Planning the Distributed Energy Future

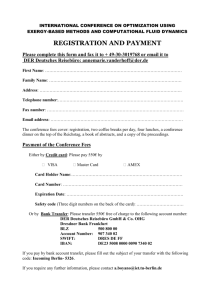

advertisement