ESCO Annual Report 2014

advertisement

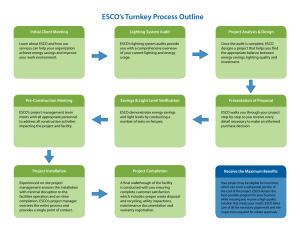

ESCO Electronic Systems Challenges & Opportunities ESCO Electronic Systems Challenges & Opportunities ESCO Electronic Systems Challenges & Opportunities Electronic Systems A plan for growth: One year on September 2014 ESCO Council Warren East CBE ESCO Co-Chairman Sir Hossein Yassaie Indro Mukerjee Juergen Maier Iain Gray Stephen Pattison Graeme Hobbs Keith Williams Joe WilLson Derek Boyd Peter Brooks Julian David Graeme Philp Imagination Technologies Innovate UK Altran Intelligent Systems NMI techUK Sarah Macken ESCO Chief Executive 2 Electronic Systems – a plan for growth; one year on Plastic Logic ARM Emerson Process Management Electronics Yorkshire Gambica Siemens Motorola Solutions The ESCO Council is jointly chaired by Industry and Government and Council members are invited to join the Council because of the contribution that they can make to the work of ESCO as opposed to representing a particular group or company. The Council has defined three core objectives that are being delivered through six workstreams. ESCO Objectives to be delivered by 2020 1. Grow UK industry’s GDP to 7.1% from 5.4% 2. Increase the number of employees to 1m from 850,000 3. Develop the UK as a centre for Electronic Systems innovation ESCO GDP and employment growth objectives priority future markets Internet of things Healthcare Robotics & Autonomous Systems Industrial Automation (Industry 4.0) Skills competitive enablers Technology September 2014 3 Contents Foreword5 1.Executive Summary 7 2. UK in the driving seat on Internet of Things (IoT) 9 3. Transforming healthcare delivery and patient care through technology 11 4. Industrial Automation, bringing manufacturing back to UK shores 13 5. Electronic Systems, the bedrock technology for Robotics and Autonomous Systems 15 6. Growing electronic systems employment to 1,000,000 by 2020 17 7. Technology development for growth in electronic systems 19 8. Appendix 1: ESCO Executive 21 “the spirit of collaboration that ESCO fosters is already starting to show results.” 4 Electronic Systems – a plan for growth; one year on Foreword Warren East CBE esco Co-Chairman The Electronic Systems Council (ESCO) has been meeting for just one year. In that time we have set ourselves ambitious goals to grow sector GDP and raise employment in our industry. We have established six workstreams which are focused on those areas where we believe we can make significant progress to deliver on those growth objectives. At ESCO we have started to bang the drum for the sector. There are challenges to overcome and it is of course necessary to carry on doing business as well. I am personally extremely grateful to our Council, Executive and Trade Associations who have all so willingly contributed over the last year. Electronic Systems is a fast moving sector with a growing public interest and awareness in the end use technology that we all contribute to. There is a heightened interest in the technological revolutions that are coming with driverless cars never more talked about, the Internet of Things, mobile health and robots rarely out of the news and industrial automation likely to change the face of manufacturing the world over. As this report shows, the spirit of collaboration that ESCO fosters is already starting to show results. During the second year of ESCO we plan to consolidate on achievements made and accelerate our activity across the six key work areas. In particular we will continue to stimulate real partnership between government and industry to both enhance the global competitiveness of UK technology and ensure technology from our Electronic Systems companies is central to UK deployment in areas like the Internet of Things, utilization of technology in healthcare and efforts to generate more high value manufacture here in the UK. There is much more to do in the year ahead and we need your help to do it, so take a look and see where you can get involved. But there is much less public awareness about the businesses behind many of these emergent technologies. Yes, our successful electronic systems companies, here in the UK, are already working on those new systems and designs that will be crucial to enabling future technologies. Raising the profile of our sector is essential if we are going to attract the brightest and the best into the industry on the scale that is needed to meet future growth projections. It is also crucial to attracting investment from private financiers and Venture Capitalists that they understand the nature of emerging markets in areas like the Internet of Things, the Future Factory Concept and Intelligent Mobility. These new markets present great future opportunities for UK companies prepared to commit to innovation and excellence. We of course also can’t forget the important role that public sector procurement plays in unleashing new technology that can have much wider applications. The Healthcare sector is one such area where ESCO sees an opportunity for procurement agencies to benefit from being more receptive to new technology that both improves patient care and reduces overall healthcare cost. One thing that I am in no doubt about, is that the global electronic systems marketplace is set to grow considerably in the years ahead. The UK is well positioned to supply into those new and emerging markets and with the collaboration that ESCO enables, let us hope that this is on a scale that delivers far greater UK growth and exciting career opportunities for generations to come. Warren East CBE ESCO Co-chairman September 2014 5 “This is the first ESCO Annual Report and provides a synopsis of activities that fall under the ESCO umbrella.” 6 Electronic Systems – a plan for growth; one year on 1. Executive Summary Sarah Macken ESCO Chief Executive ESCO was launched in June 2013 with the publication of a report setting out the size and scale of the UK electronic systems sector and a vision for the future. It put electronic systems on the map by describing the significant economic contribution of the industry accounting for 5.4% of GDP and employing 850,000 people. Following the report launch a joint Industry Government Council, the Electronic Systems Council, was formed with the goal of developing and driving forward a common agenda that would: •Build recognition of the sector as a key enabling technology crucial to the success of many other parts of the economy. •Increase the number of Electronic Systems employees by 150,000, to 1,000,000 •Raise the economic contribution of Electronic Systems to £120bn or 7.1% of GDP (up from £80bn or 5.4% GDP) The Council held its first meeting in September 2013 and joint Chairmen, Warren East CBE and Rt Hon Michael Fallon MP were appointed. Senior level support from industry and Government underlined the partnership that ESCO fosters. The Council is made up of Industry Leaders from Altran, ARM, Emerson, Imagination Technologies, Motorola Solutions, Plastic Logic, Siemens, Innovate UK and three trade Associations (GAMBICA, NMI and techUK) who have all contributed their time and energy to developing and progressing a joint agenda over the last year. The ESCO Executive, which comprises the leading trade associations in the electronic systems sector provides a forum for the wider electronic systems community to address common issues and share ideas to advance the interests of UK companies. This report sets out some of the progress that has been made in that time and provides a forward view on the year ahead. Some of the highlights include: •Building the first UK Industry 4.0 demonstrator, based at the Manufacturing Technology Centre, which is the culmination of work by the Industrial Automation workstream. This initiative provides a practical platform for UK Electronic Systems companies to advance new technology that will win business supplying future factories and process plants. •Consolidating the success of the UK Electronic Skills Foundation (UKESF) a unique public, private partnership which provides work placements and bursaries for Electrical and Electronic Engineering under-graduates. In addition to producing a comprehensive analysis of the current and future skills needs of the sector and an Electronic Systems application to develop an apprenticeship scheme for the sector as part of the Government’s Trailblazer programme. •Barriers to the uptake of technology in the health service have been identified and work is underway to explore with a cross section of stakeholders from clinicians, NHS England and a continuing cross Government dialogue on how those barriers can be overcome. •Prime Ministerial acknowledgement of the importance of the Internet of Things as an emerging market in which the UK can play a leadership role. ESCO has been helping to inform the work of the Government’s Chief Scientific Adviser Sir Mark Walport on this subject. •Intelligent mobility and reshaping the future of our transport infrastructure also offers significant opportunities for UK electronic systems. Work is underway to advance an automotive-demonstrator that provides an opportunity for UK companies to test how electronic systems interact with transport infrastructure exploring the technology required to develop driverless cars in the UK. •ESCO has also helped to shape funding applications in other sectors where electronic systems have an important role to play, for example the bid for continuing work on the ASTRAEA1 programme. •Establishing a technology working group that is scoping out the future technology requirements that enable UK companies to get ahead. This is the first ESCO Annual Report and provides a synopsis of activities that fall under the ESCO umbrella. It is far from a complete picture of everything that is happening in the industry. The report focuses on the areas that the ESCO Council has highlighted as priority areas for collaboration and where progress needs to be advanced. The report is comprised of sections from each ESCO workstream and the ESCO Executive. We are continually grateful for the efforts that people in the sector make, and would welcome wider involvement from people within the sector. Anyone interested in contributing to ESCO’s work should contact Sarah Macken via www.esco.org.uk 1 Autonomous Systems Technology Related Airborne Evaluation & Assessment September 2014 7 “Electronic Systems are a key enabling technology for IoT.” 8 Electronic Systems – a plan for growth; one year on 2. UK in the driving seat on Internet of Things (IoT) The Internet of Things revolution is on its way and the economic prize is starting to be imagined with comparisons of the future size of this market starting to emerge. Cisco has undertaken analysis that suggests IoT could generate $4.6 trillion for the public sector and $14.4 trillion for the private sector globally over the next decade. Whilst research firm IDC estimates that, in 2020, over 40 percent of all data in the world will be data resulting from Machine to Machine technology. Meanwhile Arup estimates that the global market for Smart Cities applications alone could generate $400 billion globally per annum by 2020, and that the UK could stand to gain a 10% share of that market. Electronic Systems are a key enabling technology for IoT, offering real potential to grow a substantial industry with significant export potential. Over the last year, ESCO has been encouraging the British Government to help stimulate the take up of IoT in the UK. A big success for ESCO was the Prime Minister’s speech at CEBIT in March 2014 where he echoed our call to see the UK become a world leader in this area. To propel this work forward the Government’s Chief Scientific Adviser, Sir Mark Walport, has been asked to look in detail at what Government can do and ESCO has contributed to his consultations. ESCO Internet of Things Sponsor Stephen Pattison ARM •In addition we have held discussions on IoT with our Chairman at the time, Rt Hon Michael Fallon MP, who had responsibility for Electronic Systems. Recently, we have seen a new Minister, Ed Vaizey MP, appointed as Minister for Digital and Joanna Shields appointed as Digital Adviser to the Prime Minister, a further sign of the importance that the Government places on this emerging new market. ESCO is only as good as companies interested in this sector enable us to be. We have worked so far with a small group of companies – and others - keen to drive our engagement forward. There are some great companies operating in the IoT space in the UK. We hope they too will want to support ESCO’s activities in this area as we go forward. Over the next year ESCO’s IoT activities will focus on: •Continuing to engage with Government on the steps that will help IoT grow in the UK and building on the results of Sir Mark Walport’s review. •Informing the Government’s science and research strategies and Ofcom’s activities on spectrum to ensure that they recognise the potential of IoT as a market and in particular the potential opportunity for UK electronic systems companies in that area. •Pressing UKTI to do more to showcase UK expertise in this area in its Trade Promotion Campaigns in overseas markets. We have been careful to elaborate positions which seek to explore ways in which Government can use low cost policy levers to get IoT moving. This includes, for example: •Encouraging Ofcom2 to explore which parts of the spectrum can be made available for IoT. Ofcom has a good record in this area, and this year has taken two important decisions, one on testing so called white space technology and another on exploring setting aside specific bandwidth for IoT. •In addition, we have pressed the Government to help budget a change in the NHS culture to foster greater openness to remote health monitoring, and a climate where companies and the NHS can work together to help develop affordable systems. This will be an important part of meeting the health needs of an older population. •We are also building the evidence base on the benefits of encouraging energy savings through IoT applications, for example by building on the smart meter programme to improve the chances of new meters being used effectively to help remote energy management. •Smart Cities is another area rich for IoT. We have visited Glasgow to look at how their smart city pilot project is going and have urged government to do more to incentivise cities to get smart. We have in particular emphasised the important role of smart street lighting and using streetlights as the backbone of a wireless system, can play in helping cities start down the smart path. 2 Independent regulator and competition authority for the UK communications industries. September 2014 9 “There is substantial evidence to show that the electronic systems industry is delivering real term benefits in the health and social care sector.” 10 Electronic Systems – a plan for growth; one year on 3. Transforming healthcare delivery and patient care through technology The NHS is under pressure to respond to ever-rising demand on services in primary, secondary and tertiary care. This trend is set to continue as people live for longer and the age profile of the population changes over time. At the same time healthcare providers continue to grapple with delivering the Quality, Innovation, Productivity and Prevention (QIPP) agenda and the need to find £20 billion of efficiency savings by 2015. With pressures on public spending set to continue for many years there is a real need to invest in healthcare solutions that can be delivered at scale, with minimum cost to the taxpayer, whilst also offering the patient safe, effective and convenient advice and care. At the same time, the NHS could make step change improvements in performance at both the operational level and the quality of service delivered at the point of care through quicker adoption of new technologies. Innovation in the electronics industry, especially in assisted living, is delivering real benefits to both the patient and healthcare professional, and can help address the challenges facing the NHS today, but only if it is delivered at scale. This requires a change in how the NHS procures and implements innovation. A common complaint reported by technology companies engaged in this market, is that it is very difficult to sell or deliver new technology or innovations into NHS Trusts. A consequence of this is that these innovative companies look to other markets such as the US to develop their product, or alternatively adapt the technology for consumer market purposes. This is a missed opportunity for the NHS to take advantage of emerging technology that could deliver both cost savings and improvements in patient care. The barriers to entry appear to be wide ranging and complex, but particularly seem to disadvantage the innovative start-ups and SMEs. Over the last year, ESCO has been exploring the challenges and opportunities faced by UK based electronic systems companies in addressing the marketplace. It also included a set of recommendations for further action to address these issues. ESCO Healthcare Sponsor Tony King-Smith Imagination Technologies ESCO Healthcare Lead Natalie Bateman techUK Addressing some of the difficulties around the procurement of technology in the NHS is an important challenge to overcome and as a result techUK is exploring the idea of a platform to help NHS buyers identify and engage with suppliers based on service delivery requirements. It will provide a service that will encourage a more vibrant and open technology market in the NHS. It will ensure that NHS buyers are equipped with the information they need to navigate the supplier market, build connections with the relevant companies and identify the products and services that best suit their needs. It will also ensure that suppliers can invest time, resource and money into business opportunities that are appropriate for them and their offering. There is substantial evidence to show that the electronic systems industry is delivering real term benefits in the health and social care sector. However, for the NHS to attain the improvements in service delivery, productivity and meet the budgetary goals set by Government, the situation must change to take advantage of innovative technologies available in the market and the electronic systems community is keen to play its part. During the year we have met with the Office for Life Sciences which has have responsibility for championing biotechnology and the pharmaceutical and medical technology industries in the UK, to explore the opportunities to improve health service delivery in the med-tech and e-health arena. techUK has also held a workshop that brought together clinicians, technology companies and procurement specialists to identify some of the key initiatives barriers to technology uptake within the sector. The findings of this workshop will be tested amongst the wider ESCO community and will form the basis of further activity in this area. Over the next year ESCO’s healthcare workstream will: •work to improve market access for technology companies in the health and social care sector. •develop a pragmatic action plan which will provide recommendations on how Government, NHS and the electronic systems industry can work together to address barriers that prevent the uptake of technologies that improve healthcare delivery. September 2014 11 “The vision is to create highly automated, super-connected, flexible factories.” 12 Electronic Systems – a plan for growth; one year on 4. Industrial Automation, bringing manufacturing back to UK shores Manufacturing is enjoying a renaissance in the UK. With companies bringing back production into their UK facilities and of public and government recognition that fundamental wealth creation through manufacturing is key to creating a durable, balanced economy. It is also critical to employment through higher level technical roles and a strengthened local supply chain. This offers real opportunities for UK electronic systems companies, as automation will play a larger part in manufacturing due to reasons such as complexity, miniaturisation, consistency of quality, and flexibility. ESCO Industrial Automation Sponsor Juergen Maier Siemens ESCO Industrial Automation Lead Graeme Philp GAMBICA Industry 4.0 describes a new future for manufacturing industry, based on technological developments in automation together with broader developments in the Internet of Things and Big Data. It will enable high wage economies, such as the UK, to compete on level terms with economies that have historically been outsourcing locations of choice for manufacturing. Bringing back manufacturing processes to our shores will bring new jobs and improve energy efficiency through the reduction of product miles. In the 21st century manufacturing is much less about creating factory jobs and much more about creating higher level, more technical roles and strengthening the local supply chain. Figure 1: The Industry 4.0 supply chain The Industrial Automation workstream sees the transformation in manufacturing as delivering real opportunities for UK electronic systems. The vision is to create highly automated, super-connected, flexible factories, located close to their local market, feeding off a local supply chain to increase flexibility and reduce inventory which makes products to order with the products themselves communicating with the machines that make them about the options they require (see image below). supplier ‘smart factory’ ‘smart services’ optimisation: product, process, supply chain ‘smart products’ intelligence flows back trusted cloud-based networks visualisation, MMI extraction and storage of data ‘big data systems’ decision support realtime data analysis and data fusion ‘smart data’ source: Professor Henning Kagermann’s presentation “How Industrie 4.0 Will Coin the Economy of the Future”, 4th February 2014 new insight new business September 2014 13 The manufacturing machines themselves work out the most effective order in which to make the day’s production and turn off unnecessary machines to save energy. Important aspects of the build process and of the product’s post-production life are sent wirelessly to the Cloud to be retrieved if required to help with traceability, design improvement and the efficacy of any subsequent product recalls. Very little inventory is generated as products are manufactured on a quasi as-required basis, meaning that design updates and new product introduction can be handled much more easily with hardly any obsolescent products left in the supply chain. This vision for the future of manufacturing is recognised around the world where it is given various names, but in Europe and the UK, it is known as Industry 4.0, signifying that this has the potential to be the fourth industrial revolution (after steam, electricity and computers). The technologies behind this vision are known as Cyber Physical Systems and are part of the wider Internet of Things revolution. The ESCO Industrial Automation work-stream is focused on highlighting the UK potential benefits of Industry 4.0 and helping producers and users to adopt the technology as rapidly as possible. 14 Electronic Systems – a plan for growth; one year on As a first step, ESCO has set up an Industry 4.0 demonstrator at the Manufacturing Technology Centre (MTC) near Coventry. The plan is that this will develop over time to become a test facility to be used by companies developing Industry 4.0 products, in addition to its role of showing endusers what is possible. The MTC demonstrator will focus on Factory Automation for the manufacturing of discrete products but there is also a need to develop Industry 4.0 techniques for the Process Industries, key amongst which are power generation, oil and gas, petrochemicals, water and waste and the chemical and plastics industries. Currently discussions are taking place with a number of possible partners to build a suitable Process Industry demonstrator facility. The ongoing development of the demonstrators is seen as a five year project and will need close co-operation between government and industry in the same way that the three other demonstrators in Europe (all in Germany) have close German government involvement. This approach will be the cornerstone of the Industrial Automation work-stream for ESCO for the foreseeable future. 5. Electronic Systems, the bedrock technology for Robotics and Autonomous Systems ESCO Robotics and Autonomous Systems Sponsor Keith Williams ALTRAN ESCO Robotics and Autonomous Systems Lead Derek Boyd NMI Robotics and Autonomous Systems (RAS) is recognised as one of the UK’s Eight Great Technologies. It has a fundamental reliance on electronic subsystems and embedded software and offers potential growth opportunities for electronic systems in the UK. In the year ahead Robotics and machine autonomy are already a significant part of our lives, covering a broad spectrum of applications from transport to surgery. In the fields of transport for example, mass transit metro systems are already automated and often driverless, and there will be an even greater reliance on electronic systems with the development of intelligent systems optimising transport flows across different transport modalities, and the development and introduction of numerous driver assistance systems in passenger vehicles. 1.ESCO will identify and highlight the underpinning technologies that are crucial to the development of autonomous systems and robotics in the UK. 2.ESCO will seek to inform the RAS Special Interest Group initiative to promote closer engagement and recognition of the reliance on the underpinning technologies customised for applications. 3.ESCO will continue to work alongside the ASTRAEA program and seek to establish UK Electronic Systems Supply chain opportunities in this area. 4.ESCO will continue to work with the Automotive Council Technology Workstream to identify specific proposals to develop improved vehicle autonomy and UK capability in vehicles, in highways infrastructure and in communications technologies. To ensure that ESCO is adding value to existing activities, this workstream focused on exploring the existing robotics and autonomous systems landscape to ensure that the electronic systems community adds maximum value to existing activities. Alongside IoT and Industrial Automation, Robotics and Autonomous Systems will continue to play an important role for the future and this will focus ESCO in the year ahead on the following activities. As a result of this awareness raising and relationship building activity, specific opportunities for electronic systems companies have been identified through working with other sector councils. These are summarised in the table below. Table 1: ESCO RAS engagement with other sector Councils Aerospace Council Discussions led to modifications in the most recent ASTRAEA bid to increase emphasis on electronic systems, creating greater potential for research opportunities. Automotive Council Linked up interests in Intelligent Mobility and Automotive propulsion, with discussions underway for potential joint Council technology demonstrators in intelligent mobility. Defence Growth Partnership NMI’s Automotive Electronic Systems Innovation Network (AESIN) is spearheading the development of an intelligent transport technology demonstrator, which seeks to establish a live connected corridor on an established highway. Highlighting the benefits of the UK electronic systems sector, which instantly removes ITAR compliance interests. Further exploration of activities that the sectors could advance particularly under AMSCI bids. Robotics and Autonomous Systems Special Interest Group (RAS SIG) Initial discussions have highlighted a difference in perspective with the Special Interest Group focused on developing service robots as opposed to nearer term market opportunities such as industrial robots. Further discussions are planned to identify areas of synergy. September 2014 15 “Skills-led innovation is one of the UK industry’s differentiating factors and therefore critical to the future of UK industry as a whole in attracting inward investment.” 16 Electronic Systems – a plan for growth; one year on 6. Growing electronic systems employment to 1,000,000 by 2020 The ESCO skills workstream is working towards raising employment in the sector by 150,000 in addition to increasing the capability and quality of our existing workforce to ensure the sector is able to compete globally. This will increase total employment in the sector to 1 million and comes at the same time that engineering more broadly is facing a chronic skills shortage as documented by Professor John Perkins and others. Indeed, our own industry estimates that we need three to four times the current number of graduates in order to meet future demand. It is also interesting, when set against the narrative that has accompanied public debates about growing industrial automation over the last year, where concerns have been raised about future job losses. In fact the opposite is true, the uptake of electronic systems in automated factory processes offers significant UK employment opportunities for technology companies and also in a host of other related sectors that will both use and synthesise information generated from the use of electronic systems and the expansion of the Internet of Things in the manufacturing environment. Ensuring that the UK has the right skills profile to meet both existing demand and to compete in a changing landscape with fiercely sought after markets emerging in Robotics and Autonomous Systems, Internet of Things, Smart Grid and Intelligent Mobility. Skills-led innovation is one of the UK industry’s differentiating factors and therefore critical to the future of UK industry as a whole in attracting inward investment. Over the past year, ESCO-related work has focused on three activities: 1) Taking the lead on Electronic Systems skills activities Due to the critical need for greater skills investment ESCO is building an industry group to respond to the rapidly changing landscape. This group has already compiled an overview of skills needs which charts the skills needs of the sector from software engineers to hardware manufacturers and from entry-level skills to post-graduates. 2) Improving apprenticeship provision A survey of employers on skills requirements was undertaken along with a closer look at apprenticeship provision. The results of this survey have been combined with other findings and form the basis of an ESCO skills report that will be published later in the year, but the results are already informing our existing activities. The Government is also interested in expanding apprenticeship provision across the UK, but wants industry to take the lead in defining the content of apprenticeship standards in England. A new round of Apprenticeship Trailblazers has been announced, where companies with a common interest form a group that develops standards for the sector. ESCO Skills sponsor Indro Mukerjee Plastic Logic ESCO Skills lead Derek Boyd NMI ESCO has brought together 23 electronic systems companies, led by Dialog Semiconductor, which have applied to develop an Electronic Systems Trailblazer. If successful, this Trailblazer would provide a unique opportunity and incentive to get broad industrial participation into re-defining and developing new industry standards for apprentices up to and including a post-graduate apprenticeship model. 3) Driving forward the skills programme Future skills development is vital to our sector and this is why we must take ownership of defining the new skills that industry values and extend this understanding of requirements into many industrial sectors highly dependent on Electrical and Electronic Engineering skills. To this end, the UK Electronic Skills Foundation (UKESF) continues to offer bursaries and placements to undergraduates who are interested in pursuing a career in electronic engineering. This initiative also benefits participating companies providing improved access to a potential pool of future employees who are more likely to be successfully integrated into the workforce at the end of the placement programme. UKESF is a successful initiative that was developed with a combination of public and private investment with the Department for Business, Innovation and Skills (BIS) providing seed-funding to get the project off the ground and industry providing additional investment which has led to a sustained placement programme and graduate recruitment. It is at present limited to Electrical and Electronic Engineering undergraduates at selected universities only. There is an opportunity for more employers to engage and as the number of universities involved increases the range of courses also goes up. More information on this initiative can be found here www.ukesf.org In the year ahead We will seek to place the UK at the forefront of a new wave of talent-led innovation that makes the UK an even more attractive base for electronic systems companies to grow and develop. We will therefore undertake the following to drive ahead our skills activities. •Establish an ESCO Skills Forum with a charter to act as a focal point for Electronic Systems Skills needs across multiple industrial sectors. •Publicly launch this group at an ESCO Skills Summit. •Launch an ESCO Skills Report. •Support development of the Electronic Systems Apprenticeship Trailblazer. September 2014 17 “the UK can continue to be a world leader in electronic systems.” 18 Electronic Systems – a plan for growth; one year on 7. Technology development for growth in electronic systems Technology development and exploitation is crucial to achieving continued growth in the Electronic Systems supply chain. As such electronic systems companies often spend more than 10 percent of turnover on research and development (R&D). With strong Intellectual Property, technology know-how and a vibrant world-leading University research base, the UK can continue to be a world leader in electronic systems. Commercial pressures however often mean that research activity is focused on technology development for short-term or immediate business gain with less emphasis on R&D as a long-term business development tool. As a facilitator to achieving continued growth in the UK electronic systems sector, the ESCO report recommended the formation of a technology forum of industrial and academic leaders from the community and our public sector partners. ESCO Technology Sponsor Derek Boyd NMI ESCO Technology lead Alastair McGibbon NMI In the year ahead the Technology Group will: •Conduct a survey of lead technologists in the electronic systems community to develop a wider understanding of views about key technology development barriers that are a considered a priority to advancing UK growth. •Seek to strengthen industry-academia links in electronic systems through engagement with academic groups such as eFutures. •Engage with technology partners and stakeholders to highlight the priorities that are identified by the workstream. ESCO has brought together industry, academia and the public sector to scope out common areas of interest. Through the ESCO Technology group we want to provide a forum for an exchange of ideas on strategic research and development that will be necessary to drive a sustainable electronic systems industry in the UK. In particular, the group is keen to support technology development that will underpin future technologies in ESCO’s growth markets including Internet of Things; Industrial Automation; Robotics and Autonomous Systems and Healthcare. The ESCO Technology Group is comprised of twenty technology experts from a wide range of disciplines, technologies and end market sectors, who have focused on: •Identifying the main business barriers that the technology community faces including access to end user requirements in electronic systems and the challenges associated with the development of low volume manufacturing of highly specialised products. •Ensuring UK electronic systems companies are on a level playing field when applying into EU funding streams is a key objective of the technology workstream. ESCO is currently pressing the Government to make funds available so that UK companies can apply to the c4.8bn Electronic Components and Systems for European Leadership (ECSEL) programme on a level playing field with EU competitors. September 2014 19 20 Electronic Systems – a plan for growth; one year on 8. Appendix 1: ESCO Executive The ESCO Executive, which comprises the leading trade associations in the electronic systems sector provides a forum for the wider electronic systems community to address common issues and share ideas to advance the interests of UK companies. This forum provides a much greater reach into the electronic systems supply-chain and supports the work of the Council through focused discussion on targeted matters. Over the year, the Executive has spearheaded activity to: •Reduce the impact of EU and UK regulation The ESCO executive has contributed views to the Government’s red tape challenge and raised concerns about the impact of proposed European legislation. •Inform ESCO’s skills workstream To support the work of the ESCO skills workstream the Executive, in partnership with Semta, conducted a survey of 200 Electronic Systems companies, the results of which have helped to shape the action plan to improve electronic systems skills provision in the future. Component Obsolescence Group (COG) •Reduced the cost of counterfeiting Counterfeiting is a serious concern affecting many electronic systems companies. The cost of counterfeiting is estimated at £30bn and is putting at risk 14,800 jobs. It can undermine business models and puts at risk future innovation in the UK. The ESCO Executive has worked hard throughout the year to raise awareness of mechanisms to reduce the risk to companies and provides a forum for sharing ideas and information on how to reduce the impact of those issues. More information about events and activities can be found at the AntiCounterfeiting Forum at www.anticounterfeitingforum.com The ESCO Executive is comprised of representatives of the following organisations a special interest group addressing and mitigating the effects of obsolescence. Ian Blackman e: iblackman@cognition-am.com Electronics Component Supply Network links near market research, manufacturers, channel partners and Adam Fletcher (ECSN) systems integrators encouraging co-operation through networking e: afletcher@theeuropeanoperation.com events and improving market visibility by the collation of industry statistics. Electronics Yorkshire supports businesses growth and development across the supply chain and particularly in the defence, aerospace, security, automotive and medical industries. Peter Brooks e: peter.brooks@esco.org.uk ESTnet is a network of organisations whose members design, develop, manufacture or integrate electronic and software technologies. Idris Price e: idris.price@estnet.uk.net GAMBICA represents the interests of companies in the instrumentation, control, automation and laboratory technology industry in the UK. Graeme Philp e: gsphilp@gambica.org.uk NMI has the objective to aid the development of a sustainable, Derek Boyd world-leading Electronic Systems community by building a strong e: derek.boyd@nmi.org.uk network and acting as a catalyst and facilitator for commercial and technological development. Silicon South West organisation that provides regular networking events, news and national and international promotion for the region’s microelectronics cluster. Simon Bond e: s.a.bond@bath.ac.uk SMART Group promotes the advancement of the Electronics Manufacturing Industry in Surface Mount and Related Assembly Technologies. Graham Naisbitt e: graham@thetestlab.com techUK represents the companies and technologies that are defining today the world that we will live in tomorrow. Julian David e: julian.david@techuk.org For more information on how to get involved in the ESCO Executive or to contribute to ESCO’s work more widely, contact Sarah Macken via www.esco.org.uk September 2014 21 ESCO Objectives to be delivered by 2020 A blueprint for success today 850,000 with 50% Electronic Systems at the heart of... people working on Electronic Systems embedded in other industrial sectors Ambitions for 2020 1,000,000 ACTIONS STRATEGIES ENABLED THROUGH SMART LEADERSHIP & ENGAGING THE COMMUNITY Have a clear structure to provide leadership and a focal point for the UK Electronic Systems community. Establish Leadership Forum Engaging the sector >> Building recognition of this strategically important key enabling technology sector >> SMART SUPPLY SMART INDUSTRIES DELIVERING SMART JOBS SMART UK TO GLOBAL UK Ensure UK verticals can source UK electronics and attract systems integrators. UK at the forefront of creating new Electronic Systems-based industries. Ensuring the UK continues to create great electronics technology, but striving for more UK-led global players and export. Markets of Tomorrow Electronic Systems Technology Group Promoting UK Electronic Systems capability on global stage Taxation as a strategic incentive The heart of Smart Healthcare The hub of Smart Transport Government procurement driving innovation Intellectual Property – recognition and protection Encourage and support university research, development and innovation The intelligence in the Smart Grid Catapults – recognising importance of Electronic Systems Helpline – support through the funding maze Leadership Forum connected to key verticals Building UK ecosystems Strategic on-shoring in summary 1. Grow UK industry’s GDP to 7.1% from 5.4% £80 Billion annual contribution to the economy £ £120 Billion 5.4% of GDP 2. Increase the number of employees to 1m from 850,000 7.1% 3. Develop the UK as a centre for Electronic Systems innovation > Accelerating growth in UK >> Developing and exploiting UK vertical sectors as a result of Electronic Systems capabilities, the use of UK Electronic Systems nationally and globally Electronic Systems underpins many highSMART SUSTAINABLE growth sectors in the UK. The future is high value growth with global export potential GOVERNMENT SMART BRANDS, KNOWN BRANDS DEVELOPING SMART SKILLS Create the environment to grow globally dominant electronics brands from the UK. Develop a skills base that provides UK industry (horizontal and vertical) with the resources required to take advantage of future markets. To be recognised by government as an important economic and strategic contributor to the UK economy. UK B2C brands study Graduates: develop the role of the UK Electronics Skills Foundation Increase the range of available craft and student apprenticeships Setting joint strategic objectives Post-Graduate skills prioritisation Refining migration policy support needs of UK Electronics PARTNERSHIP £ Adopting the economic model •850,000 UK people working on electronic systems will rise to 1,000,000 by 2020 •£80bn contribution to the economy will grow to £120bn by 2020 •Accounts for 5.4% of UK GDP will rise to 7.1% by 2020 •Electronic Systems companies typically invest 10% of turnover in research and development September 2014 23 ESCO Electronic Systems Challenges & Opportunities www.esco.org.uk ESCO e: info@esco.org.uk