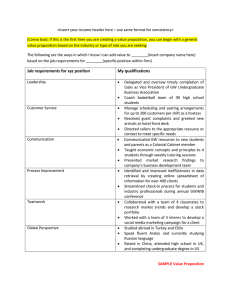

May Revise Analysis

advertisement