EU-Monitor 86

Financial Market Special

August 12, 2011

Bank funding of residential

mortgages in the EU

The funding and financing of residential mortgages may affect

financial stability, because mortgages are both an important asset

and liability for MFIs and households. The question is: which funding mix

contributes most to financial stability?

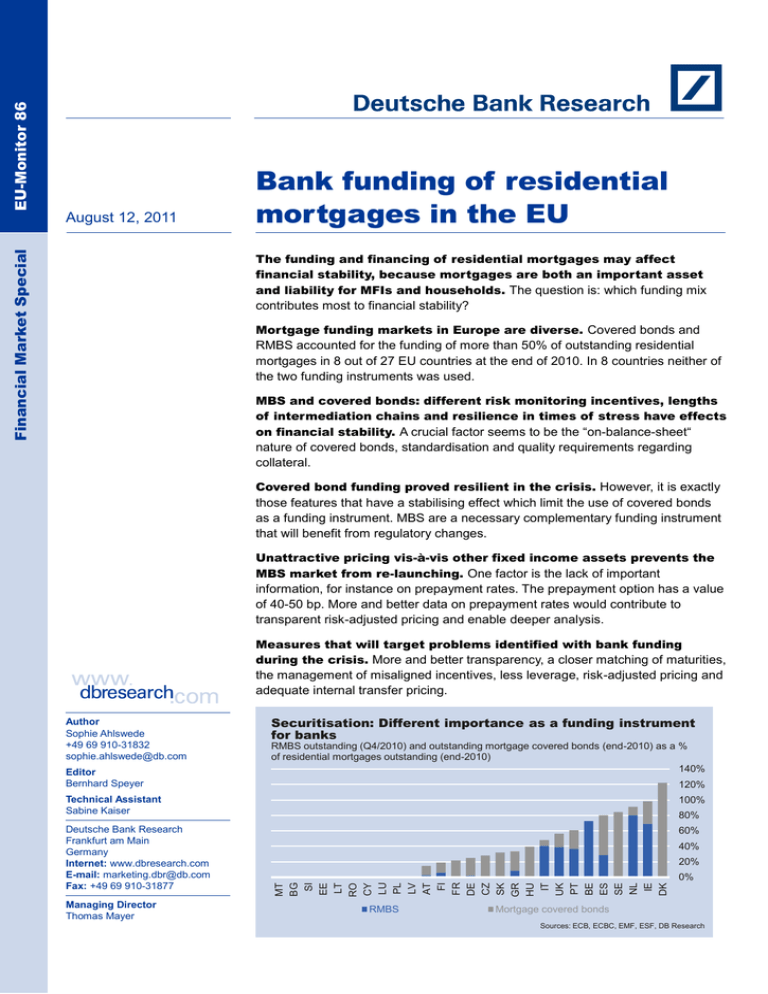

Mortgage funding markets in Europe are diverse. Covered bonds and

RMBS accounted for the funding of more than 50% of outstanding residential

mortgages in 8 out of 27 EU countries at the end of 2010. In 8 countries neither of

the two funding instruments was used.

MBS and covered bonds: different risk monitoring incentives, lengths

of intermediation chains and resilience in times of stress have effects

on financial stability. A crucial factor seems to be the ―on-balance-sheet―

nature of covered bonds, standardisation and quality requirements regarding

collateral.

Covered bond funding proved resilient in the crisis. However, it is exactly

those features that have a stabilising effect which limit the use of covered bonds

as a funding instrument. MBS are a necessary complementary funding instrument

that will benefit from regulatory changes.

Unattractive pricing vis-à-vis other fixed income assets prevents the

MBS market from re-launching. One factor is the lack of important

information, for instance on prepayment rates. The prepayment option has a value

of 40-50 bp. More and better data on prepayment rates would contribute to

transparent risk-adjusted pricing and enable deeper analysis.

Measures that will target problems identified with bank funding

during the crisis. More and better transparency, a closer matching of maturities,

the management of misaligned incentives, less leverage, risk-adjusted pricing and

adequate internal transfer pricing.

Author

Sophie Ahlswede

+49 69 910-31832

sophie.ahlswede@db.com

Editor

Bernhard Speyer

Securitisation: Different importance as a funding instrument

for banks

RMBS outstanding (Q4/2010) and outstanding mortgage covered bonds (end-2010) as a %

of residential mortgages outstanding (end-2010)

140%

120%

Technical Assistant

Sabine Kaiser

Managing Director

Thomas Mayer

60%

40%

20%

0%

MT

BG

SI

EE

LT

RO

CY

LU

PL

LV

AT

FI

FR

DE

CZ

SK

GR

HU

IT

UK

PT

BE

ES

SE

NL

IE

DK

Deutsche Bank Research

Frankfurt am Main

Germany

Internet: www.dbresearch.com

E-mail: marketing.dbr@db.com

Fax: +49 69 910-31877

100%

80%

RMBS

Mortgage covered bonds

Sources: ECB, ECBC, EMF, ESF, DB Research

EU-Monitor 86

Bank funding structures are

important for financial stability

The development of bank funding before and during the crisis has

highlighted its importance for financial intermediation and credit

1

provision in an economy. One main lesson is that maturity

mismatches not only within individual institutions but in the financial

system as a whole, created risk that was neither adequately priced

2

nor prepared for. This led, among other factors, to financial market

instability. Residential mortgages are an important asset in most

economies, accounting for a large part of banks’ assets and

households’ liabilities. Their financing and funding may affect

financial stability.

This paper provides an overview of banks’ funding of residential

mortgages in Europe, taking a close look at the structure of funding

instruments and potential effects on financial stability.

Differences in mortgage funding

Some funding instruments of banks can be clearly attributed to

residential mortgages: securitised debt in the form of covered bonds

or residential mortgage backed securities (RMBS). Others such as

equity, unsecured debt or hybrid forms of the two, and deposits are

general sources of funding, which are not clearly linked to a

particular line of business. Nevertheless, they may also be used to

fund mortgage lending. In the case of equity, retail deposits or longterm senior unsecured debt this is generally not worrying from the

maturity perspective because these funding instruments are

associated with a medium- to long-term permanence even in times

Banks' issuance

Euro-area-17, in EUR bn, securities

excluding shares and derivatives

6,000

5,000

4,000

3,000

Residential mortgages: Importance varies

2,000

Outstanding lending for house purchase in % of total assets, 12/2010

35%

1,000

1993

1999

2005

30%

0

2011

25%

20%

Short-term securities

Long-term securities

… of which fixed rate issues

… of which floating rate issues

10%

5%

1

0%

LU

MT

IE

BE

RO

AT

SI

CY

IT

FR

BG

Euro area

DE

HU

UK

GR

FI

NL

CZ

SK

ES

PT

SE

LV

PL

LT

DK

EE

Source: ECB

15%

Sources: ECB, DB Research

Certificates of deposit

of stress. The permanence in times of stress can be further

increased for retail deposits by having credible and sustainable

deposit guarantee schemes in place. Short-term unsecured debt

instruments, interbank lending and wholesale deposits, however,

tend to be more volatile funding instruments. Since the beginning of

the crisis short-term and floating-rate issues have remained

constant or declined while long-term and fixed-rate issues have

increased (see chart 1).

Short-term bonds

Funding risks

Repurchase agreements

Funding risk is the ―potential for unanticipated costs or losses due to

3

a mismatch between asset yields and liability funding costs.―

MFIs' funding layers

1 Equity

Subordinated debt

Medium and long-term senior debt

2 Customer deposits

3 Commercial paper

Swapped foreign exchange liabilities

Wholesale deposits

Source: ECB

3

1

2

3

2

2

In UK, NL, RO, HU and BE, 4-12% of mortgage loans were provided by non-banks

in 2007. However, funding of non-banks will not be a topic in this paper. For details

see London Economics. Study on the role and regulation of non-credit institutions

in EU mortgage markets. September 2008.

ECB. EU banks’ funding structures and policies. May 2009, p. 28.

IFCI Risk Institute: www. Riskinstitute.ch

August 12, 2011

Bank funding of residential mortgages in the EU

Funding risk may result from maturity mismatches, currency

mismatches and liquidity risk.

Funding in foreign currency

Euro-area-17 financial and non-financial

issuers, outstanding securities in non-euro

currencies as % of total outstanding

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

99

01

03

05

07

09

11

Short-term securities other than

shares

Long-term floating-rate issues

Long-term fixed-rate issues

Source: ECB

4

Housing loans in foreign currency as % of

total housing loans to households*

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

AT BG PL HU LT EE LV RO

End 2007

End 2010

* LV, LT: all loans, not only mortgages

5

European mortgage market

Outstanding amounts at the end of the

period, in EUR bn

6,000

5,000

4,000

3,000

2,000

1,000

RMBS

Mortage covered bonds

Residential mortgages

August 12, 2011

Funding liquidity risk is the risk that liabilities can only be met at

prices that result in the obligor incurring a loss, or not at all. If this

risk increases suddenly, as seen recently in the financial crisis, this

can pose a threat to financial stability as well.

Securitised debt

The bank funding landscape of residential mortgages in Europe is

diverse: in 8 out of 27 countries covered bonds and RMBS

accounted for the funding of more than 50% of outstanding

residential mortgages at the end of 2010. However, in another 8 EU

countries banks did not use covered bonds or mortgage backed

securities at all.

Covered bonds

Covered bonds are a part of the banks’ funding mix in 18 EU

member states. All in all, the value of European mortgage covered

bonds outstanding at the end of 2010 was around EUR 1.8 tr – a

third of the EU´s residential mortgage market (see chart 6). The

volume of the EU mortgage covered bond market grew by almost

18% p.a. between 2003 and 2010. However, the relevance of

covered bonds for the residential mortgage market differs

significantly from country to country. In Poland or Latvia covered

bonds hardly exist, while in 12 member states they accounted for a

minimum of 17% and up to 100% of residential mortgage funding in

2010. The different take-up of covered bonds as a funding

instrument has several reasons: 1) While some markets have a long

history of covered bond legislation (e.g. DE, DK, FR), others only

introduced a legal basis a few years ago (e.g. NL, SE, UK, IT, EL,

PT, FI, IE); 2) legal frameworks differ, making covered bonds more

or less attractive as a funding tool and for investors; or 3) alternative

funding like deposits, unsecured bonds and securitisation are

available and more attractive.

In addition to the mainly national legal framework for covered bonds

some EU legislation affecting and loosely defining covered bonds

2010

2009

2008

2007

2006

2005

2004

2003

0

Sources: AFME, ECBC, ECB, DB Research

Foreign currency risk results from assets and liabilities in different

currencies. Some euro-area banks depend to a substantial part on

non-euro currency funding (see chart 4) and in some other EUcountries, private households have increasingly taken on debt in

5

currencies not equalling the currency of their income (see chart 5).

Hence, when the ―debt currency‖ appreciates vis-à-vis the ―income

currency‖, borrowers can face higher debt service. Depending on

whether default risk resulting from currency volatility was adequately

priced or hedged by issuers, this could contribute to financial

instability.

Considering the importance of residential mortgages for banks and

households in many economies, the question is: which funding mix

for residential mortgages contributes most to financial stability?

FX mortgages

Source: National central banks

A maturity mismatch occurs when short-term funding is used to

issue long-term assets, e.g. mortgages. When risk resulting from

this maturity transformation is not adequately priced, this may

4

contribute to financial instability in times of stress.

4

6

5

Gambacorta, Leonardo and David Marques-Ibanez (2011). The bank lending

channel: Lessons from the crisis. BIS working paper No. 345. May 2011.

ECB (2010). EU Banking Sector Stability Report. September 2010 and ECB

(2011). Financial Stability Review. June 2011.

3

EU-Monitor 86

exists. Covered bonds receive a preferential treatment in EU

legislation (UCITS, CRD and Solvency directives) if they fulfil certain

basic criteria. The UCITS directive sets limits for investments in

securities by mutual funds and allows a higher concentration in

6

covered bonds (25% as opposed to 5% for other securities). In the

CRD covered bonds receive a preferential risk weighting for the

7

calculation of capital requirements.

Residential mortgage backed securities (RMBS)

Residential mortgage backed securities (RMBS) are being used as

a funding tool by banks in 12 out of 27 EU countries. They

accounted on average for 23% of outstanding mortgage funding in

the EU at the end of 2010. In 2006, this was estimated to be around

Securitisation of residential mortgages in Europe

RMBS outstanding in % of residential mortgages outstanding

Q1/2008

Q3/2008

UK

IT

Q1/2009

Q3/2009

Q1/2010

ES

IE

PT

BE

Q3/2010

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Q1/2011

NL

Sources: AFME, ECB, DB Research

7

8

10%. However, they only play a major role in seven countries: BE,

NL, IT, IE, UK, PT, ES. In those countries, RMBS accounted on

average for 52% of residential mortgage funding at the end of 2010.

While Belgium, Ireland and Italy had the highest growth rates of

9

RMBS outstanding between 2008 and 2010 (see chart 7) , the

highest amounts outstanding of total European RMBS are in UK, NL

and ES.

MBS are based on individual contracts which are partly

standardised but there is no law regulating collateral or supervision

of securitisations in most countries. As for covered bonds, the same

EU legislation affects securitisation.

Other sources of funding

Deposits are more important for

banks in new member states

10

Competition for deposits has increased which is further fuelled by

regulatory initiatives such as Basel III and bank levies introduced

recently in many markets. For example, in the calculation of the

bank levy in Germany, a larger share of deposits in total liabilities

will lead to lower contributions. However, deposits are finite

depending on a variety of factors (e.g. income, savings, interest

11

rates). They grew by 7% p.a. in Europe during the last 10 years.

6

7

8

9

10

11

4

Art. 52 (4) of Directive 2009/65/EC.

Art. 113, 3. (l) and Annex VI, Part 1, point 71 of Directive 2006/48/EC.

Report of the Mortgage Funding Expert Group 2006.

Including retained issuance. Retained issuance for all securitisations in Europe

(not only MBS) was around 23% in 2007. In 2008 and 2009 94% and 96% were

retained and only very selected transactions were placed. In 2010 retained

issuance declined slightly to 81%, see ESF Securitisation 2011 datafile.

ECB (2010).

Calculated on the basis of the 14 countries for which ECB data on deposits by

non-MFIs is available for February 2001-February 2011. Deposits by non-MFIs

August 12, 2011

Bank funding of residential mortgages in the EU

Mortgage lending increases where it

is not restrained by deposit growth

In general, deposits play a more prominent role in the funding of

banks in the new Member States. Where no form of securitisation is

used, deposits are more important or mortgages are not that

important as assets for banks. In countries where the mortgage

market is relatively large compared with the size of the economy,

deposits are relatively unimportant and covered bonds and/or RMBS

account for a high share of residential mortgage funding. This points

to increased mortgage lending where funding is not restrained by

deposit availability and growth. The ability to refinance assets via

on-balance (covered bonds) or off-balance (MBS) securitisation

relieves banks of funding constraints.

Funding structures and importance of mortgage credit 2009

How important

are mortgages

as assets for

MFIs?

How important How important

are mortgages are mortgages in

for the economy? households loan

portfolios?

How important

are mortgages

relative to

households

income?

How important

are RMBS as a

funding tool?

How important

How important

are mortgage

are deposits as

covered bonds as a funding tool?

a funding tool?

Mortgages as % Mortgages as % Mortgages as % Mortgages as % RMBS as % of

of total MFIs

of GDP

of total loans to of net disposable mortgages

assets

households

income of

outstanding

households

Mortgage

Total deposits

covered bonds as from non-MFIs

% of mortgages in % of MFIs

outstanding

total assets

LU

1.8%

42.0%

56.6%

-

0.0%

0.0%

34.6%

MT

5.4%

43.0%

70.3%

-

0.0%

0.0%

38.9%

IE

6.5%

90.3%

77.1%

123.0%

48.9%

26.9%

23.4%

BE

7.5%

43.3%

75.8%

39.1%

61.2%

0.0%

46.9%

RO

7.5%

4.9%

24.2%

0.0%

0.0%

53.3%

AT

8.2%

26.2%

54.9%

44.1%

3.0%

7.2%

42.0%

SI

9.1%

11.4%

46.7%

18.2%

0.0%

0.0%

46.5%

CY

9.1%

61.3%

50.3%

88.0%

0.0%

0.0%

50.9%

IT

9.3%

21.7%

56.5%

28.7%

49.6%

5.0%

41.9%

FR

9.9%

38.0%

75.1%

56.3%

1.6%

18.8%

36.8%

BG

11.2%

12.6%

43.8%

28.6%

0.0%

0.0%

61.3%

DE

11.7%

47.6%

68.0%

61.9%

1.8%

23.4%

31.4%

HU

12.5%

16.7%

50.5%

29.1%

0.0%

48.4%

49.5%

UK

12.8%

87.6%

83.0%

98.8%

46.4%

20.3%

36.0%

GR

15.5%

33.9%

69.3%

40.5%

13.7%

9.6%

56.4%

FI

16.0%

58.0%

73.0%

73.7%

7.9%

10.6%

31.7%

NL

16.0%

105.6%

89.1%

143.8%

52.2%

7.5%

44.9%

CZ

16.8%

19.4%

70.2%

36.1%

0.0%

31.4%

70.6%

SK

18.6%

14.6%

67.9%

24.4%

0.0%

38.0%

69.2%

ES

19.2%

64.6%

75.0%

97.3%

25.5%

51.2%

49.8%

PT

20.4%

67.5%

79.7%

96.5%

32.3%

18.3%

42.7%

SE

21.0%

82.0%

66.6%

98.2%

0.2%

88.3%

28.0%

LV

21.4%

36.6%

79.3%

58.6%

0.0%

1.2%

46.1%

PL

21.7%

18.2%

50.8%

26.7%

0.0%

1.1%

60.7%

LT

23.3%

22.6%

72.1%

32.0%

0.0%

0.0%

45.5%

DK

24.1%

103.8%

85.8%

271.7%

0.0%

120.5%

25.8%

EE

29.4%

44.5%

82.1%

79.7%

0.0%

0.0%

46.5%

-

Sources: ECB, ECBC, EMF, Eurostat, DB Research

8

So, which specific features of the two funding instruments make a

difference with regard to their impact on financial stability?

grew 8.3% p.a. in the last 5 years (26 Member States). Most of the new Member

States had double-digit CAGRs in the last 5 years.

August 12, 2011

5

EU-Monitor 86

How covered bonds and MBS affect financial stability

Three aspects play a role when looking at differences in the way

covered bonds and MBS affect financial stability: 1. risk monitoring

incentives; 2. the length of the credit intermediation chain; and 3.

resilience in times of stress.

Risk monitoring

Covered bonds: issuer monitors and

hedges risks

The cover pool of covered bonds is generally dynamic. This means

that in case a loan in the cover pool defaults or prepays, the issuer

substitutes it with a performing loan. The cover pool is essentially a

credit enhancement rather than an exposure to the asset class from

the point of view of the investor because first of all he has a claim

vis-à-vis the issuer. In case the issuer fails, he also has a claim on

the cover pool. From the perspective of the issuer this order of

claims carries risks that he has to monitor and hedge. The bank that

originated the loan therefore retains a strong incentive to monitor its

performance.

MBS: risks are completely passed on

to investors

By contrast, MBS generally have a static cover pool and pass

ondefaults and prepayments directly to investors or allocate them

according to tranches reflecting different maturities and default risk.

For example, there could be three different tranches A, B and C,

where tranche A receives the first prepayments and/or defaults, B

the later ones and C the last. Investors with a long desired maturity

and high risk aversion will opt for tranche C while short-term

investors may choose tranches A or B.

Default rates in Europe

Countries missing: DE, NL, AT, SE, SI, LU

4.0%

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

2008

No RMBS*

2009

RMBS

Hence, interest rate risk, prepayment risk and default risk is passed

on to investors in the case of MBS. The pass-through of risks

translates, inter alia, into higher risk premia for MBS compared with

12

covered bonds. A result of this risk transfer together with the

derecognition of the securitised loans from the balance sheet, is that

the incentive for the issuer to monitor those risks decreases. This

has resulted in higher default rates in the case of loans securitised

13

in US subprime RMBS. Data on the European market is patchy but

points into the same direction (see chart 9). Default rates for

residential mortgages tend to be higher in countries were banks

securitised and sold loans off their balance sheet.

The length of the intermediation chain

* Countries where RMBS are not or hardly used as a

funding instrument by banks

Sources: AFME, European Commission,

DB Research

Another feature that distinguishes covered bonds from MBS is that

they generally pay fixed rates while MBS generally have floating

rates.

9

Another difference between the two instruments is the length of the

intermediation chain:

Covered bonds: short intermediation

chain

Assets backing the cover pool of a covered bond are not

derecognised from the balance sheet of the issuer. The bank issuing

the covered bond is the direct intermediary between the borrower

and the investor. Hence, the initial risk taker (bank) and the one

bearing the risk (investor) have a close relationship.

MBS: longer intermediation chain

In a simple securitisation the intermediation chain has at least one

more layer: the bank advancing the loan to a borrower sells the loan

to a special purpose vehicle (SPV). The SPV funds its purchase of

12

13

6

Schaefer, Stefan (2006). Integration of EU mortgage markets: Its the funding,

commissioner! DB Research. EU Monitor 38. 19. October 2006.

Keys, Benjamin et al. (2008). Did securitization lead to lax screening? Evidence

from subprime loans. December 2008 and Mian, Atif and Amir Sufi (2008). The

consequences of mortgage credit expansion: Evidence from the U.S. mortgage

default crisis. December 2008.

August 12, 2011

Bank funding of residential mortgages in the EU

the loans with the issuance of bonds which it sells to investors and

which are backed by claims on the loans purchased. Some

investors in turn fund the purchase of those bonds by issuing shortterm papers.

The lengthening of the intermediation chain of funding carries risks

14

to financial stability. This is due to risk being transferred several

times which increases the distance between the originator and the

ultimate risk bearer.

Who holds what?

The investor base in European RMBS and covered bonds is not

transparent. According to the CML, investors in UK RMBS before

the crisis were increasingly (around 75%) so-called leveraged

15

investors, including banks. Long-term unleveraged investors such

as pension funds, insurers or other asset managers chose to invest

in more long-term fixed-rate bonds such as covered bonds. A survey

among covered bond dealers in 2009 showed that only 34% of

covered bond investors can be counted towards the ―intermediary

16

sector‖, i.e. the so-called leveraged investors.

Resilience in times of stress

Looking at the performance in terms of spread widening and actual

issuance during the financial crisis, covered bonds proved to be a

17

more resilient funding instrument than MBS. Apart from the

structural differences already mentioned (risk monitoring, short

intermediation chain), quality requirements for covered bond

collateral are strict. The standardised quality requirements and credit

enhancement via ―dual recourse‖ contributed to the (relative)

liquidity of the market. Investors knew what they were buying and

pricing was less distorted by doubts about the value of the

underlying assets. Yields of covered bonds have started to show a

stronger differentiation since the beginning of the crisis (see chart

10) which reflects different levels of resilience. This is, among other

18

things , a result of different legal requirements.

Funding via Pfandbriefe is very attractive

Covered bond yields

Yield to maturity in %, all maturities,

collateral includes mortgages and/or public

loans

8.0

7.5

7.0

6.5

6.0

5.5

5.0

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

04 05 06 07 08 09 10 11

FR

DE

IE

ES

Asset swap spreads of iBoxx covered bond indices, in bp

09

10

11

Italy

Spain Pooled Cedulas

UK

Sources: Markit, Deutsche Bank

11

UK

Source: EuroMTS

10

14

15

16

17

18

August 12, 2011

French Legal

Mortgage Pfandbriefe

Ireland

500

450

400

350

300

250

200

150

100

50

0

Shin, Hyun Song (2010). Financial intermediation in the post crisis financial

system. BIS working paper No. 304. March 2010.

CML (2010). The outlook for mortgage funding markets in the UK 2010-2015. 28.

January 2010.

Shin (2010) and SIFMA (2009). 1st Annual European Covered Bond Investors

Survey. May 2009.

See also Fitch (2011). Trends in bank funding profiles. June 2011.

Other things include, for example, requirements for over-collateralisation by rating

agencies which differ depending on national or even regional mortgage market

characteristics.

7

EU-Monitor 86

Covered bonds: better for financial stability?

LTV limits for calculation of

collateralization rates of

cover pools for residential

mortgage covered bonds

DE

60% of MLV*

HU

70% of MLV

SK

70% of MLV

ES

80% of MLV

FR - Obligations

Foncières

80% of MLV

IE

75% of MV**

SE

75% of MV

DK-SDO

75% or 80% of MV

DK-SDRO

75% or 80% of MV

In contrast to covered bonds, funding via MBS has an expansionary

effect on the credit market. By derecognising loans from the balance

sheet banks do not have to hold own capital against those loans and

19

can use the freed up capital for generating other assets. This is not

necessarily bad for financial stability and covered bonds are not per

se better for financial stability than MBS. MBS do not necessarily

have negative effects on the economy as long as higher risk

resulting from structural characteristics of the instrument is

transparent, understood by investors and adequately priced.

FR general law based 80% of MV

FR - Obligations á l'

Habitat

80% of MV

DK-RO

80% of MV

IT

80% of MV

NL

80% of MV

PT

80% of MV

UK

80% of MV

In fact, several reasons call for caution with respect to an

unconditional increase in covered bond funding:

* MLV= Mortgage Lending Value, ** MV= Market Value

Source: ECBC

12

Overcollateralisation

Overcollateralisation means that the value of

underlying assets backing a securities issue is

higher than the value of securities issued. For

example, a cover pool contains mortgages

worth EUR 120 bn but the bonds issued

backed by this cover pool only amount to EUR

100 bn. This lowers the creditors’ exposure to

default risk and is done in order to obtain a

higher credit rating.

Since the start of the crisis, normal

overcollateralisation levels have roughly

doubled.

The fact that assets are not derecognised in the case of covered

bonds is an advantage from a stability perspective. It leads to higher

incentives for risk monitoring and keeps the intermediation chain

short, which together with quality requirements resulted in better

resilience in times of crisis. However, keeping loans on the balance

sheet requires banks to hold certain regulatory own capital which

limits the ability to issue covered bonds and other assets.

Consequently, the use of covered bonds and the concomitant

increase in mortgage lending is limited by available own capital in

addition to the quality restrictions.

1. Too much covered bond funding may lead to a greater

subordination of other creditors of the issuer. Increasing overcollateralisation (see box) contributes to greater subordination.

Since the cover pool is reserved for covered bond investors in

case the issuer defaults, other creditors have access to fewer

20

and potentially less valuable assets to cover their claims. Other

creditors will therefore ask for higher risk premia. Shareholders,

too, are likely to react with lower equity valuations as their

residual claim will be reduced. Consequently, the amount of

covered bond funding that is economically sensible for an issuer

is limited.

2. Secondly, not all mortgages are eligible for covered bond funding

based on national and EU legislation (UCITS, CRD) requiring

certain quality standards. MBS are not subject to such

restrictions and are therefore a complementary funding

instrument.

3. As spread developments in the crisis have shown, the quality

and resilience of covered bonds differs substantially depending

on national legislation covering quality requirements and

supervision of covered bonds, the country of the collateral and

21

the issuer (see chart 11). Different LTV limits are just one

example (see table 12) showing the differences in the national

legal frameworks (and considering that property valuation

standards vary significantly, this shows only part of the

differences).

4. There is also a risk that (an overly) preferential treatment for

covered bonds will distort incentives and lead to excessive

19

20

21

8

Loutskina, Elena (2010). The role of securitization in bank liquidity and funding

management. August 2010.

Spain is an extreme case in this respect, because there the cover pool consists of

all of the issuer`s outstanding mortgages.

ECBC (2011). Covered Bond Fact Book 2010. P. 51 and BayernLB Research

(2011). Covered Bond Report. 21. April 2011. P. 3 and Volk, Bernd. EUR Liquid

Credit Weekly. 23.5.2011, P. 2.

August 12, 2011

Bank funding of residential mortgages in the EU

22

demand from investors. The risk that this might happen could

increase as a result of planned regulation (see below) that will

likely boost demand for covered bonds.

5. Covered bond funding does not automatically mean that

maturities are better matched. Covered bonds may have a

significantly shorter maturity than the assets in the cover pool.

How to increase monitoring

incentives?

As discussed, MBS have characteristics that let them appear, prima

facie, as a greater risk to financial stability than covered bonds.

What could help mitigate the risks resulting from structural

differences between MBS and covered bonds? Requiring the issuer

to hold the equity tranche as well as transparency in the market

(loan-level data, ―who holds what‖) will contribute to correct some of

the market failures detected. However, regarding the US market it

has been argued that data was available and transparent but not

adequately used. This points to a need for better data consolidation

and analysis, not only for more data. Independent, unbiased and

forward-looking ratings could also benefit the MBS market.

Standardisation could make risk monitoring easier for investors.

Most of these aspects feature the current public regulatory

discussion but are also being taken up by the private sector.

Regulatory answers

More and better transparency

Several work streams of public authorities and industry associations

aim to address the shortcomings of securitisations that became

23

evident in the crisis. Among those, one that is pursued by public

and private agents alike are transparency and standardisation

initiatives:

— Regarding covered bond funding, the ICMA´s Covered Bond

Investor Council (CBIC) has reacted to calls for greater

transparency and launched an initiative to set transparency

24

standards for covered bonds.

— In Germany, the True Sale Initiative has established standards

leading to a certification (―seal of quality‖) for securitisations. The

standards define certain criteria regarding reporting, disclosure,

the credit process and the relationship between lenders and

borrowers.

— The European Financial Services Roundtable (EFR) has

launched an initiative for a ―Prime Collateralised Standard‖ (PCS)

for securitisations.

— Regarding ABS/MBS the ECB has announced its intention to

25

introduce loan-level-data information requirements and is

working together with the BIS and the IMF on the design of the

statistics on securities holdings.

— Provisions introduced in the CRD following the crisis included

additional disclosure and capital requirements for complex

securitisations.

— CRD IV will introduce reporting requirements regarding default

rates of mortgages.

Better data on prepayment rates

More and better transparency of relevant information should make

risk-based pricing of MBS and covered bonds easier. The Joint

Forum highlights that not all potentially important information will be

22

23

24

25

August 12, 2011

Joint Forum. Report on asset securitization incentives. July 2011.

Joint Forum (2011) shows a more detailed overview.

http://www.icmagroup.org/ICMAGroup/files/5f/5fb7d2ce-e9b6-4286-9222e4d63906f4dd.pdf

https://www.ecb.int/press/pr/date/2011/html/pr110429.en.html

9

EU-Monitor 86

readily available, for example on prepayment rates. However,

information on prepayment rates is crucial for risk-based pricing.

The introduction of a reporting requirement on prepayment rates

would allow more transparent pricing of the option. More

transparency with regard to prepayment rates could also benefit EU

mortgage market integration and inform policy makers’ decision

making.

Matching maturities

Another work stream pursued by legislators and regulators strives to

achieve a better matching of maturities through different measures:

— The liquidity coverage ratio (LCR) and the net stable funding ratio

(NSFR) are part of “Basel III” that is currently in the process of

being transposed into EU legislation (CRD IV). The LCR is a

short-term (30 days) and the NSFR a longer-term liquidity

measure. Covered bonds receive preferential treatment in the

26

LCR. However, detailed definitions on what will count as

extremely high liquidity and high liquidity for the LCR in Europe

27

will only be proposed by EBA by the end of 2013.

In the NSFR, mortgages that are in a cover pool have an

advantage vis-à-vis residential mortgages not backing a cover

pool. They receive a lower weighting in the denominator requiring

less available stable funding. In the current Commission proposal

the NSFR figures as a reporting requirement only.

— Solvency II makes a similar difference between residential

mortgages and mortgage covered bonds as the NSFR. Apart

from that, considering the importance of insurers and pension

funds in the financial system and investors in corporate and bank

bonds in particular, Solvency II rules will have an impact on

28

funding structures in the economy.

Risk-adjusted pricing and aligned

incentives

Other measures to be pursued partly on the issuers’ own initiative

and partly by regulators include:

— Adequate internal transfer pricing which takes account of funding

liquidity risk in times of stress

— Management of misalignment of incentives regarding rating

agencies.

What’s the issue with covered bonds, MBS and

prepayment?

As mentioned above, one structural factor distinguishing MBS from

covered bonds is the pass-through of prepayments. Prepayment

affects pricing: the prepayment option is worth 40-50 bp, according

29

to estimates. Since unattractive pricing vis-à-vis other fixed income

assets is mentioned as a factor that keeps the MBS market from re30

launching , the following will shed some light on the differences

between covered bonds and MBS when it comes to prepayment.

26

27

28

29

30

10

Within the LCR, covered bonds (rated AA- and above) fall under the definition of

high-quality liquid assets (Level 2). This means a haircut of 15% has to be applied

and, all in all, Level 2 assets may not comprise more than 40% (after haircut) of

total high-quality liquid assets. Furthermore, an issuer’s own covered bonds do not

count towards high-quality liquid assets.

European Commission (2011). Proposal for a Regulation on prudential

requirements for credit institutions and investment firms Part III. 20 July 2011.

BIS (2011). Fixed income strategies of insurance companies and pension funds.

CGFS Papers No. 44. July 2011; Zaehres, Meta. Solvency II. DB Research

Current Issues. Forthcoming.

LaCour-Little, Michael (2005). Call protection in mortgage contracts.

Joint Forum (2011).

August 12, 2011

Bank funding of residential mortgages in the EU

As described earlier, with covered bonds the issuer bears the

prepayment risk while MBS pass prepayments through to investors.

Covered bond: issuer bears

prepayment risk

In case the replacing loan in the cover pool is issued at a lower

interest rate, the covered bond issuer will incur a loss if two things

apply: 1) the covered bond pays investors a fixed rate above the

one that the issuer contracted with the borrower for the new loan

(reinvestment loss) and 2) this loss and the margin loss is not

covered by prepayment compensation.

There are several options to reduce losses from early repayment

and hence increase the attractiveness of long-term funding through

covered bonds for banks and investors:

1. Covering reinvestment loss and margin loss by early repayment

compensation. This reduces prepayment speed and decreases

prepayment risk for issuers. In many European countries

currently only parts of early repayment losses are covered by

31

compensation.

2. Increasing issuance of variable-rate mortgages and floating-rate

covered bonds to fund them. Variable-rate mortgages enjoy the

advantage that interest rate risk is passed on to the consumer.

This prevents reinvestment loss for the lender in case of early

repayment. However, investors such as pension funds and

insurance companies or even other MFIs might be reluctant to

take on interest rate risk and demand fixed-rate issues (―Spanish

case‖, see below). This is also reflected in the current

32

predominance of fixed-rate covered bonds.

3. Hedging interest rate risk with derivatives as done, for example,

by Spanish issuers. They hedge their interest rate risk resulting

from predominantly variable-rate mortgage loans and fixed-rate

Cédulas via swaps.33 However, hedging comes at a cost.

Furthermore, this does not solve the initial problem but just

distributes it within the financial system.

4. Changing legislation so that it allows a splitting into tranches or

34

(re-)introduction of redeemable covered bonds. However, this

would lead to additional costs since any splitting of the covered

bond universe into sub-segments would lead to less liquidity and

hence higher risk premiums in the sub-segments.

Funding costs for covered bonds would rise in any of these cases

and options discussed, except for option 1.

Summary and outlook

Covered bonds and MBS make asset-liability management easier,

allowing better management of banks’ exposure to maturity, interest

rate and liquidity risk. While MBS markets ground to a halt in the

crisis, covered bond markets showed greater resilience. Due to

―dual recourse‖, high-quality collateral, generally high liquidity, longterm predominantly fixed-rate issuance, standardisation, and the

fact that loans are not derecognised from the issuers’ balance sheet,

covered bonds seem to be a funding instrument that contributes to

financial stability.

31

32

33

34

August 12, 2011

Ahlswede, Sophie. „Easy way out― will raise costs for everyone. DB Research.

Research Briefing. 23 March 2011.

ECBC (2010). Covered Bond Fact Book 2009. Descriptive Review of Statistics.

2009.

Volk, Bernd (2011). Covered Bond Market Overview 2011.

Schaefer, Stefan. There is no free lunch. DB Research Financial Market Special.

EU Monitor 36. July 6, 2007.

11

EU-Monitor 86

Diversified funding base essential

However, a diversified funding base is essential to avoid

dependence on particular instruments, markets or investors. This

applies to covered bonds just as to any other funding source. Due to

several reasons it is neither desirable nor economically sensible to

exclusively increase the share of covered bond funding from a

stability perspective.

Current investor demand is leading to MBS issues resembling

covered bonds with respect to the collateral used. However, this is

likely to be a reaction to developments in the crisis (quality of ratings

and collateral, overly complex securitisation structures) that will

partially change again, once regulation addressing these issues is in

place, the broader economic recovery has picked up and investors

perceive risks to be adequately priced.

Prepayment risk as crucial pricing

factor

Prepayment risk is an important factor when it comes to pricing MBS

or covered bonds. The cost of funding increases when prepayment

risk is passed on to investors or has to be hedged because resulting

costs are not fully covered by users of the prepayment option. A full

and objective cost compensation should enhance the attractiveness

of covered bonds as a funding tool, contributing to financial stability.

Funding costs are set to rise

Funding costs for banks will rise further once the regulatory

initiatives mentioned above start to bite. Therefore, it is argued that

lending rates may have to increase in order to compensate for lower

credit volume growth and higher funding costs. The competition for

35

deposits has already pushed up the cost of deposit funding.

With regard to the initial question - which funding mix is best with

regard to financial stability? - the following observations can be

made:

Covered bonds are not a panacea

Misaligned incentives resulting from funding instruments have

played a role in the crisis. However, we cannot blame the choice on

funding instruments alone: for example, RMBS account for a large

part of outstanding mortgages in Belgium and Portugal but these

countries did not experience a lending and house price boom as

36

similar to Spain or the UK. Obviously, not all securitisations in the

boom phase have had negative repercussions on financial stability.

Policy makers should therefore differentiate and be careful with

overly simplistic analysis with regard to securitisation. Similarly,

despite the fact that covered bonds have substantial conceptual

advantages and have fared well during the crisis, exclusive reliance

on that instrument is not advisable. When it comes to funding

mortgage business, a well-balanced mixture, attuned to the

characteristics of the business funded, is the best bet for financial

stability.

Sophie Ahlswede (+49 69 910-31832, sophie.ahlswede@db.com)

35

36

ECB (2011).

Just, Tobias. The European housing markets: three different dynamics. DB

Research. Talking Point. 1 August 2011.

© Copyright 2011. Deutsche Bank AG, DB Research, D-60262 Frankfurt am Main, Germany. All rights reserved. When quoting please cite ―Deutsche Bank

Research‖.

The above information does not constitute the provision of investment, legal or tax advice. Any views expressed reflect the current views of the author, which do

not necessarily correspond to the opinions of Deutsche Bank AG or its affiliates. Opinions expressed may change without notice. Opinions expressed may differ

from views set out in other documents, including research, published by Deutsche Bank. The above information is provided for informational purposes only and

without any obligation, whether contractual or otherwise. No warranty or representation is made as to the correctness, completeness and accuracy of the

information given or the assessments made.

In Germany this information is approved and/or communicated by Deutsche Bank AG Frankfurt, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht.

In the United Kingdom this information is approved and/or communicated by Deutsche Bank AG London, a member of the London Stock Exchange regulated by

the Financial Services Authority for the conduct of investment business in the UK. This information is distributed in Hong Kong by Deutsche Bank AG, Hong

Kong Branch, in Korea by Deutsche Securities Korea Co. and in Singapore by Deutsche Bank AG, Singapore Branch. In Japan this information is approved

and/or distributed by Deutsche Securities Limited, Tokyo Branch. In Australia, retail clients should obtain a copy of a Product Disclosure Statement (PDS)

relating to any financial product referred to in this report and consider the PDS before making any decision about whether to acquire the product.

Printed by: HST Offsetdruck Schadt & Tetzlaff GbR, Dieburg

12ISSN Print: 1612-0272 / ISSN Internet and e-mail: 1612-0280

August 12, 2011