603, 0805, BGAs, CSPs,

VCO, Transformer)

Output:

- Electrical test at every 75 cycles for 450 cycles

- Red dye analysis at 150, 300, and 450 cycles www.

indium .com

©

LLTS Transformer Crack Data

Slide #28

125

100

75

Crack data @ 450 cycles

50

25

0

-25

Pb-free Sn-Pb

All Pairs

Tukey-Kramer

0.05

Solder

All components passed 300 cycles of LLTs www.

indium .com

No statistically significant difference

©

Slide #29

Shear Test

• 10

• 6

• 5

• 9

• 8

• 7

• 4

• 3

• 2

• 1

• SnPb

• SnAgCu

• 0

• Ceramic

• Inductors

• Tantalum

• Capacitors

• Small

• Capacitors

• Ferrite Bead • Mid-size

• capacitors

No significant difference in shear force after LLTS.

www.

indium .com

©

Slide #30

Drop Test Results

6 mechanical planar drops at 5 feet, 2 hrs vibe (vert, horiz.),

24 hours Temp. shock (-40 to +80C), then repeated 5 times.

Figure 1: % FRACTURED Shield Solder Joints: Lead and No-Lead Process

25

20

15

10

5

0

Re g

Ca ps

Sw itch er

Gc ap

ODC

T

Mu lti

/AD

D

Au dio

PA

PA

NL

R

No - Lead Process eg.

..

NL

S wi t..

.

NL

G ca p

NL

OD

CT

NL

M ult

...

NL

A ud

...

NL

P

A

Shield solder joint cracking is significantly reduced using lead free solder www.

indium .com

©

Slide #31

Lead Free Summary

• Legislation not inline w/ technical data

• Lead free Alloy identified

– Sn/3.9Ag/0.6Cu (NEMI, JEITA, IDEALS)

• Pb-free manufacturing processes are possible, but require modifications

– Component temperature will be main concern

• MSL level is adversely affected

• Rework & Repair is difficult

• Reliability equal, if not improved over Sn/Pb

• Wave soldering concerns are just now being evaluated

www.

indium .com

©

Questions???

Slide #32 www.

indium .com

©

NiPdAu – Better than Matte Sn for Pb-Free Leaded

Components?

Donald C. Abbott

Texas Instruments

Attleboro, MA 02703

508-236-1569 d-abbott1@ti.com

Abstract – The requirement of lead (Pb)-free industry. Note that the Pd thickness is much lower in electronics challenges integrated circuit (IC) manufacturers in two areas: first, elimination of Pb from the IC package and second, development of the NiPdAu system. packages to withstand the rigors of reflow at 260°C.

This paper discusses the elimination of Pb from IC’s by using nickel-palladium (NiPd) based lead finishes.

NiPd based lead finishes have been in commercial use since 1989 with more than 50 billion NiPd finished devices in the field from one semiconductor house alone. The NiPd finish with 10+ years of

Palladium (0.075µ min.)

Nickel (1.0µ min.)

Palladium/Nickel Strike

Nickel Strike history was recently modified to a nickel-palladiumgold (NiPdAu) finish. The structure of the current

NiPdAu finish and the reasons for the change are discussed.

Pre-plated (PPF) leadframe finishes eliminate the need for plating after plastic encapsulation of the device. That NiPd based finishes have not become

Copper Base

Figure 1 . 4-layer NiPd

Gold (0.003µ min.) more widely used by the industry is puzzling. There are obvious advantages to any type of pre-plated leadframe. There are some unique advantages to Pd based finishes that are less obvious. The disadvantages and risks, real and perceived, associated with NiPd based finishes are also covered.

Palladium (0.02µ min.)

Nickel (0.5µ min.)

I NTRODUCTION

Structure - A Ni/Pd finish for IC leads was introduced in the late 1980s. [1,2] To date (March

2003) an estimated 50 billion Ni/Pd finished IC packages are in the field. A typical four-layer nickel palladium (NiPd) structure is shown in Figure 1. A variation on the NiPd lead finish, using nickel palladium gold (NiPdAu) was introduced in Japan in the early ‘90s. The prototypical three-layer NiPdAu finish is shown in figure 2. Upon its introduction, many Japanese IC users opted for the NiPdAu finish because of its key technical attribute of faster wetting time in solderability tests. Faster wetting times in solderability tests can be taken as a bellwether of improved wetting with the variety of Pb-free solder alloys under consideration by the electronics

Copper Base

Figure 2. 3-Layer NiPdAu

Pb-free Implications - With the interest in Pb-free processing that developed in the mid-‘90s the need for Pb-free package terminations became critical.

[3,4,5,6,7,8,9] Because NiPd and NiPdAu are Pbfree finishes, use of either on components in conjunction with a Pb-free solder alloy and OSP

PWB pad finish yields a Pb-free solder joint.

Studies have shown that NiPd and NiPdAu finishes achieve equivalent or better lead pull and

37

W I R E B O N D A B L E

H IG H Y IE L D

P R O C E S S

• S IM P L IC IT Y

• C Y C L E T IM E

C O S T

E F F E C T IV E

T O T A L C O S T O F

O W N E R S H I P

S O L D E R A B L E

L E A D F R A M E

F I N I S H

R E Q U I R E M E N T S

S H E L F L IF E

A P P L IC A B L E F O R

F IN E P IT C H

2 6 0 ° C

M O U N T C O M P A T IB L E

A L L T Y P E S

O F P A S T E

E N V IR O N M E N T A L L Y

G R E E N

A S S E M B L Y

P R O C E S S

C O M P A T IB L E

T E M P E R A T U R E

M O L D C O M P O U N D

N O P b

L e a d fr a m e F in is h A ttr ib u te s performance difference of the different lead finishes

(Sn/Pb, Ni/Pd, Ni/Pd/Au) was merely visual.

Lead Finish Attributes - The two primary functions of a lead frame finish are to provide a surface that is wire bondable and solderable after device assembly.

There are other attributes or requirements that make a finish desirable and commercially viable. These are shown in Figure 3.

Lead Frame Finish History – Lead frames started out with a gold (Au) finish, 35 years ago. Cost and Au embrittlement led to a move to full silver (Ag) finish on what was the typical base metal at that time, alloy

42 or Kovar. This system was prevalent in the mid-

‘70s. The base metals with high Ni content were used because the IC’s were relatively large and fragile – matching the coefficient of thermal expansion (Cte) of the leadframe to the silicon was important. The Ag was relatively thick, on the order of 3 – 4 microns. Ag did have the advantage of not only being wire bondable, but also preserving solderability, though at this time IC’s were dual inline packaged and the molded devices were solder dipped after assembly.

Several companies noticed a propensity for Ag, particularly Ag outside the plastic, to grow Ag dendrites that could short adjacent leads. The

Figure 3 temperature cycle results than Sn/Pb plated component leads (control). [10,11,12] Any

This observation led to major players in the IC industry mandating there be no Ag outside the plastic. The leadframe makers’ solution was spot Ag plating, where the Ag is selectively plated in the wire bond area that after assembly will be inside the plastic. About the same time as Ag spot plating took hold, there was a shift to copper (Cu) alloy base metals. The silicon had shrunk so matching Cte was not as critical. The Cu also offered lower cost and better thermal and electrical performance. The problem with Ag spot plating is that while wire bondable, it leaves a non-solderable lead surface after assembly of the IC. The thermal exposure of

Cu base metal by die attach, wire bond and molding/mold cure leaves a thoroughly oxidized Cu surface. To overcome this a major change and investment in assembly technology and equipment occurred.

Post mold solder plating was developed. This took care of the solderability issue with Ag spot plated leadframes, but moved part of the leadframe finishing operation into the assembly/test (A/T) site.

Now the leadframe maker provided the leadframe form and a wire bondable surface as an Ag spot.

But, the A/T site was responsible for plating that part of the leadframe that was outside the plastic. This put cost, cycle time, equipment, and yield issues directly in the A/T house. As will be shown below, this is not as bad as it sounds for some in the industry. dendrites grew under bias and humid conditions.

38

COST OF OWNERSHIP

ELIMINATION OF POST MOLD Sn/Pb PLATING

ELIMINATED COSTS

PLATING

PROCESS W ATER

W ASTE TREATM ENT

QUALITY CONTROL

CHEM ICAL STORAGE

9

9

9

9

9

9

9

9

SP

AC

E

9 9

EQ

UI

PM

EN

PE

RS

T

O

NN

EL

UT

IL

IT

IE

WA

S

9 9 9

TE

R

EX

H

AU

ST

IN

VE

9 9

NT

O

RY

CO

NSU

M

AB

LE

S

YIELD RELATED COSTS:

• No solder flake/burrs @ t/f

9

9

9

9

9

9

9

9

9

9 9

9

9

9

9

9

9

9

•

•

Improved lead planarity

No chemical exposure or thermal shock to assembled device

• Less mechanical damage

DISPOSAL COSTS ELIMINATED

WASTE TREAT SLUDGE

SPENT PLATING LINE BATHS

Pb CONTAMINATED TRIM SCRAP

OTHER COSTS

PERMITTING -- WASTE TREATMENT

CHEMICAL STORAGE

REDUCES CYCLE TIME/LOWERS

INVENTORY OF ASSEMBLED DEVICES

Figure 4.

For the dual in line packages, there was still the option to solder dip the oxidized Cu, using strong fluxes. But, as surface mount packages with finer pitch gull wing lead designs started to gain acceptance, the solder dipping option evaporated because of solder bridging. The need for high speed, reliable solder plating was driven by fine pitch surface mount packages. And since that time, this has been the prevalent lead frame finishing system used – spot Ag plating on Cu alloy leadframes followed by post mold solder, SnPb, plating.

The NiPd system was developed to eliminate post mold solder plating. It is a so called pre-plated lead finish (PPF), meaning the leadframe maker does all of the plating, leaving the A/T site to do die attach, wire bond, molding, trimming and forming and test.

The A/T site does not need any wet chemical processes for plating – or associated equipment, water treatment, exhaust, permitting, etc. See figure

4.

For a brief time in the mid-‘70s there were efforts to develop a pre-plated spot Ag + SnPb spot lead finish that was done at the leadframe maker. The technical catch with this system was the need for assembly temperatures that never exceeded the melting point of eutectic SnPb, ~170°C. At that time, wire bonding and die attach equipment could not function in this temperature range .

T

ECHNICAL

F

EATURES OF

N

I

P

D

A

U

Functions of the Ni, Pd and Au – The Ni is the functional layer in this finishing system. It is a barrier to Cu diffusion, it is the surface to which the wire bond is made and it is also the surface that is soldered. The Pd is a sacrificial layer that protects the Ni from severe oxidation. The Au, in the NiPdAu system, serves a similar function as the Pd and permits lower thickness of Pd.

Die Attach - For NiPd based finishes, die attach is functionally the same as for Ag spot plated finishes, namely attachment typically by Ag filled epoxy.

This attachment is made to the topmost layer of the leadframe finish – either Pd or Au in the cases at hand.

Wire Bond - The mechanism for wire bond is different than for Ag spot plated leadframes. The bond is to the Ni surface. The Au wire scrubs through the thin Pd (up to 0.25µ) and makes a NiAu intermetallic. In Ag spot plated lead frames; the wire bond is to the Ag surface, a relatively thick, soft substrate. The differences in bonding mechanics have implications for capillary design and bonding parameters. Competent bonding technicians can develop parameters for bonding NiPd and NiPdAu finishes in less that 8 hours.

Soldering - Soldering proceeds by a very different mechanism than for solder plated leads. The Pd and

Au dissolve rapidly into the molten solder. The reflow temperature required is substantially below the melting point of Pd. See Table 1 for dissolution rates. The solder joint is made to the Ni and the Pd and Au move into the bulk solder. This has been shown to be the case for SnPb and the Sn-rich Pb free solders. [11,12]. Sn or SnPb finishes are fusible coatings – they melt during reflow. The increased reflow temperatures required for Pb-free solders accelerate the dissolution of the Pd/Au layers.

Table 1 Dissolution Rates of Metals in Eutectic SnPb

Solder [After Bader]

RATE RATE

µ/s (215°C) µ/s (250°C)

Ni

Pd

Cu

Au

< 0.0005

0.0175

0.08

1.675

0.005

0.07

0.1325

4.175

Solder joints to NiPd or NiPdAu finished leads look different than solder joints to solder finished leads.

The only solder brought to the joint is in the paste.

This allows the total volume of solder is controlled absolutely by the board assembly house. When NiPd finished leads were introduced, programs for some automated solder joint inspection machines needed to be adjusted to recognize as good, solder joints with no solder on the top surface of the lead. A cross section of a typical solder joint to a NiPdAu finished lead is shown in Figure 5.

39

Cross Section of Solder Joint

Figure 5.

E

CONOMICS OF THE

N

I

P

D

A

U

F

INISH

There are potentially three areas of economic concern with any NiPd based leadframe finish that may have led to its less than enthusiastic adoption as a standard leadframe finish by the industry.

First, there is the cost of post mold plating that is part of the total cost of ownership for a silver spot plated leadframe. This is often not understood, disregarded or discounted. The initial cost of the Ag spot plated leadframe may be lower, but the cost of post mold plating must be added to the total cost of ownership.

Often, this is not done. Refer to Figure 4.

A second potential concern is the intrinsic cost and supply of Pd and Au. These are precious metals, with Au being widely traded and Pd less so. Au is mined in many countries while the major sources of

Pd are Russia and South Africa. Anxiety over reliable Pd supply has been know to occur. As with any precious metals, the key is to minimize content.

The conversion from NiPd to NiPdAu did this dramatically. The cost of Pd versus Au must take into account the density difference between the two.

For a given thickness, the mass of Pd required is about 40% less than for Au. Managing the purchasing of the metals through various precious metal market trading instruments available is prudent. Of the three concerns, the intrinsic costs, and to a lesser extent supply, of the metals are the most valid.

The last concern is related to the first. Much IC assembly is done at subcontract A/T houses that have a vested interest in maintaining a post-mold solder plating business. The two prime areas for subcontract A/T’s to add value are plating and final testing. Die attach, wire bond, and molding are materials intensive so there is little margin to add value with the highly automated equipment used for these functions. The leadframe is the most expensive part of the IC package after the silicon. With a PPF leadframe, such as NiPdAu, the plating function and associated value added is transferred to the leadframe maker. Through efficiencies in plating and minimizing precious metal content and the drop in

Pd price, the cost for NiPdAu finished leadframes is approaching that of Ag spot plated leadframes.

Adoption of any PPF, even Ag spot + Sn or SnPb spot, leaves the A/T with all the investment for solder plating and much loser revenue. It is not surprising that many subcontract A/T houses have quoted higher prices for package assembly using a

PPF than for post-mold solder plated packages. The end users, not the subcontract A/T houses, will ultimately drive the wider acceptance of NiPdAu or any PPF.

A

DVANTAGES OF

N

I

P

D

A

U

Leadframe makers see many advantages to using the

NiPdAu finish: no Pb, no free cyanide, fast cycle time, no selective plating required, low capital investment for plating equipment, better yields, and very high throughput. No Pb is key. NiPdAu offers a

“green” solution that starts with the leadframe manufacture and runs through to the consumer. The elimination of a selective plating requirement simplifies the plating process and leads to the yield and productivity improvements. Whole categories of defects are eliminated – spot Ag location for example.

For the A/T house, NiPdAu also improves yields by eliminating solder burrs and flakes at the lead trim/form operation. It also lowers the total cost of ownership by eliminating the post-mold plating operation. This frees factory space for additional die attach, wire bond and molding machines. NiPdAu effectively takes out the wet processes from the A/T house. NiPdAu is also compatible with the existing

A/T process. There is no need for lower assembly temperatures as there is for an Ag/SnPb PPF as noted above. Finally, the process options for the A/T house are simplified, no decision need be made among

SnPb, matte Sn, SnBi or any other solder plating system.

For the IC user, there are very controlled solder filets/joints because the amount of solder brought to the joint is that screened onto the board. As lead pitch is reduced, this advantage increases in importance. Lead planarity is improved, as there is less handling of the part so the risk of mechanical damage is reduced. The absolute variation of the

NiPdAu finish is less than that for either Sn or SnPb that are typically plated in the range of 2 – 10 µ versus an aggregate thickness of less than 1µ for

40

NiPdAu. This too leads to improved lead planarity.

There is no Pb in the system and unlike matte Sn finished leads; there is no risk of Sn whiskers.

Conclusions

As noted in the abstract, it is a puzzle that the

[11] D. Romm, B. Lange, D. Abbott, Evaluation of

Nickel/Palladium-Finished ICs With Lead-Free

Solder Alloys, TI SZZA024, January 2001.

[12] D. Romm, B. Lange, D. Abbott, Evaluation of

Nickel/Palladium/Gold Finished Surface-Mount

Integrated Circuits, TI SZZA026 July 2001.

NiPdAu lead frame finish has not gained wider acceptance in the semiconductor industry. When fully understood it offers cost advantages – through yield improvements, throughput, faster cycle time, lower capital investment, and streamlined factory flow in all stages of IC assembly and use. It uses no

Pb, is compatible with the leading Pb-free solder pastes under consideration, and require no modification to the device assembly process, save

Donald Abbott is a TI Fellow and Manger of New

Technology Development at Texas Instruments,

Attleboro, MA. He has more than 20 years experience in lead frame manufacturing; metal finishing research, waste minimization and recycling. He is a member of the American

Chemical Society, the American Electroplaters and Surface Finishers Society and the Minerals, elimination of post-mold soldering and no modification for the board mounting operation. The risks for using the NiPdAu finish are associated with the cost and supply of primarily Pd and to a lesser

Chemistry from Northeastern University, Boston,

MA. extent Au. The leading alternate candidate for Pbfree lead finishing is post-mold plated matte Sn. The primary risk with matte Sn is the well-known and poorly understood Sn whisker phenomenon. NiPdAu

Metals and Materials Society. Dr. Abbott received his BA degree in biology from Bowdoin College,

Brunswick, ME and the Ph.D. degree in Analytical carries no such risk. As industry consortia (NEMI,

JEITA, and ITRI) struggle with defining Sn whisker appearance and inspection protocol and also continue to investigate the mechanism driving Sn whisker growth, more companies are starting to look favorably on a NiPdAu based lead finish.

R EFERENCES

[1] D. C. Abbott, R. M. Brook, N. McLelland, and J.

S. Wiley, IEEE Trans. CHMT , 14, 567 (1991).

[2] Murata and D. C. Abbott, Technical Proceedings,

Semicon Japan, 415 (1990).

[3] M. Kurihara, M. Mori, T. Uno, T. Tani, T.

Morikawa, SEMI Packaging Seminar, Taiwan, 59

(1997).

[4] Yanada, IPC Printed Circuits Expo 1998.

[5] M. Jordan, Trans IMF, 75(4), 149, (1997).

[6] T. Kondo, K. Obata, T. Takeuch & Masaki,

Plating and Surface Finishing, 51, Feb. (1998).

[7] R. Schetty, IPC Works 99 Proceedings, Oct.

(1999).

[8] Y. Zhang, J. A. Abys, C. H. Chen, & T. Siegrist,

SUR/FIN 96 (1996).

[9] Ji-Cheng Yang; Kian-Chai Lee; Ah-Chin Tan,

Electronic Components and Technology Conference

Proceedings, 49 th , 842-847 (1999).

[10] D. W. Romm and D. C. Abbott, Lead Free

Solder Joint Evaluation, Surface Mount Technology,

March, (1998).

41

NiPdAu – Better Than Matte Sn for

Pb-Free Leaded Components?

Donald C. Abbott

Texas Instruments

Attleboro, MA

NiPdAu – Better Than Matte Sn for

Pb-Free Leaded Components?

Structure of NiPd and NiPdAu

History of Lead Finishes

Leadframe Finish Attributes

Technical Features of NiPdAu

Economic Concerns

Advantages

Conclusions

Structure of NiPd finish

Palladium (0.075 µ min.)

Nickel (1.0 µ min.)

Palladium/Nickel Strike

Nickel Strike

Copper Base Metal

Structure of NiPdAu Finish

Gold (30 – 150 angstroms)

Palladium (0.02 µ min.)

[1/3 Pd content of NiPd system]

Nickel (.5 µ min.)

Copper Base Metal

WIRE BONDABLE

HIGH YIELD

PROCESS

• SIMPLICITY

• CYCLE TIME

COST

EFFECTIVE

TOTAL COST OF

OWNERSHIP

SOLDERABLE

LEADFRAME

FINISH

REQUIREMENTS

SHELF LIFE

APPLICABLE FOR

FINE PITCH

260°C

MOUNT COMPATIBLE

ALL TYPES

OF PASTE

ENVIRONMENTALLY

GREEN

ASSEM BLY

PROCESS

COMPATIBLE

TEMPERATURE

MOLD COMPOUND

NO Pb

Leadframe Finish Attributes

Leadframe Finish History

GOLD PLATE

COST

FULL SILVER PLATE (70s)

DENDRITIC

SILVER

SPOT SILVER PLATE WITH SOLDER DIP

POST MOLD (LATE 70s)

MID 70s

FINER PITCH

SPOT SILVER + POST

MOLD Sn/Pb PLATE

SPOT SILVER WITH

PREPLATED Sn/Pb

1988/1989

2001-2002

Pd/ Ni INTRODUCTION

NiPdAu CONVERSION

Pre-Plated (PPF) v. Post-Mold Finish

NiPd and NiPdAu are pre-plated finishes (PPF) .

The solderable finish is applied at the leadframe maker, not in a post-mold finishing (PMF) operation.

NiPd is a departure from the Ag spot plating, and has implications beyond simply the wire bonding and soldering mechanism differences.

COST OF OWNERSHIP

ELIMINATION OF POST MOLD Sn/Pb PLATING

-

-

-

ELIMINATED COSTS

SP

A

C

E

EQ

U

IP

M

EN

T

PE

R

SO

N

N

EL

U

TI

LI

TI

ES

W

A

TE

R

EX

H

A

U

IN

ST

V

EN

C

R

Y

TO

O

N

SU

M

A

BL

ES

PLATING

PROCESS W ATER

W ASTE TREATM ENT

QUALITY CONTROL

CHEM ICAL STORAGE

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

9

YIELD RELATED COSTS:

• No solder flake/burrs @ t/f

• Improved lead planarity

• No chemical exposure or thermal shock to assembled device

• Less mechanical damage

DISPOSAL COSTS ELIMINATED

WASTE TREAT SLUDGE

SPENT PLATING LINE BATHS

Pb CONTAMINATED TRIM SCRAP

OTHER COSTS

PERMITTING -- WASTE TREATMENT

CHEMICAL STORAGE

REDUCES CYCLE TIME/LOWERS

INVENTORY OF ASSEMBLED DEVICES

NiPdAu – Better Than Matte Sn for Pb-

Free Leaded Components?

Wire Bonding - is done to the Ni surface. The wire goes through the thin Pd (up to 0.25µ) and makes a NiAu intermetallic. Whereas in Ag spot plated leadframes, wire bonding is done to the Ag surface, a relatively thick, soft substrate.

The differences in wire bonding mechanics have implications for capillary design and bonding parameters.

NiPdAu – Better Than Matte Sn for Pb-

Free Leaded Components?

Soldering - the Au dissolves rapidly into the solder paste, as does the Pd. The solder joint is made to the Ni.

METAL RATE µ/SEC

(215C)

RATE µ/SEC

(250C)

Ni

Pd

Cu

Au

< 0.0005

0.0175

0.08

1.675

0.005

0.07

0.1325

4.175

Sn or SnPb finishes are fusible coatings, they melt during reflow.

This explains some anomalous results seen with steam aging.

Soldering

Solder joints to NiPd or NiPdAu finished leads look different than solder joints to solder finished leads.

• The only solder brought to the joint is in the paste.

• This allows control of volume of solder by the board assembly house.

• Early on there were issues with machine vision recognizing good solder joints - this has been fixed.

• Studies with SnAgCu and SnBi show compatibility.

Cross Section of Solder Joint

4000X, Lead Side

NiPdAu + NiAu PWB

Economics

There are 3 main areas of economic concern:

1. Cost of post mold plating/ cost of ownership .

2. Cost of Pd and Au - precious metals

3. (Subcontract) Assembly/test house - vested in PMF.

Pd and Au

• Au is a widely traded metal. Cost is ~ $300/t.oz with a density of 19.32 g/cm3.

• Pd is less widely traded. Cost is ~ $230/t.oz. with a density of 12.16 g/cm3.

• Au is widely used in industry, jewelry, dentistry, bullion.

• Pd - major user is/was automotive catalysts.

Major producers of Pd: Russia, S. Africa

• Electronics is <10% of annual usage; Semiconductors is <5% of the electronics usage.

Courtesy Kitco - http://www.kitco.com/market/

Courtesy Kitco - http://www.kitco.com/market/

'000 oz

Supply

South Africa

Russia

North America

Others

Total Supply

Pd Supply & Demand

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

1,260 1,395 1,500 1,600 1,690 1,810 1,820 1,870 1,860 2,010

2,100 2,400 3,300 4,200 5,600 4,800 5,800 5,400 5,200 4,340

450 415 410 470 455 545 660 630 635 850

70 70 70 70 95 95 120 160 105 120

3,880 4,280 5,280 6,340 7,840 7,250 8,400 8,060 7,800 7,320

Demand by Application

Autocatalyst gross 490 705 975 1,800 2,360 3,200 4,890 5,880 5,640 5,110 recovery -95 -100 -105 -110 -145 -160 -175 -195 -230 -290

Chemical * 205 190 185 210 240 240 230 240 255 235

Dental

Electrical

Jewelry

1,195 1,210 1,265 1,290 1,320 1,350 1,230 1,110 820 670

1,830 2,015 2,230 2,620 2,020 2,550 2,075 1,990 2,160 700

205 210 205 200 215 260 235 235 255 240

Other 60 35 115 110 140 140 115 110 60 65

Total Demand 3,890 4,265 4,870 6,120 6,150 7,580 8,600 9,370 8,960 6,730

Movements in stocks -10 -15 410 220 1,690 -330 -200 -1,310-1,160 590

3,880 4,280 5,280 6,340 7,840 7,250 8,400 8,060 7,800 7,320

After Johnson Matthey http://www.platinum.matthey.com/data/pd_92-02.pdf

What If...

the entire semiconductor industry converted to Pd based leadframe finishes?

• Our calculations show that the usage would be in the range of 5-10% of the Pd supply .

• And as the shift from PDIPs to SO’s to Leadless packages continues, this will offset volume increases in units.

• And the “entire semiconductor industry” won’t convert to NiPdAu or NiPd.

Pd Supply

Excerpts from – Reuters Article

Implatsseeks to stimulate palladium demand

Wednesday March 12, 10:12 am ET

By Sue Thomas

JOHANNESBURG, March 12 (Reuters) - The world's second-largest platinum producer is anxious to boost palladium use as a platinum boom in South Africa brings with it an increase in production of its sister metal.

…less concerned about reports that forecast soaring palladium supplies from the secondary -- or recycling -- market, than he was about primary supply growth .

Pd Supply

Standard Bank London… sees supplies of Pd from the secondary market rocketing to 3.0 million ounces by 2008, from around 300,000 ounces currently as tough European recycling laws kick in.

… there's going to be growth in palladium (from primary sources) and more supply with static demand means lower prices. Unless demand grows it's going to have an impact.

The price of palladium, used to make autocatalysts in the auto industry and components in the electronics industry, crashed to $220 an ounce by

December 2002 after reaching a peak of $1,094 in January 2001.

South African producers, the largest in the world, are expanding at full speed in a bid to meet soaring platinum demand. But the area in the Bushveld complex that they are expanding into produces a higher ratio of palladium than the area currently being mined.

Pd Supply

Matthey forecast palladium demand to plunge 28 percent to 4.9 million ounces in 2002 -- its lowest since 1994 -- as auto companies and the electronics industry worked off their inventories of the metal.

"The platinum story looks good going forward, but palladium doesn't. If we don't expand with palladium, we'll put more pressure on platinum. We have to find ways to encourage new palladium users," Engelbrecht said.

He said the car-making industry should be enticed to use more palladium, while he had noted a small increase in interest from the electronics industry recently.

Subcontract Assembly Interest

1. Subcons major value added is in post mold plating.

2. Large investment in machines, people, space, support equipment.

3. Theirs is a material intensive business - leadframes, gold wire, mold compound, die attach material.

4. Sn or Sn/Pb plating is one area where they add considerable value.

THE DILEMMA

If a subcon goes to any PPF, then the value added by plating is transferred to the leadframe maker.

The subcon then has lower revenue over which to spread the cost of the expensive equipment he has bought to do PMF.

Summary of Key Advantages

IC USER

• CONTROLLED SOLDER FILLETS

• NO LEAD (Pb)

• IMPROVED LEAD PLANARITY

• NO Sn WHISKERS

ASSEMBLY SITE

• COMPATIBLE WITH EXISTING

PROCESS

• ELIMINATE POST MOLD Sn/Pb or Sn

• NO LEAD (Pb)

• IMPROVE TRIM/FORM OPERATION

• CYCLE TIME

• LOWER COST OF OWNERSHIP

L/F MANUFACTURER

• NO LEAD (Pb)

• NO FREE CYANIDE

• FAST CYCLE TIME

• NO TOOLING

• NO SPOT LOCATION

• BETTER YIELDS

• PRODUCTIVITY

• LOW CAPITAL

INVESTMENT

Conclusions

•

Pd based lead finishes have been commercialized for

>12 years. This is not a “new” technology.

• Given a close to 100% conversion at the A/T site, the economics work for total cost of ownership.

• There are concerns about the supply/demand of Pd.

• There are no whisker or solderability issues.

• Pd finishes are compatible with Pb-free solders

(SnAgCu, SnBi).

Stumbling Around the Loop:

Complex Goods, Recovery Strategies, and Assessment of Cycle Closure in Reverse Manufacturing

Charles David White

310 Barrows Hall, MD-3050

University of California, Berkeley

Berkeley, CA 94720 cdwhite@socrates.berkeley.edu

Abstract - The closed-cycle concept in industry ecology literature provides a normative basis for advancing recycling and reuse as means for diverting products from harmful disposal alternatives. However, although this orienting framework sounds straightforward in the abstract, bringing it into practice is much more difficult.

Drawing from research in the computer industry, this study explores the meaning of closing material cycles for technologically complex products. A primary finding is that recovery of computer equipment creates output streams that generally do not return goods to their original manufacturers for reuse. As a result, without significant information infrastructure development, even ambitious endof-life management is unlikely to produce asset flows that can be traced through the manufacturing loop. This finding raises concern about how to assess the extent of recovery and the effectiveness of policies designed to close material cycles.

Introduction

In 1984 my Apple IIe computer cost roughly

$1400, a pretty penny in those days. Long past its prime, this 128 kB (RAM) machine now retains market value only among collectors mesmerized by its green monochrome monitor or 5 ¼-inch floppy drives. Such fate has befallen computer products at an increasing rate, and many owners, shocked by the rapid depreciation, have found it hard to trash their once-costly products. As a result, a multitude of obsolete machines like my old Apple have lain idly in attics and storerooms – awaiting uncertain but inevitable end-of-life disposition. Today, the estimated population of spent computers reaches upward of two hundred million and, combined with rapid turnover in technology, grows by forty million per year [1, 2].

Oddly enough, consumer attachment and consequent reluctance to toss out obsolete machines may have helped reduce environmental damage. While dust collected on the keyboards, studies brought to light toxic hazards from conventional disposal in landfills and incinerators,

42 such as the release of lead from circuit board solder and computer screens.

Dealing safely with the mounting backlog of electronic waste and planning for future obsolescence requires more than simply overcoming emotional attachments and alarm at rapid product devaluation; end-of-life disposition alternatives require institutional changes in industrial production and consumption. In this article, I focus on the emergence of one type of change: the development of reverse manufacturing (i.e., product reuse and recycling of industrial goods) as a means for reclaiming industrial assets and diverting them from disposal.

Of note are efforts to institute reverse manufacturing already underway on both sides of the pond. The European Union has passed a

Directive on Waste Electrical and Electronic

Equipment (WEEE) that assigns responsibility to manufacturers for disposition of spent products

[3], and this regulation is spurring development of reuse and recycling infrastructure. Far less bold, the United States government has taken little concerted action; the onus of responsibility for end-of-life management remains with consumers and municipalities, and the development of reverse manufacturing has largely been left to the market.

Unfortunately, emerging infrastructure has already run into serious problems. Suspected for years, the global trade of e-waste is exporting harm from the industrialized world to less economically advantaged countries [4]. In addition to violating international accords banning shipment of hazardous wastes [5], this cross-boundary transport of industrial trash raises questions about the benefits and drawbacks of reverse manufacturing in practice. Setting aside the assumption that material loops close benignly, this paper follows products, parts, and materials through reverse manufacturing to describe loop dynamics in practice. By examining waste computer processing in the United States, this research reveals challenges inherent in reuse and

recycling for complex products like electronics.

This case further reveals why aspirations for loop closure may be insurmountable, or at least seem unrealistic, in some instances.

My intention in describing emerging infrastructure

(i.e., assets flow, amount of recovery, underlying process choices, etc.) and its challenges is to lay a foundation for asking the bigger questions: how successful is product recovery at reducing environmental impacts, and how might responsibility best be assigned to stimulate it? My argument is that we can only answer these questions by first understanding the processes of product recovery and the consequent shape of the manufacturing loop(s) they create. The purpose of this paper is not to argue for the superiority of one form of loop closure over another; rather the point is to examine the process of reverse manufacturing for complex goods to describe the unfolding infrastructure and to uncover hidden assumptions that affects its form and function. In this vein, this paper does three things: (i) describes closed-loop models and underlying assumptions, (ii) points out challenges for the reverse manufacturing of complex goods like computers, and (iii) suggests next steps that can help improve the development of product recovery for electronics.

Product Recovery in Theory

Product recovery as an environmental imperative has roots in industrial ecology’s application of ecological metaphor to industrial planning and practice [6, 7]. Akin to life-cycle analysis of design and materials flow accounting, product recovery is a tool to help manage the biogeochemistry of industrial systems (i.e., the ecologically acceptable cycling of substances between and through industrial sub sectors). In concept bridging the grave of one product with the cradle of another, product recovery not only proposes to mitigate anthropogenic impacts by diverting goods from harmful disposal; it also reclaims industrial assets – whole products, component parts, and constituent materials – for another generation of use. That is, through reuse and recycling

1 product recovery recirculates assets

back into the industrial economy when they would otherwise dissipate out.

The normative principles of industrial ecology are powerful lenses for considering industrial transformation. However, theoretical critiques of

1 Here “reuse” describes redeployment of industrial assets geared toward preserving their design content. In contrast,

“recycling” is the reprocessing of assets to facilitate another generation of use without concerted attention to design preservation.

43 the core ideas justify closer study of the largely untested derivative concepts. In the case of product recovery, the shortcomings of the closedloop ideas are particularly important. Scholars have noted that descriptions of industrial ecology largely ignore the thermodynamic tension between the entropy in systems and the energetic demands of maintaining order [8, 9]. This limitation translates into trade-off choices between tracking down and redirecting errant molecules and the energy requirements of doing so. Accordingly, the degree of loop closure depends on the dynamism of closure efforts. Implementation studies provide an additional justification for empirical scrutiny of product recovery [10]: simply put, ideas change between the drawing board and the workbench.

Product Recovery in Action

Much of the literature on reverse manufacturing focuses on the technology and logistics for relatively simple products, like beverage containers, toner cartridges, and tires. As this section explains, the end-of-life processing for such goods provides limited insight into the challenges involved in the reuse and recycling of complex products like photocopying machines, automobiles, and computers. Based on field interviews conducted with eight firms involved in the reverse manufacturing of computers, here I offer an empirically based model of recovery as a series of stages.

Commonly labeled simply “recycling” 2 , product

recovery is a complement to production – analogous to the way that reverses manufacturing mirrors “forward” manufacturing. In this sense, the term “recovery” describes a broad set of activities that reclaim value by refurbishing whole products, salvaging components, or simply reprocessing constituent materials. In this paper I focus on the industrial processes involved in product recovery and, for this reason, use the term interchangeably with “reverse manufacturing.” It is important to note, though, that reuse and recycling of product assets need not proceed through industrial processing and, therefore, recovery and reverse manufacturing do not truly have a one-to-one mapping.

In addition to this caveat, I must note a simplification in my model. In practice the blend of products recovered can vary across companies, and computers are not atypical in this regard. One should expect to see a variety of machine types, peripheral equipment, and even other electronics

2

For a more complete treatment of terminology in product recovery, White et al. (2003) provide a glossary of terms [11]

in a computer recovery stream. However, for illustrative purposes I am reducing my discussion simply to the reverse manufacturing of desktop computers. Overcoming this prevarication requires tackling lots of the messy aspects of recovery, since the handling of myriad products converges and diverges at various points in the process, as well as from firm to firm.

Acknowledging that the lynchpin of predictive power is effective simplification, I modestly leave the complicating effects of product diversity to future discussions.

A Model of Computer Recovery: desktop computers

Generically speaking, three types of recoverable assets form the triumvirate of inputs to reverse manufacturing: the whole product, its individual designed parts, and the materials comprising both.

For a desktop computer three subassemblies, which contain the various recoverable parts, constitute the whole: the central processing unit

(CPU), the monitor, and other input/output peripherals such as keyboards, mice, or speakers.

The CPU contains hard and disk drives, circuit boards with integrated circuit chips, impactresistant plastic casings, an internal metal framework, small batteries, motors, power supplies, and cables. The cathode ray tube-based monitor is housed in an impact-resistant plastic shell and composed of a leaded glass funnel and coated glass front panel, a cathode, and circuitry.

The peripheral equipment is composed of minor circuitry and some movable parts, most of which are not readily salable in their own right. The materials recoverable from this medley of components include ferrous metals, aluminum, copper, precious metals, polystyrene and ABS plastics, thermosetting epoxy plastics, leaded and unleaded glass, and hazardous wastes like batteries

(see Figure 1). Because products are often transported with appreciable amounts of paper, cardboard, and polystyrene foams, these materials also require disposition and present parallel material management challenges [12].

During reverse manufacturing firms must make a variety of choices about assets to recover vis-à-vis logistics, technology, and economics. Some choices limit other options; certain assets are destroyed or “cannibalized” in the process of practically or efficiently extracting others. As a result, the outputs of reverse manufacturing are not simply a reverse bill of materials for the original product but rather an admixture of refurbishable whole products, reusable parts, recyclable materials, and waste.

44

Figure 1. A Desktop Computer and Its Assets

Monitor

CPU

Peripherals

Cathode Ray Tube

Equipment Casings

(external structure)

Structural Components

(internal structure)

Hard Drive, Disk Drives

Circuit Boards

(motherboard and adapter cards)

IC Chips

(microprocessor and memory)

Hazardous Components

(batteries)

Electrical Devices

(cables, motors, power supply, etc.)

Input Devices

(keyboard, mouse, speakers) leaded and unleaded glass, copper-containing circuitry high impact polystrene and ABS plastics ferrous and nonferrous (Al) metals, polystyrene plastic ferrous metals precious and nonferrous (Cu) metals, thermosetting plastics precious and nonferrous (Cu) metals, silicon-based chips hazardous waste nonferrous (Cu) metals, plastic coatings nonferrous (Cu) metals, polystyrene plastics

Product Subassembly Parts Materials

As printed in White et al. (2003)

Drawing on the closed-loop concept, in Figure 2 mimics contemporary models by depicting reverse manufacturing as a multi-stage process analog to forward manufacturing [13, 14, 15]. In this stylized view production and recovery form two halves of a circular industrial process. The left side of this figure demonstrates four generic stages in forward manufacturing: material manufacturing, component manufacturing, product assembly, and distribution and sale. On the right are four activities that constitute reverse manufacturing: acquisition, assessment, disassembly, and reprocessing. The middle of the diagram also contains two ancillary stages: testing and repair (often integrated with warranty and service programs) and redistribution and resale

(which may combine with product distribution and

3 This discussion focuses on the four

recovery stages on the right.

During the first stage, called acquisition, reverse manufacturers make decisions about which products to recover and how to gather them. That is, acquisition involves selecting product types, locating them, collecting them, and transporting them to the recovery facility. Although the field of reverse logistics offers approaches for controlling the timing, quantity, composition, and quality of products entering the recovery process

[16], computer recovery companies have been able to make little use of it. Because of the spatial dispersion of computers among individual owners and variation in product technologies, firms find it very difficult to reduce recovery input flow

3 In addition, there are two sets of notable activities not depicted as stages in this diagram: product design and contracting strategy, which influence the entire process but exceed the complexity of this basic input-output model.

Figure 2. Supply Loop inv en tor y y

Redistribution and Resale

Acquisition

- collection

- transport inve ntor

- valuation

- reusability inve nto ry

Component inv en

- disaggregation

- dismantling

- demolition in ve nt or y y ry nto ve in ry nto ve in

- recycling

- energy recov.

Adapted from White et al. (2003). Forward manufacturing on the left; reverse manufacturing on the right. uncertainty (quantity and timing) and equipment contingencies (composition and value). Some recovery firms have reduced variability in inputs is by developing contracts with large end-users, such as financial institutions or original equipment manufacturers (OEMs), who produce a steadier and more consistent stream of products from inhouse use. Most of the time, acquisition utterly lacks such sophistication. Instead, firms face a continuing tension between accepting diverse product types, which requires more manufacturing flexibility, and coping with intermittent inputs streams, whose oscillation disrupts the efficient use of labor and shop space. With little ability to control the flow of process inputs, businesses collect what they can find and ship the equipment to their processing facilities

Regardless of its trajectory of arrival, once equipment has arrived at the facility, managers must determine which assets are valuable and, given that the wholes, parts, and materials are mutually exclusive outputs, the optimal mixture to recover. This determination is assessment, the second stage of reverse manufacturing. By assessing products, recoverers determine whether to repair (aka refurbish, renovate, recondition, retrofit, etc.) or just plain resell a product or its parts. For the most part, this process occurs when products first arrive and are sorted and, ideally, would be closely linked with product acquisition. However, the cross-section of computer models in any given year, notwithstanding the longitudinal variability given the backlog in attics and basements, makes it very hard to conduct computer assessment upfront and in one shot. For one thing, reverse manufacturers generally lack product schematics for the computers they receive. For another, many products are modified during their lifetime, and information about this tinkering rarely accompanies waste electronics. As a result, assessing computer products is like playing with Russian dolls. As layers of the product are uncovered, firms discover the constituent parts and materials that are available for recovery. The lack of comprehensive, introductory assessment constitutes one of the greatest risks in recovery. The need for repeat assessment or assessment-on-the-fly during disassembly, a direct result of incomplete information about inputs as well as market immaturity for outputs, takes extra time and opens the process up to errors and oversight.

The stage that follows assessment in the model loop is disassembly, the actual deconstruction of a computer to extract its assets for reuse, recycling, or disposal. For computers, disassembly begins by disentangling reusable subassemblies and by opening the product to locate reusable parts. Once the casings have been penetrated, valuable reusable parts are removed. The remainder of the products

45

is manually or mechanically sorted for material recovery.

There are two primary axes for variation in this process.

The first is the organization of the disassembly activities as continuous or batch processes. Only large reverse manufacturing operations, whose contracts help them to source consistent inputs streams, have been able to establish semi-continuous operating lines along which disassemblers unscrew, pry open, or break apart computer products. Most of the time, disassembly is a batch operation that takes place at a semi-circular workbench, where a lone disassembler sorts assets into bins.