Midterm (with solution)

advertisement

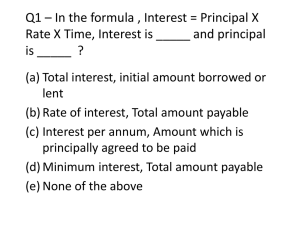

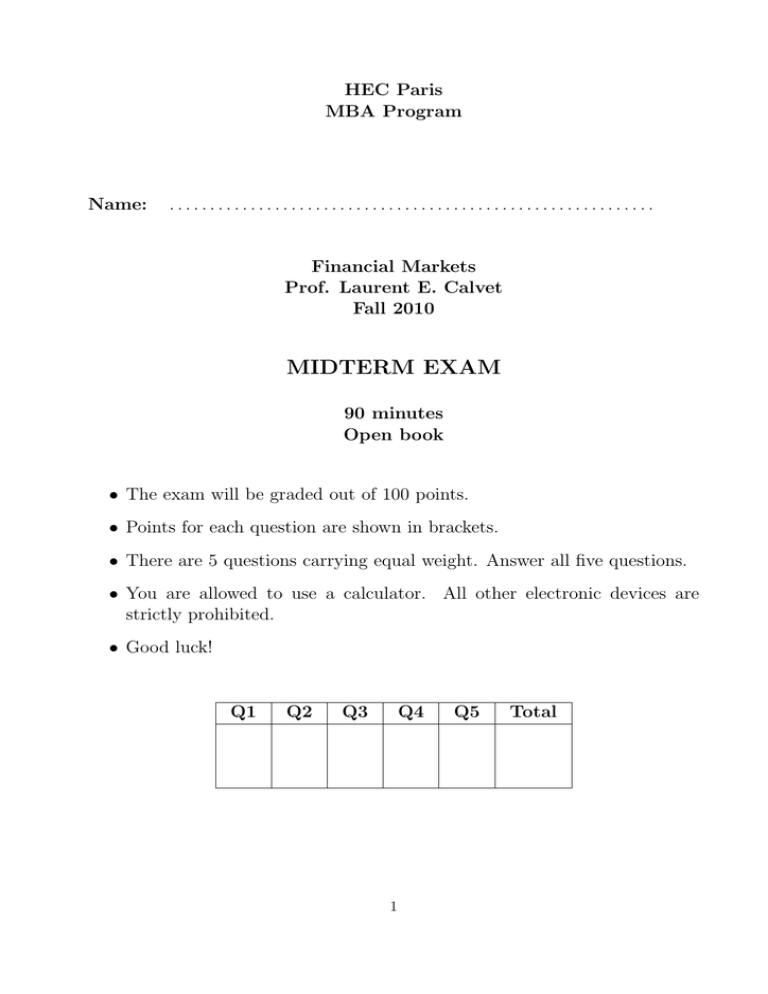

HEC Paris MBA Program Name: ............................................................ Financial Markets Prof. Laurent E. Calvet Fall 2010 MIDTERM EXAM 90 minutes Open book • The exam will be graded out of 100 points. • Points for each question are shown in brackets. • There are 5 questions carrying equal weight. Answer all five questions. • You are allowed to use a calculator. All other electronic devices are strictly prohibited. • Good luck! Q1 Q2 Q3 Q4 1 Q5 Total Problem 1. Decide whether the following statements are true or false. No explanations are necessary. (a) Forwards and futures are examples of derivative contracts. (True) (b) You short a stock if you believe that it will go up. (False) (c) You are financially better off if you receive $1 in five years than if you receive $1 today. (False) (d) The IRR rule always gives the same answer as the NPV rule. (False) (e) A futures contract is typically settled daily. (True) (f) A forward contract is typically settled daily. (False) (g) In order to trade a futures contract, you need to deposit funds in a margin account. (True) (h) Consider an interest rate that is quoted as 10% per annum with semiannual compounding. The equivalent rate with continuous compounding is 9.758% per annum. (True) (i) According to the liquidity premium hypothesis (also called liquidity preference theory), long-term interest rates are typically higher than short-term interest rates. (True) (j) A zero-coupon bond typically trades above its face value prior to maturity. (False) 2 Problem 2. You want to buy an apartment in Versailles, which costs 700,000 euros. You can put 300,000 euros down, and for the rest you get a 20-year fixed rate mortgage from your bank. The annual percentage rate is 5% per year, compounded monthly. How big is your monthly payment? You assume that there are no other taxes and fees involved. Solution: Denote the unknown monthly payment amount by C. You are liable an annuity with monthly cash flows C, and you know that the fair value is 400,000 euros. There are T = 240 monthly cash flows and the monthly interest rate is r = 5%/12. The annuity formula implies that: 1 C 400, 000 = × 1 − r (1 + r)T or equivalently: 400, 000 × r . 1 − (1 + r)−T So the amount you have to pay each month is C= C = 400, 000 × 0.05/12 = 2, 639.82 euros. 1 − (1 + 0.05/12)−240 3 Problem 3. A riskless coupon bond is offered in the market at a price of $124.73. It has coupon payments of $10 in one year, $10 in two years, $10 in three years, and a coupon and principal payment of $110 in four years. In this problem, we assume that all yields and interest rates are compounded annually. (a) Compute the YTM based on the market offer price. Solution: The YTM satisfies the equation: $124.73 = $10 $110 $10 $10 + + . + 1 + Y T M (1 + Y T M )2 (1 + Y T M )3 (1 + Y T M )4 We check by trial and error (or with a financial calculator) that Y T M = 3.30%. (b) Using the yield curve of zero coupon bonds, price this bond and determine if it the offer in the market is a fair price. The annualized yields on zerocoupon bonds are given below. Maturity Annualized Yield 1 year 1.00% 2 years 2.00% 3 years 3.00% 4 years 3.50% Solution: The bond is worth: P0 = $10 $10 $110 $10 + + + = $124.52. 1.01 (1.02)2 (1.03)3 (1.035)4 The offer price is slightly higher than the price implied by zero yields. (c) The zero yields are now 5% per annum for all maturities. What is the bond worth? Solution: The bond is worth: P = $10 $10 $10 $110 + + + = $117.73. 1.05 (1.05)2 (1.05)3 (1.05)4 The higher interest rates negatively impact the bond price. 4 Problem 4. You are asked to compute the price of the following foward contracts. (a) Suppose that you enter into a 6-month forward contract on a non-dividend paying stock when the stock price is $30 and the risk-free interest rate (with continuous compounding) is 12% per annum. What is the forward price? Solution: The price of the 3-month futures contract is F0 = $30e0.12×0.5 = $31.86. (b) A stock index currently stands at $350. The risk-free interest is 8% per annum (with continuous compounding) and the dividend yield on the index is 4% per annum. What should the futures price for a 4-month contract be? Solution: The price of the 3-month futures contract is: F0 = $350e(0.08−0.04)×4/12 = $354.70. (c) The spot price of silver is $9 per ounce. The storage costs are $0.06 per quarter payable in advance. Assuming that interest rates are 10% per annum for all maturities, calculate the forward price of silver for delivery in 9 months. Solution: The present value of the storage costs is: $0.06 + $0.06e−0.1×0.25 + $0.06e−0.1×0.5 = $0.1756. The forward price is therefore: F0 = ($9 + $0.1756)e0.1×9/12 = $9.89. The forward contract can be replicated as follows. • At date t = 0, we borrow $9.06, purchase 1 ounce of silver on the spot market, pay the storage cost, and store our purchase. • In 3 months, we borrow $0.06 and pay the storage cost. • In 6 months, we borrow $0.06 and pay the storage cost. • In 9 months, we pay back our debt, which now amounts to: $9.06e0.1×9/12 + $0.06e0.1×6/12 + $0.06e0.1×3/12 = $9.89, and take the silver out of storage. 5 Problem 5. A stock is expected to pay a dividend of $2 per share in 2 months and in 5 months. The stock price is $50, and the risk-free rate of interest is 8% per annum with continuous compounding for all maturities. An investor has just taken a short position in a 6-month forward contract on the stock. (a) What are the forward price and the initial value of the forward contract? Solution: The present value of the dividends is I = $2e−0.08×2/12 + $2e−0.08×5/12 = $3.9079. The forward price is therefore F0 = (50 − 3.9079)e0.08×6/12 = $47.97. The value at origination of a forward contract is zero. (b) Three months later, the price of the stock is $48 and the risk-free rate of interest is still 8% per annum. What is the value of the short position in the forward contract? Solution: The present value of the future dividend is now I1 = $2e−0.08×2/12 = $1.9735. The forward price is now F1 = ($48 − $1.9735)e0.08×3/12 = $46.96. The value of the short position is therefore (F0 − F1 )e−0.08×3/12 = $1.00 6