Preliminary Annual Results 2014 presentation

advertisement

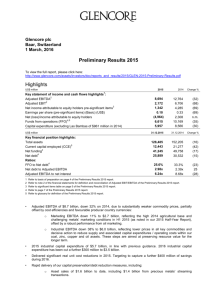

2014 Preliminary Results London, 3 March 2015 Mt Owen coal, Australia Basis of preparation and disclaimer Basis of preparation The reported financial information has been prepared on the basis as outlined in note 1 of the financial statements with the exception of the accounting treatment applied to certain associates and joint ventures for which Glencore’s attributable share of revenues and expenses are presented (see note 2). The unaudited and unreviewed pro forma financial information for 2013 has been prepared in a manner consistent with the accounting policies applicable for periods ending on or after 1 January 2013 as outlined in note 1 of the financial statements with the exception of the accounting treatment applied to certain associates and joint ventures for which Glencore’s attributable share of revenues and expenses are presented (see note 2) and reflects the final fair value adjustments arising from the acquisition of Xstrata on 2 May 2013 as if the acquisition and full consolidation of such had taken place as of 1 January 2013. These adjustments primarily relate to depreciation, amortisation and the release of onerous and unfavourable contract provisions. The pro forma financial information has been prepared for illustrative purposes only and, because of its nature, addresses a hypothetical situation and therefore does not reflect the Group’s actual financial position or results. A reconciliation of the pro forma results to the reported results for the year ended 31 December 2013 is included in the Glossary on page 117 of Preliminary Results 2014. The reported and pro forma financial information is presented in the Financial Review section before significant items unless otherwise stated to provide an enhanced understanding and comparative basis of the underlying financial performance. Significant items (refer to page 8 of Preliminary Results 2014) are items of income and expense which, due to their financial impact and nature or the expected infrequency of the events giving rise to them, are separated for internal reporting and analysis of Glencore’s results. Forward looking statements This document contains statements that are, or may be deemed to be, “forward looking statements” which are prospective in nature. These forward looking statements may be identified by the use of forward looking terminology, or the negative thereof such as “outlook”, "plans", "expects" or "does not expect", "is expected", "continues", "assumes", "is subject to", "budget", "scheduled", "estimates", "aims", "forecasts", "risks", "intends", "positioned", "predicts", "anticipates" or "does not anticipate", or "believes", or variations of such words or comparable terminology and phrases or statements that certain actions, events or results "may", "could", "should", “shall”, "would", "might" or "will" be taken, occur or be achieved. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Forward-looking statements are not based on historical facts, but rather on current predictions, expectations, beliefs, opinions, plans, objectives, goals, intentions and projections about future events, results of operations, prospects, financial condition and discussions of strategy. By their nature, forward looking statements involve known and unknown risks and uncertainties, many of which are beyond Glencore’s control. Forward looking statements are not guarantees of future performance and may and often do differ materially from actual results. Important factors that could cause these uncertainties include, but are not limited to, those discussed in Glencore’s Annual Report 2013 and “Risks and uncertainties” in Glencore’s Half-Year Results 2014. Neither Glencore nor any of its associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements in this document will actually occur. You are cautioned not to place undue reliance on these forward-looking statements which only speak as of the date of this document. Other than in accordance with its legal or regulatory obligations (including under the UK Listing Rules and the Disclosure and Transparency Rules of the Financial Conduct Authority and the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited and the Listing Requirements of the Johannesburg Stock Exchange Limited), Glencore is not under any obligation and Glencore and its affiliates expressly disclaim any intention, obligation or undertaking to update or revise any forward looking statements, whether as a result of new information, future events or otherwise. This document shall not, under any circumstances, create any implication that there has been no change in the business or affairs of Glencore since the date of this document or that the information contained herein is correct as at any time subsequent to its date. No statement in this document is intended as a profit forecast or a profit estimate and no statement in this document should be interpreted to mean that earnings per Glencore share for the current or future financial years would necessarily match or exceed the historical published earnings per Glencore share. This document does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for any securities. The making of this document does not constitute a recommendation regarding any securities. 2 CCR copper refinery, Canada Highlights Ivan Glasenberg – Chief Executive Officer 2014 Highlights(1) Strong financial performance despite difficult market conditions • Adjusted EBITDA(2) of $12.8bn, down 2% • Marketing Adjusted EBIT(2) of $2.8bn, up 18% • Net income(3) of $4.3bn, down 7% • Industrial synergies and cost savings of $1.9bn realised Robust balance sheet and strong cash flow coverage • Funds from operations(4) of $10.2bn, down 2% • Net debt(4) of $30.5bn, down $7.1bn from H1 2014 • BBB stable outlook reconfirmed by S&P • Capex of $8.6bn, down $2.8bn, further declining significantly in 2015 Confidence in our outlook • Exposure to the right commodities - market balances for our core commodities are now in deficit or transitioning into deficit • $3.3bn returned to shareholders in 2014, c.$9.3bn returned since IPO in 2011 Notes: (1) Refer to basis of preparation on page 5 of Preliminary Results 2014. (2) Refer to note 2 of the financial statements for definition and reconciliation of Adjusted EBIT/EBITDA and slide 21 in Appendix. (3) Attributable to equity holders pre-significant items; refer to significant items table on page 7 of Preliminary Results 2014. (4) For Funds from operations (FFO) and Net debt definition refer to page 9 of Preliminary Results 2014. 4 Sustainability and governance Safety • Regrettably 16 fatalities in 2014 (26 in 2013) • Reduction on 2013 reflects ‘SafeWork’ focus on safety LTIFR(1) 2009 to 2014 2.96 2.74 leadership, culture and implementation of Fatal Hazard Protocols • Significant performance improvement at DRC, Zambia, Bolivia and Kazakhstan operations • 118,000 employees completed “SafeWork” awareness 2.49 47% reduction 2.06 1.87 Governance 1.58 • Consolidation of Board: A. Hayward, Chair; P. Grauer SID; Patrice Merrin, new NED • Published Code of Conduct and policies on bribery and corruption, carbon and human rights External Recognition and Memberships 2009 2010 2011 2012 2013 2014 • ICMM, UN Global Compact, EITI, PACI (Partnering Against Corruption Initiative – World Economic Forum) • Voluntary Principles on Security and Human Rights (application in progress) • Mopani Copper awarded “Company of the Year” from Zambia for EITI reporting transparency Note: (1) Lost time incidents (LTIs) are recorded when an employee or contractor is unable to work following an incident. In the past Glencore recorded LTIs which resulted in lost days from the next calendar day after the incident whilst Xstrata recorded LTIs which resulted in lost days from the next rostered day after the incident - therefore the combined LTI figure is not based on data of consistent definition (historically, prior to merger). From 2014 Glencore records LTIs when an incident results in lost days from the first rostered day absent after the day of the injury. The day of the injury is not included. LTIFR is the total number of LTIs recorded per million working hours. LTIs do not include Restricted Work Injuries (RWI) and fatalities (fatalities were included up to 2013). Historic data has been restated to exclude fatalities and to reflect data collection improvements. 5 Ulan West coal, long wall operation, Australia Financial performance Steven Kalmin – Chief Financial Officer Financial performance highlights • Robust financial • • • • • • performance despite difficult market conditions Weaker prices largely offset by resilience of the marketing business 24% decline in capex and the disposal of Las Bambas supported $7.1bn reduction in net debt from H1 2014 ($5.3bn for full year) Merger synergies/cost efficiencies of c.$1.9bn realised $2.3bn working capital release, excluding RMI(2) Healthy cash flow coverage ratios, well positioned within current rating target metrics BBB stable outlook reaffirmed by S&P in Feb 2015 $12.8bn $4.3bn $33cents Adjusted EBITDA, down 2% Net income presignificant items, down 7% Earnings per share, down 6% $8.6bn $30.5bn $2.3bn Total capex, down 24% (1) Net debt, down 19% over H1 2014 Release in working capital (excluding RMI movements) $10.2bn $1.9bn 33.3% Funds from operations, down 2% Industrial synergies and cost savings realised. Streamlined cost structures now embedded FFO to net debt Target: >25% 2.39x Net debt to adj.EBITDA Target: <3x Notes: (1) Excludes Las Bambas. (2) RMI (Readily Marketable Inventories) up $2.8bn during 2014 (mostly H2) on account of our strong financial position allowing us to seize attractive marketing opportunities. The majority of this temporary increase is expected to reverse in 2015. 7 Marketing EBIT up 18% Adjusted EBIT 2013 vs 2014 ($M) Strongest performance since 2008. Adjusted EBIT up 18% to $2.8bn, reflecting strong contribution from agricultural products and resilient earnings in metals Metals & Minerals: Modestly lower adjusted EBIT largely reflects the impact of challenging iron ore marketing conditions. The remaining business was relatively consistent year-on-year Energy: decrease in EBIT reflects oversupplied coal and ‘flat’ oil markets. Conditions for oil improved towards year end with higher volatility and supportive curve structure Agriculture: Strong contribution from Viterra’s grain handling operations (large crops) and the traditional oilseed marketing business +18% 2'790 2'356 (7)% 1'622 1'515 +332% 856 (17)% 629 2013 2014 Total 2013 2014 Metals & Minerals 2013 524 2014 Energy 198 2013 2014 Agriculture 8 Robust industrial financial performance despite weaker prices Adjusted pro forma EBITDA/EBIT 2013 vs 2014 ($M) EBITDA Healthy industrial performance despite generally weaker commodity prices. Prices partially offset by cost reductions, higher production in copper, coal and oil as well as favourable FX. EBIT impacted by higher volume related D&A Metals & Minerals: Impact of weaker copper and precious metals prices largely offset by higher copper production, stronger zinc and nickel prices and US dollar strength Energy: Higher production volumes and productivity improvements were more than offset by weaker prices. Negative EBIT impact from higher depreciation in line with the rising volumes Agriculture: Significant improvement in earnings supported by higher crush volumes and ownership at Timbues. Processing/production volumes rose 16% over the year (7)% 10'472 9'763 (2)% EBIT 7'203 5'078 (23)% 3'916 7'077 (9)% 4'036 3'674 3'378 (16)% 2'841 1'244 (61)% 486 2013 2014 Total 2013 2014 Metals & Minerals 2013 2014 Energy 61 -6 2013 213 136 2014 Agriculture 9 Benefit of merger synergies/cost efficiencies, volume growth and FX gains only partially offset lower prices and extra depreciation (non-cash) Industrial Adjusted EBIT pre-exceptional items – 2012 to 2014 ($M)(1) $1.9bn cost savings 1'020 1'738 389 1'299 (997) (517) 215 (453) 666 (227) 1'344 6'461 (1'969) (693) 5'078 3'916 (4'360) 2012 EBIT Price Volume Cost Inflation Note: (1) 2012 and 2013 pro forma for the Xstrata merger. FX D&A Other 2013 EBIT Price Volume Cost Inflation FX D&A Other 2014 EBIT 10 Robust balance sheet and strong cashflow coverage Net funding(1) ($bn) 52.2 • Robust liquidity position with $9.4bn of 54.4 committed undrawn credit facilities and cash as of 31 December 2014 49.2 49.8 Net debt(1) 34.8 ($bn) • FFO to Net debt of 33.3% • Net debt to Adjusted EBITDA of 2.39x 37.6 35.8 30.5 33% FFO to net debt 29% (Target >25%) 29% 2.8 • 2014 debt activities • April: issued $2bn and EUR1.1bn of bonds • June: new $15.3bn multi-tranche committed RCF • September: issued AUD500M and EUR700M of • 28% Net debt to Adjusted EBITDA(2) • Strong cashflow coverage ratios: bonds December: issued CHF500M of bonds • Moody’s and S&P’s investment grade credit 2.8 ratings at Baa2 (stable) and BBB (stable) • maintenance of strong Baa/BBB levels remains a 2.7 financial target/priority (Target <3x) 2.4 Adjusted EBITDA(2) to net interest 9.1 9.5 8.7 • Average VaR (1 day 95%) of $36M in 2014, representing less than 0.1% of shareholders’ equity ($32M in 2013) 7.8 H113 FY13 H114 FY14 Notes: (1) Refer to page 9 of Preliminary Results 2014. (2) Refer to note 2 of the financial statements for definition and reconciliation of Adjusted EBIT/EBITDA and slide 21 in Appendix. 11 $2.8 billion reduction in 2014 capex Total capex: $8.6bn(1) (24%) Expansionary Metals & Minerals:$5.7bn(1) Energy: $2.2bn -$2.8bn Marketing and capitalised interest 7'025 -$1,826M 4'175 4'224 -$1,164M 2'704 3'316 2013 3'146 2014 Sustaining 2'568 4'059 3'860 2013 2014 1'549 694 685 2013 2014 Notes: 2013 is pro forma for the Xstrata merger. (1) Excluding Las Bambas expansionary capex of $961M and $1,734M in 2014 and 2013 respectively. 12 2015E industrial capex at $6.5-6.8bn, down from $7.9bn $7.9bn Investor day 2014 forecast for 2015: $3.6bn expansionary + $4.3bn sustaining • Reduction of $1.1 - 1.4bn of capital has been identified • • • across the business Reduction of c.$200M in sustaining capital through further cost efficiencies and lower cost inputs/stronger US dollar Up to $1.2bn reduction in expansionary capital guidance, including the slowing down of oil exploration and development in West Africa and a range of coal project deferrals Text here Text here Negligible expected direct impact on earnings $6.5-6.8bn $4.8-5.0bn $1.4-1.5bn 2015 capex review: Metals & Minerals total (was $5.1bn) Energy total (was $2.5bn) $2.4 to $2.7bn expansionary + $4.1bn sustaining Text here Reduction is c.50% from each of oil and coal Oil: reduced Chad/Cameroon exploration and development Coal: expansion deferral 13 Returning excess capital to shareholders in 2014 +2.3bn -8.4bn Working capital change Capex net of disposals +4.5bn Net acquisitions and disposals M&A / brownfield projects screened against risk, return and payback criteria Shareholder returns 10.2bn Funds from operations Excess capital allocation matrix -3.3bn Distributions and share buyback =5.3bn Total movement in net debt progressive distribution supplemented with buybacks and/or special distributions Ensure capital structure maintain strong BBB/Baa credit metrics • Investment opportunities also screened against returns generated from buybacks • Generates growth in profits and FCF • $1bn buyback (93% complete), generating EPS accretion of c.1.2% • Final 2014 cash distribution of $0.12/share; full-year distribution of $0.18/share • Strong BBB/Baa target – optimal balance between growth and shareholder returns • Provides abundant access to capital markets 14 2015 Priorities Ivan Glasenberg – Chief Executive Officer Ulan West coal pre-shift safety briefing Confidence in our outlook • Our key earnings’ drivers accounted for 95% of EBIT in 2014 • Market balances for many of our commodities have transitioned (or are transitioning) into • • deficit Operational leverage provides significant earnings upside as and when prices inevitably recover Group is comfortably free cash flow positive at current spot FX and commodity prices Cu Zn Ni Coal Marketing Deficit Deficit Transitioning to deficit Rebalancing Resilient “Consensus” surplus elusive so far, increasing downside risk to supply in 2015/16 An additional 3-3.5Mt of zinc supply needed over the next 5 years to balance the market Balanced 2015 and deficits thereafter; substantial from 2018 Some supply shutting and new investment delayed. Coal essential to meet energy demand Defensive earnings, less sensitive to falling prices. Benefits from own source production 36% Data: 2014 Adjusted EBIT. 5% 7% 5% 42% 16 Our priorities for 2015 Deliver growth from remaining key projects: McArthur River, Katanga, Koniambo and Chad oil Operating efficiency Achieving at or near first quartile costs/margins Confidence Capital discipline to maximise free cash flow generation; portfolio NPV is key BBB/Baa Maintain strong investment grade credit rating • Grow base dividend • Return excess capital to shareholders • Be opportunistic, but within our capital allocation framework Continuous improvement in health, safety, sustainability and governance performance 17 Installing ground support at the George Fisher zinc mine, Australia DVM Q&A Temperature monitoring, Raglan nickel, Canada Appendix Final 2014 distribution • Increased final distribution reflects Distribution payments (US cents per share) confidence in our outlook and financial position +9.1% 18.0 • Final cash distribution of 12 cents per share declared, representing a 9% increase in the full year dividend to 18 cents per share +4.8% 16.5 +5% • Excluding proposed in specie 15.8 distribution of our non-core 23.9% stake in Lonmin 15.0 • Payment date: 21 May 2015 2011 Final distribution timetable (2015) Jersey Exchange rate reference date: Last time to trade on JSE to be recorded in the register on record date: Last day to effect removal of shares cum div between Jersey and JSE registers: Final Ex-Div Date: Last time for lodging transfers in Hong Kong: Final Distribution record date: Deadline currency election (Jersey): Removal of shares between Jersey and JSE: Exchange rate reference date: Final Distribution payment date: 2012 Johannesburg 2013 2014 Hong Kong 9 April 17 April 17 April 23 April 20 April 24 April 27 April 24 April 22 April 23 April 24 April From 27 April 30 April 21 May 21 May Note: Dematerialisation and rematerialisation of registered share certificates in South Africa may not be effected during the period from Monday 20 April 2015 to Friday 24 April 2015, both days inclusive. Distributions will be declared and paid in U.S. dollars, although Shareholders on the Jersey register will be able to elect to receive their distribution payments in Pounds Sterling, Euros or Swiss Francs. Shareholders on the Hong Kong branch register will receive their distributions in Hong Kong dollars. Shareholders on the Johannesburg register will receive their distributions in South African Rand. 30 April 21 May 20 Adjusted and reported EBITDA The impact of the proportionate consolidation of certain associates and joint ventures and the Xstrata acquisition pro forma adjustments, are set out in the following table: 2014 Reported Adjustment for proportionate consolidation 2014 Adjusted Reported 2013 Reported Adjustments for proportionate consolidation and Xstrata 2013 Pro forma 221,073 2,910 223,983 232,694 6,979 239,673 11,825 939 12,764 9,684 3,387 13,071 Adjusted EBIT 6,377 329 6,706 5,635 1,799 7,434 Net income attributable to equity holders – pre significant items 4,285 - 4,285 3,666 917 4,583 (1,977) - (1,977) (11,712) 9,602 (2,110) Net income attributable to equity holders – post significant items 2,308 - 2,308 (8,046) 10,519 2,473 FFO 9,968 201 10,169 7,136 3,239 10,375 Capex 9,060 467 9,527 9,587 3,463 13,050 US$ million Revenue Adjusted EBITDA Significant items 21 Industrial 2015 EBIT sensitivity Indicative full year(1) US$M 10% movement in copper price 10% movement in zinc price 10% movement in lead price 10% movement in nickel price 10% movement in ferrochrome price 10% movement in gold price 10% movement in silver price 10% movement in coal price 10% movement in oil price 1,300 280 60 160 125 110 60 725 neutral exposure 10% movement in Glencore currency basket vs. USD 10% movement in AUD vs. USD 10% movement in CAD vs. USD 10% movement in ZAR vs. USD Note: (1) Assuming no currency or commodity hedging and no contracted, priced sales and purchases, as at 31 December 2014. In practice, at a point in time, some volumes (particularly coal) are likely forward sold, which has the effect of lowering the impact of the e.g. coal price sensitivity. 1,500 540 150 270 22