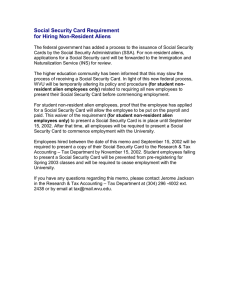

NR4 – Non-Resident Tax Withholding, Remitting

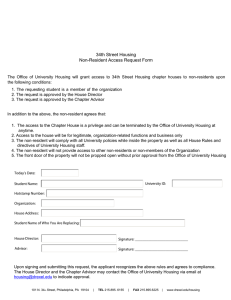

advertisement