Registered Charity Number: 1059050 Registered Company Number

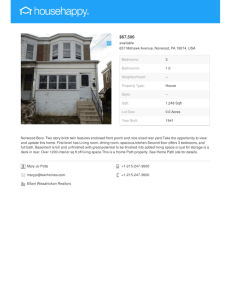

advertisement