2015 ANNUAL REPORT

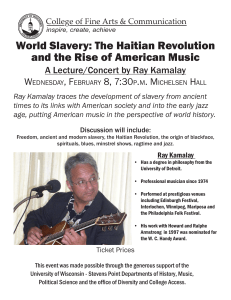

advertisement

2015 ANNUAL REPORT

Textron’s Diverse Product Portfolio

Textron is known around the world for its powerful brands of aircraft, defense and industrial products that provide

customers with groundbreaking technologies, innovative solutions and first-class service.

TEXTRON AVIATION

BELL HELICOPTER

INDUSTRIAL

TEXTRON SYSTEMS

Citation® Longitude®

Bell Boeing V-22 Osprey

Sherman + ReillyTM P2000X Puller

Shadow® M2

Citation® M2®

Bell 429WLG

E-Z-GO Freedom® RXV

Lycoming Race Engines

Beechcraft® King Air® 350i

Bell 525 RelentlessTM

Greenlee® DataScout® 10Gx

TRU Level D Full Flight Simulator

Cessna® TTx®

Bell 407GXP

Kautex NGFS® Fuel Tank

Ship to Shore Connector (SSC)

Beechcraft® T-6 Military Trainer

Bell 412EPI

Dixie Chopper® Stryker Stand-on

FuryTM Precision Guided Weapon

Cessna® Grand Caravan® EX

Bell 505 Jet Ranger XTM

TUGTM MA Tow Tractor

COMMANDOTM Elite

Textron’s Global Network of Businesses

TEXTRON AVIATION

BELL HELICOPTER

INDUSTRIAL

TEXTRON SYSTEMS

FINANCE

Textron Aviation is home

to the iconic Beechcraft,

Cessna and Hawker

brands, and continues

to lead general aviation

through two principal

lines of business: aircraft

sales and aftermarket.

Aircraft sales include

business jet, turboprop

and piston aircraft, as

well as special mission

and military aircraft.

Aftermarket includes

commercial parts sales,

maintenance, inspection

and repair services.

Bell Helicopter is one

of the leading suppliers

of helicopters and

related spare parts and

services in the world.

Bell is the pioneer of

the revolutionary tiltrotor

aircraft and has delivered

more than 35,000 aircraft

to customers around

the world. Greater than

29% of all helicopters in

operation today carry the

Bell brand, including both

military and commercial

applications.

Our Industrial segment

offers three main

product lines: fuel

systems and functional

components produced

by Kautex; specialized

vehicles and equipment

manufactured by the

Textron Specialized

Vehicles businesses and

Jacobsen; and tools and

test equipment made by

the Textron Tools & Test

companies.

Textron Systems’

businesses provide

innovative solutions to

the defense, aerospace

and general aviation

markets. Product lines

include unmanned

systems, armored

vehicles, advanced

marine craft, intelligent

battlefield and

surveillance systems,

intelligence software

solutions, piston engines,

simulation, training

and other defense and

aviation mission support

products and services.

Our Finance segment,

operated by Textron

Financial Corporation

(TFC), is a commercial

finance business that

provides financing

solutions for purchasers of

Textron products, primarily

Textron Aviation aircraft

and Bell helicopters. For

more than five decades,

TFC has played a key

role for Textron customers

around the globe.

Selected Year-Over-Year Financial Data

(Dollars in Millions, Except Per Share Amounts)

2015 2014

Total Revenues Total Segment Profit Income from Continuing Operations $13,423$13,878

1,2551,214

698605

PER SHARE OF COMMON STOCK

Common Stock Price:

High Low Year-End Diluted Earnings from Continuing Operations $ 46.93

$ 44.23

32.2032.28

42.0142.17

2.502.15

COMMON SHARES OUTSTANDING (In Thousands)

Diluted Average Year-End 278,727281,790

274,228276,582

FINANCIAL POSITION

Total Assets Manufacturing Group Debt Finance Group Debt Shareholders’ Equity Manufacturing Group Debt-to-Capital (Net of Cash) Manufacturing Group Debt-to-Capital $14,708$14,605

2,6972,811

9131,063

4,9644,272

26%33%

35%40%

KEY PERFORMANCE METRICS

Net Cash Provided by Operating Activities of Continuing Operations for Manufacturing Group—GAAP $ 1,038

$ 1,097

Manufacturing Cash Flow Before Pension Contributions—Non-GAAP1 631753

1. Manufacturing Cash Flow Before Pension Contributions is a Non-GAAP Measure. See page immediately preceding Form 10-K for Reconciliation to GAAP.

TEXTRON 2015 ANNUAL REPORT

1

Fellow Shareholders,

2015 was a year of strong execution for our company as we recorded

a segment profit of $1.3 billion and a profit margin of 9.3 percent.

With revenues of $13.4 billion for the year, we positioned ourselves

for continued long-term growth by achieving significant milestones

on a number of important programs, introducing new products and

enhancing our sales channels, actions that will enable us to expand

our markets and align with the needs of our customers.

Scott C. Donnelly

Chairman and Chief Executive Officer

Successfully executing on our commitments

Our financial results reflect the successful execution of our efforts

to realize new opportunities for growth, improve our operational

efficiency and fulfill our commitments to customers, despite

continued challenges in a number of the markets in which we

compete. At Textron Aviation, higher jet deliveries helped to lift

revenues to $4.8 billion in 2015 from $4.6 billion in 2014, while the

continued successful integration of our Beechcraft and Cessna

businesses helped to drive profits to $400 million, a 71 percent

increase over the previous year. The business celebrated Federal

Aviation Administration (FAA) certification and subsequent first

deliveries of the Citation Latitude and the new Pro Line Fusionequipped Beechcraft King Air 350i and 250 turboprop aircraft.

While the commercial helicopter market continued to be challenging

for Bell Helicopter, its long-term growth outlook remains strong

with new commercial products and upgrades on the horizon to be

TOTAL REVENUES BY SEGMENT

supported by expanded global sales efforts. Successful first flight

of the new Bell 525 Relentless­—the first-ever commercial fly-by-wire

helicopter— was a major milestone for the business in 2015. On the

military side, Bell Helicopter secured several notable contracts, both

domestically and internationally, for the H-1 and V-22 programs.

Our Textron Systems segment won a number of U.S. and

international military contracts, including additional craft for

the U.S. Navy’s Ship to Shore Connector program and a contract

for 55 COMMANDO Select vehicles to the Afghan National Army

that were delivered in 2015.

Our Industrial segment delivered solid financial performance with

continued expansion of our margin rates. By introducing new

products and leveraging the strength of our recent acquisitions, our

businesses grew and extended their product reach into new markets.

In our Finance segment, Textron Financial completed another

successful year of responding to our customers’ needs with attractive

financing options in support of Textron aircraft product sales.

Successfully launching new products and

winning customers

Textron Aviation $4.8B

Bell Helicopter $3.5B

Industrial $3.5B

Textron Systems $1.5B

Finance $0.1B

2

TEXTRON 2015 ANNUAL REPORT

Bringing new products to our markets creates excitement among

customers, which results in new orders and sales. A prime example

was Bell Helicopter’s introduction of the Bell 407GXP long light single

aircraft at Heli-Expo in March, which resulted in the largest single

order—up to 200 from one customer—in Bell’s history and one of the

largest in the rotorcraft industry. Similarly, Bell Helicopter continued

to collect customer letters of intent to purchase two new products

under development: the Bell 505 Jet Ranger X short light single

2015 Milestones

Moving with great speed, we

brought a number of new

products to market in 2015 so

our customers can accomplish

Certification and first deliveries

of Citation Latitude

Introduction of 407GXP

Introduction of Jacobsen

ProSeriesTM

Completion of COMMANDO

vehicles for Afghan

National Army

First international customer

for the V-22

great things—in the air, on the

ground and on the battlefield—

and backed it up with outstanding

sales support and service.

helicopter, scheduled to be certified and delivered in 2016, and the

Bell 525 Relentless super-medium commercial helicopter, expected

to achieve certification in 2017.

The success of the V-22 Osprey tiltrotor, which has amassed more

than 300,000 flight hours, continues to drive new orders. Japan

became the V-22’s first international customer with an agreement

to purchase five aircraft, while the U.S. Navy announced its plans

to procure 44 V-22s for its Carrier Onboard Delivery program.

Building on the success of the V-22, our V-280 development program

continues to make progress. In addition to starting initial assembly

of the aircraft, our teams developed a simulator that allows potential

customers to experience this next-generation tiltrotor at military

tradeshows and other venues. The V-280 demonstrator aircraft

is preparing for first flight in 2017 as part of the U.S. Department

of Defense’s Future Vertical Lift/Joint Multi-Role technology

demonstration program.

In August, customers began taking delivery of the new Citation

Latitude. This is the fifth Citation jet to be certified during an

18-month period, demonstrating the rapid pace of Textron Aviation’s

product development program. Textron Aviation continues to

invest in larger business jets as the Citation Longitude prepares for

its first flight in 2016 and is expected to enter into service in 2017.

Rounding out the Citation family of jets in the large-cabin segment

is the Hemisphere, targeting first flight in 2019. Textron Aviation

also announced the development of a new, clean-sheet single engine

turboprop aircraft that is expected to have a range of more than

1,500 nautical miles and speeds higher than 280 knots.

First dual FAA and EASA

qualification for TRU’s B757

Full Flight Simulator

As production continued on the first two craft as part of the

Ship to Shore Connector program at Textron Systems Marine &

Land Systems, the U.S. Navy ordered an additional two units

as part of an $84 million contract option. The first two units are

scheduled for completion in 2017 and 2018. Our Aerosond Small

Unmanned Aircraft System fee-for-service program performed

well and continued to grow. Four new sites were added to our

U.S. Department of Defense contract, while flight hours per month

increased at all of our sites around the world and surpassed a

total of 120,000 flight hours.

TRU Simulation + Training won significant new contracts and

regulatory approvals as it continued to establish strong relationships

with customers and grow its business globally. Among the notable

successes was a contract with Lufthansa Flight Training for an Airbus

A350 FFS X Level D full motion flight simulator, representing TRU’s

first venture to meet the flight training solution needs for this new

generation of wide body aircraft. Also, TRU Flight Training Iceland,

a joint venture with Icelandair, earned FAA qualification of its Boeing

757 Level D Full Flight Simulator, the first with regulatory approval

from the FAA and the European Aviation Safety Agency.

Building on the technology of its Dixie Chopper business, Jacobsen

launched a new line of zero-turn mowers to expand its business

beyond golf to reach professional landscapers. Textron Specialized

Vehicles updated its popular E-Z-GO RXV golf car to include new

styling and greater comfort and amenities, and introduced a new

Cushman Hauler 72-volt electric utility vehicle and the Gasoline

Hauler 4x4. Greenlee Communications launched its AirScout for

technicians to more easily survey a home or business for Wi-Fi

TEXTRON 2015 ANNUAL REPORT

3

Looking Forward

We have many exciting

milestones ahead. Having a

continuous pipeline of new

products means there are always

First deliveries of Canadian

TAPV (targeted for 2016)

Certification and first deliveries First flight of Citation Longitude

(targeted for 2016)

of the 505 Jet Ranger X

(targeted for 2016)

First craft completed for

Ship to Shore Connector

program (targeted for 2017)

Certification and first deliveries First flight of Citation

of the 525 Relentless (targeted Hemisphere (targeted

for 2019)

for 2017)

a number of “firsts”— from first

flights to first deliveries. Rapidly

developing new products is

central to our growth strategy.

performance. In June, Kautex began production of the first all-plastic

pressurized fuel tank for hybrid vehicles. These tanks use patented

plastic reinforcements between the tank’s bottom and top, as

opposed to metal straps, to reduce weight and costs. The design

is a first in the industry.

Building on our acquisitions

In 2015, we made strategic acquisitions to continue expanding our

businesses’ range of products and services. In January, Textron

Specialized Vehicles acquired Douglas Equipment, an aviation

ground support equipment (GSE) business in the United Kingdom.

This acquisition built on the acquisition in the previous year of

TUG Technologies, strengthening our presence in this industry

and complementing our aviation businesses. In February, Textron

Aviation acquired an aircraft interiors business, giving us the

capabilities to design and build interior components for our Citation

and King Air aircraft to ensure that we’re giving our customers the

highest quality features and to improve on-time manufacturing

performance. 2015 marked the first full year of the Beechcraft and

Cessna integration, and the business continued to successfully

generate operational efficiencies that benefit our company as well

as our customers.

Growing our presence around the world to

serve customers

As we grow globally, we’ve enhanced our capacity to engage with

customers before, during and after the sale. Over the past year,

we’ve opened sales offices and training facilities in new locations

and enhanced our service to customers where we already have a

4

TEXTRON 2015 ANNUAL REPORT

presence. Bell Helicopter opened regional sales offices in Tokyo

and Mexico City and partnered with Textron Systems to open an

office in Abu Dhabi. Our ProFlight business, acquired in 2014 by

TRU Simulation + Training to meet the needs of our customers for

advanced pilot and maintenance training, opened a second training

facility in Tampa. Meanwhile, TRU is better serving the needs

of avionics technicians and aircraft mechanics with the opening

in October of a new Aviation Maintenance Training Academy on

Textron Aviation’s Mid-Continent campus in Wichita. Over the past

year, Textron Aviation’s 21 company-operated service centers

have received certifications to expand their capabilities and service

Beechcraft, Cessna and Hawker customers. This represents another

way we are building and growing our relationships with customers.

In addition, the company tripled the size of its Paris Service Center

at Paris-Le Bourget Airport.

On course for profitable growth

Our solid financial results in 2015 were based on following through

on our strategy: developing new products, expanding our markets,

enhancing our sales channels and strategically acquiring new

businesses. As we enter 2016, we are continuing to make the

investments in our products, processes and people that will

drive growth for the year ahead and beyond.

Scott C. Donnelly

Chairman and Chief Executive Officer

Leadership

Board of Directors

Scott C. Donnelly (1)

Chairman, President and CEO

Textron Inc.

Ivor J. Evans (2) (3)

Lord Powell of Bayswater

KCMG (3) (4)

Executive Chairman

Meritor, Inc.

President and CEO (Retired)

NatureWorks LLC

Chairman and CEO (Retired)

Citizens Financial Group, Inc.

Lawrence K. Fish (3) (4)

Former Private Secretary and

Advisor on Foreign Affairs and

Defense to Prime Ministers

Margaret Thatcher and

John Major

R. Kerry Clark (1) (2) (5)

Paul E. Gagné (2) (4)

Lloyd G. Trotter (1) (4)

Kathleen M. Bader (1) (3)

Chairman and CEO (Retired)

Cardinal Health, Inc.

Chairman

Wajax Corporation

James T. Conway

Dain M. Hancock

(2) (3)

General (Retired)

U.S. Marine Corps

Executive Officers

Scott C. Donnelly

Chairman, President and CEO

Textron Inc.

Frank T. Connor

Executive Vice President and

Chief Financial Officer

Textron Inc.

Cheryl H. Johnson

Managing Partner

GenNx 360 Capital Partners

(2) (4)

Executive Vice President

(Retired)

Lockheed Martin Corporation

Segment and

Business Unit

Presidents

Scott A. Ernest

President and CEO

Textron Aviation

J. Scott Hall

President and CEO

Industrial Segment and

Greenlee

Kevin P. Holleran

Executive Vice President,

Human Resources

Textron Inc.

President and CEO

Textron Specialized Vehicles

E. Robert Lupone

President and CEO

Textron Systems Segment

Executive Vice President,

General Counsel and Secretary

Textron Inc.

Ellen M. Lord

R. Danny Maldonado

President and CEO

Textron Financial Corporation

Vicente Perez

President and CEO

Kautex

Mitch Snyder

President and CEO

Bell Helicopter

Ian K. Walsh

President and CEO

TRU Simulation + Training Inc.

James L. Ziemer (2) (4)

President and CEO (Retired)

Harley-Davidson, Inc.

Numbers Indicate Committee

Memberships:

(1) Executive Committee:

Chair, Scott C. Donnelly

(2) Audit Committee:

Chair, R. Kerry Clark

(3) Nominating and Corporate

Governance Committee:

Chair, Kathleen M. Bader

(4) Organization and Compensation

Committee:

Chair, Lloyd G. Trotter

(5) Lead Director:

R. Kerry Clark

Corporate Officers

Mark S. Bamford

Thomas N. Nichipor

Julie G. Duffy

Elizabeth C. Perkins

Dana L. Goldberg

Robert O. Rowland

Vice President and

Corporate Controller

Textron Inc.

Vice President and Deputy

General Counsel – Litigation

Textron Inc.

Vice President – Tax

Textron Inc.

Scott P. Hegstrom

Vice President – Mergers &

Acquisitions

Textron Inc.

Mary F. Lovejoy

Vice President and Treasurer

Textron Inc.

Paul Mc Gartoll

Vice President – Strategy and

Business Development

Textron Inc.

.

Vice President – Textron

Audit Services

Textron Inc.

Vice President and

Deputy General Counsel

Textron Inc.

Senior Vice President –

Washington Operations

Textron Inc.

Diane K. Schwarz

Vice President and

Chief Information Officer

Textron Inc.

Cathy A. Streker

Vice President –

Human Resources

Textron Inc.

Douglas R. Wilburne

Vice President –

Investor Relations

Textron Inc.

David Withers

President and CEO

Jacobsen

TEXTRON 2015 ANNUAL REPORT

5

FOOTNOTE TO SELECTED YEAR-OVER-YEAR FINANCIAL DATA

We use Manufacturing Cash Flow Before Pension Contributions as our measure of free cash flow. This measure is not a financial

measure under generally accepted accounting principles (GAAP) and should be used in conjunction with GAAP cash measures provided

in our Consolidated Statements of Cash Flows. Free cash flow is a measure generally used by investors, analysts and management

to gauge a company’s ability to generate cash from operations in excess of that necessary to be reinvested to sustain and grow the

business and fund its obligations.

1

Our definition of Manufacturing Cash Flow Before Pension Contributions adjusts net cash from operating activities of continuing

operations for the Manufacturing group for dividends received from TFC, capital contributions provided under the Support Agreement and

debt agreements, capital expenditures, proceeds from the sale of property, plant and equipment and contributions to our pension plans.

We believe that our calculation provides a relevant measure of liquidity and is a useful basis for assessing our ability to fund operations

and obligations. This measure may not be comparable with similarly titled measures reported by other companies, as there is no definitive

accounting standard on how the measure should be calculated. A reconciliation of net cash from operating activities of continuing

operations for the Manufacturing group as presented in our Consolidated Statement of Cash Flows to Manufacturing Cash Flow Before

Pension Contributions is provided below:

(In Millions)

6

20152014

Net cash provided by operating activities of continuing operations for the Manufacturing group—GAAP

Less: Capital expenditures

Dividends received from TFC Plus: Total pension contributions

Proceeds from the sale of property, plant and equipment

$1,038

$1,097 (420)

(429)

(63)

—

68

76 89

Manufacturing Cash Flow Before Pension Contributions—Non-GAAP

$ 631

TEXTRON 2015 ANNUAL REPORT

$ 753

This line represents final trim and will not print

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

>[@ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 2, 2016

RU

>@ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the transition period from

to

.

Commission File Number 1-5480

Textron Inc.

([DFWQDPHRIUHJLVWUDQWDVVSHFLILHGLQLWVFKDUWHU

Delaware

6WDWHRURWKHUMXULVGLFWLRQRI

LQFRUSRUDWLRQRURUJDQL]DWLRQ

05-0315468

,56(PSOR\HU

,GHQWLILFDWLRQ1R

40 Westminster Street, Providence, RI

$GGUHVVRISULQFLSDOH[HFXWLYHRIILFHV

02903

=LSFRGH

5HJLVWUDQW¶V7HOHSKRQH1XPEHU,QFOXGLQJ$UHD&RGH(401) 421-2800

6HFXULWLHVUHJLVWHUHGSXUVXDQWWR6HFWLRQERIWKH$FW

Title of Each Class

&RPPRQ6WRFN²SDUYDOXH

Name of Each Exchange on Which Registered

1HZ<RUN6WRFN([FKDQJH

6HFXULWLHVUHJLVWHUHGSXUVXDQWWR6HFWLRQJRIWKH$FW1RQH

,QGLFDWHE\FKHFNPDUNLIWKHUHJLVWUDQWLVDZHOONQRZQVHDVRQHGLVVXHUDVGHILQHGLQ5XOHRIWKH6HFXULWLHV$FW<HV1R

,QGLFDWHE\FKHFNPDUNLIWKHUHJLVWUDQWLVQRWUHTXLUHGWRILOHUHSRUWVSXUVXDQWWR6HFWLRQRU6HFWLRQGRIWKH$FW<HV

1R

,QGLFDWHE\FKHFNPDUNZKHWKHUWKHUHJLVWUDQWKDVILOHGDOOUHSRUWVUHTXLUHGWREHILOHGE\6HFWLRQRUGRIWKH6HFXULWLHV([FKDQJH$FWRI

GXULQJWKHSUHFHGLQJPRQWKVRUIRUVXFKVKRUWHUSHULRGWKDWWKHUHJLVWUDQWZDVUHTXLUHGWRILOHVXFKUHSRUWVDQGKDVEHHQVXEMHFWWRVXFK

ILOLQJUHTXLUHPHQWVIRUWKHSDVWGD\V<HV1R

,QGLFDWHE\FKHFNPDUNZKHWKHUWKHUHJLVWUDQWKDVVXEPLWWHGHOHFWURQLFDOO\DQGSRVWHGRQLWVFRUSRUDWH:HEVLWHLIDQ\HYHU\,QWHUDFWLYH'DWD)LOH

UHTXLUHG WR EH VXEPLWWHG DQG SRVWHG SXUVXDQW WR 5XOH RI 5HJXODWLRQ 67 GXULQJ WKH SUHFHGLQJ PRQWKV RU IRU VXFK VKRUWHU SHULRG WKDW WKH

UHJLVWUDQWZDVUHTXLUHGWRVXEPLWDQGSRVWVXFKILOHV<HV1RBBBB

,QGLFDWHE\FKHFNPDUNLIGLVFORVXUHRIGHOLQTXHQWILOHUVSXUVXDQWWR,WHPRI5HJXODWLRQ6.LVQRWFRQWDLQHGKHUHLQDQGZLOOQRWEHFRQWDLQHGWR

WKH EHVW RI UHJLVWUDQW¶V NQRZOHGJH LQ GHILQLWLYH SUR[\ RU LQIRUPDWLRQ VWDWHPHQWV LQFRUSRUDWHG E\ UHIHUHQFH LQ 3DUW ,,, RI WKLV )RUP . RU DQ\

DPHQGPHQWWRWKLV)RUP.>@

,QGLFDWHE\FKHFNPDUNZKHWKHUWKHUHJLVWUDQWLVDODUJHDFFHOHUDWHGILOHUDQDFFHOHUDWHGILOHUDQRQDFFHOHUDWHGILOHURUDVPDOOHUUHSRUWLQJFRPSDQ\

6HHGHILQLWLRQVRI³ODUJHDFFHOHUDWHGILOHU´³DFFHOHUDWHGILOHU´DQG³VPDOOHUUHSRUWLQJFRPSDQ\´LQ5XOHERIWKH([FKDQJH$FW&KHFNRQH

/DUJHDFFHOHUDWHGILOHU>@

$FFHOHUDWHGILOHU>@

1RQDFFHOHUDWHGILOHU>@

'RQRWFKHFNLIDVPDOOHUUHSRUWLQJFRPSDQ\

6PDOOHUUHSRUWLQJFRPSDQ\>@

,QGLFDWHE\FKHFNPDUNZKHWKHUWKHUHJLVWUDQWLVDVKHOOFRPSDQ\DVGHILQHGLQ5XOHERIWKH$FW<HV

1R

7KHDJJUHJDWHPDUNHWYDOXHRIWKHUHJLVWUDQW¶V&RPPRQ6WRFNKHOGE\QRQDIILOLDWHVDW-XO\ZDVDSSUR[LPDWHO\ELOOLRQEDVHGRQWKH

1HZ<RUN6WRFN([FKDQJHFORVLQJSULFHIRUVXFKVKDUHVRQWKDWGDWH7KHUHJLVWUDQWKDVQRQRQYRWLQJFRPPRQHTXLW\

$W)HEUXDU\VKDUHVRI&RPPRQ6WRFNZHUHRXWVWDQGLQJ

Documents Incorporated by Reference

3DUW,,,RIWKLV5HSRUWLQFRUSRUDWHVLQIRUPDWLRQIURPFHUWDLQSRUWLRQVRIWKHUHJLVWUDQW¶V'HILQLWLYH3UR[\6WDWHPHQWIRULWV$QQXDO0HHWLQJRI

6KDUHKROGHUVWREHKHOGRQ$SULO

7(;7521$118$/5(3257

This line represents final trim and will not print

Textron Inc.

Index to Annual Report on Form 10-K

For the Fiscal Year Ended January 2, 2016

PART I

,WHP

%XVLQHVV

,WHP$

5LVN)DFWRUV

,WHP%

8QUHVROYHG6WDII&RPPHQWV

,WHP

3URSHUWLHV

,WHP

/HJDO3URFHHGLQJV

,WHP

0LQH6DIHW\'LVFORVXUHV

0DUNHWIRU5HJLVWUDQW¶V&RPPRQ(TXLW\5HODWHG6WRFNKROGHU0DWWHUVDQG,VVXHU

3XUFKDVHVRI(TXLW\6HFXULWLHV

,WHP

6HOHFWHG)LQDQFLDO'DWD

,WHP

0DQDJHPHQW¶V'LVFXVVLRQDQG$QDO\VLVRI)LQDQFLDO&RQGLWLRQDQG5HVXOWVRI2SHUDWLRQV

,WHP$

4XDQWLWDWLYHDQG4XDOLWDWLYH'LVFORVXUHV$ERXW0DUNHW5LVN

,WHP

)LQDQFLDO6WDWHPHQWVDQG6XSSOHPHQWDU\'DWD

,WHP

&KDQJHV,QDQG'LVDJUHHPHQWV:LWK$FFRXQWDQWVRQ$FFRXQWLQJDQG)LQDQFLDO'LVFORVXUH

,WHP$

&RQWUROVDQG3URFHGXUHV

'LUHFWRUV([HFXWLYH2IILFHUVDQG&RUSRUDWH*RYHUQDQFH

,WHP

([HFXWLYH&RPSHQVDWLRQ

,WHP

6HFXULW\2ZQHUVKLSRI&HUWDLQ%HQHILFLDO2ZQHUVDQG0DQDJHPHQWDQG5HODWHG

6WRFNKROGHU0DWWHUV

,WHP

&HUWDLQ5HODWLRQVKLSVDQG5HODWHG7UDQVDFWLRQVDQG'LUHFWRU,QGHSHQGHQFH

,WHP

3ULQFLSDO$FFRXQWDQW)HHVDQG6HUYLFHV

([KLELWVDQG)LQDQFLDO6WDWHPHQW6FKHGXOHV

PART II

,WHP

PART III

,WHP

PART IV

,WHP

6,*1$785(6

Page

7(;7521$118$/5(3257

This line represents final trim and will not print

PART I

Item 1. Business

7H[WURQ,QFLVDPXOWLLQGXVWU\FRPSDQ\WKDWOHYHUDJHVLWVJOREDOQHWZRUNRIDLUFUDIWGHIHQVHLQGXVWULDODQGILQDQFHEXVLQHVVHVWR

SURYLGHFXVWRPHUVZLWKLQQRYDWLYHSURGXFWVDQGVHUYLFHVDURXQGWKHZRUOG:HKDYHDSSUR[LPDWHO\HPSOR\HHVZRUOGZLGH

7H[WURQ ,QF ZDV IRXQGHG LQ DQG UHLQFRUSRUDWHG LQ 'HODZDUH RQ -XO\ 8QOHVV RWKHUZLVH LQGLFDWHG UHIHUHQFHV WR

³7H[WURQ ,QF´ WKH ³&RPSDQ\´ ³ZH´ ³RXU´ DQG ³XV´ LQ WKLV $QQXDO 5HSRUW RQ )RUP . UHIHU WR 7H[WURQ ,QF DQG LWV

FRQVROLGDWHGVXEVLGLDULHV

:H FRQGXFW RXU EXVLQHVV WKURXJK ILYH RSHUDWLQJ VHJPHQWV 7H[WURQ $YLDWLRQ %HOO 7H[WURQ 6\VWHPV DQG ,QGXVWULDO ZKLFK

UHSUHVHQWRXUPDQXIDFWXULQJEXVLQHVVHVDQG)LQDQFHZKLFKUHSUHVHQWVRXUILQDQFHEXVLQHVV2Q0DUFKZHFRPSOHWHG

WKH DFTXLVLWLRQ RI %HHFK +ROGLQJV //& ZKLFK LQFOXGHG %HHFKFUDIW &RUSRUDWLRQ DQG RWKHU VXEVLGLDULHV FROOHFWLYHO\

³%HHFKFUDIW´:HFRPELQHG%HHFKFUDIWZLWKRXUOHJDF\&HVVQDVHJPHQWWRIRUPWKH7H[WURQ$YLDWLRQVHJPHQW

$ GHVFULSWLRQ RI WKH EXVLQHVV RI HDFK RI RXU VHJPHQWV LV VHW IRUWK EHORZ 2XU EXVLQHVV VHJPHQWV LQFOXGH RSHUDWLRQV WKDW DUH

XQLQFRUSRUDWHG GLYLVLRQV RI 7H[WURQ ,QF DQG RWKHUV WKDW DUH VHSDUDWHO\ LQFRUSRUDWHG VXEVLGLDULHV )LQDQFLDO LQIRUPDWLRQ E\

EXVLQHVVVHJPHQWDQGJHRJUDSKLFDUHDDSSHDUVLQ1RWHWRWKH&RQVROLGDWHG)LQDQFLDO6WDWHPHQWVRQSDJHVWKURXJKRIWKLV

$QQXDO 5HSRUW RQ )RUP . 7KH IROORZLQJ GHVFULSWLRQ RI RXU EXVLQHVV VKRXOG EH UHDG LQ FRQMXQFWLRQ ZLWK ³0DQDJHPHQW¶V

'LVFXVVLRQDQG$QDO\VLVRI)LQDQFLDO&RQGLWLRQDQG5HVXOWVRI2SHUDWLRQV´RQSDJHVWKURXJKRIWKLV$QQXDO5HSRUWRQ)RUP

.,QIRUPDWLRQLQFOXGHGLQWKLV$QQXDO5HSRUWRQ)RUP.UHIHUVWRRXUFRQWLQXLQJEXVLQHVVHVXQOHVVRWKHUZLVHLQGLFDWHG

Textron Aviation Segment

7H[WURQ$YLDWLRQLVDOHDGHULQJHQHUDODYLDWLRQ7H[WURQ$YLDWLRQPDQXIDFWXUHVVHOOVDQGVHUYLFHV%HHFKFUDIWDQG&HVVQDDLUFUDIW

DQG VHUYLFHV WKH +DZNHU EUDQG RI EXVLQHVV MHWV 7KH VHJPHQW KDV WZR SULQFLSDO SURGXFW OLQHV DLUFUDIW VDOHV DQG DIWHUPDUNHW

$LUFUDIWVDOHVLQFOXGHEXVLQHVVMHWVWXUERSURSDLUFUDIWSLVWRQHQJLQHDLUFUDIWDQGPLOLWDU\WUDLQHUDQGGHIHQVHDLUFUDIW$IWHUPDUNHW

LQFOXGHV FRPPHUFLDO SDUWV VDOHV DQG PDLQWHQDQFH LQVSHFWLRQ DQG UHSDLU VHUYLFHV 5HYHQXHV LQ WKH 7H[WURQ $YLDWLRQ VHJPHQW

DFFRXQWHG IRU DSSUR[LPDWHO\ DQG RI RXU WRWDO UHYHQXHV LQ DQG UHVSHFWLYHO\ 5HYHQXHV IRU

7H[WURQ$YLDWLRQ¶VSULQFLSDOOLQHVRIEXVLQHVVZHUHDVIROORZV

(In millions)

$LUFUDIWVDOHV

$IWHUPDUNHW

7RWDOUHYHQXHV

2015

2014

2013

7KH IDPLO\ RI MHWV FXUUHQWO\ SURGXFHG E\ 7H[WURQ $YLDWLRQ LQFOXGHV WKH 0XVWDQJ &LWDWLRQ 0 &LWDWLRQ &- &LWDWLRQ &-

&LWDWLRQ ;/6 &LWDWLRQ /DWLWXGH ZKLFK HQWHUHG LQWR VHUYLFH GXULQJ &LWDWLRQ 6RYHUHLJQ DQG WKH &LWDWLRQ ; WKH IDVWHVW

FLYLOLDQMHWLQWKHZRUOG,QDGGLWLRQ7H[WURQ$YLDWLRQLVGHYHORSLQJWKH&LWDWLRQ/RQJLWXGHDVXSHUPLGVL]HMHWH[SHFWHGWRHQWHU

LQWRVHUYLFHLQDQGUHFHQWO\DQQRXQFHGWKH&LWDWLRQ+HPLVSKHUHDODUJHFDELQMHWIRUZKLFKILUVWIOLJKWLVWDUJHWHGLQ

7H[WURQ$YLDWLRQ¶VWXUERSURSDLUFUDIWLQFOXGHWKH%HHFKFUDIW.LQJ$LUZKLFKRIIHUVWKH.LQJ$LU&*7[.LQJ$LU.LQJ$LU

(5DQG.LQJ$LULDQGWKH&HVVQD&DUDYDQDXWLOLW\WXUERSURS7H[WURQ$YLDWLRQDOVRRIIHUVWKH7WUDLQHUDQG$7OLJKW

DWWDFNPLOLWDU\DLUFUDIW0RUHWKDQFRXQWULHVXWLOL]HWKH7DLUFUDIWDVDSDUWRIWKHLUPLOLWDU\WUDLQLQJIOHHW

7H[WURQ $YLDWLRQ¶V SLVWRQ HQJLQH DLUFUDIW LQFOXGH WKH %HHFKFUDIW %DURQ DQG %RQDQ]D DQG WKH &HVVQD 6N\KDZN 6N\ODQH 7XUER

6WDWLRQDLUDQGWKHKLJKSHUIRUPDQFH77[

,QVXSSRUWRILWVIDPLO\RIDLUFUDIW7H[WURQ$YLDWLRQRSHUDWHVDJOREDOQHWZRUNRIVHUYLFHFHQWHUVWZRRIZKLFKDUHFRORFDWHG

ZLWK %HOO +HOLFRSWHU DORQJ ZLWK PRUH WKDQ DXWKRUL]HG LQGHSHQGHQW VHUYLFH FHQWHUV ORFDWHG LQ FRXQWULHV WKURXJKRXW WKH

ZRUOG 7H[WURQ $YLDWLRQRZQHG VHUYLFH FHQWHUV SURYLGH FXVWRPHUV ZLWK KRXU VHUYLFH DQG PDLQWHQDQFH 7H[WURQ $YLDWLRQ

SURYLGHV LWV FXVWRPHUV ZLWK DURXQGWKHFORFN SDUWV VXSSRUW DQG DOVR RIIHUV 6HUYLFH'LUHFW IRU &LWDWLRQ .LQJ $LU DQG +DZNHU

DLUFUDIW 6HUYLFH'LUHFW GHOLYHUV VHUYLFH FDSDELOLWLHV GLUHFWO\ WR FXVWRPHU ORFDWLRQV ZLWK D PRELOH VHUYLFH XQLW IOHHW LQ WKH 86

&DQDGDDQG(XURSH

7H[WURQ $YLDWLRQ PDUNHWV LWV SURGXFWV ZRUOGZLGH WKURXJK LWV RZQ VDOHV IRUFH DV ZHOO DV WKURXJK D QHWZRUN RI DXWKRUL]HG

LQGHSHQGHQW VDOHV UHSUHVHQWDWLYHV 7H[WURQ $YLDWLRQ KDV VHYHUDO FRPSHWLWRUV GRPHVWLFDOO\ DQG LQWHUQDWLRQDOO\ LQ YDULRXV PDUNHW

VHJPHQWV 7H[WURQ $YLDWLRQ¶V DLUFUDIW FRPSHWH ZLWK RWKHU DLUFUDIW WKDW YDU\ LQ VL]H VSHHG UDQJH FDSDFLW\ DQG KDQGOLQJ

FKDUDFWHULVWLFVRQWKHEDVLVRISULFHSURGXFWTXDOLW\DQGUHOLDELOLW\GLUHFWRSHUDWLQJFRVWVSURGXFWVXSSRUWDQGUHSXWDWLRQ

7(;7521$118$/5(3257

This line represents final trim and will not print

Bell Segment

%HOO+HOLFRSWHULVRQHRIWKHOHDGLQJVXSSOLHUVRIPLOLWDU\DQGFRPPHUFLDOKHOLFRSWHUVWLOWURWRUDLUFUDIWDQGUHODWHGVSDUHSDUWVDQG

VHUYLFHVLQWKHZRUOG5HYHQXHVIRU%HOODFFRXQWHGIRUDSSUR[LPDWHO\DQGRIRXUWRWDOUHYHQXHVLQDQG

UHVSHFWLYHO\5HYHQXHVE\%HOO¶VSULQFLSDOOLQHVRIEXVLQHVVZHUHDVIROORZV

(In millions)

0LOLWDU\

93URJUDP

2WKHU0LOLWDU\

&RPPHUFLDO

7RWDOUHYHQXHV

2015

2014

2013

%HOO VXSSOLHV DGYDQFHG PLOLWDU\ KHOLFRSWHUV DQG VXSSRUW WR WKH 86 *RYHUQPHQW DQG WR PLOLWDU\ FXVWRPHUV RXWVLGH WKH 8QLWHG

6WDWHV%HOO¶VSULPDU\86*RYHUQPHQWSURJUDPVDUHWKH9WLOWURWRUDLUFUDIWDQGWKH+KHOLFRSWHUV%HOOLVRQHRIWKHOHDGLQJ

VXSSOLHUV RI KHOLFRSWHUV WR WKH 86 *RYHUQPHQW DQG LQ DVVRFLDWLRQ ZLWK 7KH %RHLQJ &RPSDQ\ %RHLQJ WKH RQO\ VXSSOLHU RI

PLOLWDU\WLOWURWRUDLUFUDIW7LOWURWRUDLUFUDIWDUHGHVLJQHGWRSURYLGHWKHEHQHILWVRIERWKKHOLFRSWHUVDQGIL[HGZLQJDLUFUDIW7KURXJK

LWVVWUDWHJLFDOOLDQFHZLWK%RHLQJ%HOOSURGXFHVDQGVXSSRUWVWKH9WLOWURWRUDLUFUDIWIRUWKH86'HSDUWPHQWRI'HIHQVH'R'

DQGUHFHQWO\HQWHUHGLQWRLWVILUVWFRQWUDFWWRVHOOWKH9WLOWURWRUDLUFUDIWXQGHUWKH86*RYHUQPHQWVSRQVRUHGIRUHLJQPLOLWDU\

VDOHV SURJUDP 7KH 86 0DULQH &RUSV + KHOLFRSWHU SURJUDP LQFOXGHV D XWLOLW\ PRGHO WKH 8+< DQG DQ DGYDQFHG DWWDFN

PRGHOWKH$+=ZKLFKKDYHSDUWVFRPPRQDOLW\EHWZHHQWKHP

7KURXJK LWV FRPPHUFLDO EXVLQHVV %HOO LV D OHDGLQJ VXSSOLHU RI FRPPHUFLDOO\ FHUWLILHG KHOLFRSWHUV DQG VXSSRUW WR FRUSRUDWH

RIIVKRUHSHWUROHXPH[SORUDWLRQDQGGHYHORSPHQWXWLOLW\FKDUWHUSROLFHILUHUHVFXHHPHUJHQF\PHGLFDOKHOLFRSWHURSHUDWRUVDQG

IRUHLJQJRYHUQPHQWV%HOOSURGXFHVDYDULHW\RIFRPPHUFLDODLUFUDIWW\SHVLQFOXGLQJOLJKWVLQJOHDQGWZLQHQJLQHKHOLFRSWHUVDQG

PHGLXP WZLQHQJLQH KHOLFRSWHUV DORQJ ZLWK RWKHU UHODWHG SURGXFWV 7KH KHOLFRSWHUV FXUUHQWO\ RIIHUHG E\ %HOO IRU FRPPHUFLDO

DSSOLFDWLRQVLQFOXGHWKH/*7*;3(3(3,DQG+XH\,,7KHQHZ-HW5DQJHU;DVKRUWOLJKW

VLQJOHKHOLFRSWHULVH[SHFWHGWRUHFHLYHFHUWLILFDWLRQDQGEHJLQGHOLYHULHVLQ,QDGGLWLRQ%HOODFKLHYHGILUVWIOLJKWLQIRU

WKH5HOHQWOHVVLWVILUVWVXSHUPHGLXPFRPPHUFLDOKHOLFRSWHUDQGH[SHFWVFHUWLILFDWLRQLQ

)RU ERWK LWV PLOLWDU\ SURJUDPV DQG LWV FRPPHUFLDO SURGXFWV %HOO SURYLGHV SRVWVDOH VXSSRUW DQG VHUYLFH IRU DQ LQVWDOOHG EDVH RI

DSSUR[LPDWHO\ KHOLFRSWHUVWKURXJK D QHWZRUN RI HLJKW %HOORSHUDWHG VHUYLFH FHQWHUV ILYH JOREDO SDUWV GLVWULEXWLRQ FHQWHUV

DQG RYHU LQGHSHQGHQW VHUYLFH FHQWHUV ORFDWHG LQ FRXQWULHV &ROOHFWLYHO\ WKHVH VHUYLFH VLWHV RIIHU D FRPSOHWH UDQJH RI

ORJLVWLFVVXSSRUWLQFOXGLQJSDUWVVXSSRUWHTXLSPHQWWHFKQLFDOGDWDWUDLQLQJGHYLFHVSLORWDQGPDLQWHQDQFHWUDLQLQJFRPSRQHQW

UHSDLUDQGRYHUKDXOHQJLQHUHSDLUDQGRYHUKDXODLUFUDIWPRGLILFDWLRQVDLUFUDIWFXVWRPL]LQJDFFHVVRU\PDQXIDFWXULQJFRQWUDFWRU

PDLQWHQDQFHILHOGVHUYLFHDQGSURGXFWVXSSRUWHQJLQHHULQJ

%HOOFRPSHWHVDJDLQVWDQXPEHURIFRPSHWLWRUVWKURXJKRXWWKHZRUOGIRULWVKHOLFRSWHUEXVLQHVVDQGLWVSDUWVDQGVXSSRUWEXVLQHVV

&RPSHWLWLRQLVEDVHGSULPDULO\RQSULFHSURGXFWTXDOLW\DQGUHOLDELOLW\SURGXFWVXSSRUWSHUIRUPDQFHDQGUHSXWDWLRQ

Textron Systems Segment

7H[WURQ6\VWHPV¶SURGXFWOLQHVFRQVLVWRIXQPDQQHGDLUFUDIWV\VWHPVPDULQHDQGODQGV\VWHPVZHDSRQVDQGVHQVRUVVLPXODWLRQ

WUDLQLQJ DQG RWKHU GHIHQVH DQG DYLDWLRQ PLVVLRQ VXSSRUW SURGXFWV DQG VHUYLFHV 7H[WURQ 6\VWHPV LV D VXSSOLHU WR WKH GHIHQVH

DHURVSDFHDQGJHQHUDODYLDWLRQPDUNHWVDQGUHSUHVHQWVDSSUR[LPDWHO\DQGRIRXUWRWDOUHYHQXHVLQDQG

UHVSHFWLYHO\ 7KLV VHJPHQW VHOOV LWV SURGXFWV WR 86 *RYHUQPHQW FXVWRPHUV DQG WR FXVWRPHUV RXWVLGH WKH 86 WKURXJK

IRUHLJQ PLOLWDU\ VDOHV VSRQVRUHG E\ WKH 86 *RYHUQPHQW DQG GLUHFWO\ WKURXJK FRPPHUFLDO VDOHV FKDQQHOV 7H[WURQ 6\VWHPV

FRPSHWHVRQWKHEDVLVRIWHFKQRORJ\FRQWUDFWSHUIRUPDQFHSULFHSURGXFWTXDOLW\DQGUHOLDELOLW\SURGXFWVXSSRUWDQGUHSXWDWLRQ

5HYHQXHVE\7H[WURQ6\VWHPV¶SURGXFWOLQHVZHUHDVIROORZV

(In millions)

8QPDQQHG6\VWHPV

:HDSRQVDQG6HQVRUV

0DULQHDQG/DQG6\VWHPV

6LPXODWLRQ7UDLQLQJDQG2WKHU

7RWDOUHYHQXHV

7(;7521$118$/5(3257

2015

2014

2013

This line represents final trim and will not print

Unmanned Systems

8QPDQQHG6\VWHPVFRQVLVWVRIWKH8QPDQQHG6\VWHPVDQG6XSSRUW6ROXWLRQVEXVLQHVVHV7KH8QPDQQHG6\VWHPVEXVLQHVVKDV

GHVLJQHGPDQXIDFWXUHGDQGILHOGHGFRPEDWSURYHQXQPDQQHGDLUFUDIWV\VWHPVIRUPRUHWKDQ\HDUVLQFOXGLQJWKH86$UP\¶V

SUHPLHU WDFWLFDO XQPDQQHG DLUFUDIW V\VWHP WKH 6KDGRZ 7KLV EXVLQHVV¶V XQPDQQHG DLUFUDIW DQG LQWHURSHUDEOH FRPPDQG DQG

FRQWUROWHFKQRORJLHVSURYLGHFULWLFDOVLWXDWLRQDODZDUHQHVVDQGDFWLRQDEOHLQWHOOLJHQFHIRUXVHUVZRUOGZLGH2XU6XSSRUW6ROXWLRQV

EXVLQHVVSURYLGHVORJLVWLFDOVXSSRUWIRUYDULRXVXQPDQQHGV\VWHPVDVZHOODVWUDLQLQJDQGVXSSO\FKDLQVHUYLFHVWRJRYHUQPHQWDQG

FRPPHUFLDOFXVWRPHUVZRUOGZLGH

Weapons and Sensors

7KH:HDSRQVDQG6HQVRUVEXVLQHVVFRQVLVWVRIVWDWHRIWKHDUWVPDUWZHDSRQVDLUERUQHDQGJURXQGEDVHGVHQVRUVDQGVXUYHLOODQFH

V\VWHPV DQG SURWHFWLRQ V\VWHPV IRU WKH GHIHQVH DQG DHURVSDFH LQGXVWULHV ,W SULPDULO\ VHOOV LWV SURGXFWV WR LQWHUQDWLRQDO DOOLHV

WKURXJKIRUHLJQPLOLWDU\VDOHV

Marine and Land Systems

7KH0DULQHDQG/DQG6\VWHPVEXVLQHVVLVDZRUOGOHDGHULQWKHGHVLJQSURGXFWLRQDQGVXSSRUWRIDUPRUHGYHKLFOHVWXUUHWVDQG

UHODWHGVXEV\VWHPVDVZHOODVDGYDQFHGPDULQHFUDIW,WSURGXFHVDIDPLO\RIH[WUHPHO\PRELOHKLJKO\SURWHFWLYHYHKLFOHVIRUWKH

86$UP\DQGLQWHUQDWLRQDODOOLHVDQGLVGHYHORSLQJWKH861DY\¶VQH[WJHQHUDWLRQ/DQGLQJ&UDIW$LU&XVKLRQDVSDUWRIWKH

6KLSWR6KRUH&RQQHFWRUSURJUDP

Simulation, Training and Other

6LPXODWLRQ7UDLQLQJDQG2WKHULQFOXGHVILYHEXVLQHVVHV7586LPXODWLRQ7UDLQLQJ/\FRPLQJ(OHFWURQLF6\VWHPV$GYDQFHG

,QIRUPDWLRQ 6ROXWLRQV DQG *HRVSDWLDO 6ROXWLRQV 758 6LPXODWLRQ 7UDLQLQJ GHVLJQV GHYHORSV PDQXIDFWXUHV LQVWDOOV DQG

SURYLGHV PDLQWHQDQFH RI DGYDQFHG IOLJKW WUDLQLQJ FRXUVHZDUH DQG GHYLFHV LQFOXGLQJ IXOO IOLJKW VLPXODWRUV IRU ERWK URWDU\ DQG

IL[HGZLQJDLUFUDIWIRUFRPPHUFLDODLUOLQHVDLUFUDIWRULJLQDOHTXLSPHQWPDQXIDFWXUHUV2(0VIOLJKWWUDLQLQJFHQWHUVDQGWUDLQLQJ

RUJDQL]DWLRQV ZRUOGZLGH 7KURXJK LWV WUDLQLQJ FHQWHUV 758 6LPXODWLRQ 7UDLQLQJ SURYLGHV LQLWLDO W\SHUDWLQJ DQG UHFXUUHQF\

WUDLQLQJ IRU SLORWV DV ZHOO DV PDLQWHQDQFH WUDLQLQJ LQ LWV UHFHQWO\ RSHQHG $YLDWLRQ 0DLQWHQDQFH 7UDLQLQJ $FDGHP\ /\FRPLQJ

VSHFLDOL]HV LQ WKH HQJLQHHULQJ PDQXIDFWXUH VHUYLFH DQG VXSSRUW RI SLVWRQDLUFUDIW HQJLQHV IRU WKH JHQHUDO DYLDWLRQ DQG UHPRWHO\

SLORWHG DLUFUDIW PDUNHWV (OHFWURQLF 6\VWHPV SURYLGHV KLJK WHFKQRORJ\ WHVW HTXLSPHQW DQG HOHFWURQLF ZDUIDUH WHVW DQG WUDLQLQJ

VROXWLRQV $GYDQFHG ,QIRUPDWLRQ 6ROXWLRQV DQG *HRVSDWLDO 6ROXWLRQV SURYLGH LQWHOOLJHQFH VRIWZDUH VROXWLRQV IRU 86 DQG

LQWHUQDWLRQDOGHIHQVHLQWHOOLJHQFHDQGODZHQIRUFHPHQWFRPPXQLWLHV

Industrial Segment

2XU ,QGXVWULDO VHJPHQW GHVLJQV DQG PDQXIDFWXUHV D YDULHW\ RI SURGXFWV ZLWKLQ WKUHH SULQFLSDO SURGXFW OLQHV ,QGXVWULDO VHJPHQW

UHYHQXHVZHUHDVIROORZV

(In millions)

)XHO6\VWHPVDQG)XQFWLRQDO&RPSRQHQWV

6SHFLDOL]HG9HKLFOHVDQG(TXLSPHQW

7RROVDQG7HVW(TXLSPHQW

7RWDOUHYHQXHV

2015

2014

2013

Fuel Systems and Functional Components

2XU )XHO 6\VWHPV DQG )XQFWLRQDO &RPSRQHQWV SURGXFW OLQH LV RSHUDWHG E\ RXU .DXWH[ EXVLQHVV XQLW ZKLFK LV KHDGTXDUWHUHG LQ

%RQQ*HUPDQ\.DXWH[LVDOHDGLQJGHYHORSHUDQGPDQXIDFWXUHURIEORZPROGHGSODVWLFIXHOV\VWHPVIRUFDUVOLJKWWUXFNVDOO

WHUUDLQYHKLFOHVZLQGVKLHOGDQGKHDGODPSZDVKHUV\VWHPVIRUDXWRPRELOHVDQGVHOHFWLYHFDWDO\WLFUHGXFWLRQV\VWHPVXVHGWRUHGXFH

HPLVVLRQV IURP GLHVHO HQJLQHV .DXWH[ VHUYHV WKH JOREDO DXWRPRELOH PDUNHW ZLWK RSHUDWLQJ IDFLOLWLHV QHDU LWV PDMRU FXVWRPHUV

DURXQGWKHZRUOG.DXWH[DOVRSURGXFHVFDVWLURQHQJLQHFDPVKDIWVDQGGHYHORSVDQGSURGXFHVSODVWLFERWWOHVDQGFRQWDLQHUVIRU

IRRGKRXVHKROGODERUDWRU\DQGLQGXVWULDOXVHV5HYHQXHVRI.DXWH[DFFRXQWHGIRUDSSUR[LPDWHO\DQGRIRXUWRWDO

UHYHQXHVLQDQGUHVSHFWLYHO\

2XUDXWRPRWLYHSURGXFWVKDYHVHYHUDOPDMRUFRPSHWLWRUVZRUOGZLGHVRPHRIZKLFKDUHDIILOLDWHGZLWKWKH2(0VWKDWFRPSULVH

RXU WDUJHWHG FXVWRPHU EDVH &RPSHWLWLRQ W\SLFDOO\ LV EDVHG RQ D QXPEHU RI IDFWRUV LQFOXGLQJ SULFH WHFKQRORJ\ HQYLURQPHQWDO

SHUIRUPDQFHSURGXFWTXDOLW\DQGUHOLDELOLW\SULRUH[SHULHQFHDQGDYDLODEOHPDQXIDFWXULQJFDSDFLW\

Specialized Vehicles and Equipment

2XU 6SHFLDOL]HG 9HKLFOHV DQG (TXLSPHQW SURGXFW OLQH LQFOXGHV WKH SURGXFWV GHVLJQHG PDQXIDFWXUHG DQG VROG E\ RXU 7H[WURQ

6SHFLDOL]HG 9HKLFOHV DQG -DFREVHQ EXVLQHVVHV 7H[WURQ 6SHFLDOL]HG 9HKLFOHV ZKLFK LQFOXGHV WKH (=*2 %DG %R\ 2II 5RDG

&XVKPDQ78*7HFKQRORJLHVDQG'RXJODV(TXLSPHQWEXVLQHVVHVDQGEUDQGVGHVLJQVPDQXIDFWXUHVDQGVHOOVJROIFDUVRIIURDG

XWLOLW\ YHKLFOHV OLJKW WUDQVSRUWDWLRQ YHKLFOHV DQG DYLDWLRQ JURXQG VXSSRUW HTXLSPHQW $OWKRXJK 7H[WURQ 6SHFLDOL]HG 9HKLFOHV LV

7(;7521$118$/5(3257

This line represents final trim and will not print

EHVW NQRZQ IRU LWV HOHFWULFYHKLFOH WHFKQRORJ\ LW DOVR PDQXIDFWXUHV DQG VHOOV PRGHOV SRZHUHG E\ LQWHUQDO FRPEXVWLRQ HQJLQHV

7H[WURQ 6SHFLDOL]HG 9HKLFOHV¶ GLYHUVLILHG FXVWRPHU EDVH LQFOXGHV JROI FRXUVHV DQG UHVRUWV JRYHUQPHQW DJHQFLHV DQG

PXQLFLSDOLWLHV FRQVXPHUV DQG FRPPHUFLDO DQG LQGXVWULDO XVHUV VXFK DV IDFWRULHV ZDUHKRXVHV DLUSRUWV SODQQHG FRPPXQLWLHV

KXQWLQJSUHVHUYHVDQGHGXFDWLRQDODQGFRUSRUDWHFDPSXVHV6DOHVDUHPDGHWKURXJKD FRPELQDWLRQRIIDFWRU\GLUHFWUHVRXUFHVDQG

D QHWZRUN RI LQGHSHQGHQW GLVWULEXWRUV DQG GHDOHUV ZRUOGZLGH 7H[WURQ 6SHFLDOL]HG 9HKLFOHV KDV WZR PDMRU FRPSHWLWRUV IRU JROI

FDUV DQG VHYHUDO RWKHU FRPSHWLWRUV IRU RIIURDG DQG OLJKW WUDQVSRUWDWLRQ YHKLFOHV DQG IRU DYLDWLRQ JURXQG VXSSRUW HTXLSPHQW

&RPSHWLWLRQLVEDVHGSULPDULO\RQSULFHSURGXFWTXDOLW\DQGUHOLDELOLW\SURGXFWVXSSRUWDQGUHSXWDWLRQ

-DFREVHQ GHVLJQV PDQXIDFWXUHV DQG VHOOV SURIHVVLRQDO WXUIPDLQWHQDQFH HTXLSPHQW DV ZHOO DV VSHFLDOL]HG WXUIFDUH YHKLFOHV

%UDQG QDPHV LQFOXGH 5DQVRPHV -DFREVHQ &XVKPDQ DQG 'L[LH &KRSSHU -DFREVHQ¶V FXVWRPHUV LQFOXGH JROI FRXUVHV UHVRUW

FRPPXQLWLHV VSRUWLQJ YHQXHV PXQLFLSDOLWLHV DQG ODQGVFDSLQJ SURIHVVLRQDOV 3URGXFWV DUH VROG SULPDULO\ WKURXJK D ZRUOGZLGH

QHWZRUN RI GLVWULEXWRUV DQG GHDOHUV DV ZHOO DV IDFWRU\ GLUHFW -DFREVHQ KDV WZR PDMRU FRPSHWLWRUV IRU SURIHVVLRQDO WXUI

PDLQWHQDQFHHTXLSPHQWDQGVHYHUDORWKHUPDMRUFRPSHWLWRUVIRUVSHFLDOL]HGWXUIFDUHSURGXFWV&RPSHWLWLRQLVEDVHGSULPDULO\RQ

SULFHSURGXFWIHDWXUHVSURGXFWTXDOLW\DQGUHOLDELOLW\DQGSURGXFWVXSSRUW

Tools and Test Equipment

7KH7RROVDQG7HVW(TXLSPHQWSURGXFWOLQHLQFOXGHVSURGXFWVVROGE\EXVLQHVVHVWKDWGHVLJQDQGPDQXIDFWXUHSRZHUHGHTXLSPHQW

HOHFWULFDOWHVWDQGPHDVXUHPHQWLQVWUXPHQWVPHFKDQLFDODQGK\GUDXOLFWRROVFDEOHFRQQHFWRUVILEHURSWLFDVVHPEOLHVXQGHUJURXQG

DQG DHULDO WUDQVPLVVLRQ DQG GLVWULEXWLRQ SURGXFWV DQG SRZHU XWLOLW\ SURGXFWV 7KHVH EXVLQHVVHV DOVR HQFRPSDVV WKH *UHHQOHH

*UHHQOHH&RPPXQLFDWLRQV*UHHQOHH8WLOLW\+'(OHFWULF.ODXNH6KHUPDQ5HLOO\DQG(QGXUDEUDQGQDPHVDQGWKHLUSURGXFWV

DUHXVHGSULQFLSDOO\LQWKHFRQVWUXFWLRQPDLQWHQDQFHWHOHFRPPXQLFDWLRQVGDWDFRPPXQLFDWLRQVHOHFWULFDOXWLOLW\DQGSOXPELQJ

LQGXVWULHV 7KHLU SURGXFWV DUH GLVWULEXWHG WKURXJK D JOREDO QHWZRUN RI VDOHV UHSUHVHQWDWLYHV DQG GLVWULEXWRUV DQG DUH DOVR VROG

GLUHFWO\ WR KRPH LPSURYHPHQW UHWDLOHUV DQG 2(0V 7KH EXVLQHVVHV KDYH SODQW RSHUDWLRQV LQ ILYH FRXQWULHV ZLWK DOPRVW RI

WKHLUFRPELQHGUHYHQXHFRPLQJIURPRXWVLGHWKH8QLWHG6WDWHV7KHVHEXVLQHVVHVIDFHFRPSHWLWLRQIURPQXPHURXVPDQXIDFWXUHUV

EDVHGSULPDULO\RQSULFHGHOLYHU\OHDGWLPHSURGXFWTXDOLW\DQGUHOLDELOLW\

Finance Segment

2XU)LQDQFHVHJPHQWRUWKH)LQDQFHJURXSLVDFRPPHUFLDOILQDQFHEXVLQHVVWKDWFRQVLVWVRI7H[WURQ)LQDQFLDO&RUSRUDWLRQ7)&

DQGLWVFRQVROLGDWHGVXEVLGLDULHV7KH)LQDQFHVHJPHQWSURYLGHVILQDQFLQJSULPDULO\WRSXUFKDVHUVRIQHZDQGSUHRZQHG7H[WURQ

$YLDWLRQ DLUFUDIW DQG %HOO KHOLFRSWHUV 7KH PDMRULW\ RI QHZ ILQDQFH UHFHLYDEOHV DUH FURVVERUGHU WUDQVDFWLRQV IRU DLUFUDIW VROG

RXWVLGH RI WKH 86 1HZ RULJLQDWLRQV LQ WKH 86 DUH SULPDULO\ IRU SXUFKDVHUV ZKR KDG GLIILFXOW\ LQ DFFHVVLQJ RWKHU VRXUFHV RI

ILQDQFLQJIRUWKHSXUFKDVHRI7H[WURQPDQXIDFWXUHGSURGXFWV,QDQGRXU)LQDQFHJURXSSDLGRXU0DQXIDFWXULQJ

JURXS PLOOLRQ PLOOLRQ DQG PLOOLRQ UHVSHFWLYHO\ UHODWHG WR WKH VDOH RI 7H[WURQPDQXIDFWXUHG SURGXFWV WR WKLUG

SDUWLHVWKDWZHUHILQDQFHGE\WKH)LQDQFHJURXS

7KH FRPPHUFLDO ILQDQFH EXVLQHVV WUDGLWLRQDOO\ LV H[WUHPHO\ FRPSHWLWLYH 2XU )LQDQFH VHJPHQW LV VXEMHFW WR FRPSHWLWLRQ IURP

YDULRXVW\SHVRIILQDQFLQJLQVWLWXWLRQVLQFOXGLQJEDQNVOHDVLQJFRPSDQLHVFRPPHUFLDOILQDQFHFRPSDQLHVDQGILQDQFHRSHUDWLRQV

RI HTXLSPHQW YHQGRUV &RPSHWLWLRQ ZLWKLQ WKH FRPPHUFLDO ILQDQFH LQGXVWU\ SULPDULO\ LV IRFXVHG RQ SULFH WHUP VWUXFWXUH DQG

VHUYLFH

2XU )LQDQFH VHJPHQW¶V ODUJHVW EXVLQHVV ULVN LV WKH FROOHFWDELOLW\ RI LWV ILQDQFH UHFHLYDEOH SRUWIROLR 6HH ³)LQDQFH 3RUWIROLR

4XDOLW\´ LQ ³0DQDJHPHQW¶V 'LVFXVVLRQ DQG $QDO\VLV RI )LQDQFLDO &RQGLWLRQ DQG 5HVXOWV RI 2SHUDWLRQV´ RQ SDJH IRU

LQIRUPDWLRQDERXWWKH)LQDQFHVHJPHQW¶VFUHGLWSHUIRUPDQFH

7(;7521$118$/5(3257

This line represents final trim and will not print

Backlog 2XUEDFNORJDWWKHHQGRIDQGLVVXPPDUL]HGEHORZ

(In millions)

January 2,

2016

January 3,

2015

%HOO

7H[WURQ6\VWHPV

7H[WURQ$YLDWLRQ

7RWDOEDFNORJ

$SSUR[LPDWHO\RIRXUWRWDOEDFNORJDW-DQXDU\UHSUHVHQWVRUGHUVWKDWDUHQRWH[SHFWHGWREHILOOHGLQ

$WWKHHQGRIDSSUR[LPDWHO\RIRXUWRWDOEDFNORJZDVZLWKWKH86*RYHUQPHQWZKLFKLQFOXGHGRQO\IXQGHGDPRXQWV

DVWKH86*RYHUQPHQWLVREOLJDWHGRQO\XSWRWKHDPRXQWRIIXQGLQJIRUPDOO\DSSURSULDWHGIRUDFRQWUDFW%HOO¶VEDFNORJ

LQFOXGHG ELOOLRQ UHODWHG WR D PXOWL\HDU SURFXUHPHQW FRQWUDFW ZLWK WKH 86 *RYHUQPHQW IRU WKH SXUFKDVH RI 9 WLOWURWRU

DLUFUDIW

U.S. Government Contracts

,QDSSUR[LPDWHO\RIRXUFRQVROLGDWHGUHYHQXHVZHUHJHQHUDWHGE\RUUHVXOWHGIURPFRQWUDFWVZLWKWKH86*RYHUQPHQW

H[FOXGLQJ WKRVH FRQWUDFWV XQGHU WKH 86 *RYHUQPHQW VSRQVRUHG IRUHLJQ PLOLWDU\ VDOHV SURJUDP 7KLV EXVLQHVV LV VXEMHFW WR

FRPSHWLWLRQ FKDQJHV LQ SURFXUHPHQW SROLFLHV DQG UHJXODWLRQV WKH FRQWLQXLQJ DYDLODELOLW\ RI IXQGLQJ ZKLFK LV GHSHQGHQW XSRQ

FRQJUHVVLRQDODSSURSULDWLRQVQDWLRQDODQGLQWHUQDWLRQDOSULRULWLHVIRUGHIHQVHVSHQGLQJZRUOGHYHQWVDQGWKHVL]HDQGWLPLQJRI

SURJUDPVLQZKLFKZHPD\SDUWLFLSDWH

2XUFRQWUDFWVZLWKWKH86*RYHUQPHQWJHQHUDOO\PD\EHWHUPLQDWHGE\WKH86*RYHUQPHQWIRUFRQYHQLHQFHRULIZHGHIDXOWLQ

ZKROHRULQSDUWE\IDLOLQJWRSHUIRUPXQGHUWKHWHUPVRIWKHDSSOLFDEOHFRQWUDFW,IWKH86*RYHUQPHQWWHUPLQDWHVDFRQWUDFWIRU

FRQYHQLHQFH ZH QRUPDOO\ ZLOO EH HQWLWOHG WR SD\PHQW IRU WKH FRVW RI FRQWUDFW ZRUN SHUIRUPHG EHIRUH WKH HIIHFWLYH GDWH RI

WHUPLQDWLRQLQFOXGLQJLIDSSOLFDEOHUHDVRQDEOHSURILWRQVXFKZRUNDVZHOODVUHDVRQDEOHWHUPLQDWLRQFRVWV,IKRZHYHUWKH86

*RYHUQPHQWWHUPLQDWHVDFRQWUDFWIRUGHIDXOWJHQHUDOO\DZHZLOOEHSDLGWKHFRQWUDFWSULFHIRUFRPSOHWHGVXSSOLHVGHOLYHUHGDQG

DFFHSWHGDQGVHUYLFHVUHQGHUHGDQDJUHHGXSRQDPRXQWIRUPDQXIDFWXULQJPDWHULDOVGHOLYHUHGDQGDFFHSWHGDQGIRUWKHSURWHFWLRQ

DQG SUHVHUYDWLRQ RI SURSHUW\ DQG DQ DPRXQW IRU SDUWLDOO\ FRPSOHWHG SURGXFWV DFFHSWHG E\ WKH 86 *RYHUQPHQW EWKH 86

*RYHUQPHQW PD\ QRW EH OLDEOH IRU RXU FRVWV ZLWK UHVSHFW WR XQDFFHSWHG LWHPV DQG PD\ EH HQWLWOHG WR UHSD\PHQW RI DGYDQFH

SD\PHQWVDQGSURJUHVVSD\PHQWVUHODWHGWRWKHWHUPLQDWHGSRUWLRQVRIWKHFRQWUDFWFWKH86*RYHUQPHQWPD\QRWEHOLDEOHIRU

DVVHWV ZH RZQ DQG XWLOL]H WR SURYLGH VHUYLFHV XQGHU WKH ³IHHIRUVHUYLFH´ FRQWUDFWV DQG G ZH PD\ EH OLDEOH IRU H[FHVV FRVWV

LQFXUUHGE\WKH86*RYHUQPHQWLQSURFXULQJXQGHOLYHUHGLWHPVIURPDQRWKHUVRXUFH

Research and Development

,QIRUPDWLRQUHJDUGLQJRXUUHVHDUFKDQGGHYHORSPHQWH[SHQGLWXUHVLVFRQWDLQHGLQ1RWHWRWKH&RQVROLGDWHG)LQDQFLDO6WDWHPHQWV

RQSDJHRIWKLV$QQXDO5HSRUWRQ)RUP.

PatentsandTrademarks

:H RZQ RU DUH OLFHQVHG XQGHU QXPHURXV SDWHQWV WKURXJKRXW WKH ZRUOG UHODWLQJ WR SURGXFWV VHUYLFHV DQG PHWKRGV RI

PDQXIDFWXULQJ 3DWHQWV GHYHORSHG ZKLOH XQGHU FRQWUDFW ZLWK WKH 86 *RYHUQPHQW PD\ EH VXEMHFW WR XVH E\ WKH 86 *RYHUQPHQW

:H DOVR RZQ RU OLFHQVH DFWLYH WUDGHPDUN UHJLVWUDWLRQV DQG SHQGLQJ WUDGHPDUN DSSOLFDWLRQV LQ WKH 86 DQG LQ YDULRXV IRUHLJQ

FRXQWULHV RU UHJLRQV DV ZHOO DV WUDGH QDPHV DQG VHUYLFH PDUNV :KLOH RXU LQWHOOHFWXDO SURSHUW\ ULJKWV LQ WKH DJJUHJDWH DUH LPSRUWDQW

WRWKH RSHUDWLRQ RI RXU EXVLQHVV ZH GR QRW EHOLHYH WKDW DQ\ H[LVWLQJ SDWHQW OLFHQVH WUDGHPDUN RU RWKHU LQWHOOHFWXDO SURSHUW\ ULJKW LV

RI VXFK LPSRUWDQFH WKDW LWV ORVV RU WHUPLQDWLRQ ZRXOG KDYH D PDWHULDO DGYHUVH HIIHFW RQ RXU EXVLQHVV WDNHQ DV D ZKROH 6RPH RI

WKHVH WUDGHPDUNV WUDGH QDPHV DQG VHUYLFH PDUNV DUH XVHG LQ WKLV $QQXDO 5HSRUW RQ )RUP . DQG RWKHU UHSRUWV LQFOXGLQJ

$HURQDXWLFDO $FFHVVRULHV $$, DF$OHUW $VFHQW $HURVRQGH $+= $PEXVK $UF +RUL]RQ $9&2$7 %DG %R\ 2II 5RDG

%DURQ %DWWOH+DZN %HHFKFUDIW %HHFKFUDIW 7 %HOO %HOO +HOLFRSWHU %RQDQ]D %UDYR &DGLOODF *DJH &DUDYDQ &DUDYDQ

$PSKLELDQ &DUDYDQ &HVVQD &HVVQD &HVVQD &HVVQD 7XUER 6N\ODQH -7$ &HVVQD 7XUER 6N\KDZN -7$ &LWDWLRQ

&,7$7,21 $/3,1( (',7,21 &LWDWLRQ (QFRUH &LWDWLRQ /DWLWXGH &LWDWLRQ /RQJLWXGH &LWDWLRQ 0 &LWDWLRQ 6RYHUHLJQ

&LWDWLRQ ; &LWDWLRQ ; &LWDWLRQ ;/6 &- &- &- &- &- &ODLULW\ &/$: &/($57(67 &RPPDQGR &XVKPDQ

'DWD6FRXW 'L[LH &KRSSHU 'L[LH &KRSSHU 6WU\NHU (FOLSVH (1)25&(5 ([FHO (=*2 (=*2 (;35(66 )$671/$7&+

)XU\ * 7XJJHU *DWRU(\H *DWRU *ULSV */2%$/ 0,66,21 6833257 *UDQG &DUDYDQ *UHHQOHH + +$8/(5 +'(

+DZNHU +HPLVSKHUH +XH\ +XH\ ,, L&RPPDQG ,( ,QVWLQFW ,QWHJUDWHG &RPPDQG 6XLWH ,17(//,%5$.( -DFREVHQ

-DFREVHQ +RYHU.LQJ -HW 5DQJHU ; .DXWH[ .LQJ $LU .LQJ $LU &*7[ .LQJ $LU .LQJ $LU .LRZD :DUULRU .ODXNH

/) /\FRPLQJ 0 $69 0$'( )25 7+( 75$'( 0F&DXOH\ 0HFKWURQL[ 0LOOHQZRUNV 0LVVLRQ &ULWLFDO 6XSSRUW 0&6

0LVVLRQ/LQN ,9+0 0XVWDQJ 1H[W *HQHUDWLRQ &DUERQ &DQLVWHU 1H[W *HQHUDWLRQ )XHO 6\VWHP 1*&& 1*)6 2G\VVH\

7(;7521$118$/5(3257

This line represents final trim and will not print

216/$8*+723,1,&862YHUZDWFK3'&XH3RZHU$GYDQWDJH3UR)LW3UR3DUWV5DQVRPHV5($/&XH5($/)HHO5HFRLO

5HOHQWOHVV 52&211(&7 57 5;9 6$%(5 6FRUSLRQ 6HQVRU )X]HG :HDSRQ 6HUYLFH'LUHFW 6KDGRZ 6KDGRZ .QLJKW

6KDGRZ 0DVWHU 6KHUPDQ5HLOO\ 6N\KDZN 6N\KDZN 63 6N\ODQH 6N\3/86 6RYHUHLJQ 6SHHG 3XQFK 6SLGHU 6WDWLRQDLU 67

;6XSHU&DUJRPDVWHU6XSHU0HGLXP6XSHU&REUD6<07;7'&XH7H[WURQ7H[WURQ$YLDWLRQ7H[WURQ'HIHQVH6\VWHPV

7H[WURQ )LQDQFLDO &RUSRUDWLRQ 7H[WURQ 0DULQH /DQG 6\VWHPV 7H[WURQ 6\VWHPV 7,0HWDO 758(6(7 758 6LPXODWLRQ 7UDLQLQJ758&.67(577[78*7XUER6N\ODQH7XUER6WDWLRQDLU8+<9:DWFK&RQQHFW9$/2592VSUH\9

:ROYHULQH ),9( *7 *; DQG 5HOHQWOHVV 7KHVH PDUNV DQG WKHLU UHODWHG WUDGHPDUN

GHVLJQV DQG ORJRW\SHV DQG YDULDWLRQV RI WKH IRUHJRLQJ DUH WUDGHPDUNV WUDGH QDPHV RU VHUYLFH PDUNV RI 7H[WURQ ,QF LWV

VXEVLGLDULHVDIILOLDWHVRUMRLQWYHQWXUHV

Environmental Considerations

2XURSHUDWLRQVDUHVXEMHFWWRQXPHURXVODZVDQGUHJXODWLRQVGHVLJQHGWRSURWHFWWKHHQYLURQPHQW&RPSOLDQFHZLWKWKHVHODZVDQG

H[SHQGLWXUHVIRUHQYLURQPHQWDOFRQWUROIDFLOLWLHVKDVQRWKDGDPDWHULDOHIIHFWRQRXUFDSLWDOH[SHQGLWXUHVHDUQLQJVRUFRPSHWLWLYH

SRVLWLRQ$GGLWLRQDOLQIRUPDWLRQUHJDUGLQJHQYLURQPHQWDOPDWWHUVLVFRQWDLQHGLQ1RWHWRWKH&RQVROLGDWHG)LQDQFLDO6WDWHPHQWV

RQSDJHRIWKLV$QQXDO5HSRUWRQ)RUP.

:HGRQRWEHOLHYHWKDWH[LVWLQJRUSHQGLQJFOLPDWHFKDQJHOHJLVODWLRQUHJXODWLRQRULQWHUQDWLRQDOWUHDWLHVRUDFFRUGVDUHUHDVRQDEO\

OLNHO\ WR KDYH D PDWHULDO HIIHFW LQ WKH IRUHVHHDEOH IXWXUH RQ RXU EXVLQHVV RU PDUNHWV QRU RQ RXU UHVXOWV RI RSHUDWLRQV FDSLWDO

H[SHQGLWXUHVRUILQDQFLDOSRVLWLRQ:HZLOOFRQWLQXHWRPRQLWRUHPHUJLQJGHYHORSPHQWVLQWKLVDUHD

Employees

$W-DQXDU\ZHKDGDSSUR[LPDWHO\HPSOR\HHV

Executive Officers of the Registrant

7KHIROORZLQJWDEOHVHWVIRUWKFHUWDLQLQIRUPDWLRQFRQFHUQLQJRXUH[HFXWLYHRIILFHUVDVRI)HEUXDU\

Name

Age

6FRWW&'RQQHOO\

)UDQN7&RQQRU

&KHU\O+-RKQVRQ

( 5REHUW/XSRQH

Current Position with Textron Inc.

&KDLUPDQ3UHVLGHQWDQG&KLHI([HFXWLYH2IILFHU

([HFXWLYH9LFH3UHVLGHQWDQG&KLHI)LQDQFLDO2IILFHU

([HFXWLYH9LFH3UHVLGHQW+XPDQ5HVRXUFHV

([HFXWLYH9LFH3UHVLGHQW*HQHUDO&RXQVHO6HFUHWDU\DQG&KLHI&RPSOLDQFH2IILFHU

0U'RQQHOO\MRLQHG7H[WURQLQ-XQHDV([HFXWLYH9LFH3UHVLGHQWDQG&KLHI2SHUDWLQJ2IILFHUDQGZDVSURPRWHGWR3UHVLGHQW

DQG &KLHI 2SHUDWLQJ 2IILFHU LQ -DQXDU\ +H ZDV DSSRLQWHG WR WKH %RDUG RI 'LUHFWRUV LQ 2FWREHU DQG EHFDPH &KLHI

([HFXWLYH2IILFHURI7H[WURQLQ'HFHPEHUDWZKLFKWLPHWKH&KLHI2SHUDWLQJ2IILFHUSRVLWLRQZDVHOLPLQDWHG,Q-XO\

0U'RQQHOO\ZDVDSSRLQWHG&KDLUPDQRIWKH%RDUGRI'LUHFWRUVHIIHFWLYH6HSWHPEHU3UHYLRXVO\0U'RQQHOO\ZDVWKH

3UHVLGHQWDQG&(2RI*HQHUDO(OHFWULF&RPSDQ\

V$YLDWLRQEXVLQHVVXQLWDSRVLWLRQKHKDGKHOGVLQFH-XO\*(¶V$YLDWLRQ

EXVLQHVVXQLWLVDELOOLRQPDNHURIFRPPHUFLDODQGPLOLWDU\MHWHQJLQHVDQGFRPSRQHQWVDVZHOODVLQWHJUDWHGGLJLWDOHOHFWULF

SRZHU DQG PHFKDQLFDO V\VWHPV IRU DLUFUDIW 3ULRU WR -XO\ 0U 'RQQHOO\ VHUYHG DV 6HQLRU 9LFH 3UHVLGHQW RI *( *OREDO

5HVHDUFKRQHRIWKHZRUOG¶VODUJHVWDQGPRVWGLYHUVLILHGLQGXVWULDOUHVHDUFKRUJDQL]DWLRQVZLWKIDFLOLWLHVLQWKH86,QGLD&KLQD

DQG*HUPDQ\DQGKHOGYDULRXVRWKHUPDQDJHPHQWSRVLWLRQVVLQFHMRLQLQJ*HQHUDO(OHFWULFLQ

0U&RQQRUMRLQHG7H[WURQLQ$XJXVWDV([HFXWLYH9LFH3UHVLGHQWDQG&KLHI)LQDQFLDO2IILFHU3UHYLRXVO\0U&RQQRUZDV

KHDG RI 7HOHFRP ,QYHVWPHQW %DQNLQJ DW *ROGPDQ 6DFKV &R IURP WR 3ULRU WR WKDW SRVLWLRQ KH VHUYHG DV &KLHI

2SHUDWLQJ 2IILFHU RI 7HOHFRP 7HFKQRORJ\ DQG 0HGLD ,QYHVWPHQW %DQNLQJ DW *ROGPDQ 6DFKV IURP WR 0U &RQQRU

MRLQHG WKH &RUSRUDWH )LQDQFH 'HSDUWPHQW RI *ROGPDQ 6DFKV LQ DQG EHFDPH D 9LFH 3UHVLGHQW LQ DQG D 0DQDJLQJ

'LUHFWRULQ

0V-RKQVRQZDVQDPHG([HFXWLYH9LFH3UHVLGHQW+XPDQ5HVRXUFHVLQ-XO\0V-RKQVRQMRLQHG7H[WURQLQDQGKDV

KHOG YDULRXV KXPDQ UHVRXUFHV OHDGHUVKLS SRVLWLRQV DFURVV 7H[WURQ

V EXVLQHVVHV LQFOXGLQJ 6HQLRU +XPDQ 5HVRXUFHV %XVLQHVV

3DUWQHU IRU *UHHQOHH DQG 9LFH 3UHVLGHQW RI +XPDQ 5HVRXUFHV IRU (=*2 D SRVLWLRQ VKH KHOG IURP XQWLO MRLQLQJ %HOO LQ

$W%HOOVKHPRVWUHFHQWO\VHUYHGDV'LUHFWRURI7DOHQWDQG2UJDQL]DWLRQDO'HYHORSPHQW3ULRUWR7H[WURQ0V-RKQVRQ

KHOGUROHVLQKXPDQUHVRXUFHVPDUNHWLQJDQGVDOHVDQGILQDQFHGLVFLSOLQHVDWVHYHUDORUJDQL]DWLRQVLQFOXGLQJ,%0DQG+DPLOWRQ

6XQGVWUDQGD8QLWHG7HFKQRORJLHV&RPSDQ\

0U /XSRQH MRLQHG 7H[WURQ LQ )HEUXDU\ DV ([HFXWLYH 9LFH 3UHVLGHQW *HQHUDO &RXQVHO 6HFUHWDU\ DQG &KLHI &RPSOLDQFH

2IILFHU 3UHYLRXVO\ KH ZDV VHQLRU YLFH SUHVLGHQW DQG JHQHUDO FRXQVHO RI 6LHPHQV &RUSRUDWLRQ 86 VLQFH DQG JHQHUDO

FRXQVHO RI 6LHPHQV $* IRU WKH $PHULFDV VLQFH 3ULRU WR MRLQLQJ 6LHPHQV LQ 0U /XSRQH ZDV YLFH SUHVLGHQW DQG

JHQHUDOFRXQVHORI3ULFH&RPPXQLFDWLRQV&RUSRUDWLRQ

7(;7521$118$/5(3257

This line represents final trim and will not print

Available Information

:H PDNH DYDLODEOH IUHH RI FKDUJH RQ RXU ,QWHUQHW :HE VLWH ZZZWH[WURQFRP RXU $QQXDO 5HSRUW RQ )RUP . 4XDUWHUO\

5HSRUWVRQ)RUP4&XUUHQW5HSRUWVRQ)RUP.DQGDPHQGPHQWVWRWKRVHUHSRUWVILOHGRUIXUQLVKHGSXUVXDQWWR6HFWLRQD

RUGRIWKH6HFXULWLHV([FKDQJH$FWRIDVVRRQDVUHDVRQDEO\SUDFWLFDEOHDIWHUZHHOHFWURQLFDOO\ILOHVXFKPDWHULDOZLWKRU

IXUQLVKLWWRWKH6HFXULWLHVDQG([FKDQJH&RPPLVVLRQ

Forward-Looking Information

&HUWDLQVWDWHPHQWVLQWKLV$QQXDO5HSRUWRQ)RUP.DQGRWKHURUDODQGZULWWHQVWDWHPHQWVPDGHE\XVIURPWLPHWRWLPHDUH

³IRUZDUGORRNLQJVWDWHPHQWV´ZLWKLQWKHPHDQLQJRIWKH3ULYDWH6HFXULWLHV/LWLJDWLRQ5HIRUP$FWRI7KHVHIRUZDUGORRNLQJ

VWDWHPHQWVZKLFKPD\GHVFULEHVWUDWHJLHVJRDOVRXWORRNRURWKHUQRQKLVWRULFDOPDWWHUVRUSURMHFWUHYHQXHVLQFRPHUHWXUQVRU

RWKHUILQDQFLDOPHDVXUHVRIWHQLQFOXGHZRUGVVXFKDV³EHOLHYH´³H[SHFW´³DQWLFLSDWH´³LQWHQG´³SODQ´³HVWLPDWH´³JXLGDQFH´

³SURMHFW´³WDUJHW´³SRWHQWLDO´³ZLOO´³VKRXOG´³FRXOG´³OLNHO\´RU³PD\´DQGVLPLODUH[SUHVVLRQVLQWHQGHGWRLGHQWLI\IRUZDUG

ORRNLQJVWDWHPHQWV7KHVHVWDWHPHQWVDUHRQO\SUHGLFWLRQVDQGLQYROYHNQRZQDQGXQNQRZQULVNVXQFHUWDLQWLHVDQGRWKHUIDFWRUV

WKDWPD\FDXVHRXUDFWXDOUHVXOWVWRGLIIHUPDWHULDOO\IURPWKRVHH[SUHVVHGRULPSOLHGE\VXFKIRUZDUGORRNLQJVWDWHPHQWV*LYHQ

WKHVHXQFHUWDLQWLHV\RXVKRXOGQRWSODFHXQGXHUHOLDQFHRQWKHVHIRUZDUGORRNLQJVWDWHPHQWV)RUZDUGORRNLQJVWDWHPHQWVVSHDN

RQO\DVRIWKHGDWHRQZKLFKWKH\DUHPDGHDQGZHXQGHUWDNHQRREOLJDWLRQWRXSGDWHRUUHYLVHDQ\IRUZDUGORRNLQJVWDWHPHQWV,Q

DGGLWLRQ WR WKRVH IDFWRUV GHVFULEHG KHUHLQ XQGHU ³5,6. )$&7256´ DPRQJ WKH IDFWRUV WKDW FRXOG FDXVH DFWXDO UHVXOWV WR GLIIHU

PDWHULDOO\IURPSDVWDQGSURMHFWHGIXWXUHUHVXOWVDUHWKHIROORZLQJ

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

,QWHUUXSWLRQVLQWKH86*RYHUQPHQW¶VDELOLW\WRIXQGLWVDFWLYLWLHVDQGRUSD\LWVREOLJDWLRQV

&KDQJLQJSULRULWLHVRUUHGXFWLRQVLQWKH86*RYHUQPHQWGHIHQVHEXGJHWLQFOXGLQJWKRVHUHODWHGWRPLOLWDU\RSHUDWLRQVLQ

IRUHLJQFRXQWULHV

2XUDELOLW\WRSHUIRUPDVDQWLFLSDWHGDQGWRFRQWUROFRVWVXQGHUFRQWUDFWVZLWKWKH86*RYHUQPHQW

7KH 86 *RYHUQPHQW¶V DELOLW\ WR XQLODWHUDOO\ PRGLI\ RU WHUPLQDWH LWV FRQWUDFWV ZLWK XV IRU WKH 86 *RYHUQPHQW¶V

FRQYHQLHQFH RU IRU RXU IDLOXUH WR SHUIRUP WR FKDQJH DSSOLFDEOH SURFXUHPHQW DQG DFFRXQWLQJ SROLFLHV RU XQGHU FHUWDLQ

FLUFXPVWDQFHVWRZLWKKROGSD\PHQWRUVXVSHQGRUGHEDUXVDVDFRQWUDFWRUHOLJLEOHWRUHFHLYHIXWXUHFRQWUDFWDZDUGV

&KDQJHV LQ IRUHLJQ PLOLWDU\ IXQGLQJ SULRULWLHV RU EXGJHW FRQVWUDLQWV DQG GHWHUPLQDWLRQV RU FKDQJHV LQ JRYHUQPHQW

UHJXODWLRQVRUSROLFLHVRQWKHH[SRUWDQGLPSRUWRIPLOLWDU\DQGFRPPHUFLDOSURGXFWV

9RODWLOLW\ LQ WKH JOREDO HFRQRP\ RU FKDQJHV LQ ZRUOGZLGH SROLWLFDO FRQGLWLRQV WKDW DGYHUVHO\ LPSDFW GHPDQG IRU RXU

SURGXFWV

9RODWLOLW\LQLQWHUHVWUDWHVRUIRUHLJQH[FKDQJHUDWHV

5LVNVUHODWHGWRRXULQWHUQDWLRQDOEXVLQHVVLQFOXGLQJHVWDEOLVKLQJDQGPDLQWDLQLQJIDFLOLWLHVLQORFDWLRQVDURXQGWKHZRUOG

DQGUHO\LQJRQMRLQWYHQWXUHSDUWQHUVVXEFRQWUDFWRUVVXSSOLHUVUHSUHVHQWDWLYHVFRQVXOWDQWVDQGRWKHUEXVLQHVVSDUWQHUVLQ

FRQQHFWLRQZLWKLQWHUQDWLRQDOEXVLQHVVLQFOXGLQJLQHPHUJLQJPDUNHWFRXQWULHV

2XU)LQDQFHVHJPHQW¶VDELOLW\WRPDLQWDLQSRUWIROLRFUHGLWTXDOLW\RUWRUHDOL]HIXOOYDOXHRIUHFHLYDEOHV

3HUIRUPDQFHLVVXHVZLWKNH\VXSSOLHUVRUVXEFRQWUDFWRUV

/HJLVODWLYHRUUHJXODWRU\DFWLRQVERWKGRPHVWLFDQGIRUHLJQLPSDFWLQJRXURSHUDWLRQVRUGHPDQGIRURXUSURGXFWV

2XUDELOLW\WRFRQWUROFRVWVDQGVXFFHVVIXOO\LPSOHPHQWYDULRXVFRVWUHGXFWLRQDFWLYLWLHV

7KHHIILFDF\RIUHVHDUFKDQGGHYHORSPHQWLQYHVWPHQWVWRGHYHORSQHZSURGXFWVRUXQDQWLFLSDWHGH[SHQVHVLQFRQQHFWLRQ

ZLWKWKHODXQFKLQJRIVLJQLILFDQWQHZSURGXFWVRUSURJUDPV

7KHWLPLQJRIRXUQHZSURGXFWODXQFKHVRUFHUWLILFDWLRQVRIRXUQHZDLUFUDIWSURGXFWV

2XU DELOLW\ WR NHHS SDFH ZLWK RXU FRPSHWLWRUV LQ WKH LQWURGXFWLRQ RI QHZ SURGXFWV DQG XSJUDGHV ZLWK IHDWXUHV DQG

WHFKQRORJLHVGHVLUHGE\RXUFXVWRPHUV

3HQVLRQSODQDVVXPSWLRQVDQGIXWXUHFRQWULEXWLRQV

'HPDQGVRIWQHVVRUYRODWLOLW\LQWKHPDUNHWVLQZKLFKZHGREXVLQHVVDQG

&\EHUVHFXULW\ WKUHDWV LQFOXGLQJ WKH SRWHQWLDO PLVDSSURSULDWLRQ RI DVVHWV RU VHQVLWLYH LQIRUPDWLRQ FRUUXSWLRQ RI GDWD RU

RSHUDWLRQDOGLVUXSWLRQ

7(;7521$118$/5(3257

This line represents final trim and will not print

Item 1A. Risk Factors

2XUEXVLQHVVILQDQFLDOFRQGLWLRQDQGUHVXOWVRIRSHUDWLRQVDUHVXEMHFWWRYDULRXVULVNVLQFOXGLQJWKRVHGLVFXVVHGEHORZZKLFKPD\

DIIHFW WKH YDOXH RI RXU VHFXULWLHV 7KH ULVNV GLVFXVVHG EHORZ DUH WKRVH WKDW ZH EHOLHYH FXUUHQWO\ DUH WKH PRVW VLJQLILFDQW WR RXU

EXVLQHVV

We have customer concentration with the U.S. Government; reduction in U.S. Government defense spending may adversely

affect our results of operations and financial condition.

'XULQJZHGHULYHGDSSUR[LPDWHO\RIRXUUHYHQXHVIURPVDOHVWRDYDULHW\RI86*RYHUQPHQWHQWLWLHV2XUUHYHQXHV

IURPWKH86*RYHUQPHQWODUJHO\UHVXOWIURPFRQWUDFWVDZDUGHGWRXVXQGHUYDULRXV86*RYHUQPHQWGHIHQVHUHODWHGSURJUDPV

7KHIXQGLQJRIWKHVHSURJUDPVLVVXEMHFWWRFRQJUHVVLRQDODSSURSULDWLRQGHFLVLRQVDQGWKH86*RYHUQPHQWEXGJHWSURFHVVZKLFK

LQFOXGHV HQDFWLQJ UHOHYDQW OHJLVODWLRQ VXFK DV DSSURSULDWLRQV ELOOV DQG DFFRUGV RQ WKH GHEW FHLOLQJ $OWKRXJK PXOWLSOH\HDU

FRQWUDFWV PD\ EH SODQQHG LQ FRQQHFWLRQ ZLWK PDMRU SURFXUHPHQWV &RQJUHVV JHQHUDOO\ DSSURSULDWHV IXQGV RQ D ILVFDO \HDU EDVLV

HYHQ WKRXJK D SURJUDP PD\ FRQWLQXH IRU VHYHUDO \HDUV &RQVHTXHQWO\ SURJUDPV RIWHQ DUH RQO\ SDUWLDOO\ IXQGHG LQLWLDOO\ DQG

DGGLWLRQDOIXQGVDUHFRPPLWWHGRQO\DV&RQJUHVVPDNHVIXUWKHUDSSURSULDWLRQV,IZHLQFXUFRVWVLQH[FHVVRIIXQGVFRPPLWWHGRQ

DFRQWUDFWZHDUHDWULVNIRUQRQUHLPEXUVHPHQWRIWKRVHFRVWVXQWLODGGLWLRQDOIXQGVDUHDSSURSULDWHG7KHUHGXFWLRQWHUPLQDWLRQ

RUGHOD\LQWKHWLPLQJRIIXQGLQJIRU86*RYHUQPHQWSURJUDPVIRUZKLFKZHFXUUHQWO\SURYLGHRUSURSRVHWRSURYLGHSURGXFWVRU

VHUYLFHVPD\UHVXOWLQDORVVRIDQWLFLSDWHGIXWXUHUHYHQXHVWKDWFRXOGPDWHULDOO\DQGDGYHUVHO\LPSDFWRXUUHVXOWVRIRSHUDWLRQVDQG

ILQDQFLDOFRQGLWLRQ6LJQLILFDQWFKDQJHVLQQDWLRQDODQGLQWHUQDWLRQDOSULRULWLHVIRUGHIHQVHVSHQGLQJFRXOGLPSDFWWKHIXQGLQJRU

WKHWLPLQJRIIXQGLQJRIRXUSURJUDPVZKLFKFRXOGQHJDWLYHO\LPSDFWRXUUHVXOWVRIRSHUDWLRQVDQGILQDQFLDOFRQGLWLRQ

8QGHUWKH%XGJHW&RQWURO$FWRIWKH86*RYHUQPHQWFRPPLWWHGWRVLJQLILFDQWO\UHGXFHWKHIHGHUDOGHILFLWRYHUWHQ\HDUV

$VDUHVXOWORQJWHUPIXQGLQJIRUYDULRXVSURJUDPVLQZKLFKZHSDUWLFLSDWHDVZHOODVIXWXUHSXUFKDVLQJGHFLVLRQVE\RXU86

*RYHUQPHQWFXVWRPHUVFRXOGEHUHGXFHGGHOD\HGRUFDQFHOOHG,QDGGLWLRQWKHVHFXWVFRXOGDGYHUVHO\DIIHFWWKHYLDELOLW\RIWKH

VXSSOLHUVDQGVXEFRQWUDFWRUVXQGHURXUSURJUDPV7KHUHDUHPDQ\YDULDEOHVLQKRZWKHVHEXGJHWFXWVFRXOGEHLPSOHPHQWHGWKDW

PDNHLWGLIILFXOWWRGHWHUPLQHVSHFLILFLPSDFWVKRZHYHUZHH[SHFWWKDWVHTXHVWUDWLRQDVFXUUHQWO\SURYLGHGIRUXQGHUWKH%XGJHW

&RQWURO$FWZRXOGUHVXOWLQORZHUUHYHQXHVSURILWVDQGFDVKIORZVIRURXUFRPSDQ\6XFKFLUFXPVWDQFHVPD\DOVRUHVXOWLQDQ

LPSDLUPHQW RI RXU JRRGZLOO DQG LQWDQJLEOH DVVHWV %HFDXVH RXU 86 *RYHUQPHQW FRQWUDFWV JHQHUDOO\ UHTXLUH XV WR FRQWLQXH WR

SHUIRUPHYHQLIWKH86*RYHUQPHQWLVXQDEOHWRPDNHWLPHO\SD\PHQWVLIIRUH[DPSOHWKHGHEWFHLOLQJLVQRWUDLVHGDQGDVD

UHVXOW RXU FXVWRPHU GRHV QRW SD\ XV RQ D WLPHO\ EDVLV ZH ZRXOG QHHG WR ILQDQFH RXU FRQWLQXHG SHUIRUPDQFH RI WKH LPSDFWHG

FRQWUDFWVIURPRXURWKHUUHVRXUFHV$QH[WHQGHGGHOD\LQWKHWLPHO\SD\PHQWE\WKH86*RYHUQPHQWFRXOGUHVXOWLQDPDWHULDO

DGYHUVHHIIHFWRQRXUFDVKIORZVUHVXOWVRIRSHUDWLRQVDQGILQDQFLDOFRQGLWLRQ

U.S. Government contracts may be terminated at any time and may contain other unfavorable provisions.

7KH86*RYHUQPHQWW\SLFDOO\FDQWHUPLQDWHRUPRGLI\DQ\RILWVFRQWUDFWVZLWKXVHLWKHUIRULWVFRQYHQLHQFHRULIZHGHIDXOWE\

IDLOLQJWRSHUIRUPXQGHUWKHWHUPVRIWKHDSSOLFDEOHFRQWUDFW,QWKHHYHQWRIWHUPLQDWLRQIRUWKH86*RYHUQPHQW¶VFRQYHQLHQFH

FRQWUDFWRUVDUHJHQHUDOO\SURWHFWHGE\SURYLVLRQVFRYHULQJUHLPEXUVHPHQWIRUFRVWVLQFXUUHGRQWKHFRQWUDFWVDQGSURILWRQWKRVH

FRVWVEXWQRWWKHDQWLFLSDWHGSURILWWKDWZRXOGKDYHEHHQHDUQHGKDGWKHFRQWUDFWEHHQFRPSOHWHG$WHUPLQDWLRQDULVLQJRXWRIRXU

GHIDXOWIRUIDLOXUHWRSHUIRUPFRXOGH[SRVHXVWROLDELOLW\LQFOXGLQJEXWQRWOLPLWHGWROLDELOLW\IRUUHSURFXUHPHQWFRVWVLQH[FHVV

RIWKHWRWDORULJLQDOFRQWUDFWDPRXQWQHWRIWKHYDOXHRIZRUNSHUIRUPHGDQGDFFHSWHGE\WKHFXVWRPHUXQGHUWKHFRQWUDFW6XFKDQ

HYHQW FRXOG DOVR KDYH DQ DGYHUVH HIIHFW RQ RXU DELOLW\ WR FRPSHWH IRU IXWXUH FRQWUDFWV DQG RUGHUV ,I DQ\ RI RXU FRQWUDFWV DUH

WHUPLQDWHGE\WKH86*RYHUQPHQWZKHWKHUIRUFRQYHQLHQFHRUGHIDXOWRXUEDFNORJDQGDQWLFLSDWHGUHYHQXHVZRXOGEHUHGXFHGE\

WKH H[SHFWHG YDOXH RI WKH UHPDLQLQJ ZRUN XQGHU VXFK FRQWUDFWV :H DOVR HQWHU LQWR ³IHH IRU VHUYLFH´ FRQWUDFWV ZLWK WKH 86

*RYHUQPHQWZKHUHZHUHWDLQRZQHUVKLSRIDQGFRQVHTXHQWO\WKHULVNRIORVVRQDLUFUDIWDQGHTXLSPHQWVXSSOLHGWRSHUIRUPXQGHU

WKHVHFRQWUDFWV7HUPLQDWLRQRIWKHVHFRQWUDFWVFRXOGPDWHULDOO\DQGDGYHUVHO\LPSDFWRXUUHVXOWVRIRSHUDWLRQV2QFRQWUDFWVIRU

ZKLFKZHDUHWHDPHGZLWKRWKHUVDQGDUHQRWWKHSULPHFRQWUDFWRUWKH86*RYHUQPHQWFRXOGWHUPLQDWHDSULPHFRQWUDFWXQGHU

ZKLFKZHDUHDVXEFRQWUDFWRULUUHVSHFWLYHRIWKHTXDOLW\RIRXUSURGXFWVDQGVHUYLFHVDVDVXEFRQWUDFWRU,QDGGLWLRQLQWKHHYHQW

WKDWWKH86*RYHUQPHQWLVXQDEOHWRPDNHWLPHO\SD\PHQWVIDLOXUHWRFRQWLQXHFRQWUDFWSHUIRUPDQFHSODFHVWKHFRQWUDFWRUDWULVN

RIWHUPLQDWLRQIRUGHIDXOW$Q\VXFKHYHQWFRXOGUHVXOWLQDPDWHULDODGYHUVHHIIHFWRQRXUFDVKIORZVUHVXOWVRIRSHUDWLRQVDQG

ILQDQFLDOFRQGLWLRQ

As a U.S. Government contractor, we are subject to procurement rules and regulations.

:HPXVWFRPSO\ZLWKDQGDUHDIIHFWHGE\ODZVDQGUHJXODWLRQVUHODWLQJWRWKHIRUPDWLRQDGPLQLVWUDWLRQDQGSHUIRUPDQFHRI86

*RYHUQPHQWFRQWUDFWV7KHVHODZVDQGUHJXODWLRQVDPRQJRWKHUWKLQJVUHTXLUHFHUWLILFDWLRQDQGGLVFORVXUHRIDOOFRVWDQGSULFLQJ

GDWD LQ FRQQHFWLRQ ZLWK FRQWUDFW QHJRWLDWLRQ GHILQH DOORZDEOH DQG XQDOORZDEOH FRVWV DQG RWKHUZLVH JRYHUQ RXU ULJKW WR

UHLPEXUVHPHQW XQGHU FHUWDLQ FRVWEDVHG 86 *RYHUQPHQW FRQWUDFWV DQG UHVWULFW WKH XVH DQG GLVVHPLQDWLRQ RI FODVVLILHG

LQIRUPDWLRQ DQG WKH H[SRUWDWLRQ RI FHUWDLQ SURGXFWV DQG WHFKQLFDO GDWD 2XU 86 *RYHUQPHQW FRQWUDFWV FRQWDLQ SURYLVLRQV WKDW

DOORZWKH86*RYHUQPHQWWRXQLODWHUDOO\VXVSHQGRUGHEDUXVIURPUHFHLYLQJQHZFRQWUDFWVIRUDSHULRGRIWLPHUHGXFHWKHYDOXH

RIH[LVWLQJFRQWUDFWVLVVXHPRGLILFDWLRQVWRDFRQWUDFWDQGFRQWURODQGSRWHQWLDOO\SURKLELWWKHH[SRUWRIRXUSURGXFWVVHUYLFHVDQG

7(;7521$118$/5(3257

This line represents final trim and will not print

DVVRFLDWHG PDWHULDOV $ QXPEHU RI RXU 86 *RYHUQPHQW FRQWUDFWV FRQWDLQ SURYLVLRQV WKDW UHTXLUH XV WR PDNH GLVFORVXUH WR WKH

,QVSHFWRU *HQHUDO RI WKH DJHQF\ WKDW LV RXU FXVWRPHU LI ZH KDYH FUHGLEOH HYLGHQFH WKDW ZH KDYH YLRODWHG 86 FULPLQDO ODZV

LQYROYLQJIUDXGFRQIOLFWRILQWHUHVWRUEULEHU\WKH86FLYLO)DOVH&ODLPV$FWRUUHFHLYHGDVLJQLILFDQWRYHUSD\PHQWXQGHUD86

*RYHUQPHQW FRQWUDFW )DLOXUH WR SURSHUO\ DQG WLPHO\ PDNH GLVFORVXUHV XQGHU WKHVH SURYLVLRQV PD\ UHVXOW LQ D WHUPLQDWLRQ IRU

GHIDXOWRUFDXVHVXVSHQVLRQDQGRUGHEDUPHQWDQGSRWHQWLDOILQHV

As a U.S. Government contractor, our businesses and systems are subject to audit and review by the Defense Contract Audit

Agency (DCAA) and the Defense Contract Management Agency (DCMA).

:H RSHUDWH LQ D KLJKO\ UHJXODWHG HQYLURQPHQW DQG DUH URXWLQHO\ DXGLWHG DQG UHYLHZHG E\ WKH 86*RYHUQPHQW DQG LWV DJHQFLHV

VXFKDV'&$$DQG'&0$7KHVHDJHQFLHVUHYLHZRXUSHUIRUPDQFHXQGHUFRQWUDFWVRXUFRVWVWUXFWXUHDQGRXUFRPSOLDQFHZLWK

ODZVDQGUHJXODWLRQVDSSOLFDEOHWR86*RYHUQPHQWFRQWUDFWRUV7KHV\VWHPVWKDWDUHVXEMHFWWRUHYLHZLQFOXGHEXWDUHQRWOLPLWHG

WR RXU DFFRXQWLQJ HVWLPDWLQJ PDWHULDO PDQDJHPHQW DQG DFFRXQWLQJ HDUQHG YDOXH PDQDJHPHQW SXUFKDVLQJ DQG JRYHUQPHQW

SURSHUW\ V\VWHPV ,I DQ DXGLW XQFRYHUV LPSURSHU RU LOOHJDO DFWLYLWLHV ZH PD\ EH VXEMHFW WR FLYLO DQG FULPLQDO SHQDOWLHV DQG

DGPLQLVWUDWLYHVDQFWLRQVWKDWPD\LQFOXGHWKHWHUPLQDWLRQRIRXUFRQWUDFWVIRUIHLWXUHRISURILWVVXVSHQVLRQRISD\PHQWVILQHVDQG

XQGHUFHUWDLQFLUFXPVWDQFHVVXVSHQVLRQRUGHEDUPHQWIURPIXWXUHFRQWUDFWVIRUDSHULRGRIWLPH:KHWKHURUQRWLOOHJDODFWLYLWLHV

DUHDOOHJHGWKH86*RYHUQPHQWDOVRKDVWKHDELOLW\WRGHFUHDVHRUZLWKKROGFHUWDLQSD\PHQWVZKHQLWGHHPVV\VWHPVVXEMHFWWRLWV

UHYLHZWREHLQDGHTXDWH7KHVHODZVDQGUHJXODWLRQVDIIHFWKRZZHFRQGXFWEXVLQHVVZLWKRXUJRYHUQPHQWFXVWRPHUVDQGLQVRPH

LQVWDQFHVLPSRVHDGGHGFRVWVRQRXUEXVLQHVV

Cost overruns on U.S. Government contracts could subject us to losses or adversely affect our future business.

8QGHUIL[HGSULFHFRQWUDFWVDVDJHQHUDOUXOHZHUHFHLYHDIL[HGSULFHLUUHVSHFWLYHRIWKHDFWXDOFRVWVZHLQFXUDQGFRQVHTXHQWO\

DQ\FRVWVLQH[FHVVRIWKHIL[HGSULFHDUHDEVRUEHGE\XV&KDQJHVLQXQGHUO\LQJDVVXPSWLRQVFLUFXPVWDQFHVRUHVWLPDWHVXVHGLQ

GHYHORSLQJ WKH SULFLQJ IRU VXFK FRQWUDFWV PD\ DGYHUVHO\ DIIHFW RXU UHVXOWV RI RSHUDWLRQV $GGLWLRQDOO\ 86 *RYHUQPHQW

SURFXUHPHQWSROLFLHVLQFUHDVLQJO\IDYRUIL[HGSULFHLQFHQWLYHEDVHGIHHDUUDQJHPHQWVUDWKHUWKDQWUDGLWLRQDOIL[HGSULFHFRQWUDFWV

WKHVHIHHDUUDQJHPHQWVFRXOGQHJDWLYHO\LPSDFWRXUSURILWDELOLW\2WKHUFXUUHQW86*RYHUQPHQWSROLFLHVFRXOGQHJDWLYHO\LPSDFW

RXUZRUNLQJFDSLWDODQGFDVKIORZ)RUH[DPSOHWKHJRYHUQPHQWKDVH[SUHVVHGDSUHIHUHQFHIRUUHTXLULQJSURJUHVVSD\PHQWVUDWKHU

WKDQSHUIRUPDQFHEDVHGSD\PHQWVRQQHZIL[HGSULFHFRQWUDFWVZKLFKLILPSOHPHQWHGGHOD\VRXUDELOLW\WRUHFRYHUDVLJQLILFDQW

DPRXQWRIFRVWVLQFXUUHGRQDFRQWUDFWDQGWKXVDIIHFWVWKHWLPLQJRIRXUFDVKIORZV8QGHUWLPHDQGPDWHULDOVFRQWUDFWVZHDUH

SDLGIRUODERUDWQHJRWLDWHGKRXUO\ELOOLQJUDWHVDQGIRUFHUWDLQH[SHQVHV8QGHUFRVWUHLPEXUVHPHQWFRQWUDFWVWKDWDUHVXEMHFWWRD

FRQWUDFWFHLOLQJ DPRXQW ZH DUH UHLPEXUVHG IRU DOORZDEOH FRVWV DQG SDLG D IHH ZKLFK PD\ EH IL[HG RU SHUIRUPDQFH EDVHG

KRZHYHULIRXUFRVWVH[FHHGWKHFRQWUDFWFHLOLQJRUDUHQRWDOORZDEOHXQGHUWKHSURYLVLRQVRIWKHFRQWUDFWRUDSSOLFDEOHUHJXODWLRQV

ZH PD\ QRW EH DEOH WR REWDLQ UHLPEXUVHPHQW IRU DOO VXFK FRVWV 8QGHU HDFK W\SH RI FRQWUDFW LI ZH DUH XQDEOH WR FRQWURO FRVWV

LQFXUUHGLQSHUIRUPLQJXQGHUWKHFRQWUDFWRXUFDVKIORZVUHVXOWVRIRSHUDWLRQVDQGILQDQFLDOFRQGLWLRQFRXOGEHDGYHUVHO\DIIHFWHG

&RVWRYHUUXQVDOVRPD\DGYHUVHO\DIIHFWRXUDELOLW\WRVXVWDLQH[LVWLQJSURJUDPVDQGREWDLQIXWXUHFRQWUDFWDZDUGV

Demand for our aircraft products is cyclical and could adversely affect our financial results.

'HPDQG IRU EXVLQHVV MHWV WXUER SURSV DQG FRPPHUFLDO KHOLFRSWHUV KDV EHHQ F\FOLFDO DQG GLIILFXOW WR IRUHFDVW 7KHUHIRUH IXWXUH

GHPDQGIRUWKHVHSURGXFWVFRXOGEHVLJQLILFDQWO\DQGXQH[SHFWHGO\OHVVWKDQDQWLFLSDWHGDQGRUOHVVWKDQSUHYLRXVSHULRGGHOLYHULHV

6LPLODUO\WKHUHLVXQFHUWDLQW\DVWRZKHQRUZKHWKHURXUH[LVWLQJFRPPHUFLDOEDFNORJIRUDLUFUDIWSURGXFWVZLOOFRQYHUWWRUHYHQXHV

DV WKH FRQYHUVLRQ GHSHQGV RQ SURGXFWLRQ FDSDFLW\ FXVWRPHU QHHGV DQG FUHGLW DYDLODELOLW\ &KDQJHV LQ HFRQRPLF FRQGLWLRQV PD\

FDXVH FXVWRPHUV WR UHTXHVW WKDW ILUP RUGHUV EH UHVFKHGXOHG RU FDQFHOOHG 5HGXFHG GHPDQG IRU RXU DLUFUDIW SURGXFWV RU GHOD\V RU

FDQFHOODWLRQVRIRUGHUVFRXOGUHVXOWLQDPDWHULDODGYHUVHHIIHFWRQRXUFDVKIORZVUHVXOWVRIRSHUDWLRQVDQGILQDQFLDOFRQGLWLRQ

We may make acquisitions that increase the risks of our business.

:HPD\HQWHULQWRDFTXLVLWLRQVLQDQHIIRUWWRH[SDQGRXUEXVLQHVVDQGHQKDQFHVKDUHKROGHUYDOXH$FTXLVLWLRQVLQYROYHULVNVDQG

XQFHUWDLQWLHVWKDWFRXOGUHVXOWLQRXUQRWDFKLHYLQJH[SHFWHGEHQHILWV6XFKULVNVLQFOXGHGLIILFXOWLHVLQLQWHJUDWLQJQHZO\DFTXLUHG

EXVLQHVVHV DQG RSHUDWLRQV LQ DQ HIILFLHQW DQG FRVWHIIHFWLYH PDQQHU FKDOOHQJHV LQ DFKLHYLQJ H[SHFWHG VWUDWHJLF REMHFWLYHV FRVW

VDYLQJV DQG RWKHU EHQHILWV WKH ULVN WKDW WKH DFTXLUHG EXVLQHVVHV¶ PDUNHWV GR QRW HYROYH DV DQWLFLSDWHG DQG WKDW WKH DFTXLUHG

EXVLQHVVHV¶ SURGXFWV DQG WHFKQRORJLHV GR QRW SURYH WR EH WKRVH QHHGHG WR EH VXFFHVVIXO LQ WKRVH PDUNHWV WKH ULVN WKDW RXU GXH

GLOLJHQFHUHYLHZVRIWKHDFTXLUHGEXVLQHVVGRQRWLGHQWLI\RUDGHTXDWHO\DVVHVVDOORIWKHPDWHULDOLVVXHVZKLFKLPSDFWYDOXDWLRQRI

WKHEXVLQHVVRUWKDWPD\UHVXOWLQFRVWVRUOLDELOLWLHVLQH[FHVVRIZKDWZHDQWLFLSDWHGWKHULVNWKDWZHSD\DSXUFKDVHSULFHWKDW

H[FHHGVZKDWWKHIXWXUHUHVXOWVRIRSHUDWLRQVZRXOGKDYHPHULWHGWKHULVNWKDWWKHDFTXLUHGEXVLQHVVPD\KDYHVLJQLILFDQWLQWHUQDO

FRQWUROGHILFLHQFLHVRUH[SRVXUHWRUHJXODWRU\VDQFWLRQVDQGWKHSRWHQWLDOORVVRINH\FXVWRPHUVVXSSOLHUVDQGHPSOR\HHVRIWKH

DFTXLUHGEXVLQHVVHV,QDGGLWLRQXQDQWLFLSDWHGGHOD\VRUGLIILFXOWLHVLQHIIHFWLQJDFTXLVLWLRQVPD\SUHYHQWWKHFRQVXPPDWLRQRI

WKHDFTXLVLWLRQRUGLYHUWWKHDWWHQWLRQRIRXUPDQDJHPHQWDQGUHVRXUFHVIURPRXUH[LVWLQJRSHUDWLRQV

If our Finance segment is unable to maintain portfolio credit quality, our financial performance could be adversely affected.

$ NH\ GHWHUPLQDQW RI WKH ILQDQFLDO SHUIRUPDQFH RI RXU )LQDQFH VHJPHQW LV WKH TXDOLW\ RI ORDQV OHDVHV DQG RWKHU DVVHWV LQ LWV

SRUWIROLR 3RUWIROLR TXDOLW\ PD\ EH DGYHUVHO\ DIIHFWHG E\ VHYHUDO IDFWRUV LQFOXGLQJ ILQDQFH UHFHLYDEOH XQGHUZULWLQJ SURFHGXUHV

7(;7521$118$/5(3257

This line represents final trim and will not print

FROODWHUDOYDOXHJHRJUDSKLFRULQGXVWU\FRQFHQWUDWLRQVDQGWKHHIIHFWRIJHQHUDOHFRQRPLFFRQGLWLRQV,QDGGLWLRQDPDMRULW\RIWKH

QHZRULJLQDWLRQVLQRXUILQDQFHUHFHLYDEOHSRUWIROLRDUHFURVVERUGHUWUDQVDFWLRQVIRUDLUFUDIWVROGRXWVLGHRIWKH86&URVVERUGHU

WUDQVDFWLRQVSUHVHQWDGGLWLRQDOFKDOOHQJHVDQGULVNVLQUHDOL]LQJXSRQFROODWHUDOLQWKHHYHQWRIERUURZHUGHIDXOWZKLFKPD\UHVXOW

LQGLIILFXOW\RUGHOD\LQFROOHFWLQJRQWKHUHODWHGILQDQFHUHFHLYDEOHV,IRXU)LQDQFHVHJPHQWKDVGLIILFXOW\VXFFHVVIXOO\FROOHFWLQJ

LWVILQDQFHUHFHLYDEOHSRUWIROLRRXUFDVKIORZUHVXOWVRIRSHUDWLRQVDQGILQDQFLDOFRQGLWLRQFRXOGEHDGYHUVHO\DIIHFWHG

We may need to obtain financing in the future; such financing may not be available to us on satisfactory terms, if at all. :HPD\SHULRGLFDOO\QHHGWRREWDLQILQDQFLQJLQRUGHUWRPHHWRXUGHEWREOLJDWLRQVDVWKH\FRPHGXHWRVXSSRUWRXURSHUDWLRQV

DQGRUWRPDNHDFTXLVLWLRQV2XUDFFHVVWRWKHGHEWFDSLWDOPDUNHWVDQGWKHFRVWRIERUURZLQJVDUHDIIHFWHGE\DQXPEHURIIDFWRUV

LQFOXGLQJ PDUNHW FRQGLWLRQV DQG WKH VWUHQJWK RI RXU FUHGLW UDWLQJV ,I ZH FDQQRW REWDLQ DGHTXDWH VRXUFHV RI FUHGLW RQ IDYRUDEOH

WHUPVRUDWDOORXUEXVLQHVVRSHUDWLQJUHVXOWVDQGILQDQFLDOFRQGLWLRQFRXOGEHDGYHUVHO\DIIHFWHG

Failure to perform by our subcontractors or suppliers could adversely affect our performance.

:H UHO\ RQ RWKHU FRPSDQLHV WR SURYLGH UDZ PDWHULDOV PDMRU FRPSRQHQWV DQG VXEV\VWHPV IRU RXU SURGXFWV 6XEFRQWUDFWRUV DOVR

SHUIRUPVHUYLFHVWKDWZHSURYLGHWRRXUFXVWRPHUVLQFHUWDLQFLUFXPVWDQFHV:HGHSHQGRQWKHVHVXSSOLHUVDQGVXEFRQWUDFWRUVWR

PHHWRXUFRQWUDFWXDOREOLJDWLRQVWRRXUFXVWRPHUVDQGFRQGXFWRXURSHUDWLRQV2XUDELOLW\WRPHHWRXUREOLJDWLRQVWRRXUFXVWRPHUV

PD\ EH DGYHUVHO\ DIIHFWHG LI VXSSOLHUV RU VXEFRQWUDFWRUV GR QRW SURYLGH WKH DJUHHGXSRQ VXSSOLHV RU SHUIRUP WKH DJUHHGXSRQ

VHUYLFHV LQ FRPSOLDQFH ZLWK FXVWRPHU UHTXLUHPHQWV DQG LQ D WLPHO\ DQG FRVWHIIHFWLYH PDQQHU /LNHZLVH WKH TXDOLW\ RI RXU

SURGXFWVPD\EHDGYHUVHO\LPSDFWHGLIFRPSDQLHVWRZKRPZHGHOHJDWHPDQXIDFWXUHRIPDMRUFRPSRQHQWVRUVXEV\VWHPVIRURXU

SURGXFWVRUIURPZKRPZHDFTXLUHVXFKLWHPVGRQRWSURYLGHFRPSRQHQWVRUVXEV\VWHPVZKLFKPHHWUHTXLUHGVSHFLILFDWLRQVDQG

SHUIRUPWRRXUDQGRXUFXVWRPHUV¶H[SHFWDWLRQV2XUVXSSOLHUVPD\EHOHVVOLNHO\WKDQXVWREHDEOHWRTXLFNO\UHFRYHUIURPQDWXUDO

GLVDVWHUVDQGRWKHUHYHQWVEH\RQGWKHLUFRQWURODQGPD\EHVXEMHFWWRDGGLWLRQDOULVNVVXFKDVILQDQFLDOSUREOHPVWKDWOLPLW WKHLU

DELOLW\WRFRQGXFWWKHLURSHUDWLRQV7KHULVNRIWKHVHDGYHUVHHIIHFWVPD\EHJUHDWHULQFLUFXPVWDQFHVZKHUHZHUHO\RQRQO\RQHRU

WZRVXEFRQWUDFWRUVRUVXSSOLHUVIRUDSDUWLFXODUUDZPDWHULDOSURGXFWRUVHUYLFH,QSDUWLFXODULQWKHDLUFUDIWLQGXVWU\PRVWYHQGRU

SDUWV DUH FHUWLILHG E\ WKH UHJXODWRU\ DJHQFLHV DV SDUW RI WKH RYHUDOO 7\SH &HUWLILFDWH IRU WKH DLUFUDIW EHLQJ SURGXFHG E\ WKH

PDQXIDFWXUHU ,I D YHQGRU GRHV QRW RU FDQQRW VXSSO\ LWV SDUWV WKHQ WKH PDQXIDFWXUHU¶V SURGXFWLRQ OLQH PD\ EH VWRSSHG XQWLO WKH

PDQXIDFWXUHUFDQGHVLJQPDQXIDFWXUHDQGFHUWLI\DVLPLODUSDUWLWVHOIRULGHQWLI\DQGFHUWLI\DQRWKHUVLPLODUYHQGRU¶VSDUWUHVXOWLQJ

LQVLJQLILFDQWGHOD\VLQWKHFRPSOHWLRQRIDLUFUDIW6XFKHYHQWVPD\DGYHUVHO\DIIHFWRXUILQDQFLDOUHVXOWVGDPDJHRXUUHSXWDWLRQ

DQGUHODWLRQVKLSVZLWKRXUFXVWRPHUVDQGUHVXOWLQUHJXODWRU\DFWLRQVDQGRUOLWLJDWLRQ

Our business could be negatively impacted by information technology disruptions and security threats.

2XULQIRUPDWLRQWHFKQRORJ\,7DQGUHODWHGV\VWHPVDUHFULWLFDOWRWKHVPRRWKRSHUDWLRQRIRXUEXVLQHVVDQGHVVHQWLDOWRRXUDELOLW\

WR SHUIRUP GD\ WR GD\ RSHUDWLRQV )URP WLPH WR WLPH ZH XSGDWH DQGRU UHSODFH ,7 V\VWHPV XVHG E\ RXU EXVLQHVVHV 7KH

LPSOHPHQWDWLRQRIQHZV\VWHPVFDQSUHVHQWWHPSRUDU\GLVUXSWLRQVRIEXVLQHVVDFWLYLWLHVDVH[LVWLQJSURFHVVHVDUHWUDQVLWLRQHGWR

WKH QHZ V\VWHPV UHVXOWLQJ LQ SURGXFWLYLW\ LVVXHV LQFOXGLQJ GHOD\V LQ SURGXFWLRQ VKLSPHQWV RU RWKHU EXVLQHVV RSHUDWLRQV ,Q

DGGLWLRQ ZH RXWVRXUFH FHUWDLQ VXSSRUW IXQFWLRQV LQFOXGLQJ FHUWDLQ JOREDO ,7 LQIUDVWUXFWXUH VHUYLFHV WR WKLUGSDUW\ VHUYLFH

SURYLGHUV$Q\GLVUXSWLRQRIVXFKRXWVRXUFHGSURFHVVHVRUIXQFWLRQVDOVRFRXOGKDYHDPDWHULDODGYHUVHLPSDFWRQRXURSHUDWLRQV

,Q DGGLWLRQ DV D 86 GHIHQVH FRQWUDFWRU ZH IDFH FHUWDLQ VHFXULW\ WKUHDWV LQFOXGLQJ WKUHDWV WR RXU ,7 LQIUDVWUXFWXUH XQODZIXO

DWWHPSWV WR JDLQ DFFHVV WR RXU SURSULHWDU\ RU FODVVLILHG LQIRUPDWLRQ DQG WKUHDWV WR WKH SK\VLFDO VHFXULW\ RI RXU IDFLOLWLHV DQG

HPSOR\HHV DV GR RXU FXVWRPHUV VXSSOLHUV VXEFRQWUDFWRUV DQG MRLQW YHQWXUH SDUWQHUV &\EHUVHFXULW\ WKUHDWV VXFK DV PDOLFLRXV

VRIWZDUH DWWHPSWV WR JDLQ XQDXWKRUL]HG DFFHVV WR RXU FRQILGHQWLDO FODVVLILHG RU RWKHUZLVH SURSULHWDU\ LQIRUPDWLRQ RU WKDW RI RXU

HPSOR\HHV RU FXVWRPHUV DV ZHOO DV RWKHU VHFXULW\ EUHDFKHV DUH SHUVLVWHQW FRQWLQXH WR HYROYH DQG UHTXLUH KLJKO\ VNLOOHG ,7

UHVRXUFHV:KLOHZHKDYHH[SHULHQFHGF\EHUVHFXULW\DWWDFNVZHKDYHQRWVXIIHUHGDQ\PDWHULDOORVVHVUHODWLQJWRVXFKDWWDFNVDQG

ZHEHOLHYHRXUWKUHDWGHWHFWLRQDQGPLWLJDWLRQSURFHVVHVDQGSURFHGXUHVDUHUREXVW'XHWRWKHHYROYLQJQDWXUHRIWKHVHVHFXULW\

WKUHDWV WKH SRVVLELOLW\ RI IXWXUH PDWHULDO LQFLGHQWV FDQQRW EH FRPSOHWHO\ PLWLJDWHG $Q ,7 V\VWHP IDLOXUH LVVXHV UHODWHG WR

LPSOHPHQWDWLRQRIQHZ,7V\VWHPVRUEUHDFKRIGDWDVHFXULW\ZKHWKHURIRXUV\VWHPVRUWKHV\VWHPVRIRXUVHUYLFHSURYLGHUVRU

RWKHUWKLUGSDUWLHVZKRPD\KDYHDFFHVVWRRXUGDWDIRUEXVLQHVVSXUSRVHVFRXOGGLVUXSWRXURSHUDWLRQVFDXVHWKHORVVRIEXVLQHVV

LQIRUPDWLRQ RU FRPSURPLVH FRQILGHQWLDO LQIRUPDWLRQ 6XFK DQ LQFLGHQW DOVR FRXOG UHTXLUH VLJQLILFDQW PDQDJHPHQW DWWHQWLRQ DQG

UHVRXUFHVDQGLQFUHDVHGFRVWVDQGFRXOGDGYHUVHO\DIIHFWRXUFRPSHWLWLYHQHVVDQGRXUUHVXOWVRIRSHUDWLRQV

Developing new products and technologies entails significant risks and uncertainties.

7RFRQWLQXHWRJURZRXUUHYHQXHVDQGVHJPHQWSURILWZHPXVWVXFFHVVIXOO\GHYHORSQHZSURGXFWVDQGWHFKQRORJLHVRUPRGLI\RXU

H[LVWLQJSURGXFWVDQGWHFKQRORJLHVIRURXUFXUUHQWDQGIXWXUHPDUNHWV2XUIXWXUHSHUIRUPDQFHGHSHQGVLQSDUWRQRXUDELOLW\WR

LGHQWLI\HPHUJLQJWHFKQRORJLFDOWUHQGVDQGFXVWRPHUUHTXLUHPHQWVDQGWRGHYHORSDQGPDLQWDLQFRPSHWLWLYHSURGXFWVDQGVHUYLFHV

'HOD\VRUFRVWRYHUUXQVLQWKHGHYHORSPHQWDQGDFFHSWDQFHRIQHZSURGXFWVRUFHUWLILFDWLRQRIQHZDLUFUDIWDQGRWKHUSURGXFWV

FRXOGDIIHFWRXUUHVXOWVRIRSHUDWLRQV7KHVHGHOD\VFRXOGEHFDXVHGE\XQDQWLFLSDWHGWHFKQRORJLFDOKXUGOHVSURGXFWLRQFKDQJHVWR

PHHWFXVWRPHUGHPDQGVXQDQWLFLSDWHGGLIILFXOWLHVLQREWDLQLQJUHTXLUHGUHJXODWRU\FHUWLILFDWLRQVRIQHZDLUFUDIWRURWKHUSURGXFWV

FRRUGLQDWLRQZLWKMRLQWYHQWXUHSDUWQHUVRUIDLOXUHRQWKHSDUWRIRXUVXSSOLHUVWRGHOLYHUFRPSRQHQWVDVDJUHHG:HDOVRFRXOGEH

DGYHUVHO\ DIIHFWHG LIRXU UHVHDUFK DQG GHYHORSPHQW LQYHVWPHQWV DUH OHVV VXFFHVVIXO WKDQ H[SHFWHG RU LI ZH GR QRW DGHTXDWHO\

7(;7521$118$/5(3257

This line represents final trim and will not print

SURWHFW WKH LQWHOOHFWXDO SURSHUW\ GHYHORSHG WKURXJK WKHVH HIIRUWV /LNHZLVH QHZ SURGXFWV DQG WHFKQRORJLHV FRXOG JHQHUDWH

XQDQWLFLSDWHGVDIHW\RURWKHUFRQFHUQVUHVXOWLQJLQH[SDQGHGSURGXFWOLDELOLW\ULVNVSRWHQWLDOSURGXFWUHFDOOVDQGRWKHUUHJXODWRU\

LVVXHVWKDWFRXOGKDYHDQDGYHUVHLPSDFWRQXV)XUWKHUPRUHEHFDXVHRIWKHOHQJWK\UHVHDUFKDQGGHYHORSPHQWF\FOHLQYROYHGLQ

EULQJLQJ FHUWDLQ RI RXU SURGXFWV WR PDUNHW ZH FDQQRW SUHGLFW WKH HFRQRPLF FRQGLWLRQV WKDW ZLOO H[LVW ZKHQ DQ\ QHZ SURGXFW LV

FRPSOHWH$UHGXFWLRQLQFDSLWDOVSHQGLQJLQWKHDHURVSDFHRUGHIHQVHLQGXVWULHVFRXOGKDYHDVLJQLILFDQWHIIHFWRQWKHGHPDQGIRU

QHZSURGXFWVDQGWHFKQRORJLHVXQGHUGHYHORSPHQWZKLFKFRXOGKDYHDQDGYHUVHHIIHFWRQRXUILQDQFLDOFRQGLWLRQDQGUHVXOWVRI

RSHUDWLRQV ,Q DGGLWLRQ WKH PDUNHW IRU RXU SURGXFW RIIHULQJV PD\ QRW GHYHORS RU FRQWLQXH WR H[SDQG DV ZH FXUUHQWO\ DQWLFLSDWH

)XUWKHUPRUH ZH FDQQRW EH VXUH WKDW RXU FRPSHWLWRUV ZLOO QRW GHYHORS FRPSHWLQJ WHFKQRORJLHV ZKLFK JDLQ VXSHULRU PDUNHW

DFFHSWDQFHFRPSDUHGWRRXUSURGXFWV$VLJQLILFDQWIDLOXUHLQRXUQHZSURGXFWGHYHORSPHQWHIIRUWVRUWKHIDLOXUHRIRXUSURGXFWV

RU VHUYLFHV WR DFKLHYH PDUNHW DFFHSWDQFH UHODWLYH WR RXU FRPSHWLWRUV¶ SURGXFWV RU VHUYLFHV FRXOG KDYH DQ DGYHUVH HIIHFW RQ RXU

ILQDQFLDOFRQGLWLRQDQGUHVXOWVRIRSHUDWLRQV

We are subject to the risks of doing business in foreign countries.

'XULQJZHGHULYHGDSSUR[LPDWHO\RIRXUUHYHQXHVIURPLQWHUQDWLRQDOEXVLQHVVLQFOXGLQJ86H[SRUWVDQGZHH[SHFW

LQWHUQDWLRQDO UHYHQXHV WR FRQWLQXH WR LQFUHDVH &RQGXFWLQJ EXVLQHVV LQWHUQDWLRQDOO\ H[SRVHV XV WR DGGLWLRQDO ULVNV WKDQ LI ZH

FRQGXFWHG RXU EXVLQHVV VROHO\ ZLWKLQ WKH 86 :H PDLQWDLQ PDQXIDFWXULQJ IDFLOLWLHV VHUYLFH FHQWHUV VXSSO\ FHQWHUV DQG RWKHU

IDFLOLWLHVZRUOGZLGHLQFOXGLQJLQYDULRXVHPHUJLQJPDUNHWFRXQWULHV:HDOVRKDYHHQWHUHGLQWRDQGH[SHFWWRFRQWLQXHWRHQWHU

LQWRMRLQWYHQWXUHDUUDQJHPHQWVLQHPHUJLQJPDUNHWFRXQWULHVVRPHRIZKLFKPD\UHTXLUHFDSLWDOLQYHVWPHQWJXDUDQWLHVRURWKHU